Australia Ride Hailing Market Size, Share, Trends and Forecast by Vehicle Type, Booking Type, End-Use, and Region, 2025-2033

Australia Ride Hailing Market Overview:

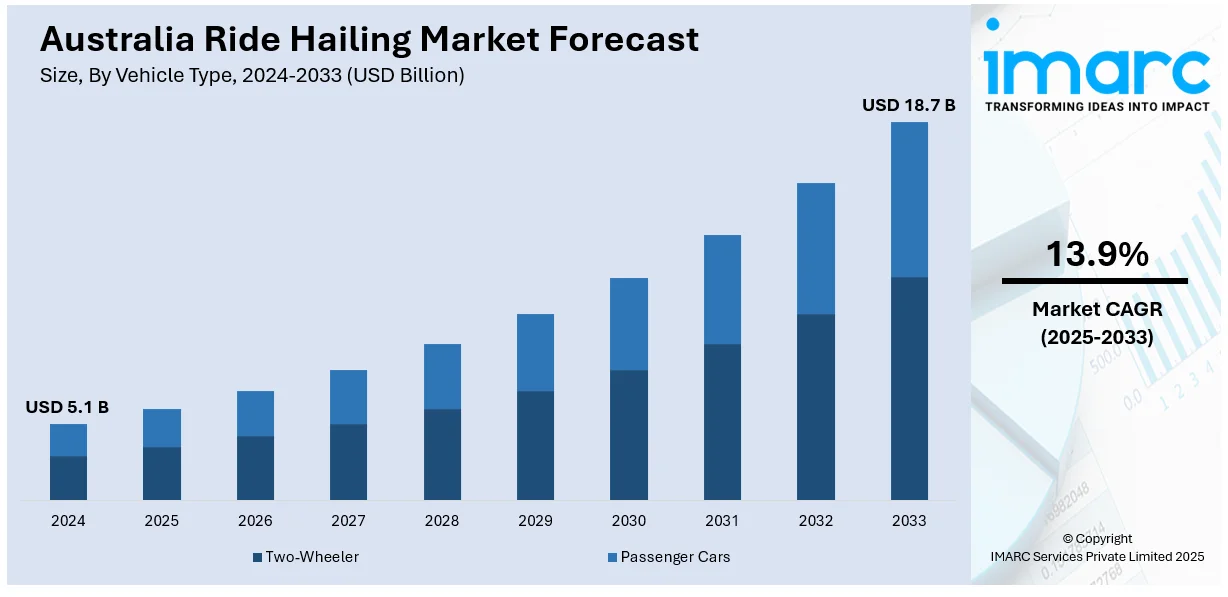

The Australia ride hailing market size reached USD 5.1 Billion in 2024. Looking forward, the market is expected to reach USD 18.7 Billion by 2033, exhibiting a growth rate (CAGR) of 13.9% during 2025-2033. Growing urbanization, increasing smartphone usage, declining interest in car ownership, rising fuel prices, surging influx of international students escalating prevalence of digital payments, promoting shared mobility, easing traffic congestion, and flexible ride options are some of the factors supporting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.1 Billion |

| Market Forecast in 2033 | USD 18.7 Billion |

| Market Growth Rate 2025-2033 | 13.9% |

Key Trends of Australia Ride Hailing Market:

Declining Preference for Car Ownership Among Young Adults

A generational shift in transportation preferences is reshaping mobility patterns in Australia. Younger age groups, particularly Millennials and Gen Z, are increasingly deprioritizing private vehicle ownership in favor of convenience-led alternatives like ride hailing. Rising vehicle acquisition costs, maintenance expenses, and insurance premiums are key deterrents, particularly in major urban centers where cost of living is already high. Additionally, these cohorts value experiences and flexibility, aligning with the shared economy mindset. Access to ride hailing platforms offers the benefits of private transportation without the long-term commitments and financial burdens associated with owning a car. Apart from this, surging environmental consciousness is also playing a role, with younger users more inclined to support sustainable mobility choices, which is another factor stimulating the Australia ride hailing market growth. As this consumer behavior trend continues, the addressable market for ride hailing services expands, particularly in university hubs, inner-city areas, and emerging tech-savvy suburbs.

To get more information on this market, Request Sample

High Smartphone Penetration and Strong Mobile Connectivity

According to the Australia ride hailing market analysis, the region features a highly digitized consumer environment, with smartphone penetration among the highest in the world. This is supported by robust fourth generation (4G) and emerging fifth-generation (5G) networks, which provide reliable, high-speed connectivity. Such technological infrastructure is a key factor contributing to the positive outlook of the ride-hailing market in the country. In 2025, Telstra announced a USD 510 million investment to upgrade its 5G network, with a focus on programmable 5G technologies. This move aligns with the company's goal to achieve 95% 5G coverage by mid-2025. Additionally, Telstra revealed a USD 475 million stock buyback, reflecting its strong financial position and commitment to shareholder value. This digital infrastructure is crucial for enabling seamless access to ride hailing platforms, from app installation and account creation to real-time booking, driver tracking, and cashless payment processing. Users can book rides instantly and receive accurate estimated time of arrivals (ETAs), which increases usage frequency and platform loyalty. The integration of advanced mobile features, such as biometric login, location-based alerts, and in-app safety options, further enhances user experience and trust.

Government Support for Congestion Reduction and Emissions Control

Policy frameworks at both federal and state levels are indirectly supporting the expansion of ride hailing services in Australia. Urban congestion and rising carbon emissions are critical concerns for transport planners and environmental agencies. In response, several cities are promoting low-emission zones, expanding public transport integration, and discouraging private car use through pricing disincentives such as tolls, parking levies, and congestion charges. These measures create a favorable landscape for shared mobility alternatives, including ride hailing platforms, that offer efficient trip management and potential for vehicle pooling. Furthermore, some jurisdictions are encouraging the adoption of electric vehicles within ride hailing fleets, offering rebates and registration concessions, which is which is boosting the Australia ride hailing market share.

Growth Drivers of Australia Ride Hailing Market:

Shifting Consumer Habits and Digital Uptake

One of the key drivers of the ride hailing industry in Australia is the changing consumer behavior to adopt digital, on-demand services. Australians are increasingly opting for convenience, flexibility, and real-time availability in the way they get around cities. With a high rate of smartphone penetration and an IT-savvy populace, mobile-based ride hailing applications are being quickly adopted, particularly among younger generations and working professionals. Customers now desire frictionless digital experiences, from ordering to payment, within a single app. The convenience of cashless payments, GPS-tracking of drivers, and service reputation has resulted in ride hailing becoming safer and easier to use than traditional taxis. Additionally, time-constrained lifestyles and the rise of the gig economy have further established the need for instant mobility solutions. As digital infrastructure improves in Australia, both in semi-urban and regional regions, the ride hailing sector is likely to gain considerably from this behavioural change in favor of app-based transport.

Increased Service Availability and Regional Expansion

In expansion of ride hailing services from core metropolitan cities to regional and semi-urban regions is yet another key factor in driving growth in the market in Australia. While ride hailing platforms have long centered their efforts on cities, growing demand in towns and rural centers has prompted wider rollouts. This is especially true in Australia, where the vast distances between towns may restrict access to good public transport. Ride hailing is becoming a useful solution for filling these transport gaps, providing mobility to residents in under-served communities and helping toward greater regional connectivity. Further, the emphasis of the Australian government on enhancing regional transport access has also contributed indirectly toward the growth of ride hailing in such regions. For instance, collaborations between ride hailing services and neighborhood councils are being considered to complement or even substitute conventional transport corridors. This diversification of coverage is broadening the customer base and aiding companies in establishing a broader, more sustainable footprint in the country.

Emergence of Sustainable Mobility and Electrification

Increasing green consciousness and the drive toward cleaner transportation modes are playing an important role in influencing the Australia ride hailing market demand. As growing anxieties exist over carbon emissions and city air quality, consumers as well as service providers are eyeing cleaner mobility options. Ride hailing services in Australia are slowly introducing electric vehicles (EVs) into their fleet, backed by national and state policies promoting sustainability. For example, some states provide EV incentives and are investing in public charging stations, to the advantage of ride hailing operators seeking to switch to zero-emission vehicles. Additionally, consumers increasingly have an environmental preference for travel modes, with most ride hailing applications now providing users with the option to choose hybrid or electric rides. This congruence with Australia's overall environmental objectives is improving the public profile of ride hailing firms and creating new commercial opportunities centered on environmentally friendly city transport.

Australia Ride Hailing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on vehicle type, booking type, and end-use.

Vehicle Type Insights:

- Two-Wheeler

- Passenger Cars

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes two-wheeler and passenger cars.

Booking Type Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the booking type. This includes online and offline.

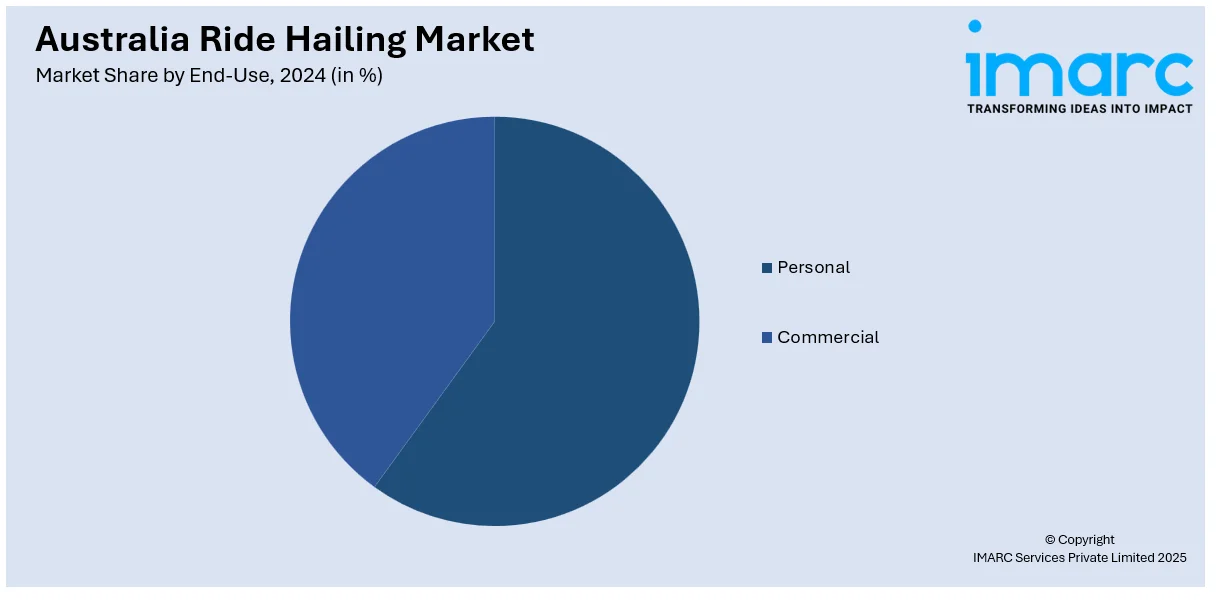

End-Use Insights:

- Personal

- Commercial

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes personal and commercial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Ride Hailing Market News:

- In 2024, Uber Green in Australia announced they will exclusively feature fully electric vehicles (EVs), phasing out hybrids. This move complements the existing Comfort Electric service and aligns with Uber's global sustainability goals.

- In 2025, Ola Electric, the EV arm of Ola, completed a Network Transformation and Opex Reduction Program. This initiative aimed to reduce costs and improve customer experience, potentially impacting Ola's Australian operations.

Australia Ride Hailing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Two-Wheeler, passenger cars |

| Booking Types Covered | Online, Offline |

| End-Uses Covered | Personal, Commercial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia ride hailing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia ride hailing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia ride hailing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia ride hailing market was valued at USD 5.1 Billion in 2024.

The Australia ride hailing market is projected to exhibit a CAGR of 13.9% during 2025-2033.

The Australia ride hailing market is expected to reach a value of USD 18.7 Billion by 2033.

The Australia ride hailing market trends include rising adoption of electric and hybrid vehicles, integration with public transport apps, and expansion into regional areas. Subscription-based ride packages, multi-modal mobility platforms, and demand for environmentally sustainable options are also shaping the sector, along with growing competition from local and international ride hailing players.

The Australia ride hailing market is driven by increasing digital adoption, changing consumer mobility preferences, and expanding coverage into regional areas. Government support for transport innovation and growing demand for sustainable, flexible travel options also contribute to market growth, alongside rising integration of electric vehicles and real-time, app-based ride booking systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)