Australia Risk Management Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, Industry Vertical, and Region, 2025-2033

Australia Risk Management Market Overview:

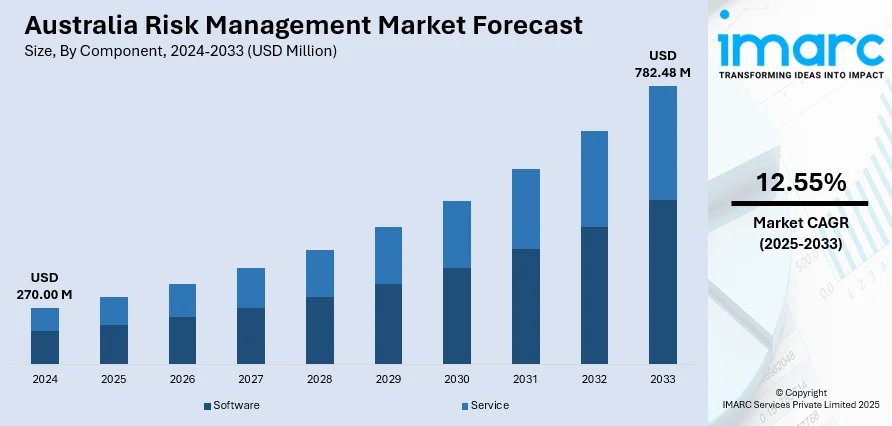

The Australia risk management market size reached USD 270.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 782.48 Million by 2033, exhibiting a growth rate (CAGR) of 12.55% during 2025-2033. The rising frequency of cybersecurity threats, expanding regulatory compliance demands, increased enterprise digitization, heightened focus on governance and data protection, rising focus on regulatory alignment, and the surging need for proactive threat mitigation across diverse sectors are among the key factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 270.00 Million |

| Market Forecast in 2033 | USD 782.48 Million |

| Market Growth Rate 2025-2033 | 12.55% |

Australia Risk Management Market Trends:

Escalating Cybersecurity Threats and Digital Transformation

Australia's rapid digital transformation across sectors has expanded the attack surface for cyber threats, making cybersecurity a critical component of risk management. The proliferation of remote work, cloud services, and digital platforms has introduced new vulnerabilities, compelling organizations to invest in advanced security measures. Australian organizations are projected to spend over AUD 7.3 billion on information security and risk management products and services in 2024. In line with this, cloud security is expected to witness the largest growth, with a 26.9% increase anticipated in 2024 due to the surge in cyber incidents, including ransomware attacks and data breaches. In a 2023 survey conducted by the Australian Institute of Criminology, 47% of respondents reported experiencing at least one cybercrime in the preceding 12 months, underscoring the pervasive nature of digital threats. This environment has led to increased adoption of integrated risk management solutions that encompass cybersecurity, data protection, and compliance, thereby driving market growth.

To get more information on this market, Request Sample

Increasing Regulatory Complexities and Compliance Requirements

The evolving regulatory landscape in Australia has intensified the need for comprehensive risk management frameworks. Organizations are navigating a complex web of regulations pertaining to data privacy, financial reporting, and operational transparency. In addition to this, high-profile cyber incidents have further catalyzed regulatory scrutiny. For instance, in January 2024, Russian hackers infiltrated 65 Australian government departments and agencies, stealing 2.5 million documents in the country's largest government cyberattack. Such events have prompted regulators to enforce stricter compliance measures, compelling organizations to adopt enterprise governance, risk, and compliance solutions that facilitate real-time risk assessment, policy management, and audit readiness. The integration of these solutions not only ensures compliance but also enhances organizational resilience, thereby contributing to the growth of the risk management market.

Australia Risk Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, deployment mode, enterprise size, and industry vertical.

Component Insights:

- Software

- Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and service.

Deployment Mode Insights:

- On-Premises

- Cloud-based

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-based.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

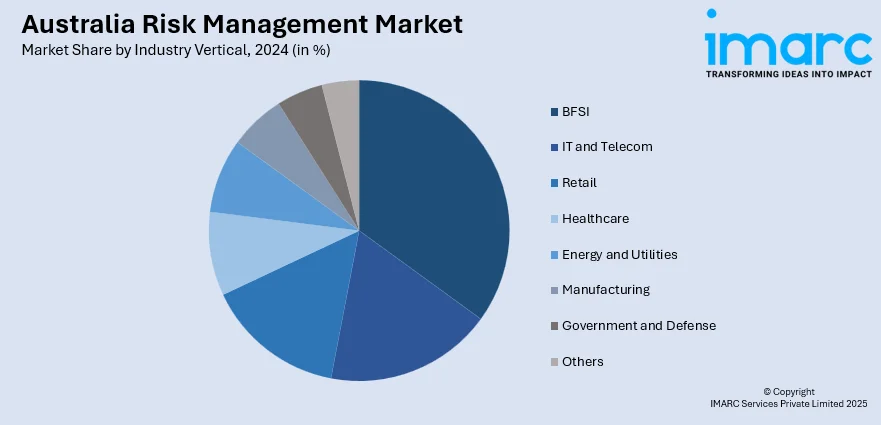

Industry Vertical Insights:

- BFSI

- IT and Telecom

- Retail

- Healthcare

- Energy and Utilities

- Manufacturing

- Government and Defense

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes BFSI, IT and telecom, retail, healthcare, energy and utilities, manufacturing, government and defense, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Risk Management Market News:

- March 2025: JBA Risk Management launched a new Australia flood model to support insurers and risk management professionals with high-resolution flood data. The model enhances risk assessment, planning, and compliance by offering detailed climate insights and customizable flood risk scenarios nationwide.

- November 2024: PwC launched ‘Regulatory Pathfinder’, a generative AI tool in Australia to streamline regulatory compliance. Designed for effective risk management, it automates compliance tracking, reduces manual work, identifies gaps, and helps businesses prioritize obligations.

- August 2024: Lockton launched a new risk consulting practice in Australia to enhance risk management services for mid-market clients. This expansion addresses growing client demands, offering integrated risk consulting and insurance solutions to improve risk assessment and business continuity.

- August 2024: Grameenphone partnered with Mobileum to transform risk management using AI-driven revenue assurance and fraud detection. This collaboration enhances fraud prevention, secures revenue, and optimizes operations, empowering Grameenphone to deliver secure, efficient services and proactive risk management.

Australia Risk Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Service |

| Deployment Modes Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Industry Verticals Covered | BFSI, IT and Telecom, Retail, Healthcare, Energy and Utilities, Manufacturing, Government and Defense, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia risk management market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia risk management market on the basis of component?

- What is the breakup of the Australia risk management market on the basis of deployment mode?

- What is the breakup of the Australia risk management market on the basis of enterprise size?

- What is the breakup of the Australia risk management market on the basis of industry vertical?

- What is the breakup of the Australia risk management market on the basis of region?

- What are the various stages in the value chain of the Australia risk management market?

- What are the key driving factors and challenges in the Australia risk management market?

- What is the structure of the Australia risk management market and who are the key players?

- What is the degree of competition in the Australia risk management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia risk management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia risk management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia risk management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)