Australia Robotics Market Size, Share, Trends and Forecast by Product Type and Region, 2025-2033

Australia Robotics Market Size and Growth:

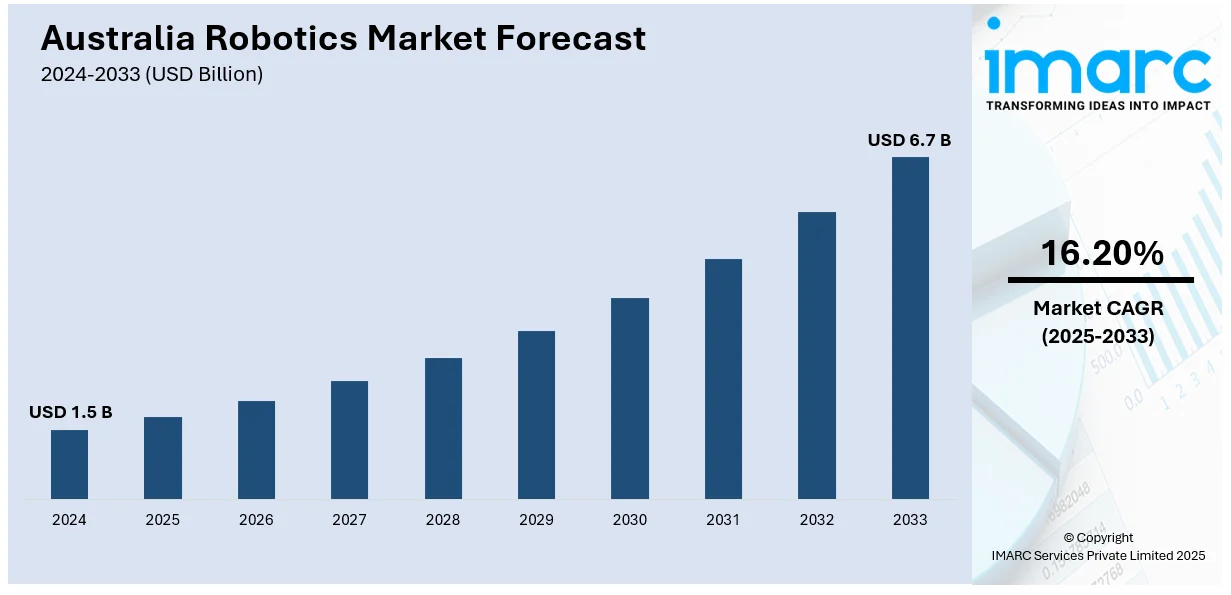

The Australia robotics market size reached USD 1.5 Billion in 2024. Looking forward, the market is expected to reach USD 6.7 Billion by 2033, exhibiting a growth rate (CAGR) of 16.20% during 2025-2033. The rising automation demand, growing labor shortages, government incentives, strong mining adoption, precision agriculture growth, e-commerce-driven logistics automation, increasing healthcare robotics integration, growing academic research and development (R&D) collaborations, and development of artificial intelligence (AI) enabled smart robotics are propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Market Growth Rate 2025-2033 | 16.20% |

Key Trends of Australia Robotics Market:

Industrial Automation Across Key Sectors

Increasing implementation of industrial automation across key sectors, such as manufacturing, mining, logistics, and agriculture, is one of the key factors supporting the Australia robotics market growth. Moreover, the wide availability of industrial robots and their growing use in manufacturing facilities to streamline production processes, reduce manual labor, and operational errors are propelling the market growth. The manufacturing sector is gradually transitioning into smart factories that use robotic arms, conveyor systems, and automated quality checks to gain better efficiency and consistency. In mining, automation of extraction and material handling is improving productivity and helping to solve the problem of working in hazardous and remote environments, which is another factor boosting the market growth. Apart from this, the widespread application of robotics is decreasing costs and enabling business scalability in a competitive world marketplace, which is facilitating the growth of the Australia robotics market share.

To get more information on this market, Request Sample

Government Incentives and Industry 4.0 Initiatives

The Australian government is proactively promoting the adoption of robotics using monetary incentives, innovation grants, and policy settings in line with Industry 4.0 objectives. Programs such as the Modern Manufacturing Strategy and Advanced Manufacturing Growth Centre (AMGC) funding are enabling the use of advanced technologies, including robotics, by small and medium enterprises (SMEs). These initiatives are focused on increasing local production capacity, reduce reliance on imports, and establish Australia as a technologically advanced manufacturing hub. One such example is the Defence Industry Development Grant program launched in 2024 that grants funding to Australian businesses that are building capability, such as robotics, autonomous systems, and other defense technology. In addition to this, collaboration between public institutions and private sector is facilitating testbeds and pilot projects for the use of robots in umpteen industries, which is supporting the market growth. Apart from this, the push for digitalization by the government is compelling key industries to make a significant investment in robotics, which is creating a positive Australia robotics market outlook.

Robotics Integration in the Mining Industry

Mining sector is the backbone of Australia's economy, which is increasingly moving toward robotics to improve operational efficiency, cost-effectiveness, and safety. Mining often involves hazardous conditions and operations in remote or inaccessible locations, which has significantly increased the demand for robotics as a viable solution for executing dangerous and repetitive tasks. In response, key industry players are investing in advanced technologies such as autonomous trucks, robotic drilling systems, and drone-based inspection equipment to reduce human exposure to high-risk environments. For instance, in 2024, Brisbane start-up Australian Droid and Robot (ADR) received an investment of USD 2 million to expand the production of its mine-monitoring robots. The 30kg robots, which have several sensors, operate in challenging conditions to collect data and take measurements without disrupting mining operations. Furthermore, the information acquired through robotic systems is supporting real-time decision-making and preventive maintenance planning, which is accelerating the Australia robotics market growth.

Growth Drivers of Australia Robotics Market:

Government Support and Strategic Initiatives

Government support in the form of strategic initiatives and funding for innovation is one of the main drivers of growth for the Australian robotics market. The government of Australia has invariably promoted automation and digitalization across sectors for the purpose of increasing productivity and competitiveness globally. Initiatives like the Modern Manufacturing Strategy and investments in Industry 4.0 projects are building the ecosystem for the adoption of robotics. These initiatives target key areas such as advanced manufacturing, agriculture, mining, and healthcare, all of which gain considerably from automation technologies. Australia's commitment to advancing research and development in robotics is also boosted through public institution-private enterprise partnerships. Regional innovation clusters and tech parks are developing in major cities like Sydney, Melbourne, and Brisbane, where robotics research labs and startup companies create tailored automation solutions for local sectors. Such institutional support and ecosystem establishment are serving to propel the development of the Australia robotics market demand.

Industry-Specific Needs and Labor Challenges

Australia's huge geography, comparatively low population density, and chronic shortages of skilled labor are encouraging industries to shift toward robotics for overcoming gaps in productivity. In agriculture, for example, robotic harvesters and autonomous machinery are becoming indispensable instruments in combating seasonal shortages of labor while improving efficiency in yields. The mining industry, a backbone of the Australian economy, is investing heavily in robotics and autonomous systems to promote operational safety and minimize human exposure in hostile environments. The construction and logistics industries are also embracing robotics for high-risk and repetitive work, maximizing efficiency and workplace safety. In healthcare and aged care, robots are being implemented to support an ageing population, providing reliable care and alleviating pressure on limited human resources. These sector-specific pressures, along with the specific demographic and geographic circumstances in Australia, are building long-term demand for robotic solutions customized for local operational issues and workforce characteristics.

Research Ecosystem and Cross-Sector Collaboration

According to the Australia robotics market analysis, the region has a strong research environment that makes a considerable contribution toward driving the development of the industry. Top universities like University of Sydney, University of Melbourne, and Queensland University of Technology are pushing the boundaries of robotics and AI research, frequently collaborating with industries to establish useful applications. Cross-sector collaboration is also promoted by the nation through programs that integrate academia, industry, and government. This collaborative strategy hastens the commercialization of robotics technologies in different sectors. Furthermore, Australia's rich experience in niche markets like underwater robotics, space robotics, and farm automation gives it a competitive edge on the international level. Local startups are also gaining global attention for building sophisticated robotics solutions, particularly those tailored to Australia's local environment and industry requirements. These constant innovations and collaborations are creating a dynamic robotics industry that continues to grow across industries, setting the stage for a more automated and technologically sophisticated economy.

Government Support for Australia Robotics Market:

Strategic National Initiatives and Policy Frameworks

The Australian government has made conscious efforts to promote the development of its robotics market with national initiatives and sound policy frameworks. One of the most impactful efforts is the Modern Manufacturing Strategy, which focuses on adopting cutting-edge technologies like robotics in defense, food processing, medical products, and resource technology sectors that are given top priorities. These efforts are centered on providing funding along with establishing long-term frameworks for technology adoption and commercialization. The government sees robotics as a key driver of productivity, competitiveness, and resilience, especially with the concerns of global supply chain risks. Furthermore, Australia's drive toward being an Industry 4.0 hub is seen in policies promoting automation and digital transformation in established and new industries. With a focus on sovereignty in critical technologies, Australia is spending wisely on robotics development to enhance non-reliance on overseas supply chains and to create indigenous expertise suited to the nation's particular economic and industrial requirements.

Funding Programs and Research Incentives

To directly drive innovation in robotics, the Australian government has enacted a series of funding schemes and research initiatives that offer financial and structural assistance to businesses as well as educational institutions. Grants under programs such as the Cooperative Research Centres (CRC) Program, as well as regional innovation funds, are directed toward projects that have tangible applications in everyday life, particularly in sectors like agriculture, mining, and health. This assistance carries over into small and medium-sized businesses, enabling them to incorporate automation and robotics into their operations without incurring unaffordable financial risk. Further, tax credits for research and development enable businesses to invest in robotics technologies while minimizing their tax burdens. Australia's singular economic reliance on resource-driven industries presents a strong argument for government assistance of robotics, so that the nation continues to lead in safe, cost-effective, and scalable industrial practices. These programs have also spurred international firms to partner with domestic institutions, further enriching Australia's robotics ecosystem.

Education, Infrastructure, and Workforce Development

Aside from direct financing, the Australian government is further facilitating robotics development through investments in education, infrastructure, and human resource development. Understanding the necessity for an educated workforce in the future, state and federal governments are placing robotics and coding within school curricula while augmenting vocational training in automation technologies. Technical schools and industries are forging partnership agreements, resulting in graduates with training on robotics use and maintenance. Infrastructure expenditure, especially in technology clusters and innovation precincts, is another strong indication of the government's support. These are places that facilitate cross-industry collaboration, allowing startups, researchers, and incumbent companies to collaborate on co-developing robotics solutions tailored to local industry requirements. The nation's focus on inclusive growth is also supported by initiatives encouraging robotics innovation in rural and remote areas, where automation can significantly boost productivity and service access. Through the coordination of education, infrastructure, and workforce activities, Australia is establishing a strong platform to enable and maintain the long-term growth of its robotics market.

Australia Robotics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type.

Product Type Insights:

.webp)

- Industrial

- Type

- Articulated

- Cartesian

- SCARA

- Cylindrical

- Others

- Type

- Service

- Type

- Personal and Domestic

- Professional

- Type

- Application

- Household Applications

- Entertainment Applications

- Defence Applications

- Field Applications

- Logistics Applications

- Healthcare Applications

- Infrastructure Applications

- Mobile Platform Applications

- Cleaning Applications

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes industrial [ type (articulated, cartesian, SCARA, cylindrical, and others)], service [ type (personal and domestic, and professional), and application (household applications, entertainment applications, defence applications, field applications, logistics applications, healthcare applications, infrastructure applications, mobile platform applications, cleaning applications, and others).

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Robotics Market News:

- In 2025, SwarmFarm Robotics inaugurated a new manufacturing facility in Toowoomba, Queensland, dedicated to producing its autonomous agricultural robots, 'Robbie' and 'Bottomley Potts'. These modular robots are designed for tasks such as fertilizer spraying, weed elimination, and soil tilling. The establishment of this hub aims to meet the growing demand for precision agriculture solutions across Australia.

- In 2024, Anduril Industries, in collaboration with the Australian Department of Defence, unveiled the first prototype of the Ghost Shark autonomous submarine, designated 'Alpha'. This project aims to provide the Royal Australian Navy with a stealthy, long-range autonomous undersea warfare capability. The prototype's development is reported to be ahead of schedule and within budget.

Australia Robotics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia robotics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia robotics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia robotics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia robotics market was valued at USD 1.5 Billion in 2024.

The Australia robotics market is projected to exhibit a CAGR of 16.20% during 2025-2033.

The Australia robotics market is expected to reach a value of USD 6.7 Billion by 2033.

The Australia robotics market trends include rising adoption of autonomous systems in mining and agriculture, growth in AI-integrated service robots, and expanding robotics research hubs. Increased collaboration between universities and industries, along with government-backed innovation programs, is accelerating development. Sustainability and robotics for aged care are also gaining significant attention.

The Australia robotics market is driven by labor shortages, government support, and the need for automation in mining, agriculture, and healthcare. Advancements in AI, strong research institutions, and demand for improved productivity across vast, remote areas also contribute to the growing adoption of robotics across multiple sectors in the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)