Australia Same Day Delivery Market Size, Share, Trends and Forecast by Service, Mode of Transportation, Application, End User, and Region, 2025-2033

Australia Same Day Delivery Market Overview:

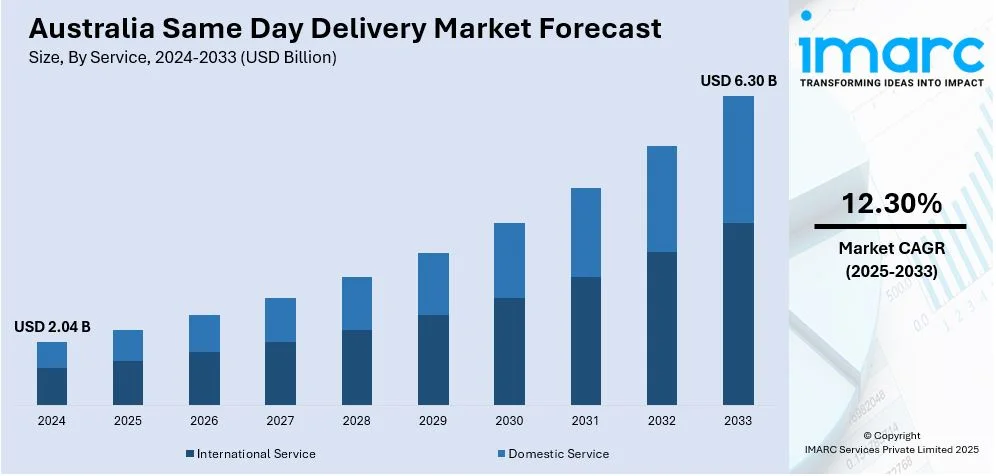

The Australia same day delivery market size reached USD 2.04 Billion in 2024. Looking forward, the market is projected to reach USD 6.30 Billion by 2033, exhibiting a growth rate (CAGR) of 12.30% during 2025-2033. The market is driven by the rapid expansion of e-commerce, with consumers demanding faster deliveries, prompting retailers to invest in automation and optimized logistics. The rise in on-demand grocery and pharmacy services has intensified competition, pushing businesses to adopt same-day delivery to retain customers. Additionally, sustainability initiatives, such as electric fleets and AI-driven routing, are enhancing efficiency while meeting eco-conscious preferences, further augmenting the Australia same day delivery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.04 Billion |

| Market Forecast in 2033 | USD 6.30 Billion |

| Market Growth Rate 2025-2033 | 12.30% |

Key Trends of Australia Same Day Delivery Market:

Rapid Growth of E-Commerce Driving Demand for Same-Day Delivery

The market is experiencing significant growth, fueled by the rapid expansion of e-commerce. With online shopping becoming increasingly popular, consumers now expect faster and more convenient delivery options. In 2024, Australia's e-commerce spending reached a value of AUD 56.07 Billion (approximately USD 36.33 Billion), as the monthly online shoppers increased to 17.08 million, covering 63.94% of the population. With the augmenting demand for quick and reliable services, same-day delivery has become a vital expectation, especially in industries, such as fashion, generating AUD 11.64 Billion (approximately USD 7.54 Billion) in sales, and electronics generating AUD 9.66 Billion (approximately USD 6.26 Billion). As more than half of the country’s population, around 52.8% of Australians, shop products or avail services online at least once a week, numerous sites are improving their services to offer quick delivery options that meet these shifting demands. Shippers and retailers are currently investing in next-generation fulfilment technologies, including automated warehouses and route-optimizing technology, to cater to this demand. Major retailers and small local startups are expanding their same-day delivery networks in Sydney, Melbourne, and Brisbane. Moreover, on-demand pharmacy and on-demand grocery services have also led to a rapid rise in the demand for instant deliveries. This trend is expected to continue as consumer expectations change, further propelling the Australia same day delivery market growth.

To get more information on this market, Request Sample

Adoption of Sustainable and Efficient Last-Mile Delivery Solutions

Sustainability is becoming a key focus in the market, with businesses seeking eco-friendly last-mile solutions. Electric vehicles (EVs), bicycles, and drones are increasingly being used to reduce carbon emissions and operational costs. Companies are leading the shift toward green logistics by deploying electric vans and e-bikes for urban deliveries. Furthermore, AI-driven route optimization is minimizing fuel consumption and improving delivery efficiency. Consumers are also showing a preference for brands that prioritize sustainability, pushing retailers to adopt greener delivery practices. As 75% of Australian consumers demand businesses to take a clear stance on sustainability, various businesses are increasingly inclined towards environmentally friendly logistics options, such as DHL Express' GoGreen Plus, which can reduce carbon emissions by up to 80% using Sustainable Aviation Fuel. Since 40% of online consumers in Australia prefer ethical brands, with a majority willing to pay extra for sustainable practices, the demand for sustainable same-day delivery services is growing, thereby encouraging Australian businesses to adopt green practices for long-term success. Some businesses are even offering carbon-neutral delivery options at checkout to appeal to environmentally conscious shoppers. Government incentives for EV adoption and stricter emissions regulations are further accelerating this trend. As the demand for fast deliveries grows, balancing speed with sustainability will be crucial for long-term success in Australia’s competitive same-day delivery market.

Urban Warehousing Enhances Delivery Efficiency

Urban warehousing is crucial in revolutionizing Australia’s same-day delivery capabilities. With consumer demand for quicker turnaround times, businesses are strategically establishing micro-fulfillment centers close to urban centers and residential areas. These compact, automated warehouses facilitate swift order processing and shorter delivery routes, enabling logistics providers to adhere to tight schedules and lower last-mile delivery expenses. By reducing transit delays and optimizing inventory placement, urban warehouses boost customer satisfaction and enhance operational effectiveness. This infrastructure proves especially beneficial in densely populated regions where traffic congestion can impede deliveries. As more retailers embrace this model, dependency on regional distribution centers diminishes, resulting in more agile and localized fulfillment. This trend significantly contributes to the rising Australia same day delivery market demand.

Growth Drivers of Australia Same Day Delivery Market:

Growth of Business-to-Consumer (B2C) Adoption

The increasing inclination towards direct-to-consumer (D2C) business models is transforming Australia’s logistics landscape. As brands eliminate intermediaries to connect directly with consumers, the demand for speed becomes essential. Same-day delivery has emerged as a key competitive advantage, particularly in sectors such as fashion, electronics, health, and lifestyle. Modern consumers seek convenience and immediacy, prompting businesses to offer faster delivery options as part of their value proposition. The rise of subscription models and personalized services also reinforces this trend, establishing same-day delivery as a standard rather than a premium option. According to Australia same day delivery market analysis, innovations in B2C logistics are anticipated to drive continued growth in both metropolitan and tier-2 cities.

Technological Advancements

The foundation of same-day delivery is built on the integration of smart logistics technologies. In Australia, organizations are increasingly utilizing real-time GPS tracking, AI-based route optimization, automated dispatch systems, and predictive analytics to fulfill tight delivery schedules. These technologies ensure quicker deliveries while keeping operational costs low and minimizing idle time. Moreover, digital proof-of-delivery, mobile workforce management, and API integration with e-commerce platforms improve coordination among warehouses, drivers, and customers. The implementation of such innovations guarantees transparency, accuracy, and agility throughout the supply chain. This tech-driven evolution is vital for bolstering customer trust and accommodating the rapid logistics demands shaping the same-day delivery landscape in Australia.

Retail Omnichannel Strategies

Conventional retailers are redefining their function in the logistics chain by incorporating e-commerce capabilities into their physical stores. In Australia, numerous brick-and-mortar establishments are now serving as micro-fulfillment centers, providing same-day delivery for local online orders. This omnichannel strategy shortens delivery times and reduces costs and also enhances inventory turnover and customer satisfaction. Retailers are outfitting their locations with inventory management systems and partnering with third-party logistics providers to manage last-mile delivery. The ability to offer same-day delivery directly from stores provides a competitive advantage in bustling urban locations. This integration of digital and physical retail is becoming a fundamental aspect of contemporary logistics strategies, reshaping consumer expectations and supply chain models within the Australia same day delivery market.

Opportunities of Australia Same Day Delivery Market:

Growth in Regional and Suburban Markets

As Australia's major urban centers become saturated, the next wave of growth in the same-day delivery sector will occur in regional and suburban areas. Tier-2 cities and outskirts are seeing an increase in consumer expectations influenced by metropolitan standards, but many still lack quick logistics services. By expanding into these areas, delivery providers can tap into overlooked markets, face reduced competition, and enhance brand loyalty. With advancements in road infrastructure and a rise in online ordering in smaller towns, logistics companies have a strategic chance to broaden their service areas, address growing e-commerce needs, and secure first-mover advantages in these promising regions.

Collaborations with Local Retailers

Partnering with local shops such as pharmacies, florists, electronics outlets, and boutique stores creates a robust delivery network suited for fulfilling community needs. Many of these businesses do not have the logistics capabilities to offer same-day delivery on their own. By serving as a reliable delivery partner, logistics providers can assist retailers in meeting consumer demands for swift service. These collaborations lead to mutual benefits: retailers gain a competitive advantage while delivery firms see an increase in volume and local visibility. This approach also enhances customer satisfaction and brand presence by facilitating hyperlocal deliveries backed by trusted neighborhood names.

Healthcare and Pharmaceutical Deliveries

The healthcare and pharmaceutical sector offers a lucrative niche for same-day delivery services in Australia. There is a growing need for quick deliveries of prescription medications, medical supplies, and diagnostic equipment—particularly for elderly or chronically ill patients—where speed and reliability are essential. Proper handling, cold-chain logistics, and secure transport protocols are crucial for maintaining compliance and trust. Providers that focus on healthcare delivery solutions can establish long-term contracts with clinics, pharmacies, and telehealth services. By addressing both regulatory and operational requirements, this sector presents opportunities for financial growth and positively impacts society, positioning same-day delivery services as vital partners in the healthcare landscape.

Challenges of Australia Same Day Delivery Market:

High Operational Expenses

One significant challenge in the Australian same-day delivery market is the high cost of operations. Delivering packages within tight timeframes necessitates a well-organized logistics network, which includes a dedicated fleet, trained personnel, fuel, warehousing, and up-to-date technology. These costs are particularly high in Australia due to the vast distances between cities and the need for prompt delivery. Companies must maintain local inventory hubs or micro-fulfillment centers to enable fast service, which further increases capital and maintenance costs. Smaller businesses may find these expenses particularly burdensome, hindering their competitiveness. Managing costs while meeting customer expectations will continue to be a challenging balancing act as the market evolves.

Logistics in Rural Areas

While same-day delivery services are becoming more common in urban areas, extending these services to remote and rural locations introduces significant logistical challenges. Australia’s low population density outside of metropolitan regions makes last-mile delivery both difficult and costly. Long travel distances, limited delivery volumes, and inadequate infrastructure decrease the feasibility of offering such services in these areas. Additionally, factors like weather-related disruptions and poor road conditions can result in further delays. Many providers concentrate primarily on urban centers, which creates a service gap for rural areas. To bridge this gap, solutions such as local partnerships, drone deliveries, and regional fulfillment centers are needed, which require substantial investment. Without addressing these rural delivery challenges, achieving nationwide scalability remains limited.

Driver Shortages and Retention

The challenge of finding and keeping qualified delivery drivers continues to be a significant issue in the same-day delivery market in Australia. As demand for rapid logistics increases, companies find themselves vying for a smaller pool of eligible drivers. This shortage leads to disruptions in service, delayed deliveries, and higher labor costs due to the need for overtime or incentives. Moreover, high turnover rates driven by job stress, long hours, and inadequate benefits make staff retention difficult. These factors can negatively impact operational efficiency and customer satisfaction. To stabilize their workforce, companies need to invest in improved working conditions, smarter routing, and technologies that are more accommodating to drivers. Without a steady and scalable driver workforce, maintaining fast and reliable same-day delivery becomes a critical operational challenge.

Australia Same Day Delivery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service, mode of transportation, application, and end user.

Service Insights:

- International Service

- Domestic Service

The report has provided a detailed breakup and analysis of the market based on the service. This includes international service and domestic service.

Mode of Transportation Insights:

- Airways

- Roadways

- Railways

- Intermodal

A detailed breakup and analysis of the market based on the mode of transportation have also been provided in the report. This includes airways, roadways, railways, and intermodal.

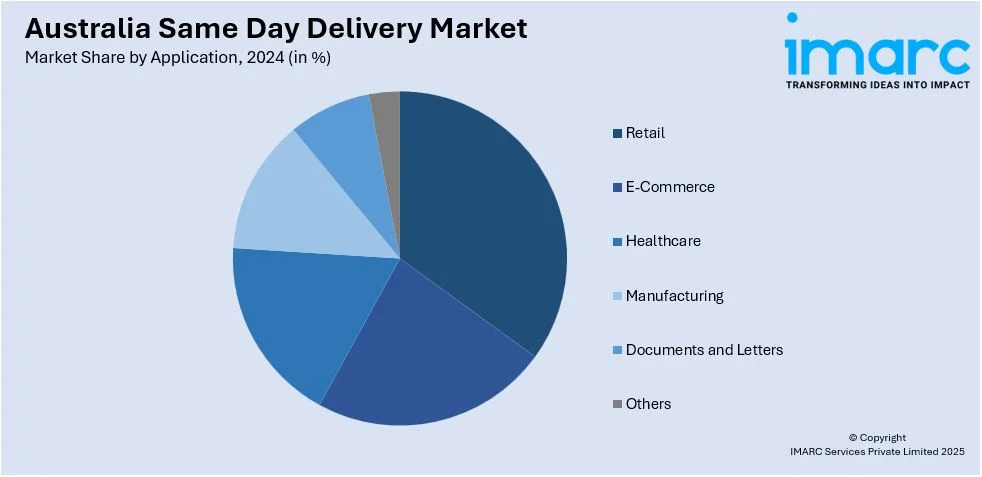

Application Insights:

- Retail

- E-Commerce

- Healthcare

- Manufacturing

- Documents and Letters

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes retail, e-commerce, healthcare, manufacturing, documents and letters, and others.

End User Insights:

- Business to Business (B2B)

- Business to Customer (B2C)

- Customer to Customer (C2C)

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes business to business (B2B), business to customer (B2C), and customer to customer (C2C).

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided including:

- DHL Global Forwarding

- DTDC Australia Pty Ltd

- GoPeople

- PACK & SEND Holdings Pty Ltd

- TransDirect

- Zoom2u Pty Ltd

Australia Same Day Delivery Market News:

- In May 2025, Amazon launched Prime Free Same-Day Delivery in Perth, extending its success in Sydney. It offers free delivery on eligible orders over $49 to most residents. This is reflective of a 40% rise in expectation of same-day and next-day deliveries in Australia between 2023 and 2024.

- In July 2025, Amazon announced its plans to invest over USD 30 Million in next-generation delivery station technology in Australia by 2025, enhancing safety and efficiency. Two new stations will open soon, creating 200 jobs. This investment has already improved delivery speeds for Prime members, with same-day services now available in Sydney and Perth.

- In August 2024, Amazon Australia launched its Prime Free Same-Day Delivery service in Sydney, covering over 90% of the population. The initiative allows Prime members to order from over one million products for same-day delivery.

Australia Same Day Delivery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | International Service, Domestic Service |

| Mode of Transportations Covered | Airways, Roadways, Railways, Intermodal |

| Applications Covered | Retail, E-Commerce, Healthcare, Manufacturing, Documents and Letters, Others |

| End Users Covered | Business to Business (B2B), Business to Customer (B2C), Customer to Customer (C2C) |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | DHL Global Forwarding, DTDC Australia Pty Ltd, GoPeople, PACK & SEND Holdings Pty Ltd, TransDirect, Zoom2u Pty Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia same day delivery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia same day delivery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia same day delivery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The same day delivery market in the Australia was valued at USD 2.04 Billion in 2024.

The Australia same day delivery market is projected to exhibit a compound annual growth rate (CAGR)of 12.30% during 2025-2033.

The Australia same day delivery market is expected to reach a value of USD 6.30 Billion by 2033.

Australia is witnessing increased use of micro-fulfillment centers, app-based delivery coordination, and partnerships between retailers and third-party logistics providers, which represent the primary key trends of the market. Consumers now expect flexible delivery time slots, and businesses are integrating predictive analytics to manage demand spikes and ensure rapid, last-mile efficiency.

The major growth driver of the market is the rising e-commerce adoption, especially in urban areas. Businesses leveraging digital tools and expanding local distribution networks to reduce delivery times and consumer preference for convenience and rapid service is encouraging retailers to offer competitive, same-day shipping options across categories.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)