Australia Sanitary Napkin Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

Australia Sanitary Napkin Market Size and Share:

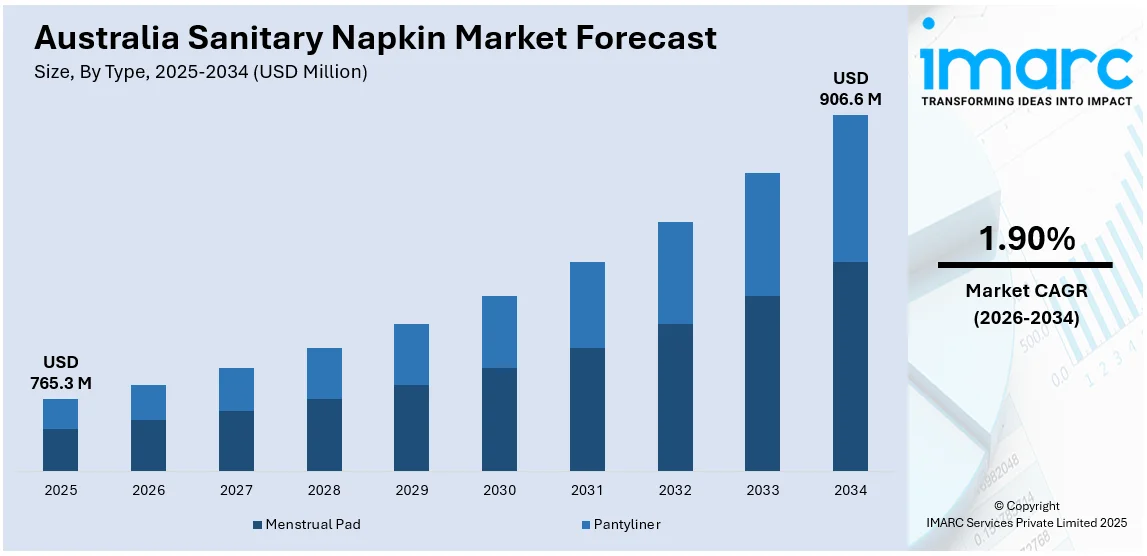

The Australia sanitary napkin market size was valued at USD 765.3 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 906.6 Million by 2034, exhibiting a CAGR of 1.90% from 2026-2034. The market is witnessing a steady growth driven by the rising disposable incomes, increasing awareness of hygiene practices, expanding distribution channels, rapid technological advancements in product innovation, imposition of government initiatives promoting menstrual health, and the growing preference for premium and eco-friendly options.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 765.3 Million |

| Market Forecast in 2034 | USD 906.6 Million |

| Market Growth Rate (2026-2034) | 1.90% |

The imposition of policies by the Commonwealth of Australia to enhance menstrual hygiene accessibility and affordability is one of the major factors bolstering the market growth. These measures include tax reduction or exemption on sanitary products and free sanitary napkins distribution in schools and community centers. For example, in the federal budget of 2024-25, the government allocated USD12.5 million to supply free period products to women and girls in remote First Nations communities, resulting in alleviating period poverty and improving menstrual health. The introduction of these initiatives aims to promote menstrual health and reduce period poverty, thereby increasing the demand for sanitary napkins.

To get more information on this market Request Sample

The increasing number of women in the workforce and urban areas, which led to higher disposable incomes and a preference for convenient and hygienic menstrual products, is also boosting the sanitary napkin market in Australia. As per industry reports, it has been found that the share of female employees in full-time employment was 56.9% in July 2024. Along with this, the gap in gender participation for full-time employment has reduced to 23.6%. This demographic shift supports the demand for sanitary napkins as working women seek reliable and comfortable options during menstruation. Besides this, the rising popularity of organic and luxury sanitary napkins among Australian women is catalyzing the expansion of the market.

Australia Sanitary Napkin Market Trends:

Rising Awareness and Education on Menstrual Hygiene

The awareness of campaigns and education programs that lead to an increased understanding of menstrual health and hygiene among the Australian women is providing a significant boost to sanitary napkins market growth. This awareness increases the adoption of sanitary napkins over traditional methods, contributing to the market expansion. In addition, organizations like Share the Dignity are introducing activities like the "Period Pride" campaign to raise the awareness about the new age sanitary practices, among the women and girls, fueling the market growth. Moreover, in August 2023, Woolworths demonstrated its endorsement to Share the Dignity by announcing the biannual Dignity Drive, to demolish period poverty across Australia.

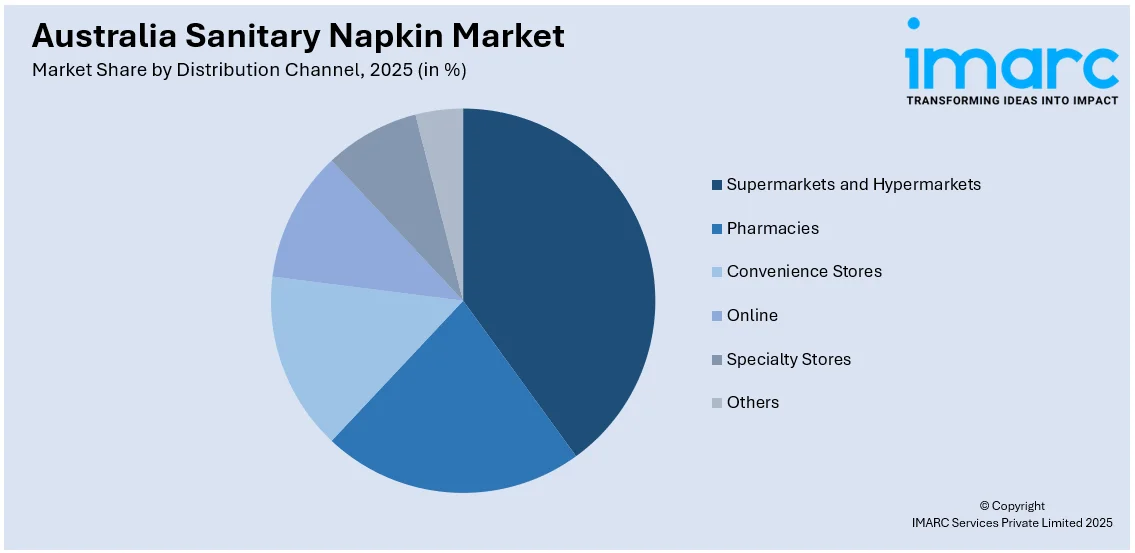

Expansion of Distribution Channels

The proliferation of online retail platforms and the presence of sanitary napkins in supermarkets, pharmacies, and convenience stores that improve product accessibility is creating a positive outlook for the market. As per an industry report, over 5.6 million Australian households shopped online every month, and over 9.4 million households purchased physical goods. This surge in the e-commerce has bolstered the availability of sanitary napkins on various online platforms. Moreover, due to the ease of accessing a wide range of products through retail stores, sanitary napkins are becoming more convenient and user-friendly to larger sections of the population which is contributing to market growth. Besides this, the addition of subscription based services that offer deliveries of sanitary napkins on a monthly basis is promoting the market growth.

Increasing Disposable Incomes

The steady growth in the disposable incomes of households in Australia is allowing consumers to spend more on higher-quality sanitary products, which is boosting the market growth. Additionally, in 2023, Australia's median disposable income increased by 2.8%, and more women switched from basic to organic and premium sanitary napkins. These improved and upgraded products contain advanced materials, improved absorbency, and better skin-friendliness, which aligns with the demands of health-conscious consumers. Apart from this, the growing interest of an environmental conscious women in newer category of products, such as reusable sanitary napkins and biodegradable sanitary napkins, is impelling the growth of the industry.

Australia Sanitary Napkin Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia sanitary napkin market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type and distribution channel.

Analysis by Type:

- Menstrual Pad

- Pantyliner

Menstrual pads are available in various of sizes, absorbent capacity, and styles to cater to various menstrual needs, such as light and heavy-flow days. Moreover, recent innovations, including ultra-thin, organic, and biodegradable pads, which are increasingly attracting the attention of environmentally conscious consumers are fueling the market growth.

Pantyliners are used for daily freshness, as backup protection during light-flow days or at the beginning or end of menstruation phase. They are known for their thin and discreet design and are popular among women seeking convenience and comfort for everyday use. Moreover, the rising awareness of feminine hygiene and the promotion of pantyliners as an essential daily-use product is contributing to the market growth.

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online

- Specialty Stores

- Others

Supermarkets and hypermarkets offer a wide range of brands and types under one roof. Moreover, their extensive reach, frequent promotions, and convenience makes them a preferred choice for many consumers. Besides this, these outlets provide bulk purchasing options, enabling cost savings. Additionally, the rising popularity of supermarkets and hypermarkets, owing to the dedicated aisles and prominent visibility for feminine hygiene products, is contributing to the market growth.

Pharmacies serve as a trusted source for sanitary napkins, particularly for consumers seeking expert advice on product selection, such as dermatologically tested or hypoallergenic options. Moreover, they are known for carrying mainstream and premium brands, thus catering to health-conscious buyers. Besides this, their accessibility and presence in urban and rural areas ensure consistent product availability, boosting the market growth.

Convenience stores offer quick and easy access to sanitary napkins, especially for last-minute purchases. Moreover, their widespread locations and extended operating hours, which make them a popular choice for busy consumers, are acting as growth-inducing factors. Furthermore, convenience stores cater to urban shoppers and travelers, driving steady sales within this segment.

Online platforms have emerged as a rising segment in the sanitary napkin industry, because of the increased use of e-commerce. They provide a diverse selection of items, competitive pricing and discounts, and the convenience of home delivery. Furthermore, the emergence of subscription services for monthly delivery, which establishes online channels as an intrinsic element of the sector, is promoting the market growth.

Specialty stores specialize on organic, biodegradable, or specialty sanitary goods, catering to environmentally sensitive and health-conscious customers. These stores sell exclusive or boutique brands, giving a curated shopping experience. In addition, increased demand for sustainable and quality sanitary napkin solutions is driving the market growth.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

A major market for sanitary napkins in Australia is the Australian Capital Territory (ACT) and New South Wales (NSW), which are highly urbanized and have a high population density. Furthermore, rising demand for premium and environmentally friendly menstruation products among health-conscious and affluent customers is a key growth driver.

Victoria and Tasmania account for a large portion of the sanitary napkin market, with Melbourne serving as a cultural and commercial powerhouse. Furthermore, the region's commitment to sustainability, which encourages the use of biodegradable and organic sanitary products, is driving the industry ahead. Aside from that, the implementation of awareness initiatives and improved retail integration in rural and suburban regions is driving the market growth.

Queensland has a strong market for sanitary napkins, which is influenced by its expanding urban population and rising disposable income. In addition, an increasing need for a varied selection of menstrual hygiene products, including both low-cost and high-end solutions, is driving the market expansion. Aside from that, the growing usage of online retailers, particularly in distant locations, is fueling the market growth.

The South Australian and Northern Territory markets are expanding as a result of a shift in focus toward enhancing accessibility in distant and rural regions, as well as government programs and nonprofit activities. Aside from that, the region's growing demand for mid-range and eco-friendly items bodes well for the industry.

Western Australia has a thriving market for sanitary napkins fueled by rising incomes and consumer awareness of menstrual hygiene. Additionally, the expanding online retail channels that address addressed accessibility issues in remote areas are catalyzing the market growth. Furthermore, the growing demand for eco-conscious products, reflecting the state’s emphasis on sustainability and environmental responsibility, is fostering the market growth.

Competitive Landscape:

The major players in the market are actively enhancing their product offerings and expanding their market presence. They are developing innovative products with features such as improved absorbency and comfort to meet diverse consumer needs. Moreover, several brands are emphasizing on sustainable and reusable options, appealing to the environmentally conscious consumer base. Additionally, these companies are leveraging online platforms to reach a high scale of audience, offering subscription services and engaging in social media networking to increase brand recognition and consumer engagement. Besides this, is involves leading companies, developing collaborations with the retail shops and are participating in community initiatives to strengthen their market position.

The report provides a comprehensive analysis of the competitive landscape in the Australia sanitary napkin market with detailed profiles of all major companies.

Latest News and Developments:

- In November 2024, TLC Healthcare formed a partnership with Australian company Femmé Organic to make feminine hygiene products available across its sites for freeIt involves installing over 200 eco-friendly bathroom dispensers containing 100 per cent organic cotton and toxic-free tampons and sanitary pads in every female bathroom across the organisation’s network of 12 aged care homes, medical centres, early learning centres, health clubs, head office, and cafes.

Australia Sanitary Napkin Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Menstrual Pad, Pantyliner |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Online, Specialty Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia sanitary napkin market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia sanitary napkin market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia sanitary napkin industry and its attractiveness.

Key Questions Answered in This Report

Sanitary napkin includes a variety of menstrual hygiene products designed to manage menstrual flow effectively. They are absorbent materials worn inside underwear during menstruation to absorb blood and prevent leakage. These products are available in various types, including disposable and reusable options, catering to different flow levels, preferences, and needs.

The Australia sanitary napkin market was valued at USD 765.3 Million in 2025.

IMARC estimates the Australia sanitary napkin market to exhibit a CAGR of 1.90% during 2026-2034.

The Australian sanitary napkin market is driven by the rising awareness of menstrual hygiene, imposition of several government initiatives to combat period poverty, increasing disposable incomes of consumers, growing demand for eco-friendly and premium products, and the expansion of distribution channels.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)