Australia Seafood Market Size, Share, Trends, and Forecast by Type, Form, Distribution Channel, and Region, 2025-2033

Australia Seafood Market Size and Share:

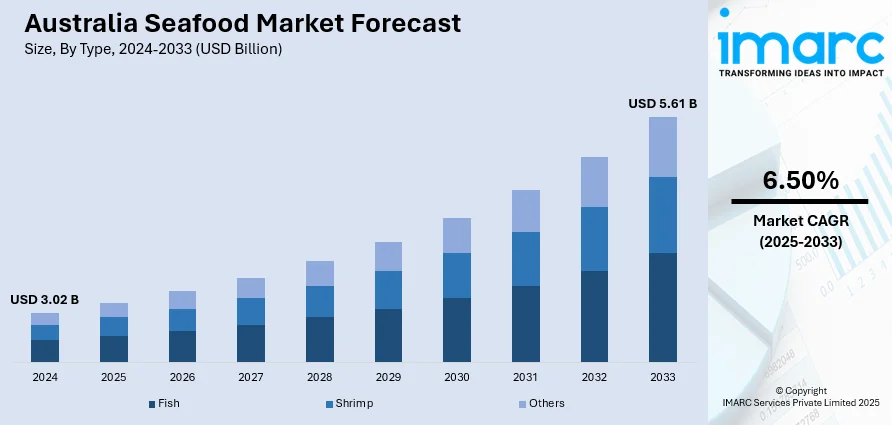

The Australia seafood market size reached USD 3.02 Billion in 2024. Looking forward, the market is expected to reach USD 5.61 Billion by 2033, exhibiting a growth rate (CAGR) of 6.50% during 2025-2033. The market is fueled by growing demand among consumers for fresh, sustainable and healthy food options, rising health awareness related to seafood consumption, and an increasing demand for locally produced and premium food.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.02 Billion |

| Market Forecast in 2033 | USD 5.61 Billion |

| Market Growth Rate (2025-2033) | 6.50% |

Key Trends of Australia Seafood Market:

Sustainable Fishing Practices

There is growing focus toward sustainability in Australia's seafood industry, primarily driven by consumers and regulatory pressure. Overfishing, catch limits, and marine habitat protection have been pivotal in the preservation of biodiversity. Certification programs such as the MSC are becoming the norm and further encourage industry players to move towards sustainable operations. For instance, as of November 2024, over 35% of Australia's wild-caught seafood by volume holds MSC certification, reflecting the increasing adoption of sustainable fishing practices. Furthermore, eco-labeling ensures consumers buy products that are environmentally friendly, and this has placed consumers in a market environment where sustainability is no longer a trend but an expectation. This responsibility to source sustainably can assist in guaranteeing that fish stocks and fragile ecosystems are safeguarded for future generations, which further contributes to the Australia seafood market demand.

To get more information of this market, Request Sample

Growth of Aquaculture

Aquaculture is emerging as a leading force in Australia's seafood market, fueled by the necessity to keep up with an increasing demand while taking pressure off wild fish stocks. According to the new data from the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES), the Australian fisheries and aquaculture production will increase its gross value by 0.5% to $3.56 Billion during 2023−24. With technology advances and better breeding methods, species such as salmon and barramundi are being cultivated more effectively, providing a reliable, high-quality supply of seafood. Aquaculture enhances food security and provide employment in coastal areas, further fueling its growth. The shift towards sustainable aquaculture practices guarantees long-term development while upholding environmental standards, thus being a major growth stimulator in Australia's seafood industry.

Growth Drivers of Australia Seafood Market:

Domestic Demand and Seafood Culture

The seafood market in Australia is highly influenced by a well-established cultural love of fresh and varied seafood. The country has a very long coastline of more than 25,000 kilometers and thus has direct access to an array of seafood such as prawns, abalone, rock lobsters, barramundi, and oysters. Marine communities in areas such as Queensland and Tasmania have had fishing culture for centuries, and this has shaped national food trends and consumption patterns. Seafood is a staple food in most Australian homes and is a common component of popular dishes, particularly in coastal urban centers such as Sydney, Melbourne, and Perth. Additionally, the multicultural population of the nation has introduced Asian and European culinary traditions, further diversifying seafood types and cooking styles utilized. This ever-changing nature of consumer preferences and the increasingly widespread consumption of seafood in regular meals play a huge role in fueling the rising demand. With Australians increasingly focusing on health and wellness, the image of seafood as a lean and nutritious source of protein further drives market expansion.

Sustainable Aquaculture and Fishing Practices

According to the Australia seafood market analysis, one of the distinctive growth drivers in the region’s seafood industry its high emphasis on sustainability and ecologically friendly aquaculture and fishing practices. Australia stands out internationally for enforcing some of the world's toughest fisheries management regulations, with national systems in place to ensure that seafood is being harvested in a manner that keeps ecosystems in balance. Places such as South Australia and Tasmania are renowned for being at the forefront of aquaculture innovations, such as employing clean and low-density farming methods for high-value species such as Atlantic salmon and southern bluefin tuna. Moreover, government policies and certification schemes, including the Marine Stewardship Council (MSC) labeling, promote the producers and consumers to prefer sustainable products. These initiatives contribute to maintaining marine biodiversity while positioning Australia at a premium level in international markets, providing its seafood with a competitive edge based on traceability and quality. Transparency and accountability inherent within the nation's seafood industry find favor with morally minded consumers, driving market demand both at home and abroad.

Export Potential and Global Market Integration

Australia's seafood market is also growing because of its growing integration in world trade networks with a high export orientation, especially towards Asia. Markets such as China, Japan, and Singapore are the major outlets for high-quality Australian seafood, such as Western rock lobster, southern bluefin tuna, and live abalone. Australia's image of having high food safety standards, clean oceans, and higher product quality has established its seafood as a premium product in most international markets. Strategic geographical location near large Asian economies helps improve export logistics, enabling the easy transportation of fresh or live products. In addition, free trade agreements and global alliances have facilitated regulatory processes to minimize obstacles for seafood exporters. Upgrades to coastal infrastructure and cold-chain logistics, especially at ports such as Fremantle and Darwin, have also facilitated export capacity. This international outreach generates increased revenue while stimulating investment in the domestic seafood sector, creating a sustained growth cycle.

Opportunities of Australia Seafood Market:

Regional Australia Aquaculture Expansion

The most promising of the Australian seafood market opportunities is the strategic development of aquaculture, especially in remote and regional coastal areas. Australia has enormous lengths of undeveloped coastline and pristine marine habitats that are suitable for supporting aquaculture businesses with sustainable growth. Areas like Tasmania, northern Queensland, and regions of Western Australia are already showing success in cultivating species like Atlantic salmon, barramundi, and black tiger prawns. These areas have the best conditions for aquaculture, while also having supportive local governments, which tend to work together with the industry to ensure sustainable growth and employment opportunities. In addition, numerous Indigenous communities along the northern coast are becoming progressively engaged in aquaculture operations, presenting potential for cultural retention in addition to economic growth. As domestic and international markets continue to grow for high value farmed seafood, increasing aquaculture production in underutilized areas has the potential to greatly increase overall capacity while promoting regional development and local economic resilience.

Value-Added Processing and Product Innovation

Another major opportunity for the Australian seafood industry is the establishment of value-added processing and product development. Historically, much of the seafood caught or produced in Australia has been exported or marketed fresh. There is increasing consumer demand, both domestically and internationally, for convenient ready-to-cook, pre-prepared, or pre-packaged seafood products that are readily preserved in terms of quality and freshness. Australian seafood producers are increasingly turning towards new technologies, including innovative packaging, preservation methods, and diversified product lines to meet contemporary dietary habits, including smoked, marinated, or frozen portions for retail and foodservice applications. Individual regional specialties, like Tasmanian smoked salmon or Coffin Bay oysters, also offer opportunities for branding and export as gourmet products. Moreover, Australia's dedication to chemical-free, clean-label food production provides a sound platform to promote natural and high-quality seafood products. By leveraging consumer patterns in favor of health-related, sustainably produced, and convenient seafood, Australia can take a bigger bite of high-margin niches from the global market.

Tourism and Food Experiences Focused on Seafood

Australia's energetic tourism industry also offers an exciting and sometimes untapped possibility for the seafood sector through culinary tourism. Coastal communities like Port Lincoln, Fremantle, and Hobart already have seafood festivals, live catch encounters, and seafood eating along the water's edge that draw domestic and international travelers. The potential is in combining seafood into travel packages even more—like seafood trails, harvest excursions, and cooking classes centered around native marine species. With seafood production brought close to tourist destinations, tourists can dine on freshly caught or cultured seafood while appreciating sustainable harvesting practices and indigenous fishing traditions. This hands-on experience enhances the awareness and attractiveness of Australian seafood while instilling an emotional affinity between the consumer and product, which tends to translate into higher demand after the visit. In addition, coupling seafood tourism with Indigenous-led experiences and local narratives provides a differentiated, authentic product that promotes Australia's distinctive marine biodiversity and culinary heritage and adds value to the industry's proposition.

Government Support of Australia Seafood Market:

Regulatory Framework and Fisheries Management

The government of Australia boasts a world-class regulatory structure that forms the basis of its sustainable management of seafood resources, laying the grounds for long-term support of the industry. Through institutions such as the Australian Fisheries Management Authority (AFMA), the government imposes stringent quotas, licensing, and observing systems to check overfishing and provide ecological equilibrium. This regulatory strategy is not only novel for its specificity but also for its responsiveness, integrating scientific inquiry and stakeholder engagement into decision-making. For instance, the Northern Prawn Fishery is governed by real-time data and seasonal mechanisms, a move that reflects Australia's embrace of dynamic, ecosystem-based management. Through cooperation with state and territory governments, Australia has accomplished highly coordinated maritime governance, which is necessary for the country's expansive exclusive economic zone (EEZ), which is the second largest in the world. Such dedication ensures that the seafood market is guided by a clearly defined, science-informed policy framework, underpinning long-term sustainability and industry integrity.

Financial Incentives and Research Investment

Government assistance for the Australian seafood industry goes far beyond regulation to include specifically targeted financial support and investment in research and development. Governments at the federal and state level actively sponsor innovation projects through groups like the Fisheries Research and Development Corporation (FRDC), which works in partnership with universities and industry to drive efficiency, biosecurity, and aquaculture sustainability. Grants and subsidies are provided to promote the uptake of cutting-edge technology among small and medium seafood businesses, including digital traceability systems and automated processing systems. In states like South Australia and Tasmania, the government has co-funded aquaculture infrastructure such as hatcheries and water treatment plants to promote regional economic growth. Climate adaptation receives particular attention with funding for research on species resilience and environmental observation. These efforts enhance competitiveness and productivity while also facilitating the adaptation of the industry to new environmental conditions, making it more viable in the long run and consistent with Australia's wider objectives of economic growth fueled by innovation.

Export Facilitation and Trade Agreements

The government of Australia has a strong role in opening global opportunities for its seafood industry through export facilitation and the negotiation of trade agreements. Organizations like Austrade provide seafood exporters with market information, branding assistance, and access to foreign buyers, especially in high-value markets in Asia, the Middle East, and North America. Free trade agreements with nations like Japan, China, and South Korea have lowered tariffs on Australian seafood products considerably, thus making them competitive in foreign markets. This assistance is especially valuable for premium species exporters such as rock lobster, abalone, and bluefin tuna. Furthermore, the government has established rigorous food safety and traceability regulations that comply or surpass global standards, providing Australian seafood with a solid reputation for quality and dependability. In port and border cities like Darwin and Cairns, infrastructure improvement bolstered by federal investment has improved cold-chain logistics further to enhance the efficiency of seafood exports and bolster Australia's international seafood presence.

Australia Seafood Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, form and distribution channel.

Type Insights:

- Fish

- Shrimp

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes fish, shrimp, and others.

Form Insights:

- Canned

- Fresh/Chilled

- Frozen

- Processed

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes canned, fresh/chilled, frozen, and processed.

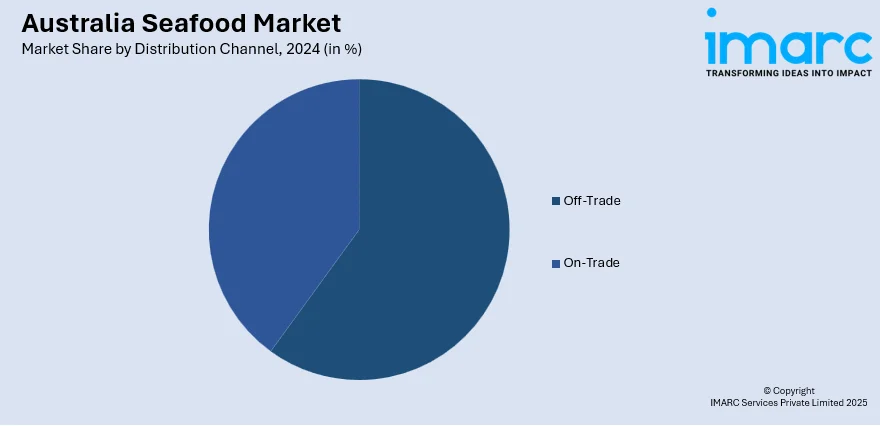

Distribution Channel Insights:

- Off-Trade

- Convenience Stores

- Online Channel

- Supermarkets and Hypermarkets

- Others

- On-Trade

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes off-trade (convenience stores, online channel, supermarkets and hypermarkets, others) and on-trade.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Seafood Market News:

- In February 2025, The CSIRO launched an experiment to discover a new species of native white-flesh fish suitable for sustainable production after it was discovered that an astounding 62% of Australia's seafood is imported. CSIRO's livestock and aquaculture research director Mat Cook stated that Australians consume 350,000 tons of seafood annually, with over 50 percent sourced from aquaculture. The project is currently at its midpoint, and the team is hopeful that pompano will be available in the commercial market by the early 2030s. The national science agency is focused on introducing this fish species to tackle the swiftly increasing demand for protein, which the CSIRO anticipates will double by 2050.

- In May 2025, Goolwa PipiCo decided to collaborate with Austrade to showcase the Goolwa PipiCo brand in these nations through trade exhibitions. The Australia exhibit will feature a Spanish-Australian chef who will cook seafood sourced from 11 different producers. The chef will arrange custom tastings for prospective clients from Europe, North America, and Asia.

- In August 2024, Tuna Australia member Walker Seafoods Australia announced partnership with renowned chef Neil Perry to launch a new product line of preserved local tuna for sale in Australian supermarkets. This collaboration marks a significant milestone in promoting sustainable seafood practices in Australia.

- In July 2024, Clean Seas Seafoods announced that it has received an automatic feeder barge, "Eyre Spirit," valued at USD 6 million, at Port Adelaide. The barge is designed by Southern Ocean Solutions and built in Vietnam. It improves efficiency, reduces waste, and enables remote feeding for 90% of operations, driving significant cost savings.

- In November 2024, a newly identified white-flesh fish species was deemed the perfect candidate for cultivation in the tropical climate of northern Australia, following successful breeding trials by Australia's national science agency, CSIRO, and encouraging preliminary market assessments with chefs and customers, the product has contributed more than USD 1 Billion to the economy. A new Pompano industry might help Australian aquaculture reduce its reliance on almost 100,000 tons of imported white-flesh fish while meeting the growing demand for seafood in a sustainable manner.

Australia Seafood Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fish, Shrimp, Others |

| Forms Covered | Canned, Fresh/Chilled, Frozen, Processed |

| Distribution Channels Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia seafood market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia seafood market on the basis of type?

- What is the breakup of the Australia seafood market on the basis of form?

- What is the breakup of the Australia seafood market on the basis of distribution channel?

- What is the breakup of the Australia seafood market on the basis of region?

- What are the various stages in the value chain of the Australia seafood market?

- What are the key driving factors and challenges in the Australia seafood market?

- What is the structure of the Australia seafood market and who are the key players?

- What is the degree of competition in the Australia seafood market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia seafood market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia seafood market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia seafood industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)