Australia Seaweed Market Size, Share, Trends and Forecast by Environment, Product, Application, and Region, 2026-2034

Australia Seaweed Market Overview:

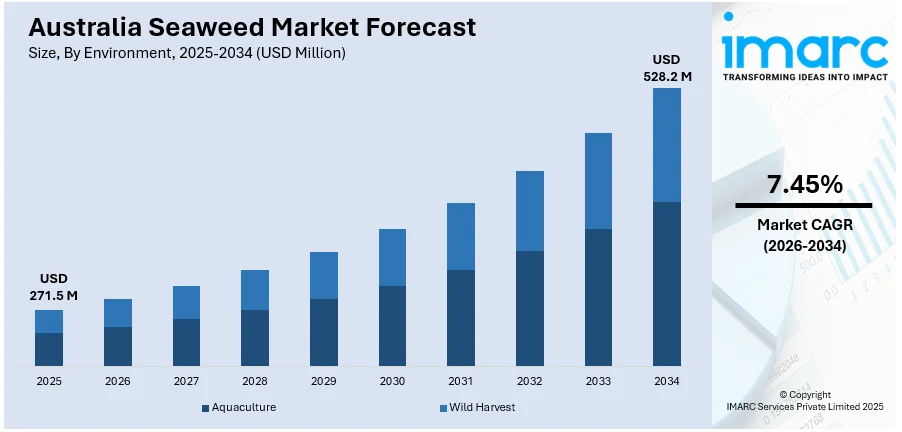

The Australia seaweed market size reached USD 271.5 Million in 2025. Looking forward, the market is projected to reach USD 528.2 Million by 2034, exhibiting a growth rate (CAGR) of 7.45% during 2026-2034. The market has seen steady growth, driven by rising demand for sustainable agriculture, alternative proteins, and carbon reduction solutions. Supportive government policies, regional projects, and research investments continue to strengthen local production and international market potential.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 271.5 Million |

| Market Forecast in 2034 | USD 528.2 Million |

| Market Growth Rate 2026-2034 | 7.45% |

Key Trends of Australia Seaweed Market:

Rising Demand for Sustainable Solutions

The growing interest in climate-smart agriculture and environmental sustainability has helped push the demand for seaweed in Australia. Seaweed, especially species like Asparagopsis, has gained attention for its ability to cut methane emissions in livestock by up to 90 percent. This environmental benefit has made it attractive for the agriculture sector, particularly beef and dairy producers looking to meet emissions targets. Increasing awareness among farmers and investors has created momentum for seaweed-based livestock feed and biofertilisers. Recent developments, such as CH4 Global's EcoPark launch in South Australia in January 2025, have helped supply methane-reducing seaweed at scale. The facility aims to serve 45,000 cattle daily, a major step forward for emissions-reducing feed. Also, seaweed's role in carbon sequestration, marine restoration, and regenerative practices continues to align with environmental goals. These factors, combined with consumer interest in cleaner supply chains and lower-carbon products, have helped shape long-term demand. Ongoing partnerships with researchers and agribusinesses are expected to streamline production further, improve processing technologies, and lower costs. Together, these shifts point to a stable and growing future for seaweed products in Australia's agriculture and environmental sectors.

To get more information on this market Request Sample

Supportive Investments and Research Growth

Government interest, research programs, and private investment have become important growth drivers for the Australian seaweed sector. Australia's long coastline and biodiversity provide a natural advantage, but until recently, the potential of seaweed aquaculture remained largely untapped. Projects like the Gippsland Seaweed Aquaculture initiative, led by Food & Fibre Gippsland and Latrobe Valley Authority, have started to change that. In September 2023, the project confirmed promising cultivation conditions through a Deakin University study, opening doors for a new regional seaweed industry. Such programs aim to create new jobs, support local supply chains, and add economic value to coastal areas. Research groups are also identifying suitable species, testing growing techniques, and exploring uses ranging from food to bioplastics. AgriFutures Australia has forecast that the national seaweed industry could exceed USD 100 Million in value by 2030, adding more than 1,000 jobs. Additionally, advances in hatchery technology, biosecurity frameworks, and processing innovation are improving the feasibility of commercial-scale seaweed farming. With better infrastructure and more collaboration between universities, startups, and regional groups, the sector is entering a new phase of development. These investments drive production and position Australia as a contributor to global seaweed demand.

Growing Demand for Functional Foods and Nutraceuticals

The increasing focus on health and wellness is substantially affecting consumer habits, resulting in a notable surge in the demand for functional foods and nutraceuticals. Seaweed, celebrated for its impressive nutritional content which includes vital vitamins, minerals, antioxidants, and dietary fiber is gaining popularity as a prominent superfood. Consumers are integrating seaweed-infused snacks, supplements, and enriched foods into their diets to promote immunity, enhance digestion, and improve overall health. This trend toward natural, plant-based nutrition is particularly evident among urban and health-oriented individuals. In response, food producers are introducing innovative seaweed-based offerings to meet this growing demand. Consequently, the heightened emphasis on preventive health is crucial for driving Australia seaweed market growth, specifically within the premium and functional food sectors.

Growth Drivers of Australia Seaweed Market:

Abundant Coastal Resources

Australia’s extensive and varied coastline provides ideal conditions for seaweed cultivation, such as clean waters, favorable temperatures, and access to nutrient-rich marine ecosystems. These natural resources facilitate the large-scale farming of diverse seaweed species, including red, brown, and green types. As sustainable aquaculture gains traction, investment in seaweed farms, research, and infrastructure is increasing in coastal areas. This regional advantage reduces production expenses and strengthens the country’s competitive position in the global market. With a dependable domestic supply chain and potential for further growth, Australia is set to emerge as a prominent producer of environmentally friendly seaweed. According to Australia seaweed market analysis, the availability of coastal resources is a crucial factor promoting the sector’s long-term viability.

Rising Health Awareness

As more Australians adopt health-conscious lifestyles, there is a growing demand for natural, nutrient-rich food options to enhance wellness. Rich in iodine, antioxidants, and vital minerals, seaweed is increasingly valued for its health benefits such as supporting thyroid function, enhancing gut health, and strengthening immunity. Its popularity continues to rise, driven by the growing shift toward plant-based nutrition across all age demographics. Seaweed-enriched foods, snacks, and supplements are becoming staple choices, particularly among urban and fitness-oriented individuals. Retailers and brands are seizing this opportunity by providing clean-label, functional seaweed products. This rising preference for holistic nutrition is propelling strong Australia seaweed market demand, reaffirming the category’s importance in the shifting health and wellness landscape.

Product Development Innovations

The Australian seaweed market is experiencing notable innovation, with new offerings emerging in the food, beverage, and personal care industries. Seaweed is being utilized in functional snacks, protein-rich smoothies, herbal teas, and natural skincare products. These advancements respond to consumer demands for clean, eco-friendly, and high-performing items. Both start-ups and established brands are exploring novel formulations, textures, and packaging to stand out in a crowded market. The increase in direct-to-consumer and e-commerce models is also enhancing product visibility and accessibility. This wave of innovation is appealing to health-focused consumers and expanding the presence of seaweed in mainstream retail. As a result, Australia seaweed market share is expanding across various segments, driven by creative and consumer-focused product launches.

Opportunities of Australia Seaweed Market:

Eco-Friendly Alternatives to Plastic

The trend towards sustainability is creating significant potential for seaweed in the creation of biodegradable packaging solutions. Materials made from seaweed, such as films and containers, are becoming popular as substitutes for petroleum-based plastics because they are compostable and non-toxic. These alternatives can be utilized in various applications, including food packaging, disposable products, and agricultural films, providing a sustainable answer to plastic pollution. As consumers and regulatory agencies demand more eco-friendly options, this innovation aligns with environmental objectives. With growing research and development efforts and support for circular economy practices, seaweed packaging solutions present a commercially viable and scalable option. This transition represents an important growth opportunity within the packaging industry, particularly in Australia, where sustainable practices are increasingly central to product development.

Growth in the Animal Feed Sector

Seaweed is recognized as a valuable supplement in animal feed, delivering essential nutrients, minerals, and bioactive compounds that enhance animal health and growth. Its prebiotic characteristics promote better gut health, while certain variants help minimize methane emissions in livestock, contributing to sustainability goals. In aquaculture, seaweed-based feed boosts immune health and enhances fish growth performance. With the rising demand for sustainable and efficient feed options, seaweed offers a natural alternative to synthetic additives. The expanding livestock and aquaculture sectors in Australia present a strong foundation for growth. Investing in processing technologies and supply chains for feed-grade seaweed can unlock long-term benefits and support a more resilient agricultural ecosystem.

Development of Functional Beverages

The functional beverage market offers exciting possibilities for the incorporation of seaweed. Known for its antioxidants, vitamins, and minerals, seaweed is a powerful ingredient for drinks aimed at boosting immunity, detoxification, and energy levels. Its natural umami flavor and hydrating properties make it suitable for diverse product formulations such as smoothies, teas, and infused waters. As consumers increasingly prefer clean-label, plant-based beverages, seaweed fits seamlessly into current health trends. Both Australian startups and established brands are experimenting with seaweed blends to create innovative product lines. By pairing seaweed with local botanicals or fruits, companies can develop unique, nutrient-rich drinks that cater to health-conscious consumers. This trend fosters market expansion and product diversification in the growing functional beverage segment.

Government Support of Australia Seaweed Market:

Funding for Sustainable Aquaculture

The Australian government is actively encouraging sustainable aquaculture by providing financial support and targeted grants for seaweed farming initiatives. These resources are aimed at promoting eco-friendly cultivation practices that have minimal effects on marine ecosystems. Assistance is also available for small-scale growers and startups to enhance infrastructure, invest in environmentally friendly harvesting methods, and expand their operations. This financial support lowers the entry barriers for new participants and aids in scaling existing projects. By supporting responsible practices, these funding programs contribute to economic growth and broader sustainability objectives. The availability of such assistance is crucial for accelerating the development of the seaweed sector and emphasizes Australia’s commitment to green marine industries.

Support for R&D Initiatives

The Australian government acknowledges the significance of innovation in realizing the full potential of the seaweed market. It backs research and development through grants, collaborations with academic institutions, and funding for joint projects. These initiatives aim to investigate new seaweed species, enhance cultivation methods, and create value-added products such as biofertilizers, cosmetics, and nutraceuticals. There is also a focus on improving processing efficiency and scalability. By investing in R&D, the government fosters a competitive and knowledge-driven industry capable of satisfying both domestic and international demand. This proactive strategy enhances product diversity and attracts private sector participation, creating a vibrant ecosystem for the long-term development of the seaweed market in Australia.

Policy Alignment with Environmental Goals

Seaweed cultivation is receiving robust backing as part of Australia’s broader environmental and climate strategies. Acknowledged for its contributions to carbon sequestration, marine biodiversity, and water purification, seaweed aligns closely with national sustainability objectives. The government promotes its cultivation through policies that endorse regenerative aquaculture, low-emission industries, and nature-based climate solutions. Seaweed farming is becoming integrated into blue economy strategies, reinforcing its significance in the shift toward cleaner, circular production methods.These policy alignments help create a favorable regulatory environment that de-risks investment and promotes industry growth. By positioning seaweed as both an economic and environmental asset, Australia strengthens its vision of sustainable marine resource management.

Challenges of Australia Seaweed Market:

Limited Commercial Infrastructure

A significant obstacle for the Australian seaweed market is the insufficient commercial infrastructure. Numerous regions lack the essential facilities for large-scale processing, storage, and transportation of seaweed, which hinders supply chain efficiency and scalability. Without investment in dependable logistics and value-added processing facilities, producers struggle to maintain consistent quality and deliver products to the market on time. This limitation affects the ability to supply both domestic and international markets at scale. Furthermore, inadequate infrastructure raises production costs and results in post-harvest losses. Addressing this issue is crucial to unlocking the full commercial potential of seaweed and establishing Australia as a competitive player in the global seaweed sector.

Lack of Skilled Workforce

The growth of the Australian seaweed industry is considerably limited by a shortage of qualified professionals in areas such as cultivation, processing, product formulation, and quality assurance. The cultivation and value-added production of seaweed require specialized expertise in marine biology, aquaculture, and food science. However, existing education and training programs do not adequately build the necessary talent pool for industry advancement. This skill gap results in inefficiencies, inconsistent production quality, and a slower adoption of best practices. It also restricts start-ups and small enterprises from innovating and scaling their operations. Investing in targeted training initiatives, research partnerships, and workforce development is essential for the long-term sustainability and competitiveness of the industry.

Low Consumer Awareness

Despite the numerous health and environmental advantages of seaweed, general consumer awareness in Australia remains minimal. Many consumers are not familiar with its nutritional benefits, culinary uses, and applications in non-food products like cosmetics and biodegradable packaging. This lack of knowledge diminishes their willingness to try seaweed-based products, keeping the category limited in appeal and restricting demand in mainstream retail. Efforts to market seaweed and educate the public about its advantages have been scarce, particularly beyond health-conscious and eco-aware demographics. To overcome this challenge, it will be necessary to enhance brand communication, offer product sampling, and initiate promotional campaigns to build trust and familiarity. Increasing awareness is vital for boosting domestic consumption and supporting broader acceptance of seaweed as a regular product.

Australia Seaweed Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on environment, product, and application.

Environment Insights:

- Aquaculture

- Wild Harvest

The report has provided a detailed breakup and analysis of the market based on the environment. This includes aquaculture and wild harvest.

Product Insights:

- Red

- Brown

- Green

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes red, brown, and green.

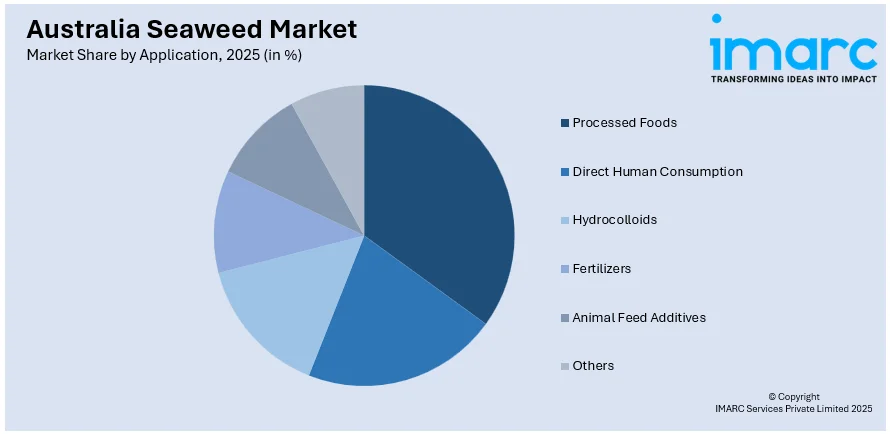

Application Insights:

Access the comprehensive market breakdown Request Sample

- Processed Foods

- Direct Human Consumption

- Hydrocolloids

- Fertilizers

- Animal Feed Additives

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes processed foods, direct human consumption, hydrocolloids, fertilizers, animal feed additives, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia Canada

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Seaweed Market News:

- January 2024: CH4 Global launched phase one of its full-scale EcoPark in Louth Bay, South Australia, cultivating Asparagopsis seaweed. With 10 ponds and plans for 100, it boosted local production, reduced methane emissions from cattle, and strengthened Australia’s seaweed industry potential globally.

- September 2023: Food & Fibre Gippsland, with Latrobe Valley Authority, completed a viability study for seaweed aquaculture. Deakin University’s findings confirmed strong potential in Gippsland, supporting future industry development, job creation, and positioning the region as a key player in Australia’s expanding seaweed sector.

Australia Seaweed Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Environments Covered | Aquaculture, Wild Harvest |

| Products Covered | Red, Brown, Green |

| Applications Covered | Processed Foods, Direct Human Consumption, Hydrocolloids, Fertilizers, Animal Feed Additives, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia seaweed market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia seaweed market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia seaweed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The seaweed market in Australia was valued at USD 271.5 Million in 2025.

The Australia seaweed market is projected to exhibit a compound annual growth rate (CAGR) of 7.45% during 2026-2034.

The Australia seaweed market is expected to reach a value of USD 528.2 Million by 2034.

The Australia seaweed market is witnessing increased innovation in food, skincare, and agricultural products. There is rising use of seaweed in eco-friendly packaging and growing collaborations between coastal communities and businesses. Expansion into wellness beverages and export-focused product lines is also shaping current market trends.

Key growth drivers include strong government support, abundant marine resources, and rising demand for plant-based, sustainable ingredients. Increasing consumer interest in functional nutrition, coupled with environmental benefits of seaweed cultivation such as carbon capture and ocean restoration, further strengthens the market’s expansion potential across multiple sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)