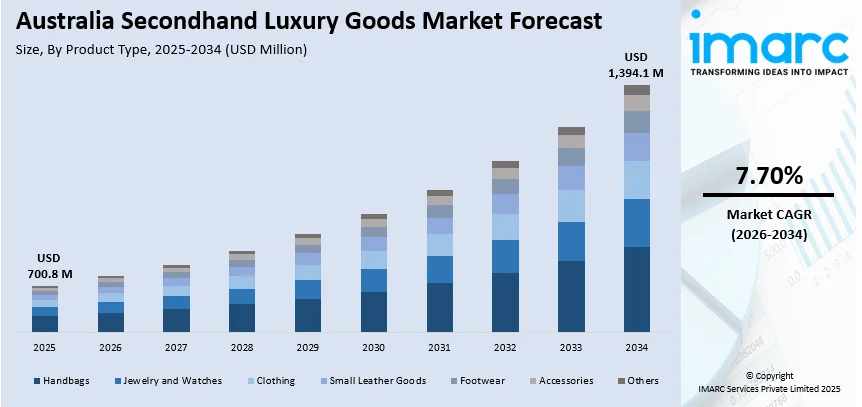

Australia Secondhand Luxury Goods Market Report by Product Type (Handbags, Jewelry and Watches, Clothing, Small Leather Goods, Footwear, Accessories, and Others), Demography (Women, Men, Unisex), Distribution Channel (Offline, Online), and Region 2026-2034

Australia Secondhand Luxury Goods Market Overview:

Australia secondhand luxury goods market size reached USD 700.8 Million in 2025. Looking forward, the market is expected to reach USD 1,394.1 Million by 2034, exhibiting a growth rate (CAGR) of 7.70% during 2026-2034. The emerging popularity of thrifting stores, coupled with the rising number of resale platforms, is primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 700.8 Million |

| Market Forecast in 2034 | USD 1,394.1 Million |

| Market Growth Rate (2026-2034) | 7.70% |

Secondhand luxury goods pertain to high-end products linked with renowned brands that have been previously possessed and utilized by individuals before undergoing resale. This category spans a diverse range of items, encompassing fashion accessories, apparel, handbags, watches, jewelry, electronic devices, etc. Buyers of these items seek to showcase their personal style, elevate their social standing, or express themselves aesthetically. Additionally, they are often considered potential investments. Moreover, the acquisition of secondhand luxury goods aligns with sustainable consumption practices, promoting an extended lifecycle for products and diminishing the need for new manufacturing.

To get more information on this market Request Sample

Key Trends of Australia Secondhand Luxury Goods Market:

Growing Sustainability and Responsible Consumption Awareness

The market has been propelled largely by the increasing awareness of consumerism in terms of sustainability and responsible consumption. More and more people are trying to find ways of decreasing their environmental footprint, and buying used luxury goods has become a common practice. The second-hand buying is considered by the consumers both a green decision and a way of prolonging the life of good products. This increasing environmental consciousness is transforming the purchasing habits, as Australians are embracing recycled luxury products more as opposed to new products. As a result, sustainable consumption practices are becoming central to the Australia secondhand luxury goods market growth, fostering stronger demand for pre-owned luxury products across the country.

Rise of E-Commerce and Online Marketplaces

The expansion of online platforms and marketplaces has provided a major impetus to market. E-commerce channels enable convenient access to a diverse range of pre-owned luxury items, making it easier for consumers to browse, compare, and purchase products from the comfort of their homes. The digital transformation of retail allows sellers to reach a wider audience, while buyers benefit from curated selections of exclusive and rare items. Additionally, trust-building mechanisms such as authentication services and return policies enhance consumer confidence in purchasing secondhand luxury products online. Consequently, the proliferation of e-commerce and digital marketplaces continues to drive sustained growth in the Australian market.

Value Retention, Investment Appeal, and Exclusivity

Another key factor driving the Australia secondhand luxury goods market demand is the perception of luxury items as valuable investments. Consumers increasingly recognize that certain products can retain or even appreciate over time, blending personal style with financial prudence. Additionally, the appeal of unique, limited-edition, and hard-to-find pieces fuels demand for pre-owned luxury items. These exclusive offerings allow buyers to express individuality and curate distinctive collections, differentiating themselves in a competitive fashion landscape. As cultural shifts toward value retention and investment-oriented purchasing strengthen, Australians are increasingly drawn to secondhand luxury products, supporting sustained market expansion in the years ahead.

Growth Drivers of Australia Secondhand Luxury Goods Market:

Enhanced Authentication Technology and Consumer Trust

Advanced authentication technologies and verification processes implemented by luxury resale platforms have significantly bolstered consumer confidence in purchasing pre-owned luxury goods. Digital authentication tools utilizing artificial intelligence, blockchain verification systems, and expert authentication services provide buyers with assurance regarding product authenticity, eliminating counterfeiting concerns that previously hindered market growth. These technological advancements have created a transparent marketplace where consumers can trust the legitimacy of their purchases, leading to increased transaction volumes and higher consumer participation rates across online and offline channels.

Rising Disposable Income among Millennials and Generation Z

The increasing purchasing power of younger demographics, particularly millennials and Generation Z, has emerged as a critical growth driver for the Australia secondhand luxury goods market share. These consumer segments demonstrate strong environmental consciousness while maintaining aspirational lifestyles, making pre-owned luxury items an attractive option that aligns with both their values and financial capabilities. Their preference for unique, sustainable fashion choices, combined with social media influence, has accelerated adoption rates, as these consumers view secondhand luxury purchases as both economically sensible and environmentally responsible investment decisions.

Expansion of Specialized Resale Infrastructure

The proliferation of dedicated luxury consignment stores, online marketplaces, and hybrid retail models has created a robust infrastructure supporting secondhand luxury goods transactions. Professional services, including item authentication, condition assessment, pricing optimization, and marketing, have transformed the resale experience from informal exchanges to sophisticated commercial operations. This infrastructure development has lowered barriers to entry for both sellers and buyers, creating seamless transaction processes that rival traditional luxury retail experiences while offering superior value propositions and convenience.

Opportunity of Australia Secondhand Luxury Goods Market:

Digital Platform Integration and Mobile Commerce Growth

The expanding integration of advanced digital technologies, including augmented reality try-on features, artificial intelligence-powered recommendation engines, and sophisticated mobile applications, presents substantial opportunities for market expansion. Mobile commerce optimization, social media integration, and personalized shopping experiences can significantly enhance customer engagement and conversion rates. These technological implementations can create immersive shopping environments that replicate in-store experiences while offering the convenience of online purchasing, potentially capturing larger market segments and increasing transaction frequency among existing customers.

Corporate Sustainability Partnerships and Brand Collaborations

Growing corporate sustainability initiatives and environmental consciousness present opportunities for strategic partnerships between luxury brands and secondhand platforms. According to the Australia secondhand luxury goods market analysis, collaborative programs focusing on circular economy principles, take-back initiatives, and certified pre-owned programs can enhance brand reputation while expanding market reach. These partnerships can legitimize the secondhand market, attract premium customers, and create new revenue streams through authenticated resale programs, ultimately driving market growth while supporting environmental sustainability goals across the luxury goods ecosystem.

Regional Market Expansion and Tourism Integration

Australia's strategic geographic position and strong tourism industry create opportunities for integrating secondhand luxury goods with travel retail and tourist shopping experiences. Development of specialized tourist-focused resale boutiques, duty-free secondhand luxury sections, and international shipping services can tap into the significant tourist market seeking authentic luxury goods at accessible price points. This integration can leverage Australia's reputation for quality and authenticity while attracting international customers and expanding the market beyond domestic consumers.

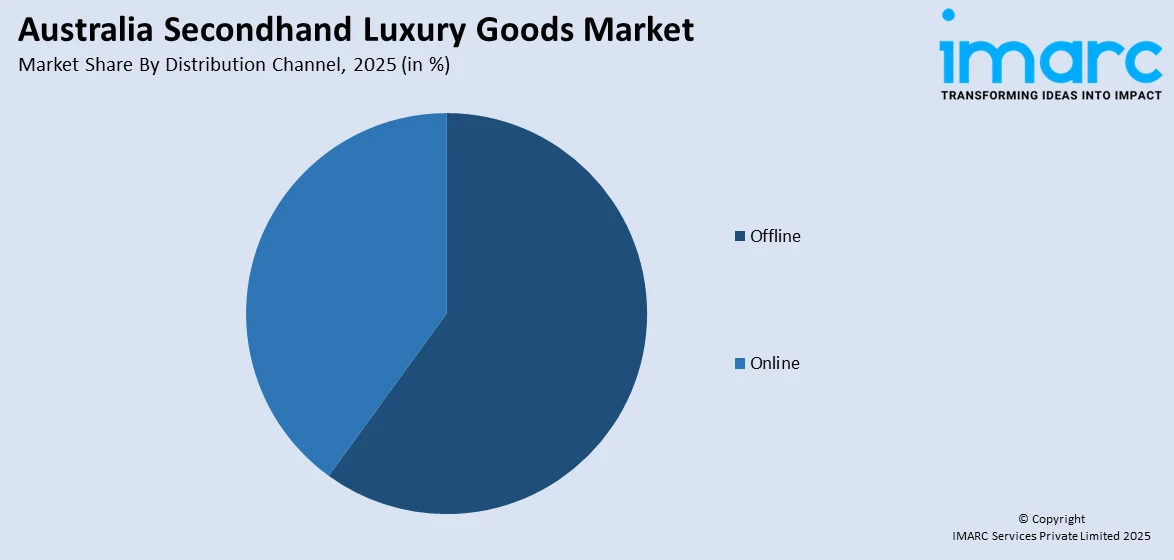

Australia Secondhand Luxury Goods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, demography, and distribution channel.

Product Type Insights:

- Handbags

- Jewelry and Watches

- Clothing

- Small Leather Goods

- Footwear

- Accessories

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes handbags, jewelry and watches, clothing, small leather goods, footwear, accessories, and others.

Demography Insights:

- Women

- Men

- Unisex

A detailed breakup and analysis of the market based on demography have also been provided in the report. This includes women, men, and unisex.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Offline

- Online

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes offline and online.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Secondhand Luxury Goods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Handbags, Jewelry and Watches, Clothing, Small Leather Goods, Footwear, Accessories, Others |

| Demographies Covered | Women, Men, Unisex |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia secondhand luxury goods market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia secondhand luxury goods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia secondhand luxury goods industry and its attractiveness.

- A competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The secondhand luxury goods market in Australia was valued at USD 700.8 Million in 2025.

The Australia secondhand luxury goods market is projected to exhibit a CAGR of 7.70% during 2026-2034.

The Australia secondhand luxury goods market is projected to reach a value of USD 1,394.1 Million by 2034.

The market experiences significant growth driven by sustainability consciousness, online platform proliferation, cultural shifts toward value retention, and consumer preference for unique limited-edition pieces that contribute to individual style expression and investment opportunities.

The Australia secondhand luxury goods market is driven by enhanced authentication technologies building consumer trust, rising disposable income among younger demographics seeking sustainable luxury options, and expanding specialized resale infrastructure creating seamless transaction experiences across multiple retail channels.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)