Secondhand Luxury Goods Market Size, Share, Trends and Forecast by Product Type, Demography, Distribution Channel, and Region, 2025-2033

Secondhand Luxury Goods Market Size and Share:

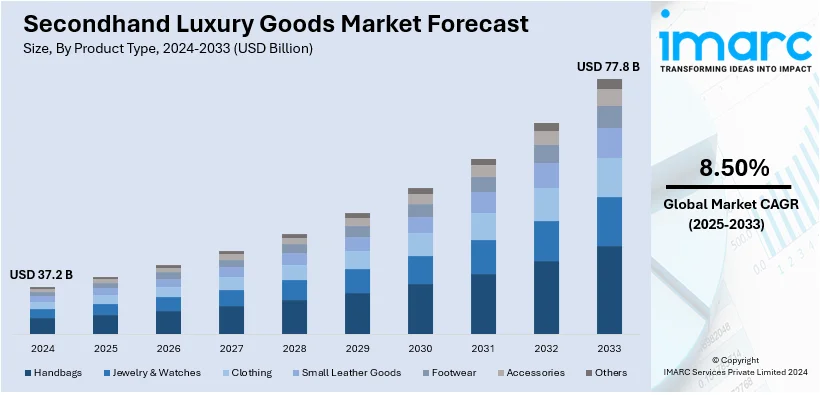

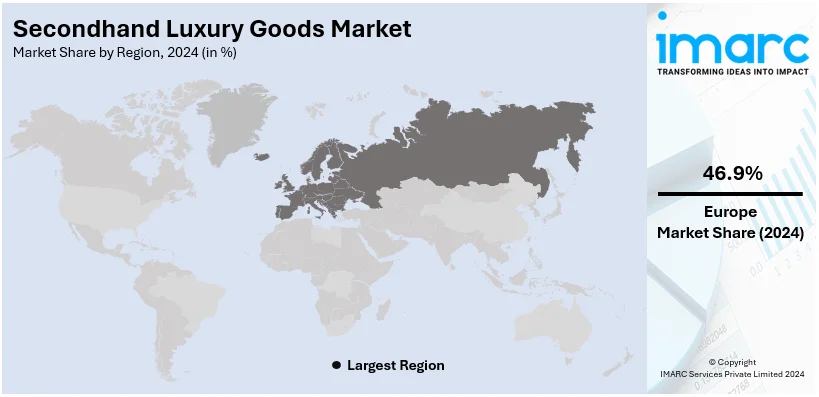

The global secondhand luxury goods market size was valued at USD 37.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 77.8 Billion by 2033, exhibiting a CAGR of 8.50% from 2025-2033. Europe currently dominates the market. This is due to the increasing sustainability consciousness, affordability of the product, increasing desire for unique pieces, increased accessibility through online platforms, growing influence of social media, and shifting consumer attituded toward ownership and consumption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 37.2 Billion |

|

Market Forecast in 2033

|

USD 77.8 Billion |

|

Market Growth Rate (2025-2033)

|

8.50% |

The secondhand luxury market is booming, as more consumers become aware about sustainability and environmental conservation, thus encouraging them to buy pre-owned luxury goods, thereby reducing waste and encouraging circular fashion. The affordability of secondhand luxury goods also opens high-end brands to a wider market, especially younger consumers who appreciate quality and exclusivity and want it at a cost-effective price. Technological advancements in online platforms are another major driver, as digital marketplaces and apps provide secure, convenient, and transparent channels for buying and selling secondhand luxury items. Authentication technologies, such as blockchain and AI, have further enhanced consumer confidence in the authenticity of pre-owned goods. Moreover, cultural shifts also play a role, as owning vintage and unique luxury pieces is increasingly seen as a statement of individuality. This trend, combined with the increasing acceptance of resale culture, is driving the growth of the secondhand luxury goods market.

The United States has emerged as a key regional market for secondhand luxury goods. The market is expanding due to rising consumer interest in sustainable fashion and cost-effective luxury. As environmental awareness grows, more individuals are seeking pre-owned luxury items to reduce waste and promote circular consumption. This aligns with the increasing emphasis on ethical purchasing practices. Additionally, affordability is a significant driver, as secondhand goods provide access to high-end brands at lower prices, appealing to a broader demographic, including younger consumers. Technological advancements are also propelling market growth, with online platforms and mobile apps making it easier to buy and sell secondhand luxury goods. These platforms offer authentication services, ensuring the quality and legitimacy of purchases, which boosts consumer confidence. The market is further driven by a growing preference for unique and vintage items, enabling buyers to express individuality. The economic uncertainty and demand for value-based purchasing also continue to strengthen this segment.

Secondhand Luxury Goods Market Trends:

Growing awareness about sustainable shopping

Presently, the secondhand luxury goods demand is escalating due to the growing consumer awareness about sustainable shopping methods. Individuals are turning to used luxury products as a more sustainable option as they become more aware of their influence on the environment. By extending the lifespan of products through secondhand purchases, consumers can minimize the carbon footprint associated with the creation and delivery of new goods, as well as the need for new production. According to recent research by OXFAM, if adults in the UK bought half of their wardrobe secondhand, that could save 12.5 billion kilograms of carbon dioxide emissions from mixing in the atmosphere. This sum is the same as a plane traveling around the earth more than 17,000 times. These results had been released in conjunction with Oxfam's yearly Second-Hand September campaign, which encourages individuals in Wales to embrace used clothing and support sustainability by shopping secondhand and donating unwanted goods.

Rising popularity of thrifting

The growing popularity of thrifting and the rise in the number of thrift stores, offering secondhand luxury goods are the primary secondhand luxury goods market drivers. As per a report published by GITNUX, about 70% of consumers have either bought or stated they are open to buying used goods. This finding is significant as it indicates that the thrifting community is becoming more environmentally, morally, and trend-aware. It also depicts the significantly growing popularity of second-hand goods. The aforementioned data highlights opportunities for thrift stores and platforms to expand, and it also highlights the increasing propensity of contemporary consumers to make sustainable and cost-conscious purchases.

Increasing number of e-commerce platforms selling secondhand luxury items

The growing number of e-commerce platforms offering diverse secondhand luxury goods is propelling the market growth. As per a leading consulting company’s industrial report, the retail e-commerce sector grew by 16 per cent in 2021, bringing in over USD 4.9 Trillion in sales globally. By 2025, this amount ought to expand by 50% to USD 7.4 Trillion. E-commerce platforms offer a worldwide reach, facilitating connections between vendors and customers around the globe. This expands the number of potential buyers for used luxury products that might have been previously restricted by location. In addition, the emergence of e-commerce sites selling secondhand luxury products lends credence to the circular economy theory, which holds that commodities should be reused rather than thrown away after usage. This reduces waste and increases the useful life of upscale products, thereby creating a positive secondhand luxury goods market overview.

Secondhand Luxury Goods Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global secondhand luxury goods market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, demography, and distribution channel.

Analysis by Product Type:

- Handbags

- Jewelry & Watches

- Clothing

- Small Leather Goods

- Footwear

- Accessories

- Others

Handbags leads the market as they are stylish accessories manufactured to contain personal belongings such as keys, wallets, makeup, and other necessities. According to a report published by GITNUX, with a 3.5% annual growth rate, the handbag market in Japan is expected to reach USD 5.5 Billion by 2025. Handbags are frequently carried by individuals as practical accessories and fashion statements. They are available in a variety of forms, sizes, materials, and styles. Designers and brands use a variety of materials, such as leather, fabric, and synthetic materials, to produce them. They can be embellished with handles, straps, clasps, zippers, and other items. They are frequently marketed as spacious, open-topped bags that can hold a range of objects. They are frequently utilized for business, shopping, and informal get-togethers. They can also be found as tiny, strapless handbags. This versatile nature of handbags is driving its demand in the market.

Analysis by Demography:

- Women

- Men

- Unisex

Women lead the market. According to a market report published by GITNUX, from 2020 to 2025, the US women's luxury bag market is expected to expand at a compound annual growth rate (CAGR) of 4.6%, with a projected value of USD 14 billion. As women buy used luxury products, the cost of ownership is substantially lower than buying them new. This is particularly enticing to women who wish to buy economical luxury goods. In addition, women frequently buy designer goods with distinctive details and patterns in order to change up their appearance and try on various outfits. This is a major factor improving the secondhand luxury goods market statistics. Besides this, access to sought-after brands and designs that could be challenging to find through traditional retail channels is one of the factors positively influencing the secondhand luxury goods market outlook. In addition, more women are choosing to invest in the future of secondhand luxury goods as a result of the growing availability of limited-edition luxury goods.

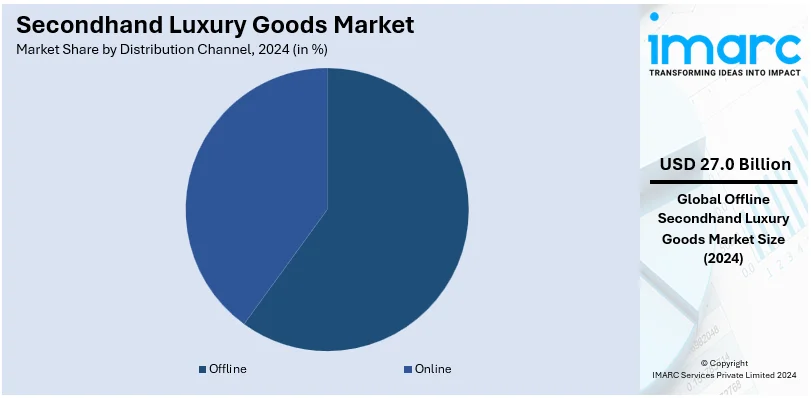

Analysis by Distribution Channel:

- Offline

- Online

Offline lead the market as in these stores, consumers can physically inspect things before making a purchase to ensure they are authentic. According to the INDIA BRAND EQUITY FOUNDATION (IBEF), the Indian retail market is expected to reach USD 1.1 trillion by 2027 and USD 2 trillion by 2032.Consumers become more confident about the authenticity and quality of the product. Online platforms might find it difficult to match the customized purchasing experience offered by offline retailers. Clients can speak with informed employees that can answer inquiries instantly, offer styling tips, and provide information about the products. Consumer happiness and the shopping experience can be improved by this caliber of customer service. Purchasing something in person instead of waiting for it to be shipped allows consumers to leave the business feeling instantly satisfied.

Regional Analysis:

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- North America

- United States

- Canada

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

According to the report, Europe represents the largest regional market for secondhand luxury goods. On account of the growing public awareness about environmental issues and the growing emphasis on sustainable buying behaviors, Europe accounted for the largest proportion of the market. According to a report published by IMARC, the Europe secondhand luxury goods market size reached US$ 18.0 Billion in 2023. In addition, the industry is expanding due to the increasing use of authentication procedures to stop luxury goods from being counterfeited. The industry is expanding as a result of the growing number of flagship stores for luxury brands and thrift shops that offer previously owned luxury goods at reduced costs.

Key Regional Takeaways:

United States Secondhand Luxury Goods Market Analysis

The secondhand luxury goods business is led by affordability, growing online resale platforms, and rising customer preferences for sustainable buying. Concerns about sustainability are important more than 50% of Gen Z and millennial buyers say they want to buy used products in order to lessen their impact on the environment. The number of young professionals and other consumers attracted to used luxury goods has also increased since they are typically 50–75% less expensive than brand-new versions. The Internet and online marketplaces like Poshmark and The RealReal have revolutionized the way in which luxury goods are purchased easily. Resale company The REalReal's Resale Report is noting an increase at exponential levels with a rising demand for branded items as most of the market shares have been dominated by the biggies in the luxury industry namely, Cartier, Tiffany & Co. as well as Van Cleef & Arpels. The focus is on making wise investments rather than following fads, and the buyer growth in the price range of USD 1,000-USD 3,000 witnessed in 2024 is the largest percentage increase of any price category-13% compared with last year. In addition, an excellent demand for luxury brands, such as Chanel, Louis Vuitton, and Rolex, gives way to expansion.

There is increased buying of used goods with long-term value due to more awareness about luxury investments. For instance, demand for used luxury watches has risen by 20% per annum, signifying the rising interest in them as an alternative investment. A growing philosophy of a circular economy also aids the market, as companies like Burberry and Gucci support resale through platform partnerships.

Europe Secondhand Luxury Goods Market Analysis

There are many reasons why the use of luxury goods is quite very popular in Europe, chief among them being cultural acceptance of used goods and emphasizing sustainability. The current markets in France, Italy, and the UK are of immense importance since consumers mainly demand antique goods as well as famous brands. Luxe vintage is a very popular notion, especially in France, where the resale market is dominated by iconic Chanel and Hermès bags.

Sustainability is an important consideration, given that 55% of European buyers of luxury used goods report citing environmental concerns. Verified authentication services, which increase buyer trust, have been crucial in this regard for platforms like Vestiaire Collective and Rebelle. Each year, the user base of these platforms grows by significantly. Also, younger consumers looking for high-end brands are attracted to the second-hand market as these are often 40–60% cheaper than the original price. The region's growth is also boosted by the EU's encouragement of the circular economy, which encompasses recycling and reusing through legislation.

Asia Pacific Secondhand Luxury Goods Market Analysis

Rising disposable incomes, growing demand from younger consumers, and a movement in culture towards sustainable consumerism are all contributing to the rapid expansion of the secondhand luxury goods sector in Asia-Pacific. Three major providers are China, Japan, and South Korea; China supplies about 60% of the demand for the regional market. Japan is known as a luxury-goods hub, with its products meeting high quality standards. This fuels stiff resale demand for high-end brands such as Prada and Cartier. Industry reports indicate that Koreans spend the most globally on luxury goods, averaging USD 325 per head each year. Platforms such as KREAM and Bunjang support tech-savvy customers in the country, including Gen Z. The rise of Alibaba and JD.com, among other e-commerce giants, has greatly improved accessibility in verified luxury secondhand sales. The encouragement of consumers to explore second-hand options as a result of pricing and environmental issues is also supporting the industry.

Latin America Secondhand Luxury Goods Market Analysis

The internet penetration combined with the charm of relatively affordable luxury is the driving factor for the Latin American used luxury market. Industry reports reveal that the Latin American luxury goods market is more than USD 30 Billion in 2023. The region's top two countries are Brazil and Mexico wherein the populations of wealthy urban networks are demanding ever more luxury brands like Gucci and Rolex. Online outlets like Enjoei and GoTrendier have made secondhand luxury attainable, with incredibly high year-to-year transaction growth. The price of second-hand goods attracts the middle class who are looking for quality brands at lower prices, typically 40–70% below retail. In addition, although regional economies are also growing at a slower pace, the business is expanding because resale is more culturally accepted, especially among young consumers, and sustainable practice is gradually being adopted in cities.

Middle East and Africa Secondhand Luxury Goods Market Analysis

The market for used luxury items in the Middle East and Africa is growing due to increased economic diversification, acceptance of resale in culture, and growing awareness of sustainability. Demand for premium labels such as Dior and Rolex remains strong in the United Arab Emirates and Saudi Arabia, where consumers are increasingly looking at secondhand alternatives. The UAE has become a market leader in this region. It is also expected that the increasing demand for luxury secondhand products will be driven further by the foreign visitors and expats entering the country in large numbers. In 2023, Dubai displayed its tourism muscles by welcoming a record 17.15 million international visitors into the country - 19.4% up from the previous year 2022. The rise of e-commerce platforms like The Luxury Closet and Buy It Now has brought second-hand luxury to more affordable accessibility levels for the general market. It is, however a still-growing yet promising sector in the region with support coming from sustainability-related drives and greater sensitivity to price in second-hand luxury.

Competitive Landscape:

Key companies in the dynamic secondhand luxury market are positioning themselves in a strategic position to take advantage of changing customer preferences and industry developments. Well-known luxury resale marketplaces such as Vestiaire Collective and The RealReal are constantly expanding their product portfolios, improving their authentication procedures, and making technological investments to deliver a flawless buying experience. In order to promote circularity in the market and ease resale, they are also collaborating with luxury labels. Furthermore, fashion rental services such as Rent the Runway are gaining traction, which give consumer the access to designer clothing without the obligation of ownership. Moreover, key players also enter into partnerships, collaborations and acquisitions in order to expand their consumer base. For instance, in October 2022, RealReal Inc. announced a circular partnership with Jimmy Choo on National Consignment Day.

The report provides a comprehensive analysis of the competitive landscape in the secondhand luxury goods market with detailed profiles of all major companies, including:

- Fashionphile Group LLC

- Fendi

- Garderobe

- Inseller

- Luxepolis

- Luxury Closet Inc.

- So Chic Boutique

- The Closet

- The RealReal Inc.

- Timepiece 360

- Vestiaire Collective

- Yoogi’s Closet Inc.

Latest News and Developments:

- October 2024: With the introduction of a secondhand service that emphasizes recycling, resale, and repair, Zara has increased the scope of its sustainability initiatives. Consumers may now donate clothing to charities through an in-store collection system, sell used Zara clothing on a dedicated platform, and get repair services for damaged goods.

- August 2024: Rebag, a premium resale platform, and Bloomingdale's have partnered to provide shoppers with access to pre-owned luxury handbags and accessories. Because of this partnership, Bloomingdale's customers can use Rebag to exchange their luxury goods for cash or store credit in addition to shopping for pre-owned goods.

Secondhand Luxury Goods Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Handbags, Jewelry and Watches, Clothing, Small Leather Goods, Footwear, Accessories, Others |

| Demographics Covered | Women, Men, Unisex |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, United States, Canada, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | Fashionphile Group LLC., Fendi, Garderobe, Inseller, Luxepolis, Luxury Closet, Inc., So Chic Boutique, The Closet, The RealReal Inc., Timepiece360, Vestiaire Collective, Yoogi's Closet Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the secondhand luxury goods market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global secondhand luxury goods market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the secondhand luxury goods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Secondhand luxury goods refer to pre-owned high-end items that are sold or purchased after their initial ownership. These goods typically belong to premium brands known for their craftsmanship, exclusivity, and quality. Common categories include designer handbags, watches, jewelry, clothing, footwear, and accessories. Secondhand luxury items retain significant value due to their brand reputation, durability, and timeless appeal.

The secondhand luxury goods market was valued at USD 37.2 Billion in 2024.

IMARC estimates the global secondhand luxury goods market to exhibit a CAGR of 8.50% during 2025-2033.

The market is primarily driven by the rising sustainability consciousness, affordability of the product, increasing desire for unique pieces, increased accessibility through online platforms, growing influence of social media, and shifting consumer attituded toward ownership and consumption.

In 2024, handbags represented the largest segment as they are frequently carried by individuals as practical accessories and fashion statements.

Women leads the market in 2024 as women frequently buy designer goods with distinctive details and patterns.

In 2024, offline is the leading segment as consumers become more confident about the authenticity and quality of the product.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global secondhand luxury goods market include Fashionphile Group LLC., Fendi, Garderobe, Inseller, Luxepolis, Luxury Closet, Inc., So Chic Boutique, The Closet, The RealReal Inc., Timepiece360, Vestiaire Collective, Yoogi's Closet Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)