Australia Skin Care Products Market Size, Share, Trends and Forecast by Product Type, Ingredient, Gender, Distribution Channel, and Region, 2025-2033

Australia Skin Care Products Market Size and Trends:

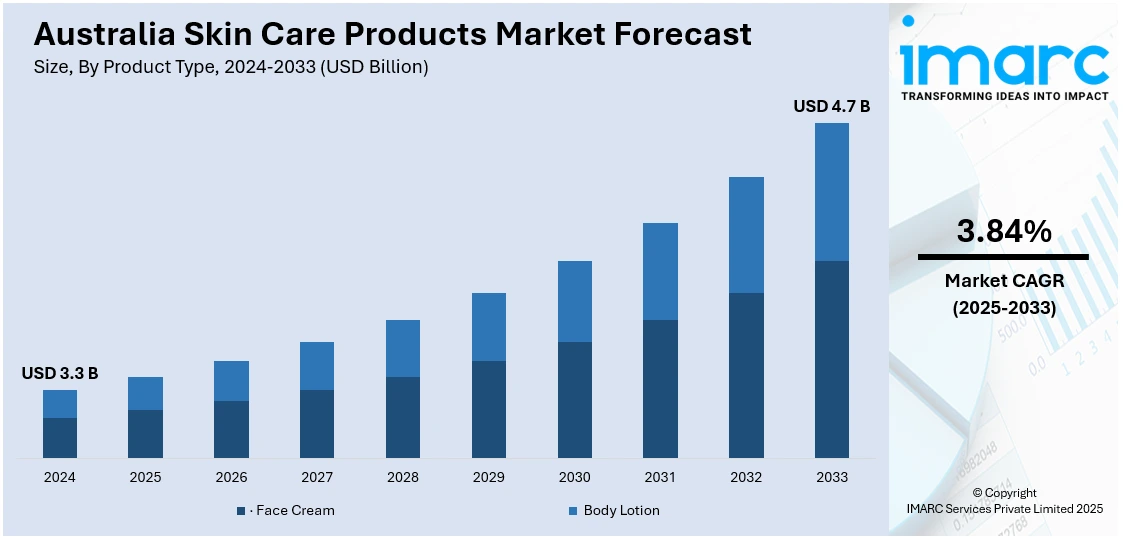

The Australia skin care products market size reached USD 3.3 Billion in 2024. Looking forward, the market is expected to reach USD 4.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3.84% during 2025-2033. The rising consumer awareness regarding skin health, increasing demand for natural and organic ingredients, higher disposable incomes, a growing middle-class population, the popularity of wellness and self-care trends, advancements in dermatological technology, and the influence of social media and e-commerce are some of the factors boosting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.3 Billion |

| Market Forecast in 2033 | USD 4.7 Billion |

| Market Growth Rate 2025-2033 | 3.84% |

Key Trends of Australia Skin Care Products Market:

Rising Consumer Awareness About Skin Health and Natural Ingredients

The importance of skin health has increasingly entered the mainstream consumer consciousness, driven by a growing awareness of the role of environmental, lifestyle, and dietary factors in skin disorders. Recently, a 2023 study conducted by experts from Kasturba Hospital and Medical College in Manipal, India, found that 44% of cosmetic product users suffer adverse effects. In one study of 400 women ages 18 to 60, most users apply one to three products each day, and many said they didn’t consult dermatologists or check labels. The growing concern over the potential risks associated with synthetic chemicals in products has surged the demand for cleaner products free from commonly used preservatives and colors, such as parabens, sulfates and phthalates. In line with this, key brands are embracing transparency due to the consumer demand for safe and sourced ethically ingredients, which is further propelling the Australia skin care products market share.

To get more information on this market, Request Sample

Increasing Disposable Incomes and Middle-Class Expansion

One of the major factors driving the market in Australia is the increasing disposable income and the growing middle-class population. For instance, Australia gross disposable income data was reported at USD 4,18,415 December 2024. This is an increase from USD 3,99,311 in Sep 2024. This upward trend in disposable income has boosted the purchasing power rises, which has resulted in growing spending on premium quality skincare products. Moreover, the rising number of middle-class citizens is fueling demand for both mass and luxury skincare products, which is further creating a positive Australia skin care products market outlook. This growing segment of affluent consumers is also influencing product innovation, as brands increasingly focus on delivering high-end, specialized skincare solutions tailored to their preferences.

Surge in Popularity of Wellness and Self-Care Trends

The expanding global emphasis on wellness and self-care movement continue to influence the Australian skincare market growth. Consumers are increasingly prioritizing self-care as an integral component of their overall wellness regimes, creating mental and physical well-being through the practice of skincare, which is another factor supporting the market growth. Additionally, the rising popularity of at-home beautification treatments, such as facial masks, exfoliators, and oils, is facilitating the market growth. Furthermore, the emphasis on mental and physical well-being has also fueled interest in stress-reducing and restorative skincare products, such as those featuring calming ingredients like chamomile, lavender, and cannabidiol (CBD), which is another growth-inducing factor.

Growth Drivers of Australia Skin Care Products Market:

Tourism, Worldwide Appeal, and Export-Oriented Brand Development

Australia's booming tourist industry and sound global reputation for clean, high-quality products are both key drivers of the growth of its skin care market. Visitors to Australia tend to seek out domestically manufactured products as part of their tourism experience, especially those that feature indigenous ingredients and reflect the nation's natural image. Major tourist destinations such as Queensland and the Great Ocean Road also help with brand discovery, particularly among international tourists from Asia, Europe, and the Middle East. These encounters have enabled Australian skincare brands to spread their global presence, with most using tourism as a means of promoting brand recognition and loyalty. Further, government assistance with export programs and trade relationships allows local businesses to move into expanding international markets where demand for "Australian-made" skin care, linked to purity, nature, and trust, is climbing steadily. This convergence of local tourism appeal and international export opportunity continues to drive industry growth and international competitiveness for Australian skincare brands.

Digital Transformation, E-Commerce, and Personalization

Another powerful growth driver is the strong digital participation of Australia in skin car, which is defining consumer behavior and brand approach. The direct-to-consumer and e-commerce models have enabled Australian players to connect with consumers much more effectively than through conventional retail. Digital allows for virtual skin consultations, product suggestions via artificial intelligence, subscription kits curated by expertise, and effortless international access to specialty brands. Younger, digitally literate Australians heavily use social media platforms—such as Instagram, TikTok, and YouTube—as a principal means of seeking skincare guidance, discovering trend information, and peer recommendation. Influencer marketing and interactive content strongly amplify local brands, allowing even small producers to achieve national and international momentum. This digital-first platform speeds up product innovation, enables tailored skincare regimens, and creates loyal communities for local brands, fueling long-term market growth through increased accessibility, personalization, and consumer trust.

Increased Demand from the Male Grooming and Multicultural Segments

Yet another rising growth driver in the Australian skincare industry is rising demand from male consumers and multicultural communities, who are both transforming product development and marketing strategies. Today, Australian men are increasingly participating in skincare routines, looking for products specifically addressing issues such as shaving irritation, oily skin, and sun damage. This has resulted in the increase of a high number of gender-neutral or male product lines being available, especially in urban and coastal parts of the country where grooming culture is more prevalent. Australia's multicultural population, having Asian, Middle Eastern, and Mediterranean segments that are strong, is also indicative of a large diversity in skincare requirements according to various skin types, tones, and issues. Brands are developing products that treat hyperpigmentation, sensitivity, and hydration for diverse climates and skin types, using inclusive nomenclature and imagery. This growth in diversity of skincare need creates a wider market, which compels brands to innovate and meet the needs of an increasingly divided and educated consumer.

Opportunities of Australia Skin Care Products Market:

Increasing Demand for Sun Care and After-Sun Products

Australia's high sun exposure and saturation public health campaigns for skin cancer awareness present a singular and lasting opportunity for the sun protection and after-sun skincare market. The high level of cultural focus on daily use of sunscreen has prompted consumers to find advanced products that offer active UV protection in combination with skincare properties such as hydration, anti-aging, and calming functions. This drives the need for multisided formulas like moisturizers with integrated SPF, colored sunscreens, and repair serums that combat sun damage. Australian shoppers want high performance due to the tough climate, so companies have to make products that are long-lasting, waterproof, and gentle on the skin. Moreover, the outdoor culture in coastal and rural regions results in sunscreen being a year-round product rather than just a seasonal one, which drives consistent demand. This long-term emphasis on sun care presents companies with the opportunity to innovate using natural ingredients, biodegradable formulations, and reef-safe products that appeal both locally and globally, and further supports the Australia skin care products market demand.

Increased Interest in Personalized and Technology-Driven Skincare

The Australian skin care industry is witnessing increased interest in customized and tech-enabled solutions that address specific skin concerns. Developments in AI, augmented reality, and skin scanners allow consumers to get customized skin care routines and product suggestions at home. This is especially prevalent among younger digitally literate Australians who look to brands to deliver customized solutions over generic products. This personalization also extends to ingredient transparency, with consumers looking for formulations that support their skin type, issues, and lifestyle conditions like urban pollution or UV exposure. Local brands are now incorporating skin analysis apps, virtual consultations, and subscription services that send personalized, curated products based on real-time skin condition feedback. This technology-powered personalization is responding to the need for effectiveness, convenience, and learning, enabling Australian businesses to stand out in a competitive marketplace while catering to the varied needs of the population.

Expansion of Regional Market and Rural Consumer Participation

Although a lot of the Australian skincare market has always been about urban centers such as Sydney, Melbourne, and Brisbane, there is increasing potential in reaching out to consumers in regional and rural communities. Such groups tend to have unique skincare requirements based on environmental conditions like extreme sun exposure, dryness, or salinity of water—conditions requiring strong, protective, and moisturizing skincare products. Regional consumers prefer utility-based, multi-purpose products that are convenient and provide obvious benefits. Enlarging retail distribution channels to rural pharmacies, general stores, and e-commerce with flexible delivery can fill this gap. Brands can also build more meaningful connections by highlighting rural stories, local ambassadors, and place-based brands that resonate with rural lifestyle and values. Access to this market expands reach and stimulates product development that is specifically tailored for the varied conditions throughout the continent and not a singular, global standard.

Challenges of Australia Skin Care Products Market:

Geographic Isolation and Supply Chain Complications

Among the major challenges confronting the Australian skin care market is its geographical remoteness, which influences the supply chain logistics and cost paradigms. The distance of Australia from key global manufacturing centers implies that most of the raw materials, packaging ingredients, and finished goods have to be imported, resulting in increased lead times and transport costs. This geographical component also makes inventory management and quick response to market trends challenging, especially for brands with smaller capitals. Foreign shipping availability and costs are also subject to fluctuations, causing interruptions in the timely supply of ingredients and finished products. To brands that desire competitive pricing while highlighting quality and sustainability, meeting these supply chain challenges needs planned strategy and solid partnerships. The isolation also impacts export opportunities and the potential for rapid production scaling, slowing down market penetration, particularly for new and emerging Australian skincare brands looking to establish a presence in international markets.

Regulatory Environment and Compliance Burdens

According to the Australia skin care products market analysis, the region has a rigorous regulatory system for cosmetics and skincare products that protects consumers yet also poses challenges to manufacturers and importers. All skin care products need to meet the requirements of the Therapeutic Goods Administration (TGA) and Australian Competition and Consumer Commission (ACCC) guidelines, which are often difficult and time-consuming to comply with. This regulatory stringency is particularly difficult for smaller or fledgling brands with constrained resources to manage, as the requirements for compliance often necessitate voluminous documentation, ingredient analysis, and label precision. Moreover, Australia's specific environmental claims legislation also mandates precise marketing wording, specifically when selling natural or native ingredients, so as not to mislead consumers. While these regulations safeguard the marketplace and reinforce customer trust, they also create layers of bureaucratic and cost pressure. For companies aiming to innovate rapidly or introduce novel formulations, balancing creativity with regulatory compliance remains a delicate and ongoing challenge.

Diverse Consumer Preferences and Market Fragmentation

Australia's multicultural society and regional differences are behind highly diversified consumer preferences that pose a challenge for skincare companies to create products which will be popular across the board and yet suit certain local requirements. Australia has a multicultural population base with large Asian, European, and Indigenous groups, hence extremely diverse skin types, sensitivities, and beauty standards. Formulating to meet this spectrum necessitates profound understanding and sophisticated product development, which can drive costs and delay time to market. Furthermore, the varying environmental conditions within urban areas, coastal areas, and the dry interior necessitate products formulated for diverse climates, from the humid subtropical to sunbaked outback regions. This cultural and geographic diversity requires brands to invest in high levels of market research, segment marketing efforts, and localized supply chains. Navigating this fragmentation successfully is key to establishing brand loyalty but is a challenging, resource-heavy effort for many participants in the Australian skincare industry.

Australia Skin Care Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, ingredient, gender, and distribution channel.

Product Type Insights:

- · Face Cream

- Skin Brightening Cream

- Anti-Aging Cream

- Sun Protection Cream

- Body Lotion

- Mass Body Care

- Premium Body Care

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes face cream (skin brightening cream, anti-aging cream, and sun protection cream) and body lotion (mass body care, premium body care, and others)

Ingredient Insights:

- Chemical

- Natural

A detailed breakup and analysis of the market based on the ingredient have also been provided in the report. This includes chemical and natural.

Gender Insights:

- Male

- Female

- Unisex

The report has provided a detailed breakup and analysis of the market based on the gender. This includes male, female, and unisex.

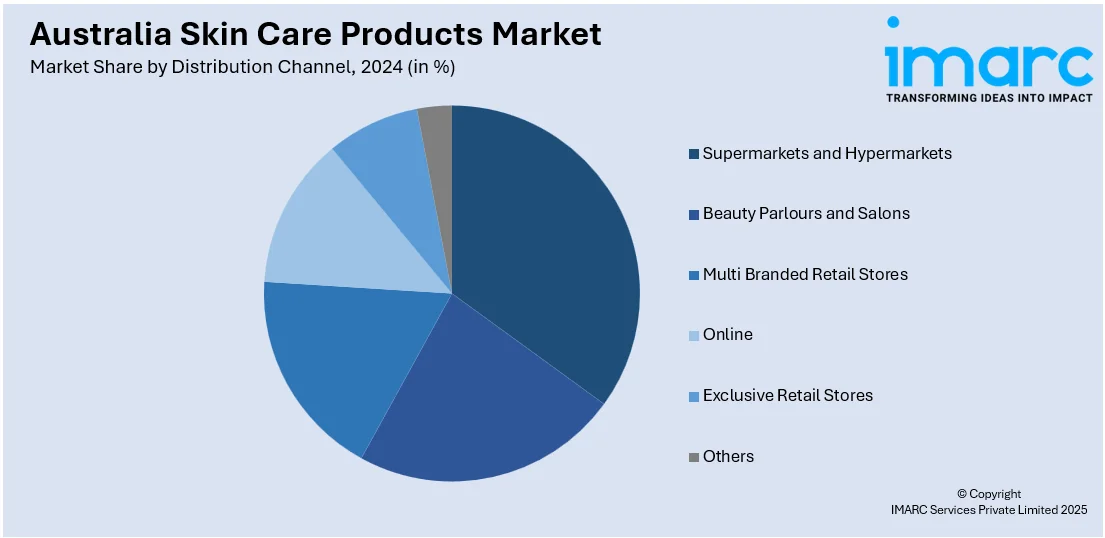

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Beauty Parlours and Salons

- Multi Branded Retail Stores

- Online

- Exclusive Retail Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, beauty parlours and salons, multi branded retail stores, online, exclusive retail stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Skin Care Products Market News:

- In 2024, L'Oréal completed its acquisition of Australian luxury beauty brand, Aesop, for USD 2.525 billion. This strategic move aimed to expand L'Oréal's presence in the high-end skincare market, particularly in regions like China, Japan, and Korea, where Aesop has a significant footprint.

- In 2024, the Body Shop became the first global beauty brand to achieve 100% vegan product formulations across all its ranges. This milestone, certified by The Vegan Society, spanned the brand's skincare, body care, hair care, makeup, and fragrance lines, reinforcing its commitment to cruelty-free and sustainable beauty.

Australia Skin Care Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Ingredients Covered | Chemical, Natural |

| Genders Covered | Male, Female, Unisex |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Beauty Parlours and Salons, Multi Branded Retail Stores, Online, Exclusive Retail Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia skin care products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia skin care products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia skin care products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia skin care products market was valued at USD 3.3 Billion in 2024.

The Australia skin care products market is projected to exhibit a CAGR of 3.84% during 2025-2033.

The Australia skin care products market is expected to reach a value of USD 4.7 Billion by 2033.

The Australia skin care market trends include a surge in natural and organic products, personalized and tech-enabled skincare solutions, and increasing male and multicultural consumer engagement. Sustainable packaging and indigenous ingredient use are rising, while digital platforms and influencer marketing continue shaping buying behaviors, reflecting evolving consumer values and the country’s unique environmental conditions.

The Australia skin care market is driven by strong sun protection awareness, demand for natural and native botanical ingredients, rising health and wellness trends, and growing digital engagement. Consumer preference for ethical, sustainable products and personalized skincare solutions further fuels growth, reflecting the country’s unique climate, culture, and diverse population needs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)