Australia Skin Treatment Market Size, Share, Trends and Forecast by Product Type, Gender, Application, End User, and Region, 2026-2034

Australia Skin Treatment Market Summary:

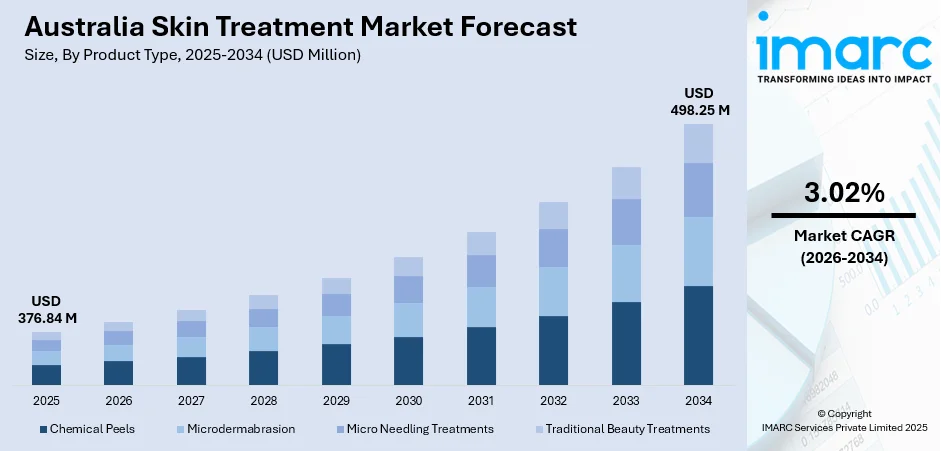

The Australia skin treatment market size was valued at USD 376.84 Million in 2025 and is projected to reach USD 498.25 Million by 2034, growing at a compound annual growth rate of 3.02% from 2026-2034.

The market is driven by increasing consumer awareness about skin health, rising disposable incomes enabling access to advanced dermatological treatments, growing prevalence of skin conditions requiring professional intervention, and expanding aesthetic consciousness among the population. The convergence of medical expertise with cosmetic preferences creates sustained demand for clinical solutions. Australia Skin Treatment Market share reflects strong regional positioning.

Key Takeaways and Insights:

-

By Product Type: Chemical peels dominate the market with a share of 34.9% in 2025, driven by effectiveness for multiple skin concerns, minimal downtime, and versatility across pigmentation, texture, and dermatological applications.

-

By Gender: Female leads the market with a share of 87.9% in 2025, owing to higher aesthetic awareness, preventive skincare engagement, cultural emphasis on youthful appearance, and frequent professional dermatology visits.

-

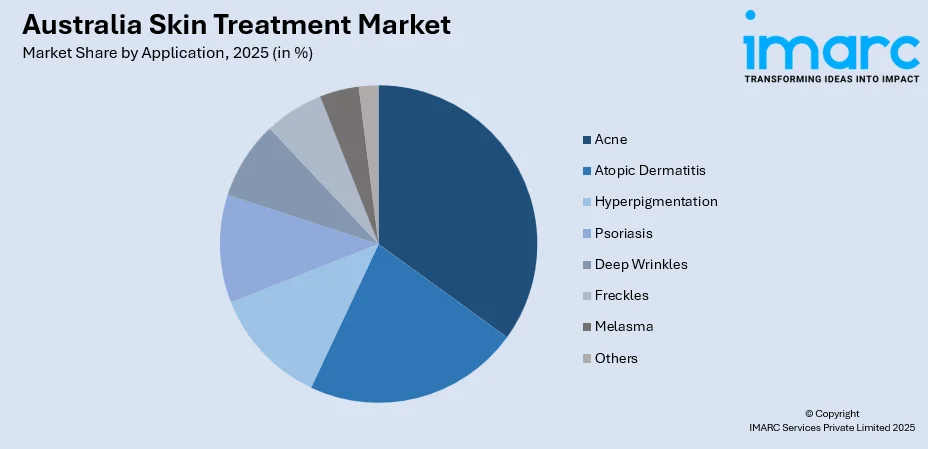

By Application: Acne represents the largest segment with a market share of 32.0% in 2025, driven by widespread prevalence, psychological impact, superior efficacy of professional interventions, and acceptance of clinical acne treatments.

-

By End User: Clinics and hospitals lead the market with a share of 58.7% in 2025, owing to comprehensive treatment capabilities, qualified dermatologists, advanced equipment, regulatory compliance, and preference for supervised interventions.

-

By Region: New South Wales dominates the market with a share of 34.2% in 2025, driven high urban population density, greater disposable incomes, concentration of specialized dermatology facilities, and strong consumer awareness and adoption of professional skin treatment services across metropolitan areas.

-

Key Players: The market exhibits dynamic competitive dynamics, with established dermatology service providers competing alongside emerging aesthetic clinics across treatment modalities and price points. Differentiation occurs through technological capabilities, practitioner expertise, and comprehensive service portfolios addressing diverse skin conditions. Some of the key players operating in the market include Australian Skin Clinics, Beiersdorf AG, Blânche Beauty, Comfortel, DermapenWorld, Ekseption Peels, PMD Beauty, SkinMed Australia, The Global Beauty Group, and The Skincare Company.

To get more information on this market Request Sample

The Australia skin treatment market experiences robust expansion driven by evolving consumer perceptions that position skin health as integral to overall wellness rather than purely cosmetic concern. Growing recognition of environmental damage from intense ultraviolet exposure unique to Australian climate conditions compels preventive and corrective interventions. According to sources, in November 2025, Cancer Council Australia reported that 63% of Australians expressed concern about developing or redeveloping skin cancer, highlighting ongoing awareness gaps and the importance of preventive dermatological care. Moreover, demographic shifts toward geriatric population increase demand for rejuvenation treatments, while younger cohorts seek proactive management of conditions like acne and hyperpigmentation. Digital connectivity amplifies awareness about available treatment options and normalizes professional dermatological care. Rising discretionary spending capacity combined with insurance coverage expansion for medical dermatology treatments reduces financial barriers. The professionalization of aesthetic medicine establishes credibility, encouraging consumers to pursue clinical solutions over unregulated alternatives.

Australia Skin Treatment Market Trends:

Integration of Personalized Treatment Protocols

The market witnesses accelerating adoption of customized treatment approaches that analyze individual skin characteristics, genetic predispositions, and lifestyle factors to formulate targeted intervention strategies. Advanced diagnostic technologies enable practitioners to assess skin conditions at microscopic levels, identifying specific concerns invisible to conventional examination methods. According to report, the Australasian College of Dermatologists endorsed the use of Artificial Intelligence in dermatology, guiding safe, ethical adoption for improved patient access and diagnostic accuracy. Moreover, this personalization extends beyond initial consultation to encompass ongoing monitoring and protocol adjustments based on treatment response patterns. Patients increasingly expect bespoke solutions reflecting their unique dermatological profiles rather than standardized procedures. The shift toward individualized care enhances treatment efficacy, reduces adverse reactions, and improves patient satisfaction by addressing root causes rather than surface symptoms. Practitioners leverage comprehensive skin analysis data to recommend optimal product combinations and procedure sequences, creating differentiated service experiences that command premium positioning.

Expansion of Combination Treatment Modalities

Dermatology providers increasingly offer integrated treatment approaches that combine multiple modalities to achieve synergistic outcomes superior to single-intervention results. This trend reflects growing clinical evidence demonstrating enhanced efficacy when complementary procedures address different aspects of skin conditions simultaneously. According to reports, in May 2024, a study reported that 18 patients receiving biweekly diamond tip microdermabrasion with targeted at-home brightening serums achieved 94.1% satisfaction, with significant hyperpigmentation improvements. Furthermore, practitioners design comprehensive treatment plans incorporating chemical peels with laser therapies, injectables with topical treatments, or mechanical procedures with pharmaceutical interventions. This holistic approach accelerates visible improvements, reduces overall treatment duration, and provides more sustainable long-term results. Patients appreciate the efficiency of addressing multiple concerns within consolidated treatment sessions, reducing time commitment and cumulative costs. The combination strategy also differentiates sophisticated practices from basic service providers, positioning them as comprehensive solutions centers rather than single-procedure facilities.

Growing Emphasis on Minimally Invasive Procedures

The market experiences pronounced shift toward non-surgical and minimally invasive treatment options that deliver significant aesthetic improvements without extensive recovery periods or surgical risks. Consumers increasingly prioritize treatments offering natural-looking results, minimal discomfort, and rapid return to normal activities. This preference drives demand for procedures like superficial peels, micro-needling, and topical interventions over aggressive surgical alternatives. Technological advancements enable these less invasive methods to achieve results previously requiring surgical intervention, expanding their applicability across diverse skin concerns. In February 2025, InMode Australia launched its QuantumRF non-suction radiofrequency technology, offering minimally invasive skin-tightening treatments with minimal downtime for facial and body rejuvenation. Moreover, the trend aligns with broader lifestyle patterns emphasizing convenience and discretion, allowing individuals to pursue aesthetic enhancement without disrupting professional or social commitments. Providers adapt service portfolios to emphasize gentler options, repositioning skin treatment as accessible wellness practice rather than dramatic medical intervention.

Market Outlook 2026-2034:

The Australia skin treatment market demonstrates promising growth trajectory driven by demographic expansion, technological innovation, and evolving consumer attitudes toward professional skincare. Rising incomes across socioeconomic segments broaden market accessibility beyond affluent demographics, while increasing male participation diversifies customer base. Enhanced practitioner training standards elevate service quality and safety perceptions, encouraging wider adoption. Regulatory frameworks establishing clear practice guidelines build consumer confidence in treatment safety and efficacy. Market revenue reflects sustained investment in advanced treatment technologies and expanding service networks across metropolitan and regional areas, positioning the sector for continued expansion through the forecast period. The market generated a revenue of USD 376.84 Million in 2025 and is projected to reach a revenue of USD 498.25 Million by 2034, growing at a compound annual growth rate of 3.02% from 2026-2034.

Australia Skin Treatment Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Chemical Peels |

34.9% |

|

Gender |

Female |

87.9% |

|

Application |

Acne |

32.0% |

|

End User |

Clinics and Hospitals |

58.7% |

|

Region |

New South Wales |

34.2% |

Product Type Insights:

- Chemical Peels

- Microdermabrasion

- Micro Needling Treatments

- Traditional Beauty Treatments

The chemical peels dominate with a market share of 34.9% of the total Australia skin treatment market in 2025.

Chemical peels lead the product type segment by providing versatile solutions for multiple skin concerns through controlled exfoliation that removes damaged layers and promotes healthier tissue regeneration. Their popularity arises from predictable outcomes, cost-effectiveness versus laser options, and minimal equipment needs, making them widely accessible in various clinical settings. Customizable formulations with different acid strengths allow treatment from superficial, no-downtime options to deeper peels offering significant rejuvenation, supported by strong clinical documentation. As per sources, from March 2023 - December 2024 a case series of 42 melasma treatments using medium-to-deep chemical peels reported 94.4% of cases showed visible pigmentation reduction and improved skin tone uniformity.

The segment’s growth is reinforced by chemical peels’ role in broader treatment plans, often complementing other therapies. They effectively address acne scars, hyperpigmentation, sun damage, and texture issues within a single category. Short procedure times improve scheduling efficiency and patient throughput, while consumer familiarity with exfoliation eases adoption. Advances in gentler formulas and enhanced penetration expand suitability, ensuring continuous market leadership through incremental innovation rather than disruptive change.

Gender Insights:

- Male

- Female

The female leads with a share of 87.9% of the total Australia skin treatment market in 2025.

Female consumers lead the gender segment, influenced by cultural emphasis on beauty standards that value flawless, youthful skin. As per sources, in June 2025, 984,000 Australian women aged 14–24 followed skincare routines, marking an 18.5% increase since June 2021, while women aged 65+ grew by 13.6% over the same period. Furthermore, societal expectations drive women to invest in professional skin treatments, viewing them as essential self-care rather than luxury. Social media and peer networks amplify awareness of aesthetic interventions, while higher engagement with beauty and wellness content enables informed decisions. The segment also reflects conditions like melasma and hormonal acne, which benefit from clinical management.

Female market dominance extends to preventive and medical motivations, particularly in skin cancer prevention amid Australia’s high ultraviolet exposure. Women demonstrate stronger adherence to dermatological check-ups, early interventions, and long-term treatment schedules, accepting temporary side effects for lasting results. This preventive and committed approach support recurring service utilization, enhances treatment success rates, and generates positive referrals, sustaining consistent market demand while blending medical and aesthetic care within the female demographic.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Acne

- Atopic Dermatitis

- Hyperpigmentation

- Psoriasis

- Deep Wrinkles

- Freckles

- Melasma

- Others

The acne exhibits a clear dominance with a 32.0% share of the total Australia skin treatment market in 2025.

Acne treatments lead the application segment by addressing a prevalent condition impacting adolescents and adults alike. The visible nature of blemishes significantly affects self-esteem, social interactions, and professional life, motivating treatment beyond physical discomfort. Chronic recurrence drives continued demand when over-the-counter solutions fall short. Professional interventions, including prescription medications, extractions, and chemical peels that offer superior efficacy, addressing multiple acne mechanisms simultaneously while reinforcing acne as a legitimate medical concern requiring clinical management. In March 2024, Sun Pharma received Australian TGA approval for Winlevi (clascoterone 1% cream), launching the topical acne treatment for patients aged 12 and above.

The segment’s leadership stems from diverse, customizable treatment options tailored to severity, skin type, and patient preference. Combined approaches of topical, oral, procedural, and maintenance protocols manage active lesions, prevent new eruptions, and address scarring. Complexity and multifactorial causes, including hormones, inflammation, and bacterial involvement which necessitate professional oversight. Acne’s visibility prioritizes treatment spending, sustaining market demand even during economic uncertainty, as patients value effective, long-term solutions over temporary home remedies.

End User Insights:

- Clinics and Hospitals

- Medical Spas and Salons

- At-home

Clinics and hospitals lead with a share of 58.7% of the total Australia skin treatment market in 2025.

Clinics and hospitals lead the end user segment by offering comprehensive infrastructure for skin treatments, ranging from basic consultations to complex procedures requiring specialized equipment and medical oversight. Access to qualified dermatologists ensures accurate diagnosis and appropriate therapy selection. Regulatory compliance and professional liability coverage provide patient safety assurance, reducing anxiety and encouraging adoption of advanced treatments. Institutional settings also support multidisciplinary care when conditions intersect with systemic diseases, enhancing overall treatment effectiveness. In January 2025, Melanoma Institute Australia received a $7.5 million grant to lead development of the National Targeted Skin Cancer Screening Roadmap, emphasizing institutional leadership in preventive dermatology.

These facilities gain competitive advantage through capacity for high-cost equipment investments, enabling delivery of advanced technologies inaccessible to smaller practices. Institutional purchasing power lowers per-procedure costs, while insurance coverage attracts patients seeking medically necessary interventions. Professional credibility, emergency response capabilities, and reassurance of medical oversight appeal to patients prioritizing safety and legitimacy over purely aesthetic environments, especially for aggressive treatments with higher complication risks.

Regional Insights:

- Western Australia

- New South Wales

- Queensland

- Victoria

- Rest of Australia

New South Wales dominates with a market share of 34.2% of the total Australia skin treatment market in 2025.

New South Wales leads the regional segment due to Sydney’s status as Australia’s largest metropolitan area with high population concentration that supports economically viable dermatology practices. The region has a well-educated, professionally employed population with discretionary income that encourages spending on aesthetic treatments. Urban social exposure normalizes professional skin care, while the multicultural population requires specialized approaches for diverse skin types. Coastal living and outdoor recreational culture increase sun exposure, creating ongoing demand for both preventive and corrective dermatological treatments.

The region’s strength is further reinforced by medical training institutions producing dermatology specialists who establish practices locally, increasing access and stimulating innovation. New South Wales attracts both domestic and international medical tourists seeking advanced treatments. Strong regulatory standards and professional organizations ensure treatment safety and practitioner credibility. According to sources, in January 2025, nearly 1,500 people in New South Wales accessed care for minor skin conditions through the NSW Pharmacy Dermatology Trial, with over 480 participating pharmacies statewide. Moreover, superior infrastructure including medical supply networks, equipment services, and continuing education supports practice operations efficiently. Population growth from migration introduces experienced consumers, sustaining market expansion and ongoing demand for professional skin treatments.

Market Dynamics:

Growth Drivers:

Why is the Australia Skin Treatment Market Growing?

Rising Awareness About Skin Cancer Prevention and Early Detection

Australia’s position as the country with the highest skin cancer incidence globally drives a unique market where dermatology visits are considered essential preventive healthcare rather than optional cosmetic services. Public health campaigns emphasizing regular skin checks and early intervention have normalized dermatology as part of routine wellness, similar to dental examinations. In November 2024, nib data revealed that nearly two-thirds (61%) of Australians are at medium-to-high risk of developing skin cancer, underscoring the importance of early detection and regular skin checks. Patients initially seeking medical screening often discover treatments for concurrent aesthetic concerns, integrating medical and cosmetic dermatology in a single consultation. Insurance coverage for medical dermatology reduces financial barriers, while awareness that sun damage accelerates visible aging motivates combined health-protective and appearance-enhancing interventions.

Technological Advancements Enhancing Treatment Efficacy and Safety

Continuous innovation in dermatological technologies expands patient access by making previously resistant conditions treatable while minimizing complication risks. Advanced imaging systems reveal subsurface damage invisible in conventional exams, demonstrating treatment necessity objectively. In March 2025, University of Queensland’s 3D total-body photography trial detected more non-melanoma skin cancers in 315 high-risk patients, demonstrating enhanced early identification compared with standard skin checks. Moreover, precision delivery systems improve active ingredient penetration while reducing surface irritation, increasing tolerance for sensitive skin. Real-time monitoring allows treatment customization, preventing over-treatment and accelerating recovery. Enhanced safety profiles reduce practitioner liability, promoting broader recommendations and extending indications beyond traditional conservative applications. Patients benefit from faster visible results, shorter downtime, and confidence in treatments tailored to individual tolerance and skin response.

Demographic Shifts Toward Aging Population Seeking Rejuvenation Solutions

Australia’s geriatric population drives demand for treatments addressing wrinkles, pigmentation, skin laxity, and texture deterioration. Older adults remain socially and professionally active, motivating maintenance of external appearance to reflect vitality. Increased financial security from superannuation and property wealth enables investment in premium treatments. Changing social attitudes reduce stigma around aesthetic procedures, positioning interventions as legitimate self-care. Longer life expectancy extends the perceived value of treatments. Existing healthcare relationships ease access and facilitate referrals, while medical comorbidities create opportunities for integrated care, allowing older patients to combine rejuvenation procedures with routine dermatological management for health and appearance.

Market Restraints:

What Challenges the Australia Skin Treatment Market is Facing?

High Treatment Costs Limiting Accessibility Across Socioeconomic Segments

Professional skin treatments carry premium pricing due to practitioner expertise, facility overheads, and product costs, limiting access for middle- and lower-income groups. Multiple sessions for optimal results increase financial burden, while limited insurance coverage leaves consumers responsible for expenses. Economic pressures and gradual visible improvements intensify price sensitivity, particularly in regional areas where lower incomes and limited competition maintain high costs.

Inconsistent Treatment Standards and Practitioner Qualification Variations

Market fragmentation among specialists, nurses, and aesthetic technicians creates confusion over appropriate qualifications, undermining consumer confidence. Regulatory gaps allow inadequately trained operators to perform complex treatments, risking poor outcomes and negative word-of-mouth. Variation in protocols, techniques, and product quality reduces reliability and safety, while disputes over legal practice boundaries further complicate patient navigation across a fragmented professional landscape.

Limited Geographic Access in Regional and Remote Areas

Qualified dermatology providers concentrate in metropolitan centers, forcing regional patients to travel long distances, incurring additional costs and time. Sparse populations make specialized clinics economically unviable, while limited telemedicine infrastructure restricts virtual care. Regional facilities often lack advanced equipment, requiring metropolitan referrals. Reduced local competition keeps pricing high and limits appointment availability, leaving rural populations underserved despite existing practitioner expertise

Competitive Landscape:

The Australia skin treatment market exhibits a dynamic competitive landscape with diverse providers operating across overlapping service segments and targeting varied demographics. Established dermatology practices led by medical specialists maintain premium positioning through clinical expertise and comprehensive treatments, competing on reliability and safety. Cosmetic clinics focus on appearance enhancement and patient experience for middle-market consumers, while day spas and beauty operators serve price-sensitive clients with limited procedure menus. Competition intensifies as providers diversify services, with medical practices offering aesthetic options and cosmetic clinics incorporating medical-grade treatments. Market maturation drives consolidation, geographic expansion into regional areas, and digital marketing adoption, emphasizing technology, practitioner credentials, specialization, and service excellence for sustainable positioning.

Some of the key players include:

- Australian Skin Clinics

- Beiersdorf AG

- Blânche Beauty

- Comfortel

- DermapenWorld

- Ekseption Peels

- PMD Beauty

- SkinMed Australia

- The Global Beauty Group

- The Skincare Company

Recent Developments:

-

In July 2024, Hydrafacial, the globally popular facial treatment performed every 15 seconds, launched its “Phyto-Retinol Booster” in Australia. The new booster enhances treatment efficacy, prolongs visible results, and is suitable for all skin types, with Australian users reporting improved skin glow, texture, and overall radiance.

Australia Skin Treatment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Type Covered | Chemical Peels, Microdermabrasion, Micro Needling Treatments, Traditional Beauty Treatments |

| Gender Covered | Male, Female |

| Application Covered | Acne, Atopic Dermatitis, Hyperpigmentation, Psoriasis, Deep Wrinkles, Freckles, Melasma, and Others |

| End User Covered | Clinics and Hospitals, Medical Spas and Salons, At-home |

| Region Covered | Western Australia, New South Wales, Queensland, Victoria, Rest of Australia |

| Companies Covered | Australian Skin Clinics, Beiersdorf AG, Blânche Beauty, Comfortel, DermapenWorld, Ekseption Peels, PMD Beauty, SkinMed Australia, The Global Beauty Group, and The Skincare Company. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia skin treatment market size was valued at USD 376.84 Million in 2025.

The Australia skin treatment market is expected to grow at a compound annual growth rate of 3.02% from 2026-2034 to reach USD 498.25 Million by 2034.

Major challenges facing the Australia skin treatment market include high treatment costs limiting accessibility, inconsistent practitioner qualifications and treatment standards, limited geographic access in regional and remote areas, and economic pressures that reduce discretionary spending on aesthetic procedures.

.

Increasing awareness about skin health, rising disposable incomes, and a broader acceptance of aesthetic care are key growth drivers. Expanding clinic networks, greater male participation, and improved access to advanced technologies are also fueling market expansion. The shift toward holistic and results-driven skincare further supports sustained market growth.

Australia is witnessing a rise in demand for personalized skincare, natural and organic treatments, and tech-enabled procedures. Non-invasive therapies, such as laser and radiofrequency, are gaining popularity. Consumers are also showing growing interest in preventive skin care and professional at-home treatment devices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)