Australia Skincare Market Size, Share, Trends and Forecast by Category, Ingredient Type, Gender, Distribution Channel, and Region, 2025-2033

Australia Skincare Market Size and Share:

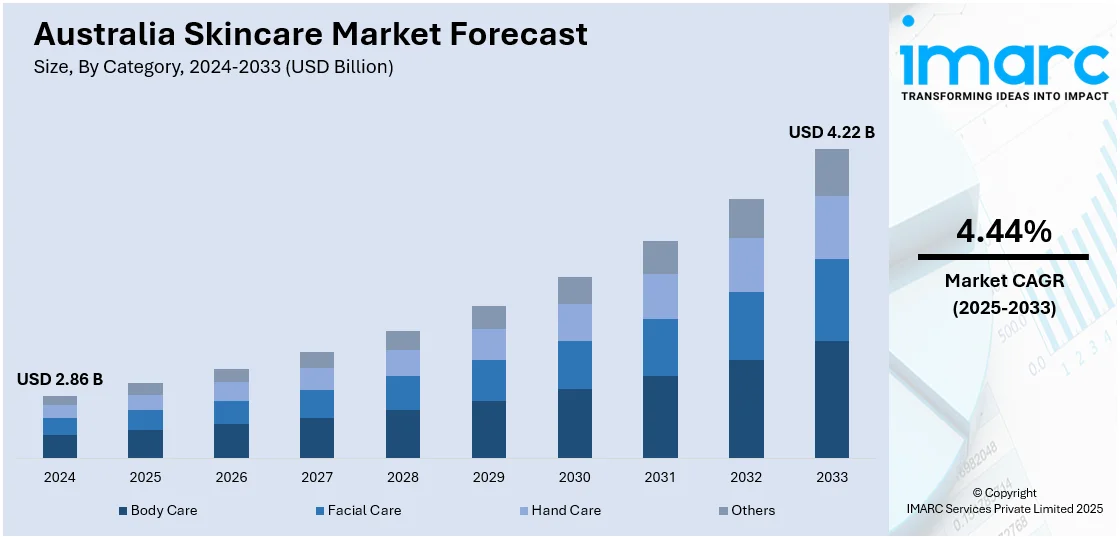

The Australia skincare market size reached USD 2.86 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.22 Billion by 2033, exhibiting a growth rate (CAGR) of 4.44% during 2025-2033. The market is fuelled by mounting consumer knowledge about skin health, surging demand for natural and organic products, rising interest in anti-aging products, and social media impact. Moreover, climate-related skin issues and an outdoor culture are strong drivers that add to the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.86 Billion |

| Market Forecast in 2033 | USD 4.22 Billion |

| Market Growth Rate 2025-2033 | 4.44% |

Key Trends of Australia Skincare Market:

Demand for Personalized Skincare Solutions

Australian consumers are now looking for customized skincare solutions based on their individual skin types, environmental factors, and lifestyle requirements. This trend is fueled by the development of skin analysis technologies, which allow brands to provide personalized product recommendations and routines. Startups and traditional skincare brands are both putting money into artificial intelligence and data-driven platforms to develop hyper-personalized products, from digital consultations to DNA-matched products. The focus on personalised care is particularly prevalent among millennials and Gen Z shoppers, who appreciate effectiveness and openness. This move towards personalisation is also spurring niche brands to be developed, targeting particular skin issues like pigmentation, sensitivity, or acne. With the market maturing, personalisation is becoming a core differentiator in driving brand loyalty and customer retention. For instance, in March 2024, Medipledge, a premium post-laser skincare brand, launched in Australia. Specializing in skin barrier restoration after cosmetic treatments, it focuses on Asian skin, particularly Type IV. With advanced ingredients like PDRN and Centella Asiatica, Medipledge’s products undergo rigorous clinical testing for safety and efficacy. The brand offers customized skincare solutions aimed at restoring the skin’s multidimensional barrier post-treatment, aligning with the rising demand for personalized skincare tailored to individual skin needs, environmental conditions, and lifestyle.

To get more information on this market, Request Sample

Rise of Cosmeceuticals and Clinical Skincare

The Australian skincare market is witnessing a significant shift toward cosmeceuticals—products that combine cosmetic and pharmaceutical properties to offer therapeutic benefits. With growing consumer interest in medically backed, results-driven products, there has been a surge in demand for clinical skincare brands that incorporate active ingredients such as retinoids, peptides, and AHAs/BHAs. Dermatologist-developed and pharmacy-distributed skincare ranges are gaining popularity, especially among consumers aged 30 and above seeking anti-aging and corrective treatments. This trend is also fueled by the increasing accessibility of professional skincare through e-commerce and teledermatology platforms. As a result, skincare routines are becoming more sophisticated, with consumers adopting multi-step regimens involving targeted serums and treatments. For instance, in March 2025, U.S.-based HYDRINITY Accelerated Skin Science, a professional, clinically backed skincare brand, announced its expansion into Australia through a strategic partnership with Device Consulting, a leading Australian medical technology provider. HYDRINITY, known for its advanced hyaluronic acid-based skincare originally developed for regenerative medicine, is now targeting over 1,000 plastic surgeons and dermatologists, as well as 39,000 GPs offering cosmetic services across Australia. This expansion aligns with Australia’s rising consumer interest in premium, science-driven skincare, especially amid one of the world’s highest UV indexes.

Growing Demand for Natural and Clean Beauty Products

Australian consumers are attracted to skincare products claiming to be natural, organic, vegan, and paraben-free, sulfates-free, synthetic fragrance-free, and animal-product-free. This is prompted by greater awareness of ingredients' safety, concern for the environment, and ethical consumption. All age groups are increasingly favoring products that are free from parabens, sulfates, synthetic perfumes, and ingredients of animal origin. Clean beauty is no longer a niche as mainstream retailers are growing their natural skincare lines, new brands are launching with a great emphasis on transparency and sustainability. Consumers are also examining ingredient lists and preferring companies that reveal sourcing and manufacturing processes. This trend is informing product development and brand strategies, with demand increasing for gentle-on-skin and eco-friendly formulations.

Growth Drivers of Australia Skincare Market:

E-commerce Growth

The swift growth of e-commerce is transforming the skincare industry in Australia. More consumers are opting for online shopping due to the convenience of purchasing from home, the availability of a broader selection of products, and the ease of comparing different brands and reviews. This trend has led to the emergence of numerous direct-to-consumer (D2C) skincare brands that avoid traditional retail channels and engage with customers through tailored marketing strategies and collaborations with influencers. Subscription models, curated skincare kits, and targeted advertising further drive online engagement. E-commerce also allows niche and indie brands to scale quickly without relying on major distributors. According to Australia skincare market analysis, digital retail continues to be a major growth driver, with younger demographics and urban buyers leading the trend.

Product Innovation

Advancements in dermatology and cosmetic science are reshaping consumer expectations and fueling demand in the Australian skincare market. Brands are introducing high-performance, science-backed products tailored to specific concerns such as acne, aging, sensitivity, and pigmentation. Formulations now often include potent actives like retinoids, peptides, niacinamide, and hyaluronic acid, offering clinical-level results for everyday use. Innovations like microbiome-supporting ingredients and biotech-driven solutions are gaining traction among informed consumers. Personalization is also on the rise, with skin assessments and AI-driven product recommendations becoming more accessible online. This level of precision and visible results is a key reason why product innovation continues to drive Australia skincare market demand, especially among younger consumers seeking effective, evidence-based skincare solutions.

Increasing Acceptance of Skincare Among Men

The increasing acceptance of skincare among Australian men is broadening the consumer base and contributing to overall market growth. What was once considered a female-dominated category is now evolving, with men actively seeking products for hydration, sun protection, acne treatment, and anti-aging. Social media, celebrity endorsements, and lifestyle shifts have played a major role in normalizing skincare in male routines. Brands are responding with gender-neutral packaging, targeted formulations, and simplified routines tailored for men’s skin needs. This shift is not limited to urban areas regional demand is also on the rise. As more men incorporate skincare into their daily habits, it is significantly expanding Australia skincare market share and reshaping product development and marketing strategies across the industry.

Australia Skincare Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on category, ingredient type, gender, and distribution channel.

Category Insights:

- Body Care

- Facial Care

- Hand Care

- Others

The report has provided a detailed breakup and analysis of the market based on the category. This includes body care, facial care, hand care, and others.

Ingredient Type Insights:

- Natural

- Chemical

The report has provided a detailed breakup and analysis of the market based on the ingredient type. This includes natural and chemical.

Gender Insights:

- Male

- Female

- Unisex

The report has provided a detailed breakup and analysis of the market based on the gender. This includes male, female, and unisex.

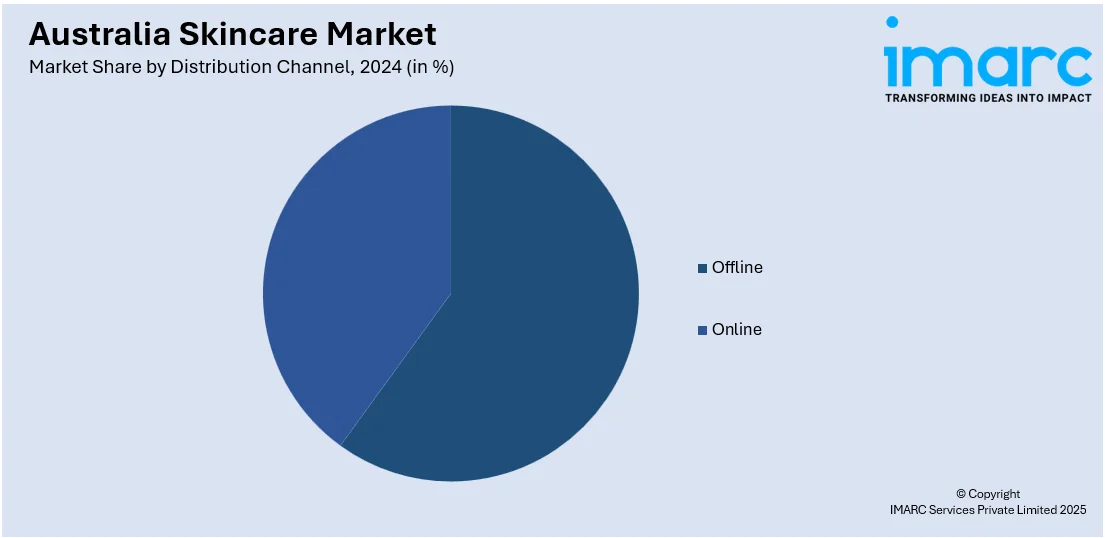

Distribution Channel Insights:

- Offline

- Online

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes offline and online.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Skincare Market News:

- In March 2025, Australian brand Vincent officially launched in the U.S. market with a unique four-step beauty-from-within regimen that includes a cleanser, serum, face cream, and an ingestible supplement called An Apple a Day. The brand taps into the rising global demand for holistic skin health solutions by combining topical skincare with nutrition-based supplements.

- In February 2025, Adore Beauty partnered with tutch to enhance its omnichannel approach. Tutch’s endless aisle technology will enable Adore Beauty to offer its full online catalog in over 25 physical stores. Customers can access detailed product info, reviews, and curate online orders via in-store digital kiosks.

- In April 2024, Australian skincare brand Dr Tanya Skincare successfully entered the Middle Eastern premium beauty market, with its products now available at FACES, a top regional beauty retailer with 85 stores across the Gulf. Supported by Austrade, the brand leveraged strategic connections and partnerships to establish a presence in the UAE and plans further expansion into Saudi Arabia.

- In April 2024, MCoBeauty, Australia's fastest-growing beauty brand, announced its exclusive U.S. launch at Kroger. Over 250 cruelty-free, affordable makeup and skincare products are made available in Kroger stores and online. Known for its “luxe for less” approach, MCoBeauty’s U.S. expansion aims to replicate its success in Australia and New Zealand by targeting American consumers seeking trendy, high-quality, and accessible beauty solutions. Key products include the XtendLash Tubular Mascara, Flawless Glow Foundation, and Lip Oil Hydrating Treatment. Kroger views the partnership as an opportunity to expand its beauty offering while supporting accessible self-care.

- In April 2025, Amazon Australia launched ‘Amazon Beauty Finds’, a new online storefront highlighting trending and viral skin and beauty products popular on social media. The curated collection features a wide range of K-Beauty and J-Beauty skincare brands, offering innovative solutions for various skin concerns.

Australia Skincare Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Categories Covered | Body Care, Facial Care, Hand Care, Others |

| Ingredient Types Covered | Natural, Chemical |

| Genders Covered | Male, Female, Unisex |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia skincare market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia skincare market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia skincare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The skincare market in the Australia was valued at USD 2.86 Billion in 2024.

The Australia skincare market is projected to exhibit a compound annual growth rate (CAGR) of 4.44% during 2025-2033.

The Australia skincare market is expected to reach a value of USD 4.22 Billion by 2033.

Consumers are leaning toward natural, vegan, and chemical-free products with sustainable packaging. Personalization, men’s grooming, and anti-aging solutions are gaining momentum. E-commerce, influencer marketing, and tech-based skin analysis tools are also shaping purchase decisions in the evolving skincare landscape.

Key drivers include rising health and beauty awareness, a growing aging population, increased male participation, and demand for sun protection. Advancements in dermatology, online retail expansion, and consumer preference for clean-label, high-performance products continue to push Australia’s skincare market forward.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)