Australia Smart Display Market Size, Share, Trends and Forecast by Type, Display Size, Resolution, End User, and Region, 2025-2033

Australia Smart Display Market Overview:

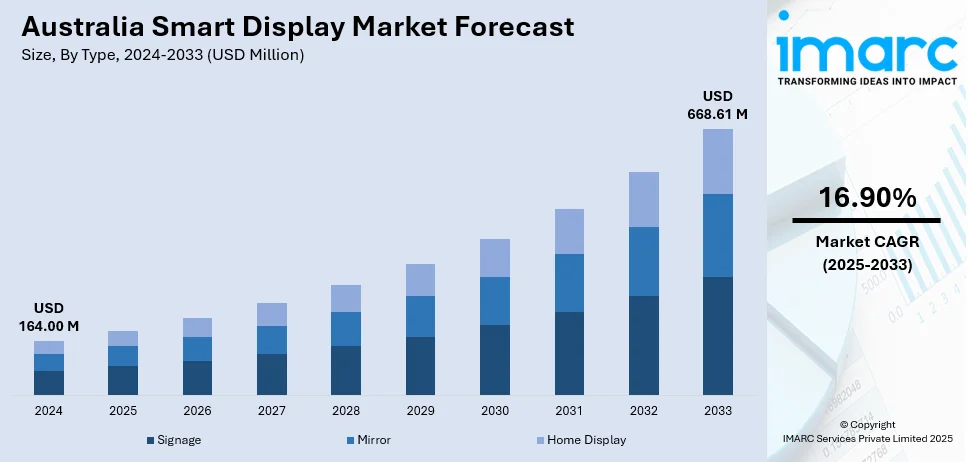

The Australia smart display market size reached USD 164.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 668.61 Million by 2033, exhibiting a growth rate (CAGR) of 16.90% during 2025-2033. The market is witnessing steady expansion, led by government efforts toward smart city projects, like the Smart Waverley Strategy, which are promoting the adoption of cutting-edge technologies in urban infrastructure, and thus promoting demand for smart displays in public areas. The growing investment by the defense industry on cutting-edge technologies, including smart displays for tactical use, is further increasing the Australia smart display market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 164.00 Million |

| Market Forecast in 2033 | USD 668.61 Million |

| Market Growth Rate 2025-2033 | 16.90% |

Australia Smart Display Market Trends:

Intelligent Displays in Australia's Smartening Cities

Australia's cities are becoming inclined toward adoption of smart technologies to improve the quality of life for citizens and make public services more efficient. Projects such as the Smart Waverley Strategy exemplify this trend, incorporating digital solutions into community planning and infrastructure. Hence, intelligent displays are also a significant part of these initiatives, acting as interactive platforms for information sharing, public notices, and community participation. Such screens are deliberately positioned in public areas, transport facilities, and civic buildings to support real-time information and provide an integrated setting. As cities progress, smart display solutions of advanced kinds will likely become necessary, owing to the call for effective city management and citizen engagement. This represents Australia's aspiration for developing smart urban ecosystems with the help of technology to enhance sustainable growth and quality public services.

To get more information on this market, Request Sample

Integration of AI and Voice Assistants in Smart Displays

The convergence of Artificial Intelligence (AI) and voice assistant technologies in smart displays is revolutionizing user experiences across industries, thus driving the Australia smart display market growth. According to the IMARC Group, the Australia artificial intelligence market size reached USD 2,072.7 Million in 2024, and is further expected to reach USD 7,761.0 Million by 2033, exhibiting a growth rate (CAGR) of 15.17% during 2025-2033. Hence, users are increasingly looking for devices that integrate seamlessly with voice commands for hands-free control of smart home systems, entertainment, and access to information. This trend is reflected in the increasing use of smart displays with AI-based features, like personalized suggestions and adaptive interfaces. In the consumer space, companies are embracing such technologies to facilitate customer interaction, offering interactive product details and individualized shopping experiences. Likewise, in healthcare, smart displays empowered by AI are being used for patient monitoring and information exchange, enhancing service provision and patient care. As voice assistant and AI capabilities evolve, their integration into smart displays is poised to become ubiquitous, providing users with intuitive and seamless interaction with their devices.

Growing Interest in Touchless and Voice-Activated Interfaces

One of the leading trends in the Australia smart display market is the growing preference for touchless and voice-controlled interfaces. With increasing health consciousness and hygiene issues—particularly after the COVID-19 pandemic—consumers in Australia are moving toward devices that minimize physical contact. Smart screens with voice assistants such as Google Assistant and Amazon Alexa enable users to access their devices without hands, carrying out actions such as weather checking, appointment management, smart home device control, or media streaming with ease through simple voice instructions. This shift adds to consumer convenience while also helping drive the use of smart displays in other environments outside the home, such as in hospitality, retail, and healthcare facilities. Producers are taking advantage of this change by adding more interactive and multilingual voice capabilities to meet Australia's multicultural population. With touchless technology becoming a norm, voice-first smart screens are set to drive growth in the Australian market.

Australia Smart Display Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, display size, resolution, and end user.

Type Insights:

- Signage

- Mirror

- Home Display

The report has provided a detailed breakup and analysis of the market based on the type. This includes signage, mirror, and home display.

Display Size Insights:

- Below 32 Inch

- Between 32 and 52 Inch

- Above 52 Inch

The report has provided a detailed breakup and analysis of the market based on the display size. This includes below 32 inch, between 32 and 52 inch, and above 52 inch.

Resolution Insights:

- UHD

- FHD

- HD

The report has provided a detailed breakup and analysis of the market based on the resolution. This includes UHD, FHD, and HD.

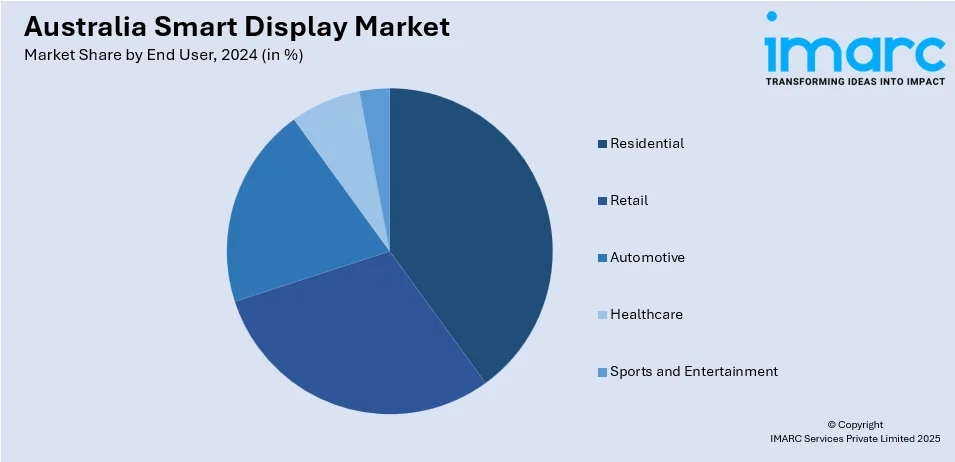

End User Insights:

- Residential

- Retail

- Automotive

- Healthcare

- Sports and Entertainment

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, retail, automotive, healthcare, and sports and entertainment.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Smart Display Market News:

- In March 2025, Samsung Electronics Co., Ltd, the top TV brand globally for 19 consecutive years, revealed that its most sophisticated and cinematic OLED TV – Samsung OLED S95F – will launch in Australia with a large 83-inch display for the first time, establishing it as the brand's largest OLED TV size to date. In yet another Samsung-first, the company will launch a third series of Samsung OLEDs, with the Samsung OLED S85F joining the existing OLED S95F and OLED S90F models.

- In January 2025, Samsung Electronics Co., Ltd. introduced Samsung Vision AI at the CES 2025 First Look event, offering AI-driven personal screens to enhance daily living. Samsung revealed the new flagship QN990F Neo QLED 8K TV along with thrilling advancements in its Lifestyle TVs and upcoming display technologies, embodying Samsung's aim to turn screens into adaptive, smart companions that enhance and simplify daily life. The Neo QLED 8K QN990F is set to arrive in Australia during the first half of 2025.

Australia Smart Display Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Signage, Mirror, Home Display |

| Display Sizes Covered | Below 32 Inch, Between 32 and 52 Inch, Above 52 Inch |

| Resolutions Covered | UHD, FHD, HD |

| End Users Covered | Residential, Retail, Automotive, Healthcare, Sports and Entertainment |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia smart display market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia smart display market on the basis of type?

- What is the breakup of the Australia smart display market on the basis of display size?

- What is the breakup of the Australia smart display market on the basis of resolution?

- What is the breakup of the Australia smart display market on the basis of end user?

- What is the breakup of the Australia smart display market on the basis of region?

- What are the various stages in the value chain of the Australia smart display market?

- What are the key driving factors and challenges in the Australia smart display?

- What is the structure of the Australia smart display market and who are the key players?

- What is the degree of competition in the Australia smart display market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia smart display market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia smart display market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia smart display industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)