Australia Smart Factory Automation Market Size, Share, Trends and Forecast by Technology, Component, Deployment Mode, Industry Vertical, and Region, 2026-2034

Australia Smart Factory Automation Market Overview:

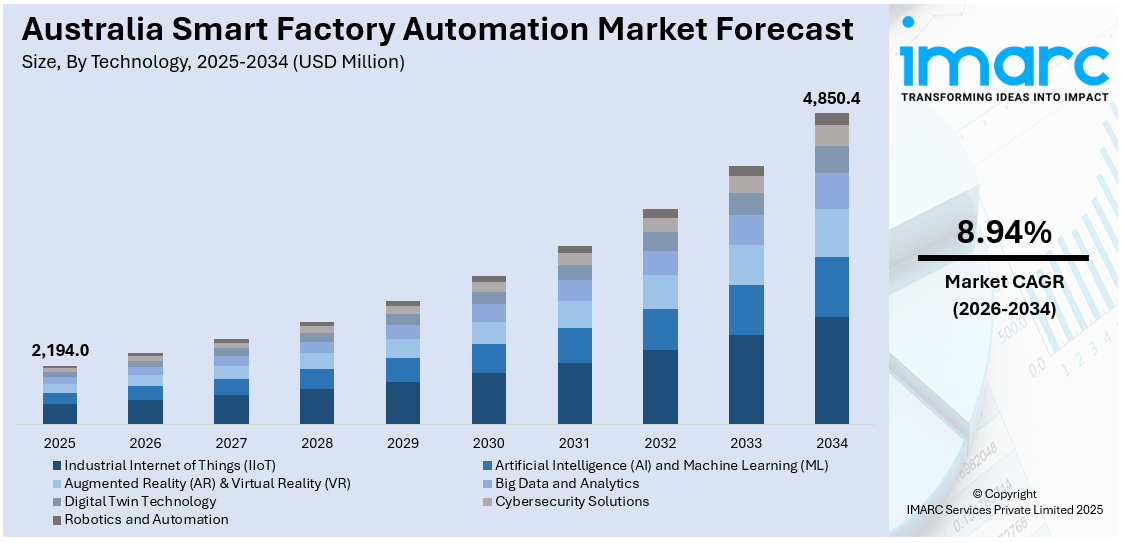

Australia smart factory automation marke market size reached USD 2,194.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 4,850.4 Million by 2034, exhibiting a growth rate (CAGR) of 8.94% during 2026-2034. The market is fueled by escalating labor costs, a strong national emphasis on advanced manufacturing, increasing demand for productivity, and robust government backing for Industry 4.0 adoption. Furthermore, supply chain challenges and the drive toward sustainable, low-emission production have hastened the adoption of intelligent automation, boosting the Australia smart factory automation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,194.0 Million |

| Market Forecast in 2034 | USD 4,850.4 Million |

| Market Growth Rate 2026-2034 | 8.94% |

Key Trends of Australia Smart Factory Automation Market:

Integration of Edge Computing in Industrial Operations

Edge computing is gaining traction in Australia’s smart factories, offering low-latency data processing and improved resilience. Manufacturers deploy edge devices for local data processing, enabling real-time insights and more responsive control systems. This is especially valuable in sectors like mining and precision manufacturing, where remote regions face connectivity challenges. Combining edge computing with AI enhances machinery performance and predictive maintenance, supporting Australia’s strategy to strengthen regional manufacturing and ensure operational continuity. For instance, at the 2025 Hannover Messe, Siemens highlighted innovations in industrial AI, automation, and digital twin technology. Key advancements include the development of an Industrial Foundation Model (IFM) with Microsoft and the use of virtual PLCs for manufacturing at Audi. Siemens emphasized partnerships with Accenture, NVIDIA, Microsoft, and AWS to enhance industrial efficiency, sustainability, and AI-driven transformations. The company aims to drive digital transformation and sustainability, helping industries become more resilient and competitive.

To get more information on this market Request Sample

Customized Automation Solutions for SME Manufacturers

SMEs play a crucial role in the Australia smart factory automation market growth by adopting scalable, modular automation to boost competitiveness. Vendors now offer flexible solutions like plug-and-play robots and low-code software, making smart manufacturing accessible without heavy investment. Government support through grants and R&D hubs accelerates SME automation adoption. For instance, in June 2024, Bystronic and Lowa Lighting launched Australia’s first Bystronic Smart Factory in Sydney to support a major LED lighting project for New South Wales schools. Operational since March 2024, the facility features automated cutting, sorting, storage, and bending systems. Plans are underway to expand smart factory installations across Australia.

Growth Drivers of Australia Smart Factory Automation Market:

Rising Labor Costs and Skills Gap Management

The increasing costs of labor and important skills gaps in high-tech manufacturing industries represent major workforce issues in Australia. Companies are progressively moving to automation technologies to deal with these challenges and remain competitive in the production process. The coming on board of automation has been a strategic reaction to the projected employment rate of a 16.8% increase in the manufacturing sector by 2033, which will need 120,000 more workers. Smart factory solutions allow a manufacturer to optimize the available human resources and minimize the reliance on manual labor to perform repetitive tasks. This trend supports the Australia smart factory automation market demand as businesses seek sustainable solutions to workforce challenges while maintaining operational efficiency and productivity growth targets.

Government Industry 4.0 Policy Support and Investment Incentives

The Australian government's commitment to Industry 4.0 advancement through substantial funding programs significantly drives market growth. The $22.7 billion Future Made in Australia initiative and $15 billion National Reconstruction Fund provide critical financial support for manufacturing modernization. These policies focus specifically on clean energy, critical minerals processing, and advanced manufacturing capabilities, encouraging private sector automation investments. Government-backed research and development (R&D) hubs and grants facilitate SME access to smart manufacturing technologies, reducing implementation barriers. The Australia smart factory automation market analysis reveals that these strategic investments accelerate technology adoption across various industry verticals, creating favorable conditions for sustained market expansion and technological advancement.

Supply Chain Resilience and Production Efficiency Requirements

Recent global supply chain disruptions have highlighted the critical importance of operational resilience and production optimization for Australian manufacturers. Companies are implementing smart automation solutions to create more flexible, responsive manufacturing systems capable of adapting to supply chain volatility. Advanced analytics, predictive maintenance, and real-time monitoring capabilities enable manufacturers to minimize downtime and optimize resource utilization. The growing emphasis on sustainable, low-emission production processes further drives automation adoption as companies seek to meet environmental regulations and corporate sustainability targets. This convergence of resilience requirements and efficiency demands substantially contributes to the expanding market demand across multiple industry sectors.

Opportunity of Australia Smart Factory Automation Market:

Green Manufacturing and Sustainability Transformation

Australia's commitment to carbon neutrality by 2050 creates substantial opportunities for smart factory automation solutions that enable sustainable manufacturing practices. The government's green manufacturing initiatives and carbon reduction targets drive demand for energy-efficient automation technologies and renewable energy integration systems. Smart factories equipped with IoT sensors and AI-driven optimization can significantly reduce energy consumption, waste generation, and carbon emissions while maintaining production efficiency. Companies adopting green automation technologies benefit from government incentives, tax credits, and preferential procurement opportunities. The market analysis indicates strong growth potential in clean energy manufacturing, circular economy processes, and environmentally conscious production systems that align with national sustainability objectives.

Asia-Pacific Regional Manufacturing Hub Development

Australia's strategic geographic position and trade relationships within the Asia-Pacific region present significant opportunities for smart manufacturing expansion. The country's high-quality manufacturing standards, political stability, and established trade agreements provide competitive advantages for export-oriented production facilities. Smart factory technologies enable Australian manufacturers to achieve the scale, efficiency, and quality required for competitive regional market participation. Advanced automation capabilities support diversification into high-value manufacturing sectors including pharmaceuticals, aerospace components, and precision engineering. The Australia smart factory automation market demand benefits from increasing regional trade volumes, supply chain localization trends, and growing recognition of Australia as a reliable manufacturing partner within the Asia-Pacific economic ecosystem.

Critical Minerals Processing and Advanced Materials Manufacturing

Australia's abundant natural resources and the global transition to clean energy create unprecedented opportunities for smart manufacturing in critical minerals processing and advanced materials production. The country's leadership in lithium, rare earth elements, and other essential materials for battery and renewable energy technologies drives demand for sophisticated automation solutions. Smart factory implementations in minerals processing enable precise quality control, efficient resource utilization, and reduced environmental impact while meeting increasing global demand. Government support through the Critical Minerals Strategy and related funding programs accelerates automation adoption in this sector. The market analysis reveals substantial growth potential as manufacturers scale operations to capture opportunities in the global green energy supply chain transformation.

Challenges of Australia Smart Factory Automation Market:

High Initial Capital Investment and ROI Uncertainty

Australian manufacturers face significant financial barriers when implementing comprehensive smart factory automation solutions, particularly smaller enterprises with limited capital resources. The substantial upfront costs for advanced robotics, IoT infrastructure, and integration services create challenging ROI calculations, especially given uncertain market conditions and evolving technology standards. Many companies struggle to justify immediate automation investments amid economic pressures and competing capital allocation priorities. Complex technology integration requirements often result in unexpected costs and extended implementation timelines, further complicating financial planning. The market growth is constrained by these capital intensity challenges, requiring innovative financing solutions and clearer ROI demonstration to accelerate widespread adoption across various industry sectors and company sizes.

Cybersecurity Vulnerabilities and Digital Infrastructure Risks

The integration of connected devices, cloud-based systems, and IoT technologies in smart factories creates substantial cybersecurity challenges for Australian manufacturers. Industrial control systems and operational technology environments face increasing vulnerability to cyber attacks, potentially resulting in production disruptions, data breaches, and safety incidents. Many manufacturers lack adequate cybersecurity expertise and robust security frameworks to protect sophisticated automation infrastructure effectively. The convergence of IT and OT systems creates new attack vectors that traditional security measures cannot adequately address. Regulatory compliance requirements and industry standards for cybersecurity add complexity and costs to automation implementations. The market analysis highlights cybersecurity concerns as a primary barrier limiting technology adoption, requiring comprehensive security strategies and specialized expertise development.

Workforce Adaptation and Skills Development Requirements

The transition to smart manufacturing creates significant workforce challenges as traditional manufacturing skills become less relevant and new technical competencies become essential. Australian manufacturers struggle to retrain existing employees and recruit qualified personnel with automation, data analytics, and digital technology expertise. The aging workforce in manufacturing sectors compounds these challenges, as experienced workers approach retirement while younger generations often lack interest in manufacturing careers. Educational institutions and training programs struggle to keep pace with rapidly evolving technology requirements and industry needs. The market demand faces constraints from skills gaps that limit effective technology utilization and operation, requiring substantial investment in workforce development, training programs, and educational partnerships to ensure successful automation implementation and sustained competitive advantage.

Government Support for Australia Smart Factory Automation Market:

Future Made in Australia Initiative and Strategic Funding Programs

The Australian government demonstrates strong commitment to manufacturing modernization through the comprehensive $22.7 Billion Future Made in Australia initiative, directly supporting smart factory automation adoption across priority industries. This landmark program provides production tax incentives for critical minerals processing, renewable hydrogen development, and clean energy manufacturing, encouraging private sector investment in advanced automation technologies. The initiative specifically targets battery manufacturing with $549 million over eight years and critical minerals processing with $7.1 billion in tax incentives over eleven years. The Australia smart factory automation market analysis benefits significantly from these targeted funding mechanisms that reduce implementation risks and improve automation project economics, creating favorable conditions for sustained market growth and technological advancement across multiple industry sectors.

National Reconstruction Fund and Manufacturing Infrastructure Investment

The $15 Billion National Reconstruction Fund represents a substantial government commitment to transforming Australia's manufacturing capabilities through strategic infrastructure and technology investments. This fund specifically supports projects that develop, diversify, and enhance industrial manufacturing capabilities, with particular emphasis on automation and digitalization initiatives. The fund's focus areas include clean energy manufacturing, medical manufacturing, transport, agriculture, forestry, and fisheries processing, all requiring sophisticated automation solutions. Government co-investment through this mechanism enables manufacturers to access advanced technologies and implement comprehensive smart factory solutions that might otherwise be financially unfeasible. The Australia smart factory automation market demand receives substantial impetus from this funding, which de-risks automation investments and accelerates technology adoption timelines.

Modern Manufacturing Strategy and Sector-Specific Support Programs

The Australian government's Modern Manufacturing Strategy provides a comprehensive policy framework and targeted support for Industry 4.0 adoption through sector-specific initiatives and collaborative programs. The strategy includes dedicated manufacturing hubs, supply chain resilience grants, and research and development (R&D) support mechanisms that directly facilitate smart factory implementation. The Manufacturing Modernization Fund and similar programs offer grants and co-investment opportunities for automation projects, reducing financial barriers for SMEs and encouraging technology adoption. Government partnerships with educational institutions and industry bodies create skills development programs aligned with smart manufacturing requirements. The Australia smart factory automation market analysis shows a positive impact from these coordinated policy measures that create an enabling environment for automation adoption, technology transfer, and manufacturing capability enhancement across diverse industry segments and company sizes.

Australia Smart Factory Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on technology, component, deployment mode, and industry vertical.

Technology Insights:

- Industrial Internet of Things (IIoT)

- Artificial Intelligence (AI) and Machine Learning (ML)

- Augmented Reality (AR) & Virtual Reality (VR)

- Big Data and Analytics

- Digital Twin Technology

- Cybersecurity Solutions

- Robotics and Automation

The report has provided a detailed breakup and analysis of the market based on the technology. This includes Industrial Internet of Things (IIoT), artificial intelligence (AI) and machine learning (ML), augmented reality (AR) & virtual reality (VR), big data and analytics, digital twin technology, cybersecurity solutions, and robotics and automation.

Component Insights:

- Sensors and Actuators

- Industrial Robots

- Human-Machine Interface (HMI)

- Industrial Control Systems

- SCADA

- PLC

- DCS

- Networking and Communication Systems

- Software and Cloud Solutions

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes sensors and actuators, industrial robots, human-machine interface (HMI), industrial control systems (SCADA, PLC, and DCS), networking and communication systems, and software and cloud solutions.

Deployment Mode Insights:

- On-Premises

- Cloud-Based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

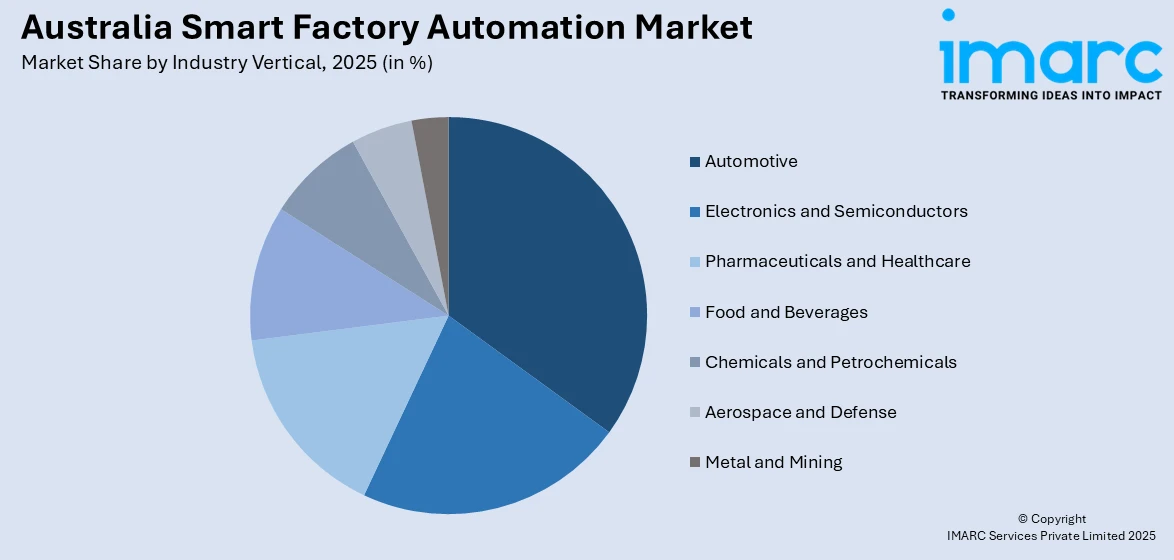

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Electronics and Semiconductors

- Pharmaceuticals and Healthcare

- Food and Beverages

- Chemicals and Petrochemicals

- Aerospace and Defense

- Metal and Mining

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes automotive, electronics and semiconductors, pharmaceuticals and healthcare, food and beverages, chemicals and petrochemicals, aerospace and defense, and metal and mining.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Smart Factory Automation Market News:

- In March 2025, Kinrise Snackfoods, one of Australia’s largest food manufacturers, partnered with Konica Minolta to implement autonomous mobile robots (AMRs) at its Cobs Popcorn facility. This smart automation solution improves operational efficiency, productivity, and safety in pallet handling, ensuring 24/7 internal logistics and significantly enhancing overall manufacturing processes.

- In July 2024, Deloitte Australia acquired Efficientia Solutions, a Sydney-based firm specializing in smart manufacturing and automation software. Established in 2018, Efficientia provides services in strategy, productivity improvement, and technology integration for the manufacturing sector. The acquisition expands Deloitte's capabilities in smart manufacturing, bringing expertise in operational technology (OT) and IT system integration to enhance client productivity through digitization.

Australia Smart Factory Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Industrial Internet of Things (IIoT), Artificial Intelligence (AI) and Machine Learning (ML), Augmented Reality (AR) & Virtual Reality (VR), Big Data and Analytics, Digital Twin Technology, Cybersecurity Solutions, Robotics and Automation |

| Components Covered |

|

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Industry Verticals Covered | Automotive, Electronics and Semiconductors, Pharmaceuticals and Healthcare, Food and Beverages, Chemicals and Petrochemicals, Aerospace and Defense, Metal and Mining |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia smart factory automation market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia smart factory automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia smart factory automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia smart factory automation market is projected to exhibit a CAGR of 8.94% during 2026-2034.

The Australia smart factory automation market is driven by Industry 4.0 adoption, IoT integration, AI-powered predictive maintenance, robotics deployment, and digital twin technology, enhancing operational efficiency, real-time monitoring, and flexible, data-driven manufacturing processes across industries.

The Australia smart factory automation market is driven by rising demand for optimized production, sustainable and energy-efficient operations, and strong government support, which together accelerate digital transformation, technological adoption, and operational innovation across various industrial sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)