Australia Smart Industrial Motors Market Size, Share, Trends and Forecast by Motor Type, Connectivity and Intelligence, Power Rating, End-Use Industry, and Region, 2025-2033

Australia Smart Industrial Motors Market Overview:

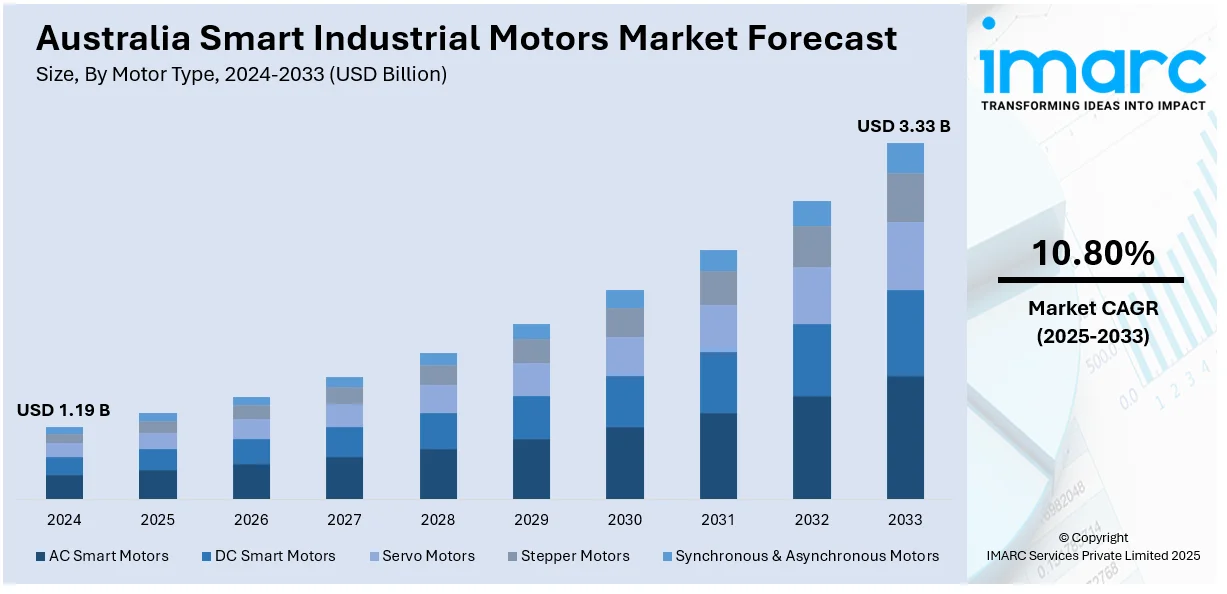

The Australia smart industrial motors market size reached USD 1.19 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.33 Billion by 2033, exhibiting a growth rate (CAGR) of 10.80% during 2025-2033. At present, the growing adoption of the Internet of Things (IoT) that enable motors to adjust their operations based on real-time demand is positively influencing the market. Besides this, the rising implementation of digital transformation initiatives is contributing to the expansion of the Australia smart industrial motors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.19 Billion |

| Market Forecast in 2033 | USD 3.33 Billion |

| Market Growth Rate 2025-2033 | 10.80% |

Australia Smart Industrial Motors Market Trends:

Increasing adoption of IoT

The rising adoption of IoT is positively influencing the market in Australia. Through IoT sensors and connectivity, industrial motors are being integrated into a smart network that gathers and relays data on performance, energy usage, temperature, vibration, and other vital metrics. This information aids maintenance teams in identifying early indicators of wear and malfunction, enabling predictive maintenance and decreasing unforeseen downtime. In industries, such as mining, manufacturing, and agriculture, where machinery operates continuously and dependability is vital, IoT-oriented smart motors offer improved efficiency and savings. IoT enables remote monitoring, which is crucial for Australia's widely dispersed industrial activities. Engineers and managers can retrieve motor data from any location, enhancing their responsiveness and ability to make decisions. Additionally, the integration of IoT enables motors to modify their functioning according to real-time demand, resulting in refined energy efficiency. This ability supports sustainability objectives and helps sectors achieve energy compliance requirements. The employment of automation, data analysis, and remote access is transforming IoT-based smart motors into an essential component of Australia's advancing industrial environment. According to the IMARC Group, the Australia IoT market size is projected to exhibit a growth rate (CAGR) of 13.70% during 2024-2032.

To get more information on this market, Request Sample

Rising energy efficiency demands

Increasing energy efficiency demands are fueling the Australia smart industrial motors market growth. Smart motors adjust their speed and power based on real-time needs, which helps avoid energy waste and lower electricity bills. The Australian Energy Regulator (AER) stated that by April 2024, the average monthly electricity bill for a typical household was approximately USD 125, resulting in an annual total of USD 1,500. High energy prices in Australia are making energy-saving solutions more attractive. Smart motors also help companies meet government regulations and sustainability targets by reducing emissions. With built-in monitoring and control features, these motors allow better oversight of operations and assist in detecting issues early. As industries are focusing on sustainability and operational efficiency, smart motors are becoming a practical and necessary investment.

Digital transformation initiatives

Digital transformation initiatives are encouraging industries to modernize equipment and improve operational efficiency. As businesses are shifting toward data-based systems and automation, they are replacing traditional motors with smart ones that offer advanced features like self-regulation, real-time performance feedback, and remote configuration. These motors support digital control systems that streamline industrial processes, minimize downtime, and enhance productivity. By integrating with digital platforms, smart motors help managers make faster and more informed decisions based on accurate performance data. Digital transformation is also motivating companies to adopt energy-efficient and intelligent solutions to stay competitive and meet modern industry standards. As per industry reports, 84% of companies in Australia indicated they employed technology upgrades in 2024. Consequently, the demand for smart industrial motors is growing steadily, with firms upgrading legacy systems as part of their broader digital modernization strategies.

Australia Smart Industrial Motors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on motor type, connectivity and intelligence, power rating, and end-use industry.

Motor Type Insights:

- AC Smart Motors

- DC Smart Motors

- Servo Motors

- Stepper Motors

- Synchronous and Asynchronous Motors

The report has provided a detailed breakup and analysis of the market based on the motor type. This includes AC smart motors, DC smart motors, servo motors, stepper motors, and synchronous and asynchronous motors.

Connectivity and Intelligence Insights:

- IoT-Enabled Smart Motors

- AI and ML-Integrated Motors

- Wireless and Cloud-Connected Motors

- Edge Computing and Embedded Systems in Motors

A detailed breakup and analysis of the market based on the connectivity and intelligence have also been provided in the report. This includes IoT-enabled smart motors, AI and ML-integrated motors, wireless and cloud-connected motors, and edge computing and embedded systems in motors.

Power Rating Insights:

- Low Power (0.1 kW - 10 kW)

- Medium Power (10 kW - 100 kW)

- High Power (Above 100 kW)

The report has provided a detailed breakup and analysis of the market based on the power rating. This includes low power (0.1 kW - 10 kW), medium power (10 kW - 100 kW), and high power (above 100 kW).

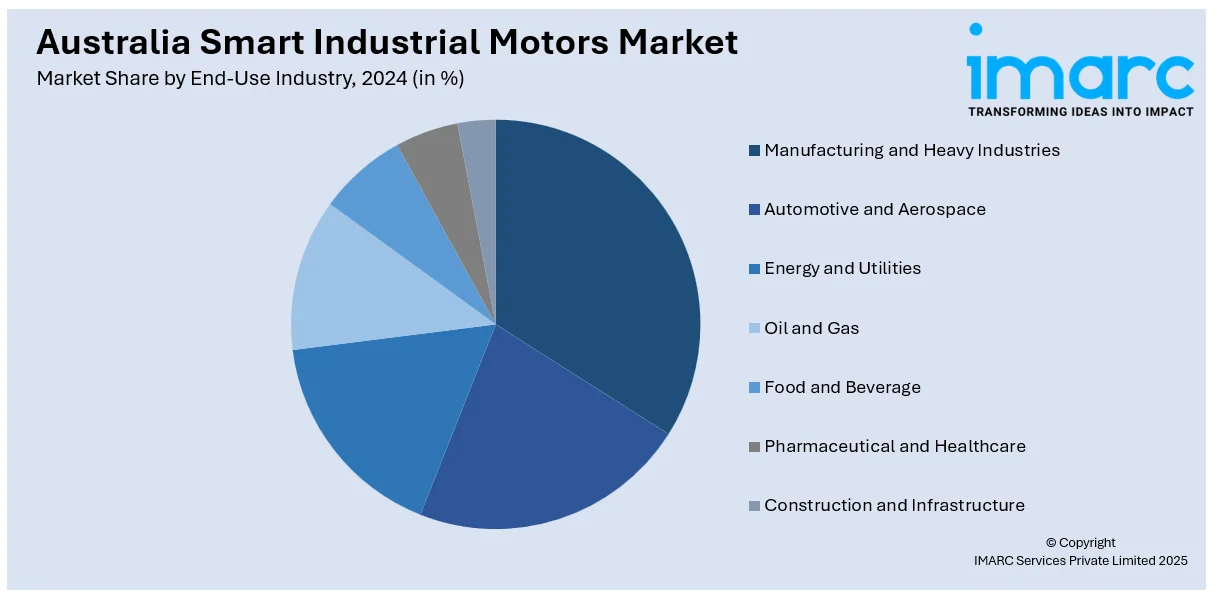

End-Use Industry Insights:

- Manufacturing and Heavy Industries

- Automotive and Aerospace

- Energy and Utilities

- Oil and Gas

- Food and Beverage

- Pharmaceutical and Healthcare

- Construction and Infrastructure

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes manufacturing and heavy industries, automotive and aerospace, oil and gas, food and beverage, pharmaceutical and healthcare, and construction and infrastructure.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Smart Industrial Motors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Motor Types Covered | AC Smart Motors, DC Smart Motors, Servo Motors, Stepper Motors, Synchronous & Asynchronous Motors |

| Connectivity & Intelligences Covered | IoT-Enabled Smart Motors, AI & ML-Integrated Motors, Wireless and Cloud-Connected Motors, Edge Computing and Embedded Systems in Motors |

| Power Ratings Covered | Low Power (0.1 kW - 10 kW), Medium Power (10 kW - 100 kW), High Power (Above 100 kW) |

| End-Use Industries Covered | Manufacturing and Heavy Industries, Automotive and Aerospace, Energy and Utilities, Oil and Gas, Food and Beverage, Pharmaceutical and Healthcare, Construction and Infrastructure |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia smart industrial motors market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia smart industrial motors market on the basis of motor type?

- What is the breakup of the Australia smart industrial motors market on the basis of connectivity and intelligence?

- What is the breakup of the Australia smart industrial motors market on the basis of power rating?

- What is the breakup of the Australia smart industrial motors market on the basis of end-use industry?

- What is the breakup of the Australia smart industrial motors market on the basis of region?

- What are the various stages in the value chain of the Australia smart industrial motors market?

- What are the key driving factors and challenges in the Australia smart industrial motors?

- What is the structure of the Australia smart industrial motors market and who are the key players?

- What is the degree of competition in the Australia smart industrial motors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia smart industrial motors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia smart industrial motors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia smart industrial motors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)