Australia Smart Lock Market Size, Share, Trends and Forecast by Lock Type, Communication Protocol, End-User, and Region, 2025-2033

Australia Smart Lock Market Size and Share:

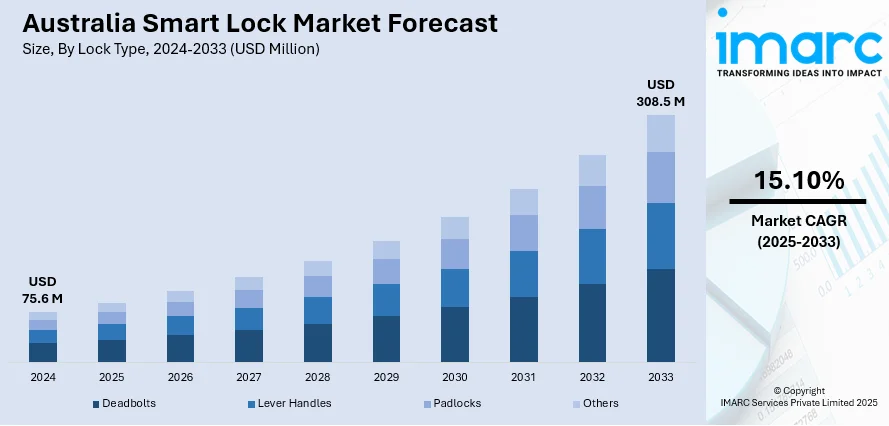

The Australia smart lock market size reached USD 75.6 Million in 2024. Looking forward, the market is expected to reach USD 308.5 Million by 2033, exhibiting a growth rate (CAGR) of 15.10% during 2025-2033. The market is stimulated by growing demand for improved security, convenience, and compatibility with smart home solutions, as well as growing usage in residential, commercial, and institutional markets for advanced access control solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 75.6 Million |

| Market Forecast in 2033 | USD 308.5 Million |

| Market Growth Rate 2025-2033 | 15.10% |

Key Trends of Australia Smart Lock Market:

Rising Adoption of Smart Home Integration

The Australia smart lock market is growing rapidly with the rising popularity of smart home technology among consumers. As the number of smart home devices, including voice assistants, smart lighting, and security systems, is on the rise, smart locks are viewed as a natural addition to home automation. For instance, in June 2024, Philips introduced its first Wi-Fi-enabled smart deadbolt, which enables remote door control through the Philips Home Access App. The product does not require extra hardware and has voice command, auto-unlock, and guest access capabilities. Moreover, Australian consumers are looking for convenience, security, and remote access, which smart locks provide by allowing users to manage locks using mobile apps or voice assistants. Amplifying demand for seamless connectivity with other smart home devices is fueling innovation in smart lock functionality, including integration with security cameras and alarm systems. This trend is especially prevalent in tech-savvy homeowners and millennials who will be more inclined toward digital solutions. As consumer trust in smart home technology builds, the Australia smart lock market share path is likely to maintain momentum, with gradual increases in adoption for urban and suburban areas.

To get more information on this market, Request Sample

Enhanced Security Features Driving Demand

Growing security concerns with regards to home security in Australia are fueling the popularity of smart locks. Smart locks provide better security features like encryption, biometric security, and notifications in real-time, making them a choice for homeowners wanting to secure their homes. The feature to provide temporary access to guests, service workers, or tenants also makes smart locks more appealing. With technological advancements, smart locks today provide functionalities like auto-locking, remote access, and audit trails to monitor who enters and leaves a property. With boosting demand for enhanced security levels, especially in urban areas, the Australia smart lock market outlook is toward smart locks as a more secure, convenient option compared to conventional mechanical locks. These technologies are poised to keep propelling the Australia smart lock market, with considerable expansion in both residential and commercial uses.

Increasing Demand in Commercial and Institutional Sectors

According to the Australia smart lock market analysis, applications of these locks in the commercial and institutional segments in the region is growing due to demands for safe, versatile access control solutions. Companies are implementing smart locks to simplify operations, enhance security, and minimize costs related to conventional lock and key systems. Office properties, offices, and multi-residential developments are using smart locks to provide keyless access for employees, tenants, and visitors, streamlining operational effectiveness and security. For instance, in March 2023, Yale introduced its Fire Rated Unity Entrance Lock with AS1428.1-approved accessible lever, providing smart app control, voice entry, and up to two-hour fire rating for Australian homes. Moreover, institutional segments like government facilities and educational institutions are also experiencing the advantage of smart locks, specifically where restricted entry is needed. Remote control over access rights, integration with other security systems, and monitoring of building entry points represent a significant benefit. With continued growth in demand for secure, efficient solutions, Australia smart locks market share is growing, with increasing take-up across commercial and institutional segments, creating further growth in the overall market.

Growth Drivers of Australia Smart Lock Market:

Growing Urbanization and Smart City Developments

The urbanization in Australia at a fast pace is largely fueling the demand for smart lock technology. With more Australians migrating to high-density cities such as Sydney, Melbourne, and Brisbane, there is an increased need for better security solutions in residential apartments, business buildings, and public facilities. Local government-driven smart city programs are accelerating the integration of IoT-based security systems, such as smart locks, into safety and operational efficiency improvements. These programs support the use of smart locks within broader urban security systems, such as networked lighting, surveillance, and access control systems. In addition, new high-rise constructions and mixed-use towers are being planned with smart security technology from the beginning, indicating a change in the market trend toward technology-enabled living in cities. This growth in cities, coupled with the growing consciousness regarding smart technologies, drives demand for smart locks in residential, business, and public spaces in Australia.

Increased Use of Contactless and Keyless Access Systems

Another principal driver influencing the Australia smart lock market demand is the increasing demand for contactless and key-free access technologies, spurred on by evolving consumer habits and public health issues. The impact of the COVID-19 pandemic elevated the focus on touchless technology to minimize physical contact points, spurring demand for smart locks that allow remote and keyless entry. This trend is seen across both residential and commercial settings, where convenience and increased hygiene are desired. Property owners, landlords, and companies are implementing smart locks to automate access management, particularly for short-term rentals, coworking offices, and service personnel. Moreover, the use of digital keys and mobile app-issued access complements easy and secure utilization of properties, which resonates well with the burgeoning gig economy and remote workforce in Australia. This changing trend of contactless solutions is further driving the national adoption of smart locks.

Technological Advancements and Local Market Innovation

Local innovation and technological advancement are also instrumental in spearheading the Australia smart lock market growth. There is active engagement by Australian startups and technology firms in creating secure, smart solutions according to local requirements, such as climate-resistant hardware and mechanisms that comply with building codes and national architectural design ideas in Australia. In addition, international smart lock companies are entering the Australian market by partnering with local distributors and home improvement stores, increasing the accessibility of the technology. Smart locks are becoming popular among consumers and businesses due to advancements in wireless communication protocols like Bluetooth Low Energy (BLE), Wi-Fi, and Z-Wave, which have improved their dependability and efficiency. Voice assistant integration with Google Assistant and Amazon Alexa is also picking up pace in Australia, enabling users to operate locks through voice commands. All these innovations, coupled with ease of use through mobile interfaces and increasing interoperability with other smart home appliances, are driving the market forward.

Australia Smart Lock Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on lock type, communication protocol, and end-user.

Lock Type Insights:

- Deadbolts

- Lever Handles

- Padlocks

- Others

The report has provided a detailed breakup and analysis of the market based on the lock type. This includes deadbolts, lever handles, padlocks, and others.

Communication Protocol Insights:

- Bluetooth

- Wi-Fi

- Others

A detailed breakup and analysis of the market based on the communication protocol have also been provided in the report. This includes Bluetooth, Wi-Fi, and others.

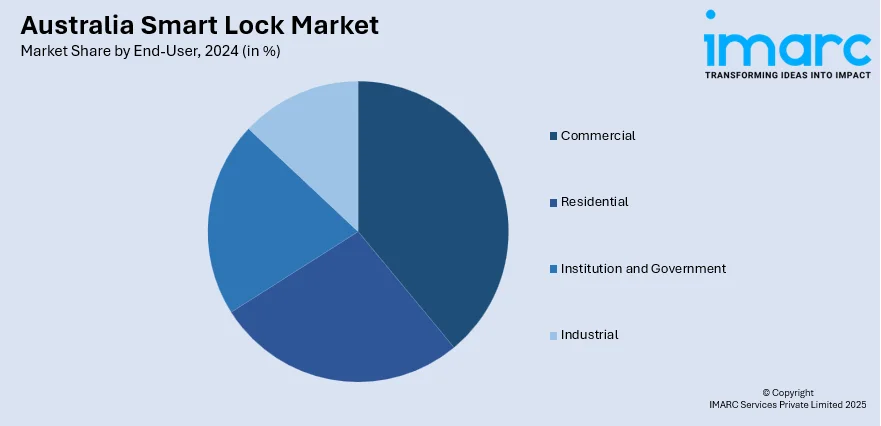

End-User Insights:

- Commercial

- Residential

- Institution and Government

- Industrial

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes commercial, residential, institution and government, and industrial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Smart Lock Market News:

- In September 2024, Yale launched the Connect Plus Hub 2 in Australia enabling effortless control of up to 16 Bluetooth and 30 Zigbee devices through the Yale Home App. With DualDoor™ Technology, voice assistant support, and remote access, it increases smart home connectivity and decreases dependence on various device bridges.

- In June 2023, Lockwood released the 001Touch Plus™ Smart Deadlatch in Australia, elevating its legendary deadlatch with Yale Home App connectivity. The smart lock provides PIN, tag, and mobile entry, auto-lock/unlock functions, and interoperability with the Yale Connect Plus Wi-Fi Bridge for easy smart home control through a single hub.

Australia Smart Lock Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Lock Types Covered | Deadbolts, Lever Handles, Padlocks, Others |

| Communication Protocols Covered | Bluetooth, Wi-Fi, Others |

| End-Users Covered | Commercial, Residential, Institution and Government, Industrial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia smart lock market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia smart lock market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia smart lock industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia smart lock market was valued at USD 75.6 Million in 2024.

The Australia smart lock market is projected to exhibit a CAGR of 15.10% during 2025-2033.

The Australia smart lock market is expected to reach a value of USD 308.5 Million by 2033.

The Australia smart lock market trends include growing integration with smart home ecosystems, increased adoption of biometric and mobile-based access, and a focus on energy-efficient, weather-resistant designs suited to local conditions. The rise of subscription-based security services and enhanced interoperability with voice assistants are also shaping market dynamics.

The Australia smart lock market is driven by rising urbanization, increasing demand for contactless access, and growing security concerns. Government smart city initiatives and technological advancements like mobile app control and voice integration further boost adoption. Additionally, evolving consumer preferences for convenience and safety accelerate market growth across residential and commercial sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)