Australia Smart Manufacturing Software Market Size, Share, Trends and Forecast by Software Type, Enterprise Size, Deployment Mode, Industry Vertical, and Region, 2025-2033

Australia Smart Manufacturing Software Market Overview:

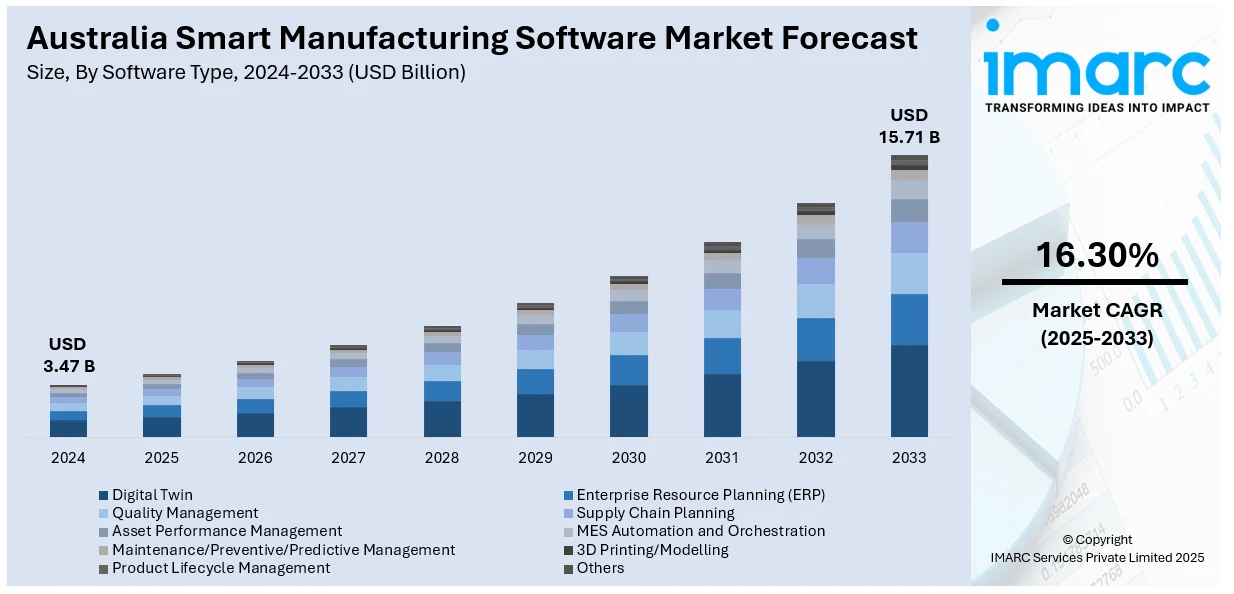

The Australia smart manufacturing software market size reached USD 3.47 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 15.71 Billion by 2033, exhibiting a growth rate (CAGR) of 16.30% during 2025-2033. The rising labor costs, Industry 4.0 government programs, and demand for real-time production visibility are driving the market growth. Moreover, increased use of digital twins, energy efficiency goals, cloud-based software growth, and cybersecurity concerns, are supporting the market growth. Furthermore, deployment of Industrial Internet of Things (IIoT) infrastructure, integration with Enterprise Resource Planning (ERP) and Supply Chain Management (SCM) systems, adoption of predictive maintenance tools, application of Artificial Intelligence (AI) in manufacturing, and collaborations between technology providers and academic research institutions are boosting the Australia smart manufacturing software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.47 Billion |

| Market Forecast in 2033 | USD 15.71 Billion |

| Market Growth Rate 2025-2033 | 16.30% |

Australia Smart Manufacturing Software Market Trends:

Industry 4.0 Adoption Push

Australia is pushing for widespread Industry 4.0 adoption to future-proof its manufacturing sector. The federal and state governments have introduced several targeted programs encouraging digital transformation. One major initiative is the Manufacturing Technology Adoption Program (MTAP), offering matched funding of up to USD 50,000 to small and medium-sized manufacturers to adopt digital and advanced production technologies. This includes artificial intelligence (AI), robotics, industrial Internet of Things (IoT), and data analytics tools. Additionally, the federal government has supported the creation of Industry 4.0 Testlabs across major universities such as Swinburne and University of South Australia. These labs provide small and medium-sized enterprises (SMEs) with access to demonstration environments where they can evaluate and pilot smart technologies before investing. This structured support is part of a national strategy to transition Australian manufacturing from traditional, labor-heavy methods to a more digital, agile, and data-driven system that can compete globally.

To get more information on this market, Request Sample

High Labor Costs

High labor costs are a major pressure point for Australian manufacturers, driving interest in automation and software-enabled process efficiencies. Unlike low-cost manufacturing countries, Australia does not have the option to rely on cheap labor to maintain competitiveness. To counterbalance these expenses, manufacturers are investing in smart manufacturing software that automates manual tasks, improves productivity, and optimizes workforce deployment. Technologies such as digital production planning, predictive analytics, and robotic process automation can help reduce labor dependency without compromising output quality. In 2024, BHP announced the expansion of its digital factory initiative in Western Australia, integrating AI-driven process automation across its mining equipment maintenance operations to reduce downtime and enhance workforce efficiency. With the added benefit of better consistency and fewer human errors, automation driven by smart software is becoming a strategic response to the country’s high wage structure.

Demand for Real-Time Production Visibility

Manufacturers in Australia are increasingly prioritizing real-time production visibility to stay responsive and competitive. However, this still indicates that a significant majority operate without full situational awareness of shop floor activities. The need to reduce downtime, improve resource planning, and quickly resolve bottlenecks is pushing adoption of smart manufacturing software solutions like Manufacturing Execution Systems (MES) and digital dashboards. These platforms help track asset performance, production status, and quality metrics in real-time, enabling immediate interventions when something goes wrong. In a 2024 development, Siemens Australia announced a partnership with local manufacturing firms to deploy its Industrial Edge platform across multiple sites, enabling on-premise data processing and real-time analytics to enhance operational responsiveness. Real-time visibility also supports just-in-time production, inventory optimization, and faster decision-making, which is further driving the Australia smart manufacturing software market growth.

Australia Smart Manufacturing Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on software type, enterprise size, deployment mode, and industry vertical.

Software Type Insights:

- Digital Twin

- Enterprise Resource Planning (ERP)

- Quality Management

- Supply Chain Planning

- Asset Performance Management

- MES Automation and Orchestration

- Maintenance/Preventive/Predictive Management

- 3D Printing/Modelling

- Product Lifecycle Management

- Others

The report has provided a detailed breakup and analysis of the market based on the software type. This includes digital twin, enterprise resource planning (ERP), quality management, supply chain planning, asset performance management, MES automation and orchestration, maintenance/preventive/predictive management, 3D printing/modelling, product lifecycle management, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Mid-sized Enterprises (SMEs)

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes large enterprises and small and mid-sized enterprises (SMEs).

Deployment Mode Insights:

- Cloud based

- On-premises

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes cloud based and on-premises.

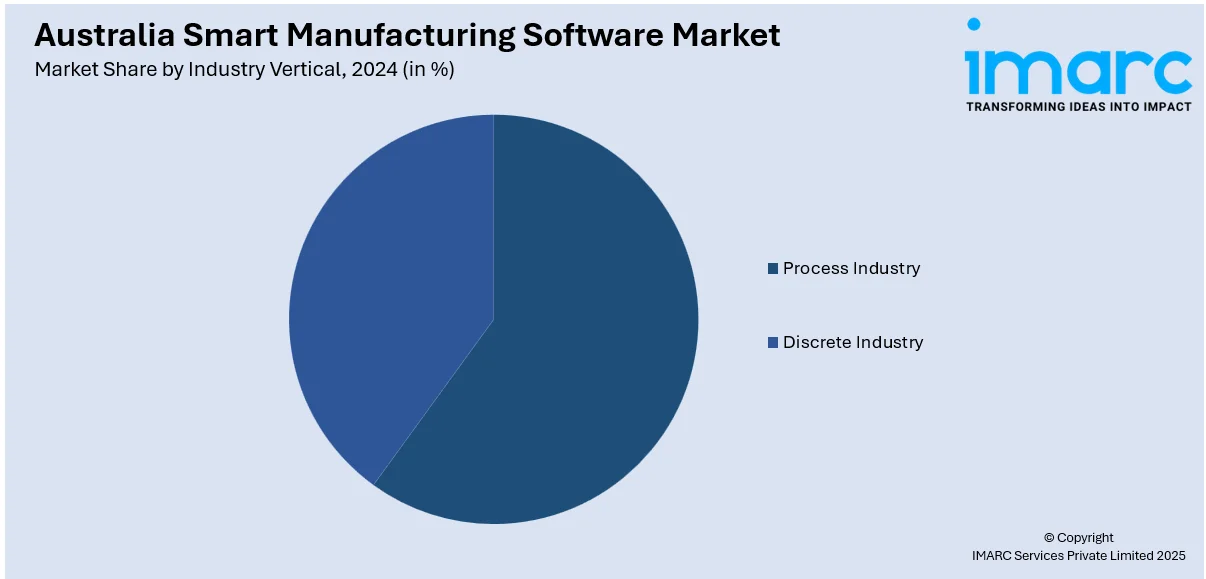

Industry Vertical Insights:

- Process Industry

- Oil and Gas

- Power and Energy

- Chemicals

- Pharmaceuticals

- Food and Beverages

- Metal and Mining

- Others

- Discrete Industry

- Automotive

- Electronics and Manufacturing

- Industrial Manufacturing

- Aerospace and Defense

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes process industry (oil and gas, power and energy, chemicals, pharmaceuticals, food and beverages, metal and mining, and others) and discrete industry (automotive, electronics and manufacturing, industrial manufacturing, aerospace and defense, and others).

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Smart Manufacturing Software Market News:

- In 2025, U.S.-based Tetra Tech agreed to acquire Australia's Sage Group for USD 150 million, with potential earn-outs raising the deal above USD 200 million. Sage, a leader in industrial automation and digital transformation, aims to accelerate its U.S. expansion under the new ownership.

Australia Smart Manufacturing Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Software Types Covered | Digital Twin, Enterprise Resource Planning (ERP), Quality Management, Supply Chain Planning, Asset Performance Management, MES Automation and Orchestration, Maintenance/Preventive/Predictive Management, 3D Printing/Modelling, Product Lifecycle Management, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Mid-sized Enterprises (SMEs) |

| Deployment Modes Covered | Cloud based, On-premises |

| Industry Verticals Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia smart manufacturing software market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia smart manufacturing software market on the basis of software type?

- What is the breakup of the Australia smart manufacturing software market on the basis of enterprise size?

- What is the breakup of the Australia smart manufacturing software market on the basis of deployment mode?

- What is the breakup of the Australia smart manufacturing software market on the basis of industry vertical?

- What is the breakup of the Australia smart manufacturing software market on the basis of region?

- What are the various stages in the value chain of the Australia smart manufacturing software market?

- What are the key driving factors and challenges in the Australia smart manufacturing software market?

- What is the structure of the Australia smart manufacturing software market and who are the key players?

- What is the degree of competition in the Australia smart manufacturing software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia smart manufacturing software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia smart manufacturing software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia smart manufacturing software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)