Australia Smart Microgrids Market Size, Share, Trends and Forecast by Type, Component, Power Technology, Consumer Pattern, Application, and Region, 2025-2033

Australia Smart Microgrids Market Overview:

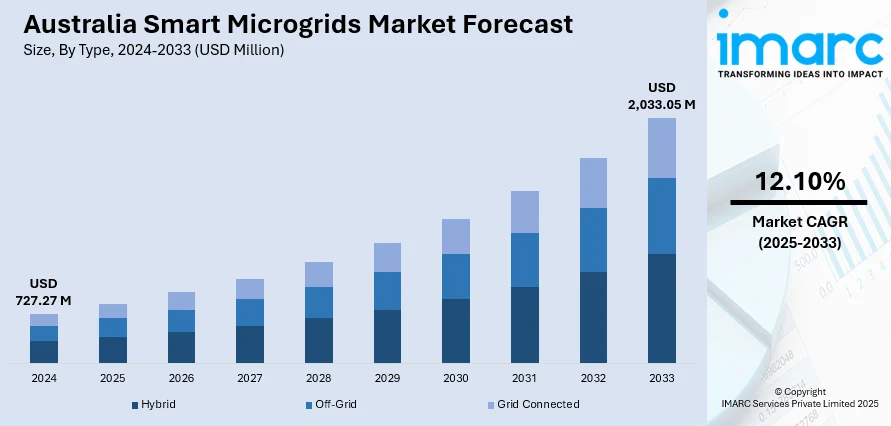

The Australia smart microgrids market size reached USD 727.27 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,033.05 Million by 2033, exhibiting a growth rate (CAGR) of 12.10% during 2025-2033. The market is expanding due to rising renewable integration, advancements in digital infrastructure, and efforts to enhance grid resilience in remote and urban areas. Supportive policies and consumer participation are further accelerating adoption, contributing to increased Australia smart microgrids market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 727.27 Million |

| Market Forecast in 2033 | USD 2,033.05 Million |

| Market Growth Rate 2025-2033 | 12.10% |

Australia Smart Microgrids Market Trends:

Hydrogen Integration Enhancing Remote Microgrid Viability

Australia’s growing focus on clean energy for remote regions is driving the development of smart microgrids that combine renewable generation with innovative storage solutions. In areas where diesel dependency is high and grid access is limited, hydrogen-based microgrids offer an efficient alternative. These systems enable greater flexibility and reduce fuel transport challenges, aligning well with decarbonization targets. The integration of electrolyzers and fuel cells is especially beneficial for off-grid communities, where a consistent and resilient power supply is essential. In July 2024, Western Australia commissioned its first renewable hydrogen microgrid in Denham, combining solar, a 348-kW electrolyzer, battery storage, and a 100-kW fuel cell. This project marked a critical step in replacing diesel in remote microgrids, providing up to 20% of the town’s electricity needs. The system’s success demonstrated hydrogen’s practicality in isolated energy systems and confirmed its potential to support Australia’s low-emission goals. The project not only reduced diesel use by an estimated 37,000 gallons annually but also showcased the potential of hydrogen as a time-shifting energy storage method. By generating hydrogen during solar peak hours and converting it back to electricity when needed, the system increased the reliability and self-sufficiency of the microgrid. Such outcomes pave the way for replication across other off-grid Australian communities. As costs continue to decline and performance improves, hydrogen-based microgrids are expected to play a central role in the country’s broader energy transformation strategy.

To get more information on this market, Request Sample

Digital Infrastructure Empowering Grid Intelligence

The market is the adoption of advanced digital technologies that enable two-way communication and data-driven energy control. These technologies empower local energy users and grid operators to balance supply and demand more efficiently while supporting real-time decision-making. Smart microgrids built with robust sensing and metering infrastructure can also respond quickly to disruptions, improving network resilience and service reliability in both urban and regional settings. Real-time visibility into grid performance enables predictive maintenance, reduces outages, and enhances energy distribution planning. In March 2025, a comprehensive review spotlighted the SmartGrid SmartCity initiative in Australia, emphasizing its use of smart meters, sensors, and communication networks. The initiative demonstrated how digital tools can facilitate bi-directional energy flows and optimize grid performance through intelligent system management. The review further highlighted how smart infrastructure enables peak load management by shifting consumer demand and maximizing the use of distributed renewable sources. In this framework, consumers become active participants, contributing stored or generated power back to the grid and reducing overall strain. With smart microgrids, network operators can implement dynamic pricing models and automate responses to fluctuations, significantly increasing operational efficiency. This technological integration is setting the foundation for a responsive, consumer-inclusive grid. It is expected to accelerate digital microgrid deployments across Australia, especially in regions with high renewable penetration and growing demand variability, thereby contributing significantly to Australia smart microgrids market growth.

Australia Smart Microgrids Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, component, power technology, consumer pattern, and application.

Type Insights:

- Hybrid

- Off-Grid

- Grid Connected

The report has provided a detailed breakup and analysis of the market based on the type. This includes hybrid, off-grid, and grid connected.

Component Insights:

- Storage

- Inverter

The report has provided a detailed breakup and analysis of the market based on the component. This includes storage and inverter.

Power Technology Insights:

- Fuel Cell

- CHP

A detailed breakup and analysis of the market based on the power technology have also been provided in the report. This includes fuel cell and CHP.

Consumer Pattern Insights:

- Urban

- Rural

A detailed breakup and analysis of the market based on the consumer pattern have also been provided in the report. This includes urban and rural.

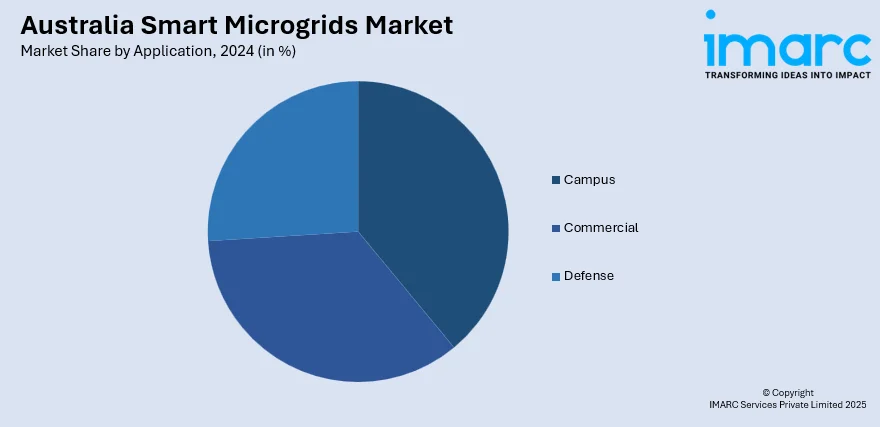

Application Insights:

- Campus

- Commercial

- Defense

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes campus, commercial, and defense.

Regional Insights:

- Australia Capital Territory and New South Wales

- Victoria and Tasmania

- Queensland

- Northern Territory and Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Smart Microgrids Market News:

- March 2025: Ergon Energy advanced smart microgrid development in Queensland by progressing the Mossman Gorge project with a custom high-voltage battery and inverter system. Designed for island mode during outages, this initiative strengthened Australia’s remote energy resilience and supported broader smart microgrid market expansion.

- November 2024: Endeavour Energy launched New South Wales' first community smart microgrid in Bawley Point and Kioloa, integrating 100 subsidized home batteries, rooftop solar, and a 3 MW battery. This initiative improved outage resilience and marked a key advancement in Australia’s smart microgrids market development.

Australia Smart Microgrids Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type Covered | Hybrid, Off-Grid, Grid Connected |

| Components Covered | Storage, Inverter |

| Power Technologies Covered | Fuel Cell, CHP |

| Consumer Patterns Covered | Urban, Rural |

| Applications Covered | Campus, Commercial, Defense |

| Regions Covered | Australia Capital Territory and New South Wales, Victoria & Tasmania, Queensland, Northern Territory and Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia smart microgrids market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia smart microgrids market on the basis of type?

- What is the breakup of the Australia smart microgrids market on the basis of component?

- What is the breakup of the Australia smart microgrids market on the basis of power technology?

- What is the breakup of the Australia smart microgrids market on the basis of consumer pattern?

- What is the breakup of the Australia smart microgrids market on the basis of application?

- What is the breakup of the Australia smart microgrids market on the basis of region?

- What are the various stages in the value chain of the Australia smart microgrids market?

- What are the key driving factors and challenges in the Australia smart microgrids market?

- What is the structure of the Australia smart microgrids market and who are the key players?

- What is the degree of competition in the Australia smart microgrids market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia smart microgrids market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia smart microgrids market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia smart microgrids industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)