Australia Smartphone Market Report by Operating System (Android, iOS, and Others), Display Technology (LCD Technology, OLED Technology), RAM Capacity (Below 4GB, 4GB - 8GB, Over 8GB), Price Range (Ultra-Low-End (Less Than $100), Low-End ($100-<$200), Mid-Range ($200-<$400), Mid- to High-End ($400-<$600), High-End ($600-<$800), Premium ($800-<$1000) and Ultra-Premium ($1000 And Above)), Distribution Channel (OEMs, Online Stores, Retailers), and Region 2025-2033

Australia Smartphone Market Size and Share:

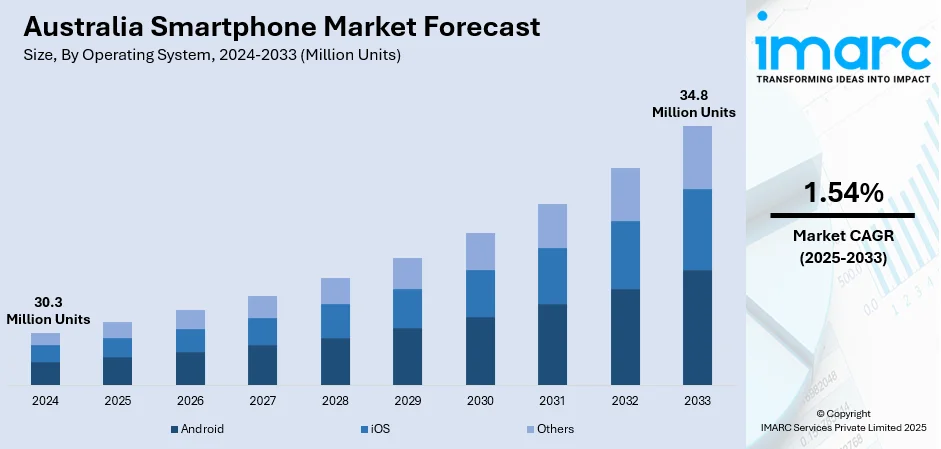

Australia smartphone market size reached 30.3 Million Units in 2024. Looking forward, the market is expected to reach 34.8 Million Units by 2033, exhibiting a growth rate (CAGR) of 1.54% during 2025-2033. The evolution of high-speed mobile networks (like 5G) and improved connectivity options, which enhance the overall smartphone experience, is primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

30.3 Million Units |

|

Market Forecast in 2033

|

34.8 Million Units |

| Market Growth Rate 2025-2033 | 1.54% |

A smartphone is a versatile handheld device that combines the functions of a mobile phone with advanced computing capabilities. It features a touchscreen interface, allowing users to interact with applications, browse the internet, and access a wide range of services. Smartphones typically support voice calls, messaging, and email while also offering features such as GPS navigation, cameras, and multimedia playback. These devices run on operating systems like Android or iOS, enabling the installation of diverse applications to enhance functionality. Smartphones have become integral to modern life, serving as communication tools, entertainment hubs, and productivity aids. Their compact design and portable nature make them indispensable for individuals seeking connectivity, information, and convenience on the go.

To get more information on this market, Request Sample

Key Trends of Australia Smartphone Market:

5G Integration

The Australia smartphone market share is experiencing a consistent increase due to the swift move toward 5G-enabled devices. As telecom companies enhance their 5G networks in both urban and regional areas, consumers are choosing to upgrade their smartphones to take advantage of quicker internet speeds and better connectivity. This shift is influenced not only by enhanced network performance but also by the growing availability of mid-range smartphones that support 5G technology. Moreover, tech-savvy users are eager to enjoy improved mobile experiences including high-quality video streaming, cloud gaming, and real-time application performance. This ongoing transformation is solidifying the market position of leading smartphone manufacturers that provide a diverse 5G portfolio significantly increasing their footprint in Australia's competitive arena.

Rising Demand for Premium Smartphones

There is a significant growth in the demand for high-end smartphones in Australia mainly driven by consumers prioritizing performance and cutting-edge features. Increasing numbers of customers are purchasing high-end models with powerful processors, high-refresh-rate AMOLED screens, and sophisticated multi-lens camera systems. The high-end devices find a strong appeal among camera-centric users, content creators, and gamers. The trend is complemented by installment payment methods provided by carriers making high-end phones affordable. As a result, luxury brands are consolidating their market space appealing to a growing segment of consumers who value quality, design, and innovation in their smartphones.

Eco-Friendly Smartphones

Sustainability trends are increasingly shaping the Australia smartphone market demand as eco-conscious consumers display a growing interest in environment-friendly devices. In response, smartphone manufacturers are launching models constructed from recycled materials featuring modular components and energy-efficient designs. Additionally, extended software support and repairability options are helping to minimize electronic waste encouraging users to keep their devices for a longer period. This shift resonates with broader consumer behavior in Australia where sustainability and ethical consumption are becoming vital factors in decision-making. The rising demand for these eco-friendly devices is not confined to niche markets; even mainstream consumers are leaning towards brands that provide green alternatives. As a result, this has become a strategic advantage in influencing demand dynamics across the Australian smartphone market.

Growth Drivers of Australia Smartphone Market:

Technological Advancements

Rapid advancements in technology heavily impact consumer behavior within the Australian smartphone marketplace. Companies continuously enhance smartphone features, including improved camera functionality, long battery life, high-definition screens, and AI features. These advancements make the use experience richer and present strong reasons for customers to upgrade their phones more regularly. Some of the features include nighttime photography, high-refresh-rate displays, and advanced facial recognition. In addition, enhanced hardware and software capabilities meet the expanding needs of multitasking, gaming, and content creation. With more and more consumers seeking high-performance, feature-enriched devices, continuous innovation is vital to market expansion and company competitiveness in Australia.

Digital Lifestyle Adoption

The increasing embrace of a digital lifestyle is a significant factor propelling the Australian smartphone market. Smartphones have become integral to daily activities, including remote work, online learning, e-commerce, streaming services, and digital banking. This transformation has resulted in longer screen time and heightened reliance on mobile devices across various age groups. As users participate in more data-intensive and app-driven activities, the demand for smartphones with superior speed, storage capacity, and connectivity is on the rise. Essential services, such as health and governmental platforms, are also becoming more accessible via mobile, reinforcing the smartphone's importance in daily life. This broad integration of digital technology into both personal and professional sectors is a key driver of continuous smartphone adoption growth in Australia.

Youth-Driven Demand

The youth demographic in Australia is a significant force behind smartphone demand, characterized by high engagement with digital trends and swift adaptation to new technologies. Younger consumers are particularly interested in smartphones that boast advanced features, sleek designs, and robust performance suitable for gaming, social media, and content creation. This group closely follows mobile innovation trends and often seeks regular upgrades to access the latest offerings. Additionally, brand loyalty among young users is shaped by lifestyle factors, camera performance, and compatibility with other smart devices. Promotions, student discounts, and installment payment options make premium smartphones more accessible to younger consumers. This tech-savvy generation continues to influence the direction and progress of the Australian smartphone market.

Opportunities of Australia Smartphone Market:

Smart Ecosystem Integration

The increasing prevalence of connected devices offers a significant opportunity for smartphones that effortlessly integrate into broader smart ecosystems. Australian consumers are progressively utilizing wearables such as smartwatches and fitness trackers along with smart home technologies, including voice assistants, security systems, and connected appliances. Smartphones act as the primary hub for managing and syncing these devices, making compatibility within the ecosystem an essential factor in purchasing decisions. Brands that provide seamless cross-device connectivity and cohesive digital experiences can boost customer loyalty and set themselves apart in a competitive landscape. Features like multi-device control, shared applications, and synchronized notifications are becoming vital. According to Australia smartphone market analysis, ecosystem-driven product strategies are anticipated to have a substantial impact on consumer preferences and foster long-term growth in the market.

Mid-Tier Smartphones

The growing interest in value-focused smartphones in Australia is paving the way for new opportunities in the mid-range premium segment. More consumers are focusing on devices that deliver flagship-level performance such as fast processors, high-quality cameras, and striking displays without the hefty price tag. This segment appeals to budget-minded users who still demand reliability, modern features, and software longevity. Manufacturers are responding by introducing models that provide a balance of cost and quality, which is particularly attractive to young professionals and tech enthusiasts. Retail promotions and flexible payment plans are enhancing the accessibility of mid-range smartphones. This expanding segment holds significant potential for brands to strengthen their market position while meeting the evolving expectations of consumers in Australia’s competitive smartphone arena.

Innovation in Foldable Smartphones

Foldable and dual-screen smartphones are emerging as a promising area of innovation in the Australian market. As consumers seek unique designs and improved multitasking capabilities, these advanced devices present an appealing alternative to conventional form factors. Foldables merge the features of a phone and a tablet, attracting users who value portability without sacrificing screen real estate. Early adopters and high-end consumers are keen on the distinct aesthetics and versatile functionality of such devices. With production costs expected to decrease gradually, the uptake of foldable smartphones is likely to increase. Brands that focus on enhancing durability and optimizing apps for foldable displays are well-placed to attract attention and redefine their premium status in Australia’s evolving smartphone market.

Challenges of Australia Smartphone Market:

Market Saturation

Australia's smartphone sector is grappling with saturation, particularly in urban areas where ownership rates are almost universal. Most consumers already own advanced smartphones that come with long software support and sturdy hardware, which diminishes the need for frequent upgrades. Consequently, growth from new buyers is limited, leading to a reliance on replacement sales. This saturation constrains expansion opportunities for both established brands and new entrants, making it challenging to achieve notable volume growth. Companies now need to concentrate on innovation, customer loyalty, and ecosystem integration to stay competitive. Furthermore, attracting consumers in mature markets demands compelling differentiation, which is increasingly challenging in a landscape where functionality and design often converge among competitors.

Rising Smartphone Prices

The increasing trend in smartphone prices, especially for premium and flagship models, presents a significant hurdle in the Australian market. The elevated costs are leading many consumers to postpone upgrades and keep their existing devices for a longer duration. Although features like powerful processors, enhanced cameras, and foldable designs justify the higher price, not all consumers perceive a corresponding advantage in day-to-day use. For budget-conscious users, the financial strain of replacing a high-end device has intensified, particularly against a backdrop of broader economic uncertainty. This change in consumer behavior impacts overall market turnover and forces brands to reconsider their pricing strategies, introduce trade-in programs, or broaden mid-range options to remain relevant in a cost-sensitive market.

E-Waste and Sustainability Pressures

Growing environmental concerns regarding electronic waste present a new set of challenges for smartphone manufacturers in Australia. With rising public awareness of sustainability issues, there is a heightened demand for environmentally friendly production practices, such as using recyclable materials, extending product lifespans, and ensuring ethical sourcing. However, making these changes without significantly increasing prices or sacrificing performance is complex. Consumers now expect brands to offer responsible disposal options, prolonged software updates, and designs that are easy to repair, which adds further pressure on product development and logistics. Striking a balance between innovation and environmental responsibility necessitates strategic investments and openness. Companies that resist adapting may encounter reputational risks, while those that embrace sustainability could gain a competitive advantage despite the operational challenges they face.

Australia Smartphone Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on operating system, display technology, ram capacity, price range, and distribution channel.

Operating System Insights:

- Android

- iOS

- Others

The report has provided a detailed breakup and analysis of the market based on the operating system. This includes android, iOS, and others.

Display Technology Insights:

- LCD Technology

- OLED Technology

A detailed breakup and analysis of the market based on the display technology have also been provided in the report. This includes LCD technology and OLED technology.

RAM Capacity Insights:

- Below 4GB

- 4GB - 8GB

- Over 8GB

The report has provided a detailed breakup and analysis of the market based on the ram capacity. This includes below 4GB, 4GB - 8GB, and over 8GB.

Price Range Insights:

- Ultra-Low-End (Less Than $100)

- Low-End ($100-<$200)

- Mid-Range ($200-<$400)

- Mid- to High-End ($400-<$600)

- High-End ($600-<$800)

- Premium ($800-<$1000) and Ultra-Premium ($1000 and Above)

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes ultra-low-end (less than $100), low-end ($100-<$200), mid-range ($200-<$400), mid- to high-end ($400-<$600), high-end ($600-<$800), and premium ($800-<$1000) and ultra-premium ($1000 and above).

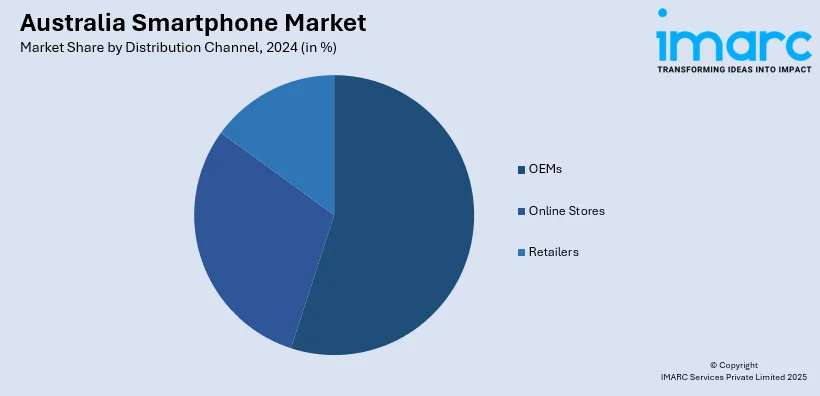

Distribution Channel Insights:

- OEMs

- Online Stores

- Retailers

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes OEMs, online stores, and retailers.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Smartphone Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Units |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Operating Systems Covered | Android, iOS, Others |

| Display Technologies Covered | LCD Technology, OLED Technology |

| RAM Capacities Covered | Below 4GB, 4GB - 8GB, Over 8GB |

| Price Ranges Covered | Ultra-Low-End (Less Than $100), Low-End ($100-<$200), Mid-Range ($200-<$400), Mid- to High-End ($400-<$600), High-End ($600-<$800), Premium ($800-<$1000) and Ultra-Premium ($1000 And Above) |

| Distribution Channels Covered | OEMs, Online Stores, Retailers |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia smartphone market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia smartphone market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia smartphone industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smartphone market in Australia reached at 30.3 Million Units in 2024.

The Australia smartphone market is projected to exhibit a compound annual growth rate (CAGR) of 1.54% during 2025-2033.

The Australia smartphone market is expected to reach a value of 34.8 Million Units by 2033.

Expansion of 5G networks, rising mobile app usage, and increased reliance on digital services are fueling smartphone demand. A tech-savvy youth population bundled carrier plans, and advancements in device performance and design are further encouraging frequent upgrades and broader adoption across demographics.

The market is witnessing growing interest in foldable smartphones, AI-powered features, and ecosystem integration with wearables and smart home devices. Demand for sustainable and long-lasting models is rising, while consumers increasingly favor online channels for smartphone purchases and service support.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)