Australia Smartwatch Market Size, Share, Trends and Forecast by Product, Operating System, Application, Distribution Channel, and Region, 2025-2033

Australia Smartwatch Market Size and Share:

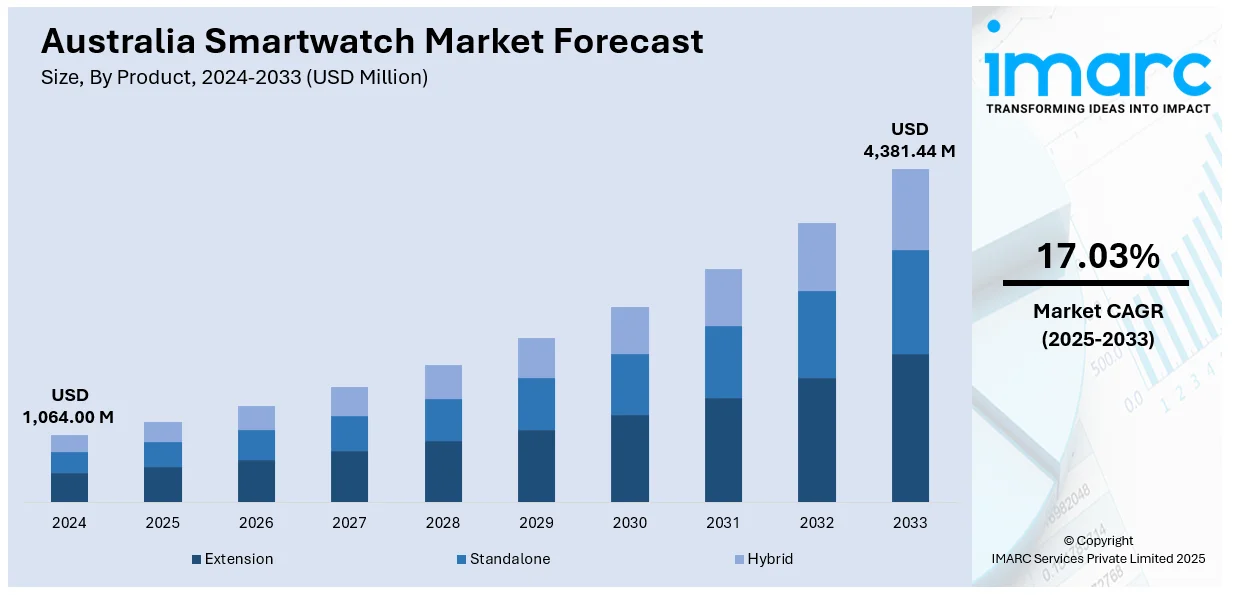

The Australia smartwatch market size reached USD 1,064.00 Million in 2024. The market is expected to reach USD 4,381.44 Million by 2033, exhibiting a growth rate (CAGR) of 17.03% during 2025-2033. The market is driven by boosting demand for fitness and health monitoring, simplicity of mobile pairing, and enhanced technology such as AI and GPS. Buyers require robust, eco-friendly designs with many products sporting better battery performance, upgraded sensors, and personalization to satisfy a range of user requirements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,064.00 Million |

| Market Forecast in 2033 | USD 4,381.44 Million |

| Market Growth Rate 2025-2033 | 17.03% |

Key Trends of Australia Smartwatch Market:

Increased Interest in Fitness and Health Tracking

The demand for enhanced fitness and health tracking smart devices has grown a lot in Australia. With heightened focus by consumers on their well-being, smartwatches that include functionalities such as monitoring of heart rates, sleep patterns, steps, and even sensors for ECG and blood oxygen have gained popularity. For instance, in September 2024, Apple launched the Watch Series 9, Watch SE, and Watch Ultra 2 with S9 SiP, double tap gesture, brighter displays, and carbon-neutral choices, with improved performance and watchOS 10. Furthermore, the trend is underpinned by increasing interest in individual well-being and fitness, and the wearables provide meaningful information on an individual's health condition. This desire for sophisticated health-related functionality will drive the ongoing expansion of the Australia smartwatch market, which is predicted to grow steadily. The convenience of monitoring health parameters with ease has made smartwatches a must-have for fitness enthusiasts and patients living with chronic diseases, further accelerating market share. Consequently, Australia smartwatch market outlook is upbeat, with health-oriented devices playing a central role in determining future consumer trends.

To get more information of this market, Request Sample

Integration with Smart Home Ecosystems

According to the Australia smartwatch market analysis, in recent times, these watches have also transitioned from being fitness watches to becoming the central part of the smart home system. As consumer demand for smart home products continues to rise, there has been a rapid shift towards convergence between smartwatches and home automation devices like smart thermostats, lights, and security cameras. This is facilitated by the convenience of being able to manage multiple devices through one platform, minimizing user interaction with connected environments. The addition of smartwatches to Internet of Things (IoT) platforms has promoted increased popularity of such devices among technologically inclined consumers who need instant control of their smart homes anywhere. As boosting number of smartwatches provide such integration features, this trend will further facilitate Australia smartwatch market growth. This transformation towards interconnection will not just enrich the experience of the users but will also add to the positive market forecast for Australian wearables over the next few years.

Focus on Personalization and Customization

Personalization is a top trend in the Australia smartwatch arena, where shoppers are looking for devices that adapt to their distinctive tastes and styles. In return, makers have been rolling out a host of customizable options like interchangeable bands, customizable faces, and user-optimized apps ranging from fitness activity to professional. This trend supports the user experience as it enables users to show their individual style while enjoying the functionality of the smartwatch. Furthermore, this movement toward personalization supports increased consumer satisfaction and encourages brand loyalty. As personalization gains importance, it will drive market growth, enabling brands to serve the increasing Australia smartwatch market demand from consumers. Given this emphasis on customized experiences, the Australia smartwatch market share is set to amplify, and the outlook for the market is positive, with more and more manufacturers competing on highly customizable products to accommodate diverse consumer needs.

Growth Factors of Australia Smartwatch Market:

Integration of Health and Fitness

Australians are increasingly using smartwatches as health and fitness monitoring essentials. Functions like heart rate tracking, ECG, sleep monitoring, and blood oxygen level measurement are becoming a norm in most devices. The trend is especially pronounced in urban centers where residents are more health-oriented and involved in outdoor activities. This focus on wellness is also endorsed by the Australian healthcare system, with policies that promote preventive health intervention. For example, some insurance companies provide a discount to policyholders who are frequent users of wearable technologies to monitor their vital health parameters. This marriage of health and technology has fueled the need for smartwatches, which have become a norm in the daily routine of most Australians.

Fashion and Personalization

While Australian smartwatches are utility devices, they are also a fashion accessory. Buyers are searching for devices that mirror their individuality, so demand is on the rise for those which can be customized. Companies are meeting this with a range of watch faces, swappable bands, and limited-edition releases. Fashion collaborations and influencer deals have added further impetus to this trend, making smartwatches an attractive option for those beyond the tech enthusiast market. This trend towards personalization is especially trendy with younger generations who consider their smartwatch an extension of their own personal brand. The merging of technology and fashion has thereby emerged as a key driver fueling the Australia smartwatch market share.

Technological Innovation and Ecosystem Integration

The fast-paced development of technology has been crucial in forming the Australian smartwatch market. Features like longer battery life, better connectivity, and compatibility with other smart devices have increased the demand for smartwatches among consumers. For instance, the rollout of 5G networks has provided a boost to data transfer, improving the capabilities of smartwatches. The integration of smartwatches with other devices, such as smartphones and smart home systems, has also resulted in a unified ecosystem that is attractive to tech-conscious Australians. This interconnectivity enables users to keep different aspects of their lives in check more effectively, further boosting the purchase of smartwatches throughout the nation.

Australia Smartwatch Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product, operating system, application, and distribution channel.

Product Insights:

- Extension

- Standalone

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the product. This includes extension, standalone, and hybrid.

Operating System Insights:

- WatchOS

- Android

- Others

A detailed breakup and analysis of the market based on the operating system have also been provided in the report. This includes watchos, android, and others.

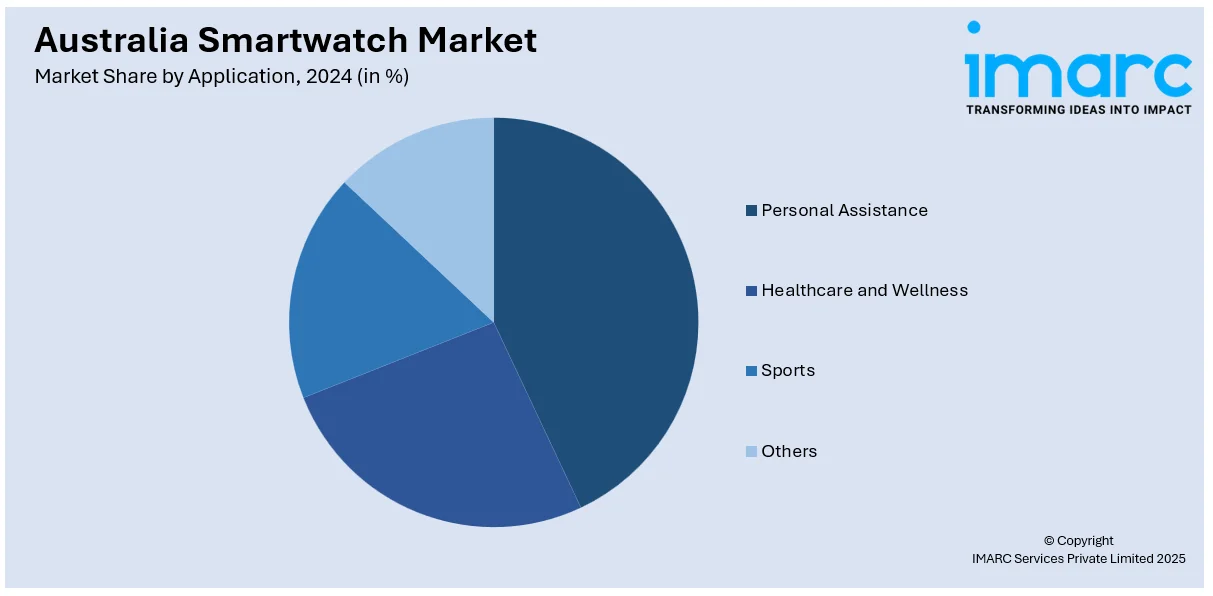

Application Insights:

- Personal Assistance

- Healthcare and Wellness

- Sports

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes personal assistance, healthcare and wellness, sports, and others.

Distribution Channel Insights:

- Online Stores

- Offline Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online stores, and offline stores.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Smartwatch Market News:

- In June 2024, OPPO has launched the Reno12 Series and Watch X in Australia. The Reno12 Series comes with cutting-edge AI features, such as GenAI technology for image enhancements, while the Watch X provides dual-frequency GPS and comprehensive health monitoring, providing a combination of innovation for mobile and wearable technology.

- In September 2024, Withings launched the ScanWatch Nova Brilliant Edition, where resilience meets advancements. With a fluted bezel, sapphire glass, and high-resolution OLED display, it comes equipped with sophisticated health functions such as ECG to detect atrial fibrillation, 24/7 body temperature measurement, and sleep quality.

Australia Smartwatch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Extension, Standalone, Hybrid |

| Operating Systems Covered | WatchOS, Android, Others |

| Applications Covered | Personal Assistance, Healthcare and Wellness, Sports, Others |

| Distribution Channels Covered | Online Stores, Offline Stores |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia smartwatch market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia smartwatch market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia smartwatch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia smartwatch market was valued at USD 1,064.00 Million in 2024.

The Australia smartwatch market is expected to reach a value of USD 4,381.44 Million by 2033.

The Australia smartwatch market is projected to exhibit a CAGR of 17.03% during 2025-2033.

Australia's smartwatch industry is fueled by increasing health awareness, fitness tracking demand, and a rise in wearable tech adoption. Convenience, live health monitoring, and smartphone connectivity are desired by consumers. Government wellness initiatives and tech-embracing lifestyles also enable adoption, rendering smartwatches more indispensable in everyday life.

Australia's smartwatch industry is witnessing strong growth, fueled by the growth in wearable technology among Australian consumers, with more consumers looking for devices that are both functional and fashionable. Health and fitness monitoring functions, including heart rate tracking, ECG, and sleep monitoring, are the most in-demand features. Other improvements in battery life and toughness are increasing the attractiveness of smartwatches to outdoor users and athletes. The ability of smartwatches to integrate with other devices and platforms, such as smartphones and smart home systems, further adds to their usefulness, fueling market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)