Australia Snacks Market Size, Share, Trends and Forecast by Product, Packaging, Distribution Channel, and Region, 2026-2034

Australia Snacks Market Overview:

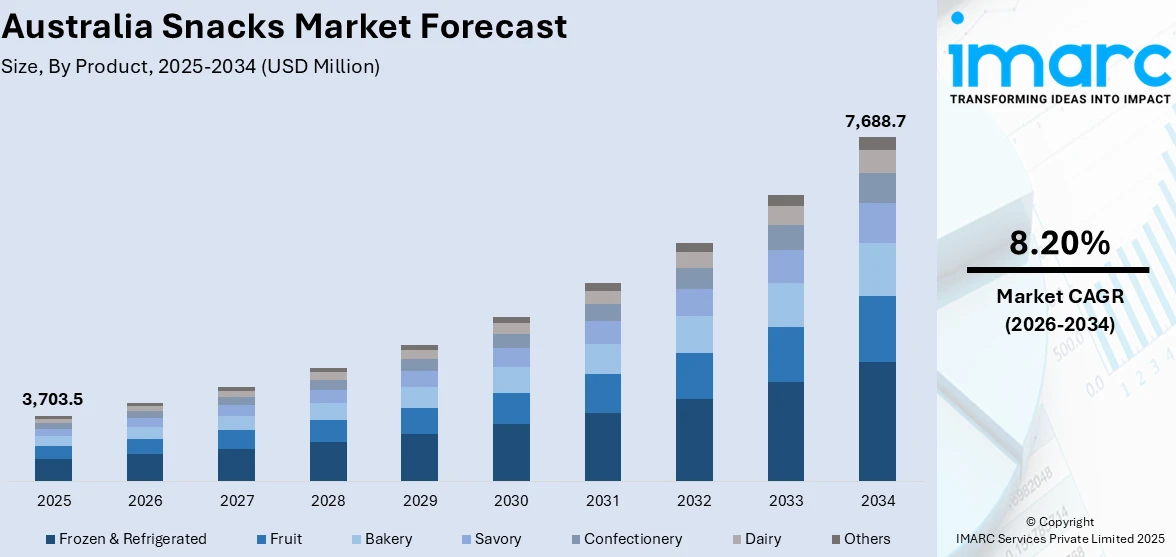

The Australia snacks market size reached USD 3,703.5 Million in 2025. Looking forward, the market is projected to reach USD 7,688.7 Million by 2034, exhibiting a growth rate (CAGR) of 8.20% during 2026-2034. The market is witnessing strong growth, fueled by growing demand for convenient, premium, and health-oriented snack products, with a positive market outlook predicting continued growth across different product categories and channels in the next few years.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3,703.5 Million |

| Market Forecast in 2034 | USD 7,688.7 Million |

| Market Growth Rate 2026-2034 | 8.20% |

Key Trends of Australia Snacks Market:

Expansion of Australia's Health-Focused Snacking

The Australia snack market has seen a marked trend towards health-conscious options fueled by a greater emphasis on health and nutrition. For instance, in May 2023, Edgell introduced three new flavors to its Snack Time range: Chick Peas with Lemon, Tahini & Garlic, Chick Peas with Fiery Moroccan Spices, and Corn with Charred Capsicum & Lime, providing healthy, convenient snack solutions with high health star ratings. Moreover, consumers are also highly looking to snacks that have nutritional value but not at the expense of flavor. Consequently, snacks like protein bars, veggie chips, and whole-grain crackers have become extremely popular over the past few years. This trend is driven by an accelerating demand for low-calorie, low-sugar, and high-protein products, which appeal to the health-conscious consumer. There is also an increase in snacks that are made from natural, organic ingredients, further reinforcing clean label trends. This change is in line with the wider Australia snacks market share, which suggests ongoing growth for the healthier snack segment, with the products supporting consumers' wants for indulgence and improved-for-you options. Consequently, the proportion of health-oriented snacks will keep on increasing, ahead of more conventional alternatives, driving the transformation of the Australian snacking industry.

To get more information on this market, Request Sample

Premium and Gourmet Snacks in Australia

Mounting Australian demand is taking place for high-end and gourmet snacks due to changing tastes from consumers and increasing premium prices paid for fine, artisan products. Such growth is manifest through a diverse selection of foods covering handmade crisps, oriental nut mix, and gourmet popcorn, all presenting distinctive tastes as well as ingredients. For instance, in April 2025, Proper Crisps launched two limited-edition flavours in its Big Cut range in Australia: Kasundi Ketchup and Habanero Mustard. The flavours are inspired by the sauces of acclaimed chef Al Brown and provide bold, chef-inspired seasonings for snackers. Furthermore, pursuers of finer snacking occasions are what the consumers are asking for, drawn by trends across the food and beverage (F&B) industry prioritizing indulgence and quality. The Australia snack market outlook indicates growing in the premium snack segment where local producers meet this boosting quest for luxurious snacking occasions. With increased emphasis on craft products and unique flavors, the premium snacks segment is gaining more and more share of the Australia snack market, speaking to customers who want higher-quality snack foods for special occasions or daily indulgence.

On-the-Go and Convenience Snacks in Australia

Australia's busy way of life has fueled the rise in on-the-go and convenience snacking, with consumers demanding quicker, more portable, and easier-to-eat foodstuffs. Single-serve packaging, resealable pouches, and snack bars are gaining popularity among busy people who want a fast snack that will fit into their busy lives. The demand for convenience foods such as ready-to-eat (RTE) snacks in the form of trail mixes, granola bars, and packaged fruit and vegetable snacks has grown, especially among young professionals and families. Along with this trend, snacks are being formulated to be convenient without compromising on nutrition, providing choices that are both healthy and convenient to eat. This intensifying need for convenient snacking is captured in the Australia snacks market report, where the on-the-go segment is poised to keep growing. The increasing proportion of convenience-driven snack food choices illustrates the way consumer taste is influencing the Australia snack food market growth, particularly in urban and regional regions.

Growth Factors of Australia Snacks Market:

Innovation in Flavors and Formats

The snack market in Australia is undergoing rapid growth, driven by ongoing innovation in product flavors and formats. Consumers are increasingly attracted to snacks that provide unique flavor experiences, including fusion options and inspirations from global cuisines. Brands are exploring various combinations, including spicy, savory, sweet, and exotic flavors to satisfy adventurous tastes. Concurrently, snack formats are changing, with items like protein chips, puffed lentils, and baked vegetable crisps becoming more popular. This diversity caters to consumers who prioritize health, indulgence, and convenience. Such innovation encourages both trial and repeat purchases while helping brands stand out in a competitive environment. Consequently, this trend significantly contributes to extending the Australia snacks market share.

Expansion of Retail and Online Channels

The Australia snacks market is gaining notable momentum as snack products become more accessible through both physical and online retail avenues. Supermarkets, convenience stores, and health food shops are allocating more shelf space to various snack categories. At the same time, e-commerce platforms and food delivery apps make it easier for consumers to discover and purchase a wide variety of snack options from home. Subscription boxes and direct-to-consumer models are also rising in popularity, offering customized selections and regular purchases. This omnichannel growth enhances product visibility, accessibility, and consumer outreach, playing a considerable role in increasing Australia snacks market demand.

Growing Urban Population

Urbanization significantly impacts snack consumption trends in Australia. With the rise in urban migration, there is a growing preference for convenient, ready-to-eat meals, driven by hectic lifestyles and longer working hours. Packaged snacks are well-suited to this urban pace, offering convenience, long shelf life, and immediate consumption. Furthermore, urban consumers tend to have greater exposure to global food trends, which heightens their openness to trying new snack varieties. The burgeoning urban middle class is also more willing to invest in premium or health-focused snacks. According to Australia snacks market analysis, retailers and brands are capitalizing on this trend by concentrating their distribution and marketing efforts in metropolitan regions, thereby supporting growth.

Opportunities of Australia Snacks Market:

Expansion of Plant-Based Options

The rising trend toward veganism and plant-based diets is unlocking substantial potential in the Australia snacks market. Consumers increasingly prefer snacks crafted from ingredients like legumes, seeds, nuts, fruits, and grains that align with their ethical and health beliefs. Plant-based snacks appeal to vegan, flexitarians and health-conscious individuals looking to minimize their intake of animal products. This trend is driving brands to create innovative options such as lentil crisps, chickpea puffs, and oat-based snack bars. The heightened demand for allergen-free, dairy-free, and cruelty-free choices is further fueling this movement. As plant-based foods gain wider acceptance, expanding these options presents a significant pathway for differentiation, increased market penetration, and sustainable growth within the Australia snacks market.

Leveraging Local and Indigenous Ingredients

Incorporating native Australian ingredients offers snack brands a distinctive chance to differentiate themselves in an oversaturated market. Ingredients such as wattleseed, finger lime, lemon myrtle, and Kakadu plum provide unique flavor profiles while connecting consumers to local culture and biodiversity. Products made from indigenous ingredients resonate with consumers looking for authenticity, traceability, and sustainability in their food selections. Additionally, utilizing these elements supports local agriculture and indigenous communities, adding an ethical dimension. Brands that weave storytelling and cultural heritage into their packaging and marketing can establish a compelling identity. This strategy enhances product differentiation and strengthens brand perception in the evolving Australia snacks market.

Growth in Private Label Products

Private label products are emerging as a strategic opportunity in the Australia snacks market, as retailers seek to provide affordable, high-quality alternatives to well-known brands. Supermarkets and convenience chains are increasingly launching their own snack lines designed to meet the needs of value-conscious consumers without sacrificing taste or variety. These private label products often feature healthier options, innovative flavors, and eco-friendly packaging, aligning with contemporary consumer preferences. Additionally, retailers gain more control over pricing, supply chains, and promotional strategies. This trend also enables them to swiftly respond to emerging demands and dietary trends. As consumers become more price-sensitive, private labels are ideally positioned to capture market share and drive growth across the Australian snack market.

Australia Snacks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product, packaging, and distribution channel.

Product Insights:

- Frozen & Refrigerated

- Fruit

- Bakery

- Savory

- Confectionery

- Dairy

- Others

The report has provided a detailed breakup and analysis of the market based on the product. this includes frozen & refrigerated, fruit, bakery, savory, confectionery, dairy, and others.

Packaging Insights:

- Bag and Pouches

- Boxes

- Cans

- Jars

- Others

A detailed breakup and analysis of the market based on the packaging have also been provided in the report. This includes bag and pouches, boxes, cans, jars, and others.

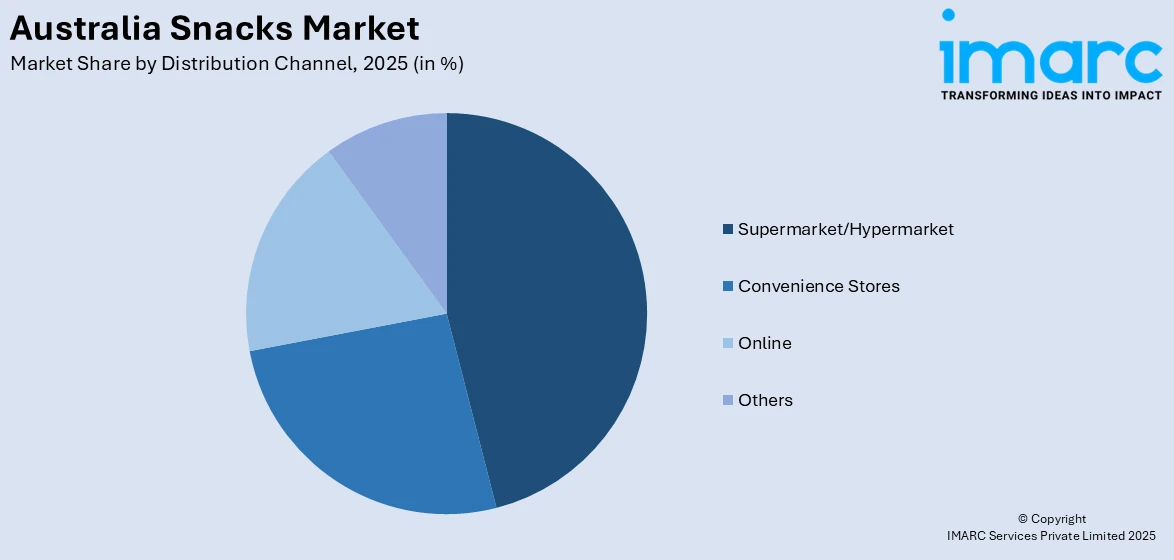

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarket/Hypermarket

- Convenience Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarket/hypermarket, convenience stores, online, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Snacks Market News:

- In December 2024, HyFun Foods released its collaboration with Woolworths to bring premium frozen products into Australia. The partnership brings hash browns and tots in the "Your Spud Co" brand across 1,000+ outlets, as the Australian retail market sees increasing demand for high-quality, convenient frozen foods.

- In November 2024, Nissin Foods Company Limited entered into a joint venture with Nissin Asia to form Australia Nissin Foods Pty. Ltd. The new subsidiary is set to enhance the Group's presence in Australia and New Zealand through the import and distribution of instant noodles and snacks, driving long-term international expansion and market penetration.

Australia Snacks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Frozen & Refrigerated, Fruit, Bakery, Savory, Confectionery, Dairy, Others |

| Packagings Covered | Bag and Pouches, Boxes, Cans, Jars, Others |

| Distribution Channels Covered | Supermarket/Hypermarket, Convenience Stores, Online, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia snacks market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia snacks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia snacks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The snacks market in the Australia was valued at USD 3,703.5 Million in 2025.

The Australia snacks market is projected to exhibit a compound annual growth rate (CAGR) of 8.20% during 2026-2034.

The Australia snacks market is expected to reach a value of USD 7,688.7 Million by 2034.

The Australia snacks market is witnessing a rise in demand for clean-label, plant-based, and globally inspired snack options. Consumers are also drawn to bold flavors, unique textures, and functional benefits. Sustainable packaging and premium snacking experiences are also gaining popularity across diverse age groups.

Rising urbanization, busy work routines, and the need for convenient food choices are fueling snack consumption. Increasing health awareness is pushing demand for nutritious options, while strong retail and digital distribution networks are improving accessibility. Tailored offerings for specific demographics are further driving the market's expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)