Australia Solar Inverter Market Size, Share, Trends and Forecast by Inverter Type, Application, and Region, 2025-2033

Australia Solar Inverter Market Size and Share:

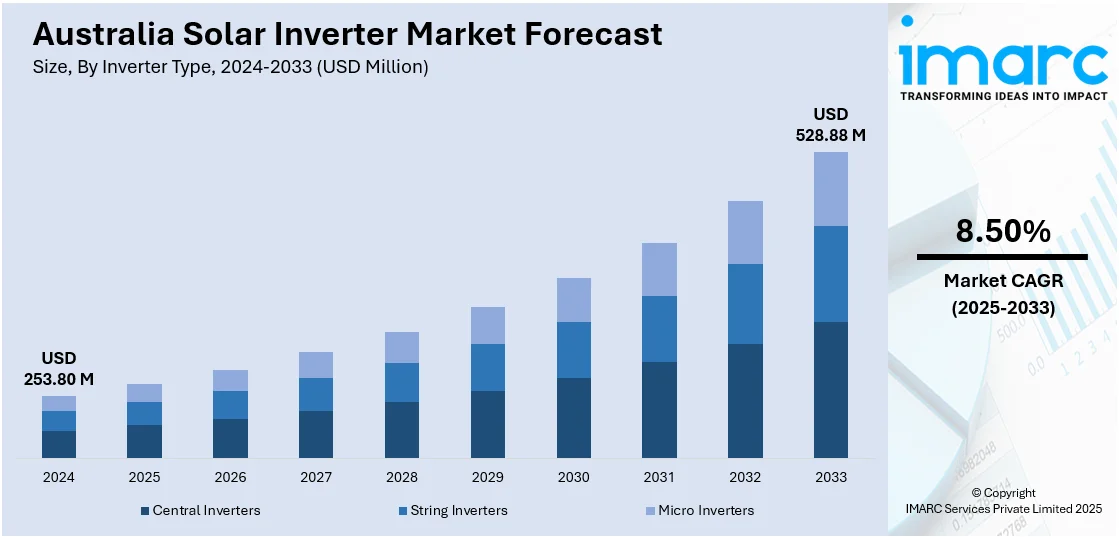

The Australia solar inverter market size reached USD 253.80 Million in 2024. Looking forward, the market is expected to reach USD 528.88 Million by 2033, exhibiting a growth rate (CAGR) of 8.50% during 2025-2033. Australia’s commitment to net-zero emissions by 2050, the declining cost of solar inverters, technological advancements, and increasing accessibility for consumers are fueling the market growth. Government incentives, such as the Small-scale Renewable Energy Scheme (SRES), the rising electricity costs, surging demand for energy efficiency, advancements in hybrid inverters, the integration of energy storage, smart inverter technology, environmental concerns, the shift toward cleaner energy, expanding solar installations, commercial sector adoption, and the growing popularity of decentralized power generation are factors boosting the Australia solar inverter market share.

|

Key Statistics

|

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 253.80 Million |

| Market Forecast in 2033 | USD 528.88 Million |

| Market Growth Rate 2025-2033 | 8.50% |

Key Trends of Australia Solar Inverter Market:

Commitment to Renewable Energy Goals

Australia's strong emphasis on renewable energy goals is providing a considerable thrust to the market growth. The country has been proactive in cutting carbon emissions, with an intention of achieving net-zero emissions by 2050. The long-term goal resulted in massive investments in renewable energy, particularly solar energy, as it is one of the lowest-priced and most cost-effective forms of clean energy. In line with this, the Australian government has implemented policies for promoting the use of solar power, like the provision of incentives for installing solar panels and inverters. Apart from this, the growing emphasis on renewable energy sources in government policy and surging public awareness are driving the demand for solar inverters, which is facilitating the Australia solar inverter market growth.

To get more information on this market, Request Sample

Decline in the Cost of Solar Inverters

According to the Australia solar inverter market analysis, the consistent decline in the cost of solar inverters is another key trend propelling market growth. Technological advancements have contributed significantly to reducing the costs associated with solar inverters, further serving as a growth-inducing factor. In line with this, manufacturers are producing inverters that are cost-effective, reducing manufacturing costs and ultimately retail prices. Lowering the cost has priced solar systems, including inverters, affordably to a larger segment of consumers, from residential to commercial to industrial markets. For businesses, the reduction in initial investment is a strong motivator as it lessens the barriers to the adoption of solar energy solutions. Additionally, with less expensive inverters, the overall return on investment (ROI) for solar installations has increased, and which is another factor creating a positive market outlook.

Government Incentives and Rebates

Government incentives and rebates are significant factors driving the adoption of solar inverters in Australia. Various policies and programs, such as the Small-scale Renewable Energy Scheme (SRES), have been implemented to reduce the financial burden of solar installations for consumers. These incentives allow homeowners and businesses to install solar systems at a reduced cost, making the switch to renewable energy more financially attractive. The government’s ongoing support for solar adoption is also reflected in grants and subsidies aimed at encouraging both residential and commercial solar projects. In addition to this, the assurance of long-term policy stability gives consumers confidence that their investment in solar energy will remain financially viable. These incentives have proven to be essential in accelerating solar energy uptake, which have directly driven the Australia solar inverter market demand, further providing a thrust to the market growth.

Growth Drivers of Australia Solar Inverter Market:

Government Incentives and Targets for Renewable Energy

Australia's dedication to renewable energy is one of the major forces behind the solar inverter market. The government has also put policies like the Small-scale Renewable Energy Scheme (SRES), which provides financial incentives for solar installations. The Renewable Energy Target (RET) also focuses on generating a significant percentage of the country's electricity from renewable energy, leading to the use of solar energy. These efforts have resulted in an upsurge in residential and commercial solar installations, which has driven the demand for effective and efficient solar inverters. Initiatives at the state level, like Queensland's Solar for Rentals program, encourage landlords to adopt solar systems, which expands the market for solar inverters. These policies have the added benefit of making solar energy more available and generating economic activity for the renewable energy industry.

Technological Advancements and Cost Reduction

Developments in solar inverter technology have been central to the growth of the market. Developments like hybrid inverters, which integrate solar power conversion with battery storage functions, provide greater energy management solutions for end-users. Additionally, the use of smart inverters with Internet of Things (IoT) features permit solar power installations to be monitored and optimized in real time. These technological advancements have brought about a decrease in the price of solar inverters, and they are now more accessible to a wider variety of consumers. The reduced prices, along with enhanced efficiency, have caused solar energy systems to become more viable investments for home and business owners. Because of this, the use of solar inverters has experienced tremendous increases, supporting Australia's shift towards green energy solutions.

Environmental Awareness and Energy Independence

Increased awareness about the environment by Australians has made a huge impact in the demand for solar power solutions, such as inverters. Climate change and sustainable living also have pushed most people and companies toward adoption of different sources of energy. Solar power, being clean and a renewable resource, is in alignment with these sentiments, and thus more installations of solar systems have been done. Additionally, the need for energy self-sufficiency has propelled the use of solar inverters since they allow consumers to produce and control their own power. This independence minimizes dependence on the national grid and shields consumers from volatile energy prices. Solar inverters provide a reliable source of electricity in remote and rural areas where grid connectivity may be limited or erratic. Cumulatively, these factors have created a positive atmosphere for the development of the solar inverter market in Australia.

Australia Solar Inverter Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on inverter type and application.

Inverter Type Insights:

- Central Inverters

- String Inverters

- Micro Inverters

The report has provided a detailed breakup and analysis of the market based on the inverter type. This includes central inverters, string inverters, and micro inverters.

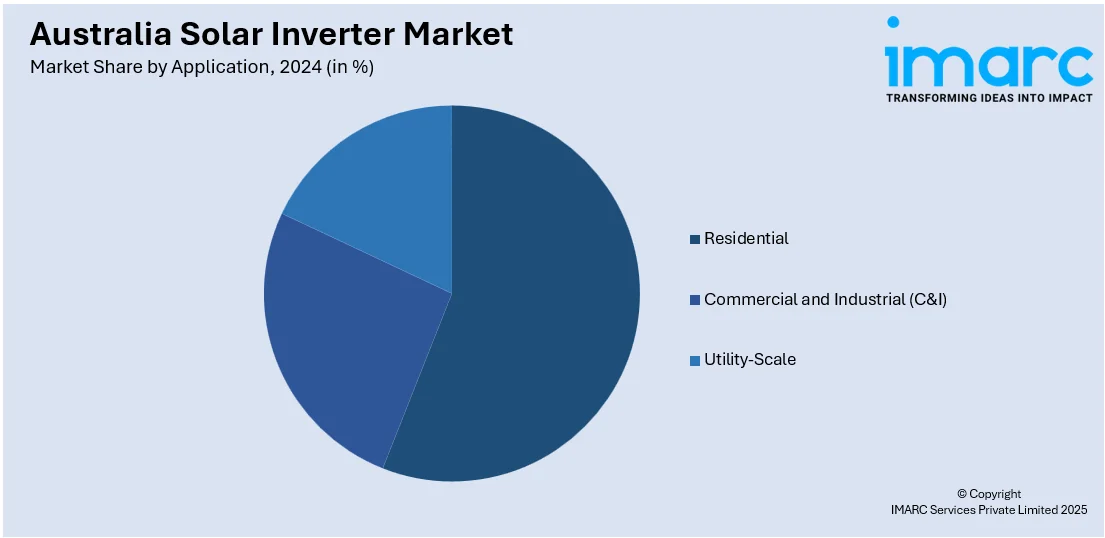

Application Insights:

- Residential

- Commercial and Industrial (C&I)

- Utility-Scale

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial and industrial (C&I), and utility-scale applications.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Delta Electronics, Inc.

- Enphase Energy, Inc.

- Fronius Australia Pty Ltd (Fronius International)

- GoodWe Technologies Co., Ltd.

- Selectronic Australia Pty Ltd

- SMA Solar Technology AG (SMA Group)

- SolarEdge Technologies, Inc.

- Sungrow Power Supply Co., Ltd.

Australia Solar Inverter Market News:

- In 2025, Sungrow contributed significantly to the Cunderdin Hybrid Solar PV + BESS Project, Australia's largest operational DC-coupled solar-storage installation. Inaugurated by Global Power Generation Australia, the project integrates solar power with advanced battery energy storage systems (BESS) to enhance grid stability and renewable energy reliability.

- In 2024, Pacific Partnerships acquired the Cobbora Solar Farm project, one of Australia's largest solar developments. Spanning 3,000 hectares, it has the capacity to store 1,600 MWh of energy in batteries. Once operational, the project aims to provide power to around 280,000 homes, significantly contributing to Australia's renewable energy goals.

Australia Solar Inverter Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Inverter Types Covered | Central Inverters, String Inverters, Micro Inverters |

| Applications Covered | Residential, Commercial and Industrial (C&I), Utility-Scale |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia. |

| Companies Covered | Delta Electronics, Inc., Enphase Energy, Inc., Fronius Australia Pty Ltd (Fronius International), GoodWe Technologies Co., Ltd., Selectronic Australia Pty Ltd, SMA Solar Technology AG (SMA Group), SolarEdge Technologies, Inc., Sungrow Power Supply Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia solar inverter market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia solar inverter market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia solar inverter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia solar inverter market was valued at USD 253.80 Million in 2024.

The Australia solar inverter market is projected to exhibit a CAGR of 8.50% during 2025-2033.

The Australia solar inverter market is expected to reach a value of USD 528.88 Million by 2033.

Australia's solar inverter industry is changing with a move toward high-efficiency inverters, hybrids, and smart technology. The SolarSunshot program is an example of government programs that seek to support local manufacturing. These trends are part of a national drive for energy self-sufficiency, grid stability, and renewable energy solutions.

Australia's solar inverter market is driven by robust government incentives like the Renewable Energy Target and the Small-scale Renewable Energy Scheme. Improved inverter efficiency technology and battery integration, as well as growing energy costs, also drive adoption. All these drivers contribute to the growth of the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)