Australia Solar Panel Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2025-2033

Australia Solar Panel Market Size and Share:

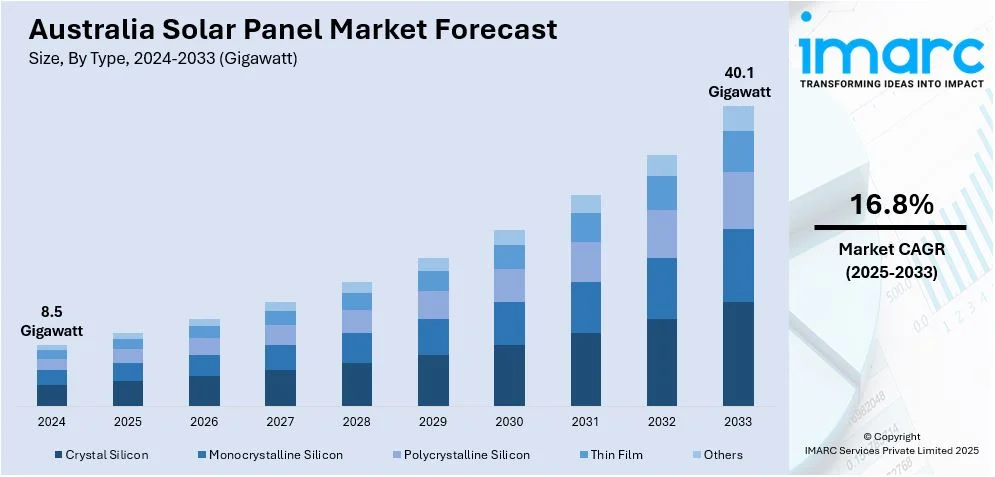

The Australia solar panel market size reached 8.5 Gigawatt in 2024. Looking forward, IMARC Group expects the market to reach 40.1 Gigawatt by 2033, exhibiting a growth rate (CAGR) of 16.8% during 2025-2033. The market is driven by rising electricity costs, government incentives, and falling solar technology prices. Residential demand grows due to energy savings and battery storage adoption, while commercial sectors invest in solar energy to cut costs and meet sustainability targets. Favorable policies, abundant sunlight, and corporate PPAs are further expanding the Australia solar panel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 8.5 Gigawatt |

| Market Forecast in 2033 | 40.1 Gigawatt |

| Market Growth Rate 2025-2033 | 16.8% |

Australia Solar Panel Market Trends:

Rising Demand for Residential Solar Panel Installations

The market is experiencing a rise in residential installations due to increasing electricity costs and government incentives. Households are adopting solar energy to reduce reliance on grid power and lower energy bills. The federal government’s Small-scale Renewable Energy Scheme (SRES) offers financial rebates, making solar systems more affordable. Net energy consumption in Australia increased by 2% to 23,294 PJ in 2022–23, and renewable energy generation increased to 325 PJ (33% of electricity generation). This growth was dominated by solar energy, which climbed 21% to 151 PJ and reflects the growing solar panel sector. As household energy consumption rose by 3% and solar energy continued to expand, the demand for solar solutions in Australia remains robust. Additionally, state-level feed-in tariffs encourage homeowners to sell excess energy back to the grid, further enhancing adoption. Technological advancements, such as high-efficiency panels and battery storage systems, are also driving the Australia solar panel market growth. Consumers prefer hybrid systems that combine solar panels with batteries, ensuring energy availability during peak hours or outages. With Australia’s abundant sunlight, residential solar power is a practical and sustainable investment. As energy prices continue to rise, more homeowners are expected to transition to solar, supporting steady market growth in the coming years.

To get more information on this market, Request Sample

Growth in Commercial and Industrial Solar Projects

The commercial and industrial (C&I) sector in Australia is increasingly adopting solar energy to cut operational costs and meet sustainability goals. Businesses are investing in large-scale solar installations to offset high energy consumption and comply with corporate environmental commitments. Government initiatives, such as the Renewable Energy Target (RET), provide financial support, accelerating solar adoption among enterprises. Australia installed 28,262 solar batteries in 2024, up 4.9% from 2023. This increases the total of hybrid systems to 121,551, or 3% of all solar energy users. New South Wales, Victoria, and South Australia lead the charge, underpinned by state rebate programs. Solar-plus-storage systems are emerging as a major piece of Australia’s shift to clean energy as growth persists. Another key driver is the declining cost of solar technology, making it a cost-effective solution for factories, warehouses, and office buildings. Companies are also leveraging power purchase agreements (PPAs) to install solar systems with minimal upfront costs. Additionally, advancements in smart energy management systems allow businesses to optimize energy usage and reduce waste. As corporate sustainability becomes a priority, the C&I solar market is expanding significantly, creating a positive Australia solar panel market outlook.

Integration of Battery Storage

The growing integration of battery storage systems with solar installations is another noteworthy trend in Australia's solar panel market. The need to store extra power for use during cloudy days has grown in importance as more homes and businesses switch to solar energy. By lowering dependency on the grid and guaranteeing a more reliable energy supply, battery storage enables users to get the most out of their solar investment. The need for energy resilience is also fueling this trend, particularly in places with unstable grid infrastructure or frequent power outages. Battery adoption has increased due to technological advancements that have made them more economical, small, and efficient. Furthermore, smart systems' capacity to track and control energy consumption is making solar-plus-storage options more alluring. In addition to giving consumers more power, this change is helping Australia's energy system become adaptable and decentralized.

Growth Drivers of Australia Solar Panel Market:

Policy Support and Government Incentives

According to the Australia solar panel market analysis, strong government support in the form of various incentives, rebates, and policy frameworks that promote the use of renewable energy sources is one of the main factors propelling the market. By providing grants, feed-in tariffs, and Small-scale Technology Certificates (STCs), Australia's federal and state governments have continuously supported solar energy and made solar systems more affordable for both businesses and homeowners. These incentives are designed to cover the initial cost of installing solar panels and offer continuous financial gains through credits and energy savings. Notably, some states have pushed for increased solar integration by implementing aggressive renewable energy targets and grid modernization programs, such as South Australia and the Australian Capital Territory. Furthermore, regional elements like the nation's high solar irradiance and pervasive energy price volatility contribute to these government programs' increased efficacy. Strong sunshine, changing energy regulations, and proactive governance have all combined to make Australia a particularly hospitable place for solar technology to flourish.

Good Climatic Conditions and Plentiful Solar Resources

The geographic and climatic conditions of Australia present a strong natural benefit that contributes to the Australia solar panel market demand. The country benefits from some of the highest levels of solar irradiance globally, especially in areas such as Western Australia, the Northern Territory, and Queensland. These regions enjoy long hours of daylight with clear skies throughout much of the year, providing conditions that are highly favorable to efficient solar energy production. With so many resources for solar power, it has made it even more feasible for both households, businesses, and utility companies to invest in solar technologies as a means of long-term energy supply. Additionally, the distributed nature of the Australian population, with many rural and remote communities spread across vast areas, makes decentralized solar power a practical alternative to grid expansion. The country’s natural sunlight advantage reduces the reliance on fossil fuels and enables energy independence, especially in areas where traditional infrastructure is limited or costly to maintain.

Energy Market Volatility and High Electricity Costs

The persistent volatility and relatively high cost of electricity in Australia are major factors driving the solar panel market. Many areas experience large swings in electricity prices because of the nation's dispersed energy grids and long-standing reliance on coal-fired power plants. Customers are now looking for more reliable and affordable options as a result of the economic pressure, and solar energy is showing up as a particularly alluring option. On-site electricity generation is appealing because it gives users more control over their energy costs and lessens reliance on the national grid. In order to counteract growing expenses and safeguard against market volatility, a large number of homes and businesses have adopted solar panels and battery storage systems. This cost-based incentive, which is specific to Australia's energy environment, keeps driving the widespread adoption of solar power in both urban and rural areas.

Australia Solar Panel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and end use.

Type Insights:

- Crystal Silicon

- Monocrystalline Silicon

- Polycrystalline Silicon

- Thin Film

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes crystal silicon, monocrystalline silicon, polycrystalline silicon, thin film, and others.

End Use Insights:

.webp)

- Commercial

- Residential

- Industrial

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes commercial, residential, and industrial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Solar Panel Market News:

- February 06, 2025: Aiko launched the most efficient residential solar panel to date in Australia, the Aiko 480W Neostar 2P module, with a smashing module efficiency of 24%. It is less than 2m² in size (less than 22kg) and is being distributed to local partner Solar Juice. This introduction adds cutting-edge, high-efficiency technology to the premium rooftop solar market in Australia.

- February 04, 2025: Canopy Power and Ocean Sun unveiled a 700 kWp floating solar system in Australia that features a special 70-meter-wide membrane design capable of harvesting rainwater. Designed for sustainable future, this versatile solution targets water-scarce and land-scarce areas and can easily mesh with microgrids and battery storage systems. This project not only advances Australia’s clean energy objectives but also enhances solar technology utilization on water bodies.

Australia Solar Panel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Gigawatt |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Crystal Silicon, Monocrystalline Silicon, Polycrystalline Silicon, Thin Film, Others |

| End Uses Covered | Commercial, Residential, Industrials |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia solar panel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia solar panel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia solar panel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia solar panel market was valued at 8.5 Gigawatt in 2024.

The Australia solar panel market is projected to exhibit a CAGR of 16.8% during 2025-2033.

The Australia solar panel market is projected to reach a value of 40.1 Gigawatt by 2033.

The Australia solar panel market is changing with the expansion of large-scale solar farms, the rise in battery storage options, and the growing use of high-efficiency panels. Demand is promoted by sustainability objectives and government incentives, while affordability is increased by technology developments. The long-term sustainability of the industry is further improved by intelligent energy management and grid integration.

Australia's solar panel market is driven by high levels of solar radiation, escalating electricity prices, and encouraging government policies. Environmental consciousness and energy independence motivation are the major impetus to grant solar to homes and businesses. Technological advancements and falling installation costs have hastened the shifted renewable energy path of Australia.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)