Australia Solar PV Inverter Market Size, Share, Trends and Forecast by Technology, Voltage, Application, and Region, 2025-2033

Australia Solar PV Inverter Market Size and Trends:

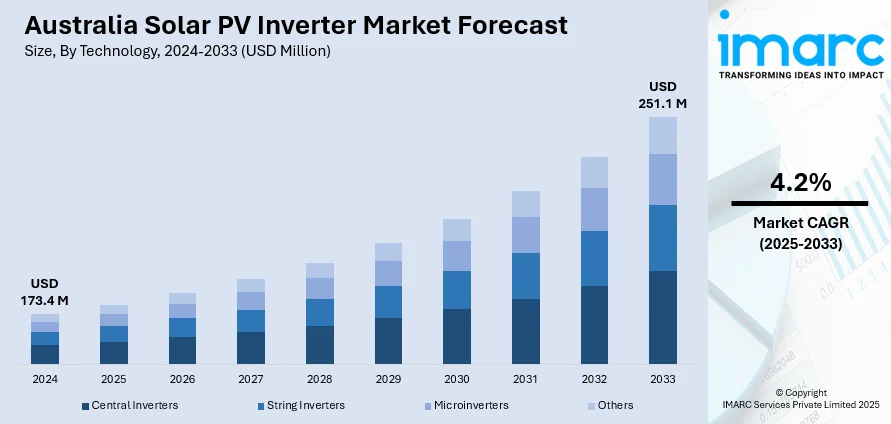

The Australia solar PV inverter market size reached USD 173.4 Million in 2024. The market is projected to reach USD 251.1 Million by 2033, exhibiting a growth rate (CAGR) of 4.2% during 2025-2033. The market is growing due to rising demand for energy-efficient systems, increasing rooftop solar installations, and a shift toward smart energy management in homes and industries, supported by advancements in inverter safety, performance, and hybrid storage integration.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 173.4 Million |

| Market Forecast in 2033 | USD 251.1 Million |

| Market Growth Rate 2025-2033 | 4.2% |

Key Trends in Australia Solar PV Inverter Market:

Growing Demand for High-Efficiency Systems

Australia’s commercial and industrial sectors are actively adopting solar energy solutions to reduce operational expenses and align with sustainability goals. With rising electricity tariffs and increasing awareness of environmental responsibility, there is a growing interest in solar PV systems that deliver high output and long-term reliability. One major trend shaping the Australian Solar PV Inverter Market is the shift toward inverters with higher conversion efficiency and greater compatibility with high-power PV modules. In January 2025, Sungrow launched the SG150CX inverter, specifically engineered for commercial and industrial use. It features a maximum efficiency of 98.8%, significantly improving overall system performance. The inverter also incorporates advanced safety measures such as Arc Fault Circuit Interrupter (AFCI) 3.0 technology, which enhances protection against electrical faults. This innovation supports higher current handling and ensures safer, more efficient solar operations. As large-scale projects expand across commercial rooftops and industrial estates, reliable inverters with minimal energy loss are in high demand. Sungrow’s development addresses these needs by reducing downtime, improving energy output, and supporting evolving photovoltaic technologies. The emphasis on safety, performance, and scalability is pushing companies to upgrade their systems, reinforcing the importance of efficient inverter technology in meeting Australia’s growing clean energy requirements.

To get more information on this market, Request Sample

Push Toward Smart Residential Energy Management

Australian households are increasingly embracing solar power not just as a cost-saving option but as a key part of smart and sustainable living. With a national push toward electrified homes and tighter energy regulations, there’s rising demand for integrated solutions that combine solar inverters with battery storage. The market is seeing growing interest in systems that manage home energy use intelligently, support backup during outages, and reduce grid dependence. In September 2024, Sieyuan Electric introduced its Swatten home energy storage system, which includes advanced hybrid inverters designed for residential applications. The solution supports energy storage, smart load shifting, and seamless integration with rooftop solar panels. It helps users manage their energy flow more efficiently, optimizing daytime generation and evening consumption. As Australians aim for all-electric households, with features like electric vehicle charging and heat pump systems, hybrid inverters are becoming essential. Sieyuan’s product directly supports this shift by offering flexible installation and improved energy control. These developments are helping drive the Solar PV Inverter Market in the residential segment, where the focus is on smart, adaptable, and efficient systems. The move toward self-sustaining homes with better energy visibility is reshaping consumer expectations and driving innovation across the market.

Utility-Scale Innovations

Australia's utility-scale solar industry is growing very fast, especially in regions with superior solar resources like Queensland, New South Wales, and Victoria. Large-scale solar systems need high-capacity, centralized inverter options that can effectively manage large energy output. In this market, grid-forming inverters are increasingly relevant, particularly with the increase in the level of renewables and the reduction of traditional synchronous generators. Grid-forming inverters are capable of delivering essential services like inertia, voltage regulation, and fault ride-through, hence playing a significant role in grid stability. Developers and operators are increasingly focusing on inverter technologies capable of fulfilling both present and future technical demands by grid operators. This is also triggering collaborations between inverter suppliers and EPC companies to provide customized solutions for utility-scale solar farms with long-term reliability and grid conformity in perspective.

Growth Drivers in Australia Solar PV Inverter Market:

Rising Solar Installations

Australia has one of the highest per capita rates of rooftop solar adoption in the world. Residential systems continue to grow as homeowners seek to cut energy costs and gain independence from the grid. In parallel, commercial and industrial (C&I) sectors are scaling up solar installations in warehouses, factories, and office buildings to offset operational expenses. Utility-scale solar farms are also expanding across sunny regions, such as Queensland, New South Wales, and South Australia, further driving inverter demand. Each solar system requires inverters for converting direct current (DC) to alternating current (AC), and as installation volumes rise, so does the need for reliable and scalable inverter solutions. This consistent growth across all segments is contributing positively to the growing Australia solar PV inverter market demand.

Grid Modernization

Australia's electricity grid is transforming to accommodate an increasing number of distributed energy resources, including solar energy. This shift requires inverters that can do more than just convert power they must actively support grid stability. Modern inverters are now expected to offer both grid-forming and grid-following capabilities, as well as voltage and frequency regulation and reactive power support. With increasing solar penetration, these features are no longer optional but essential to maintain a balanced and reliable grid. Grid operators are also enforcing stricter technical standards, especially in states like South Australia, where minimum inverter capabilities are mandated. As the grid continues to evolve, demand will favor smart inverters that facilitate the smooth integration of solar energy into the broader power system. According to Australia solar PV inverter market analysis, the shift toward smarter grid interaction is driving strong demand for advanced inverter technologies capable of complying with evolving regulatory standards.

Technological Advancements

Inverter technology has advanced rapidly, improving both performance and usability. Modern string inverters now offer higher conversion efficiencies, better cooling systems, and remote monitoring via apps and cloud platforms. These upgrades reduce maintenance requirements and extend the system's life. Hybrid inverters that can manage both solar and battery storage are gaining popularity in the residential segment. For commercial and utility-scale projects, modular and scalable inverter designs simplify deployment and reduce project timelines. Some inverters now come with integrated arc-fault detection, anti-islanding protection, and compliance with evolving Australian standards. This combination of innovation and compliance encourages system owners to replace older models with premium inverters for new installations, thereby reinforcing steady market demand.

Australia Solar PV Inverter Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on technology, voltage, and application.

Technology Insights:

- Central Inverters

- String Inverters

- Microinverters

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes central inverters, string inverters, microinverters, and others.

Voltage Insights:

- < 1,000 V

- 1,000 – 1,499 V

- > 1,500 V

The report has provided a detailed breakup and analysis of the market based on the voltage. This includes < 1,000 V, 1,000 – 1,499 V, and > 1,500 V.

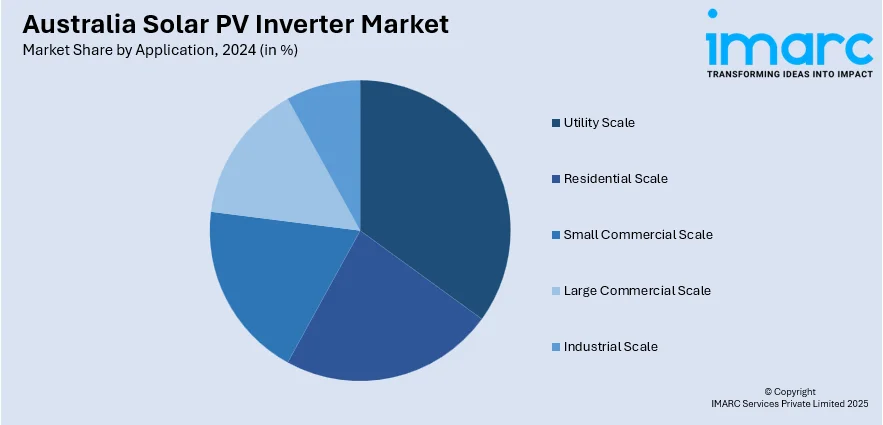

Application Insights:

- Utility Scale

- Residential Scale

- Small Commercial Scale

- Large Commercial Scale

- Industrial Scale

The report has provided a detailed breakup and analysis of the market based on the application. This includes utility scale, residential scale, small commercial scale, large commercial scale, and industrial scale.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Solar PV Inverter Market News:

- March 2025: Rio Tinto and Edify Energy signed agreements for the Smoky Creek & Guthrie’s Gap Solar Power Stations, incorporating advanced solar, battery, and inverter technologies. This development contributed to Australia’s solar PV inverter segment's growth by enhancing grid stability and boosting renewable energy integration, driving demand for high-performance inverters.

- February 2025: Energy Vault began construction of its Battery Energy Storage System (BESS) at ACEN Australia's New England Solar project. This milestone fostered growth in Australia’s solar PV inverter industry by driving demand for efficient inverters to support enhanced energy storage and grid stability.

Australia Solar PV Inverter Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Central Inverters, String Inverters, Microinverters, Others |

| Voltages Covered | < 1,000 V, 1,000 – 1,499 V, > 1,500 V |

| Applications Covered | Utility Scale, Residential Scale, Small Commercial Scale, Large Commercial Scale, Industrial Scale |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia solar PV inverter market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia solar PV inverter market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia solar PV inverter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The solar PV inverter market in the Australia was valued at USD 173.4 Million in 2024.

The Australia solar PV inverter market is expected to reach a value of USD 251.1 Million by 2033.

The Australia solar PV inverter market is projected to exhibit a compound annual growth rate (CAGR) of 4.2% during 2025-2033.

The market is witnessing a shift toward smart inverters with grid-support features, rising adoption of hybrid inverters for solar-plus-storage setups, increased demand for remote monitoring, and growing replacement of aging systems. Compliance with evolving grid codes is also shaping product development and deployment strategies.

Rising rooftop and utility-scale solar installations, supportive government incentives, high electricity prices, and the push for decarbonization are driving inverter demand. Advances in inverter efficiency, grid modernization efforts, and growing energy storage adoption further support sustained market expansion across residential, commercial, and utility segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)