Australia Solar Thermal Systems Market Size, Share, Trends and Forecast by Technology, Application, End User, and Region, 2025-2033

Australia Solar Thermal Systems Market Overview:

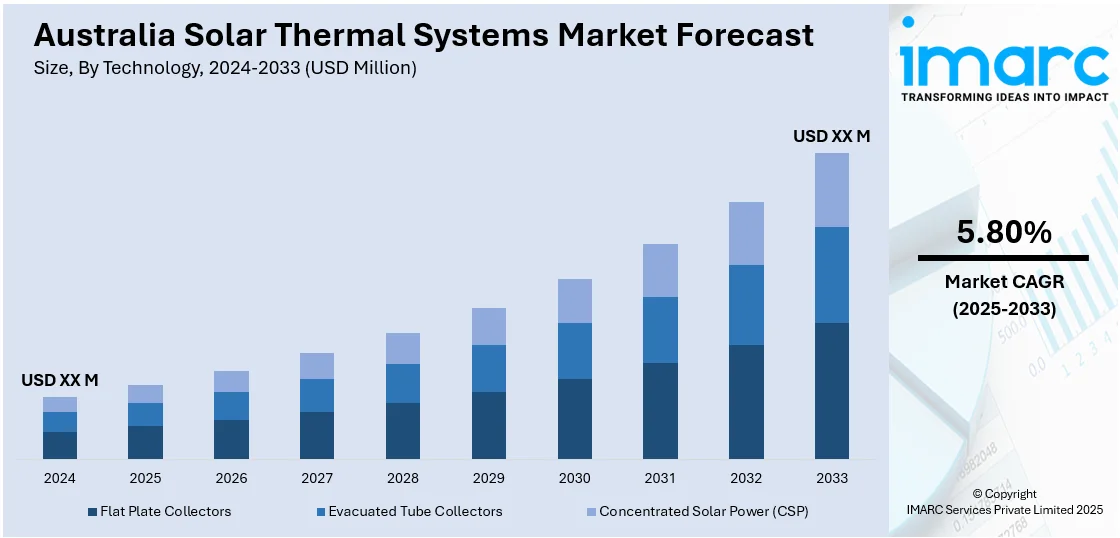

The Australia solar thermal systems market size is projected to exhibit a growth rate (CAGR) of 5.80% during 2025-2033. The market is driven by demand for energy-efficient, cost-stable heating solutions. Also, commercial and industrial use for process heating and ESG alignment are accelerating system deployment. Additionally, regulatory mandates promote adoption in public infrastructure. Government incentives, planning compliance rules, off-grid industrial viability, energy price volatility, emissions benchmarks, and builder integration strategies are some of the factors positively impacting the Australia solar thermal systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 5.80% |

Australia Solar Thermal Systems Market Trends:

Demand for Sustainable Heating and Cost Efficiency

Solar thermal systems are increasingly adopted as households and businesses prioritize long-term energy savings and environmental responsibility. With electricity prices remaining volatile, many property owners are moving toward technologies that reduce reliance on conventional grid-based power. Thermal systems offer a reliable method of water and space heating, particularly in regions with high solar exposure such as Queensland, Western Australia, and the Northern Territory. Financial accessibility is improving due to government-backed mechanisms such as the Small-scale Renewable Energy Scheme (SRES), which provides tradable certificates to offset installation costs. State-specific rebates and loan programs have widened access further, supporting installations in low- and middle-income households. On 31 August 2024, the Australian Renewable Energy Agency (ARENA) launched the first phase of the USD 1 Billion Solar Sunshot program to boost domestic solar photovoltaic (PV) manufacturing. Two funding rounds have been announced, Round 1A with USD 500 Million for manufacturing innovation (modules, inputs, and deployment systems) and Round 1B with USD 50 Million for feasibility and engineering studies. This initiative, backed by Australia’s strong solar R&D capabilities and raw material availability, aims to enhance supply chain resilience. Public awareness around lifetime energy cost savings continues to increase, prompting wider consideration among new homeowners, developers, and renovators. The shift in consumer priorities is also supported by market education campaigns and growing visibility of successful deployments across suburbs and public buildings. These combined economic and behavioral factors are influencing purchasing decisions beyond traditional sustainability motivations. Builders and architects increasingly integrate solar thermal technology into new housing designs to meet both client expectations and compliance needs. These combined dynamics are contributing directly to Australia solar thermal systems market growth.

To get more information on this market, Request Sample

Government Incentives and Regulatory Frameworks

Regulatory mandates and financial assistance have become structural forces supporting adoption across both public and private domains. The Small-scale Renewable Energy Scheme reduces upfront investment through tradable certificates, while various state governments offer additional rebates and concessional finance. These programs reduce the cost barrier significantly and influence procurement decisions in favor of solar thermal systems. At the local level, councils are incorporating renewable energy requirements into planning approvals, particularly for medium- and large-scale developments. Developers seeking approval for new projects increasingly face conditions that mandate the inclusion of energy-efficient systems, of which solar thermal is one of the most viable options. The result is a shift from discretionary to regulated adoption, establishing a more predictable and scalable market base. On 24 March 2025, European Energy inaugurated its first Australian solar project, the 58 MW Mokoan Solar Park in Winton, Victoria, marking a key milestone in its 9 GW pipeline in the country. The project was completed ahead of schedule and under budget, supplying clean electricity to over 18,000 households and cutting annual emissions by 85,000 tonnes, with over AUD 95 Million (USD 61.5 Million) spent on local procurement and 150 jobs created. As part of the Australian Government's Capacity Investment Scheme, the project is also supported by AUD 400,000 (USD 260,000) in community investments and aims for full commercial operation by June 2025. These combined incentives, codes, and legal mechanisms continue to build confidence and drive momentum throughout the sector.

Australia Solar Thermal Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, application, and end user.

Technology Insights:

- Flat Plate Collectors

- Evacuated Tube Collectors

- Concentrated Solar Power (CSP)

- Parabolic Trough

- Solar Tower

- Fresnel Reflectors

- Dish Stirling

The report has provided a detailed breakup and analysis of the market based on the technology. This includes flat plate collectors, evacuated tube collectors, and concentrated solar power (CSP) (parabolic trough, solar tower, Fresnel reflectors, and dish stirling).

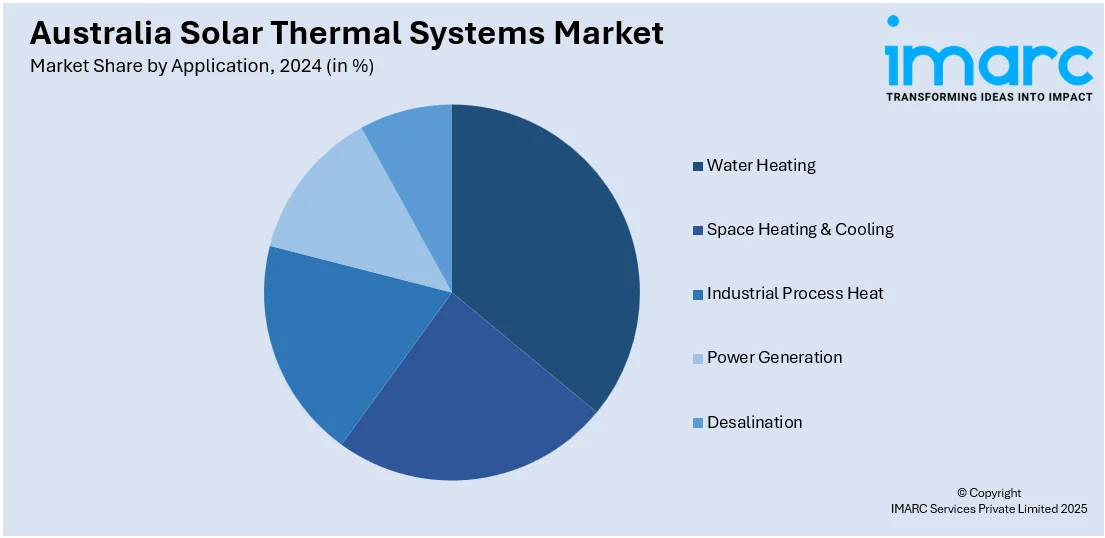

Application Insights:

- Water Heating

- Space Heating & Cooling

- Industrial Process Heat

- Power Generation

- Desalination

The report has provided a detailed breakup and analysis of the market based on the application. This includes water heating, space heating & cooling, industrial process heat, power generation, and desalination.

End User Insights:

- Residential

- Commercial

- Industrial

- Agricultural

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial, industrial, and agricultural.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has provided a comprehensive analysis of all major regional markets, including Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Solar Thermal Systems Market News:

- On 1 April 2025, Canadian Solar and Flow Power announced the deployment of Canadian Solar's anti-hail solar panel technology in a new solar and battery energy storage system (BESS) project in Coonawarra, South Australia. The project marks the first use of the company's hail-resistant modules in Australia and is designed to enhance resilience in extreme weather conditions while integrating solar with DC-coupled BESS. This collaboration is expected to set a precedent for further installations across the country, strengthening the durability and reliability of solar infrastructure in Australia’s challenging climate.

- On 30 October 2024, Mars Petcare and ARENA announced the launch of an AUD 39.3 Million (USD 25.4 Million) renewable heat project at the Mars Petcare Wodonga facility, centered on an 18 MW concentrated solar thermal (CST) system and electric thermal energy storage (eTES) to replace fossil gas use. The parabolic trough collectors, capable of reaching 240°C and delivering up to 10 hours of storage, will displace 50% of the site’s gas use—equivalent to the annual consumption of over 2,000 households—while the eTES and a green hydrogen purchase agreement will offset an additional 50%. ARENA contributed AUD 17.2 Million (USD 11.1 Million).

Australia Solar Thermal Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered |

|

| Applications Covered | Water Heating, Space Heating & Cooling, Industrial Process Heat, Power Generation, Desalination |

| End Users Covered | Residential, Commercial, Industrial, Agricultural |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia solar thermal systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia solar thermal systems market on the basis of technology?

- What is the breakup of the Australia solar thermal systems market on the basis of application?

- What is the breakup of the Australia solar thermal systems market on the basis of end user?

- What is the breakup of the Australia solar thermal systems market on the basis of region?

- What are the various stages in the value chain of the Australia solar thermal systems market?

- What are the key driving factors and challenges in the Australia solar thermal systems market?

- What is the structure of the Australia solar thermal systems market and who are the key players?

- What is the degree of competition in the Australia solar thermal systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia solar thermal systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia solar thermal systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia solar thermal systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)