Australia Specialty Gases Market Size, Share, Trends and Forecast by Type, Element, Application, Packaging Type, Sales Type, and Region, 2026-2034

Australia Specialty Gases Market Overview:

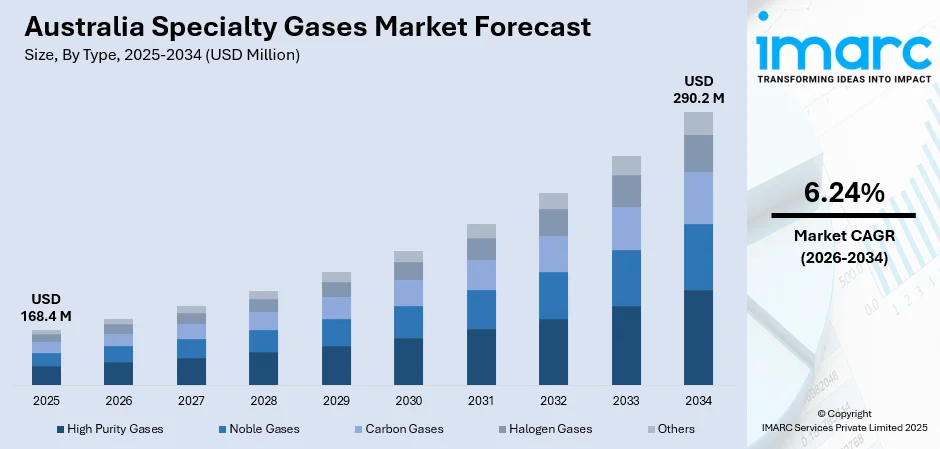

The Australia specialty gases market size reached USD 168.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 290.2 Million by 2034, exhibiting a growth rate (CAGR) of 6.24% during 2026-2034. The market is expanding, driven by sectors, such as electronics, healthcare, and clean energy. The demand for high-purity gases, alongside a focus on sustainability and green hydrogen, is shaping the industry's future. Growing applications in various industries boost market potential.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 168.4 Million |

| Market Forecast in 2034 | USD 290.2 Million |

| Market Growth Rate 2026-2034 | 6.24% |

Australia Specialty Gases Market Trends:

Rising Demand for High-Purity Gases in Semiconductor and Electronics Manufacturing

Australia's electronics and semiconductor industries are fueling enormous demand for specialty gases of high purity. As the use of cutting-edge technologies including artificial intelligence (AI), 5G networks, and quantum computing becomes more prevalent, the demand for ultra-clean gases such as nitrogen, argon, and hydrogen is on the rise. These gases are critical to processes including wafer fabrication, chip production, and circuit assembly. Further driving demand is also Australia's drive to develop its local semiconductor industry, less dependent on imports. Firms are making investments in domestic production units to provide a consistent supply of specialty gases custom-made for the industry. Government efforts to promote high-tech manufacturing capacity are also backing this trend. As the production of electronics and semiconductors grows, the specialty gases market will experience healthy growth, making purity and consistency of gases the most important concerns for companies trying to sustain competitive positions in the rapidly changing electronics industry. For instance, in March 2024, Air Liquide announced its leadership in supporting the new Safe Work Australia welding fume standards, providing expert consultation, safety training, and advanced solutions to help businesses comply with the updated 1 mg/m³ exposure limit.

To get more information on this market Request Sample

Expanding Role of Specialty Gases in Healthcare and Medical Applications

Australian health care is facing greater dependence upon specialty gases in medical imaging, respiratory therapy, and pharmaceutical discovery. Helium, oxygen, and carbon dioxide are all pivotal in MRI imaging, anesthesia treatment, and cell culture use. As Australia faces an aging demographic and expanding medical infrastructure, healthcare facilities and hospitals need a continued supply of such high-purity gases. Further, increased demand for personalized medicine and biopharmaceuticals is also stimulating gas application innovation for drug development and storage. Also, specialty gases contribute to diagnostic innovations, such as mass spectrometry and gas chromatography in research laboratories. As health becomes more data-oriented and precision-driven, manufacturers of gases are enhancing delivery mechanisms and improving safety standards. This continuous growth in medical uses is placing specialty gases as a vital element in modernizing Australia's healthcare sector.

Sustainability and Green Hydrogen Driving Specialty Gas Innovations

Australia has pledged to achieve net-zero emissions as the position of specialty gases in sustainability efforts is gaining importance. Green hydrogen, which is made from renewable energy, is being observed as a major solution for decarbonizing sectors like transportation, energy, and manufacturing. This trend is driving demand for specialty gases, such as high-purity hydrogen and oxygen, which are crucial for hydrogen fuel cell production and storage solutions. Further, carbon capture and use technologies are making headways with specialty gases to enable efficient sequestration and reuse of carbon. Australia-based industrial gas producers are going for environmentally friendly manufacturing processes with recycling of gases and low-carbon emission process technology. All this is keeping pace with government-supported clean energy initiatives and investment by the private sector in hydrogen infrastructure. With sustainability being a top agenda, specialty gas producers are anticipated to continue innovating, helping drive Australia's transition to clean energy and lowering environmental footprints across sectors.

Australia Specialty Gases Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on type, element, application, packaging type, and sales type.

Type Insights:

- High Purity Gases

- Noble Gases

- Carbon Gases

- Halogen Gases

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes high purity gases, noble gases, carbon gases, halogen gases, and others.

Element Insights:

- Argon

- Nitrogen

- Helium

- Carbon Monoxide

- Methane

- Oxygen

- Hydrogen

- Others

A detailed breakup and analysis of the market based on the element have also been provided in the report. This includes argon, nitrogen, helium, carbon monoxide, methane, oxygen, hydrogen, and others.

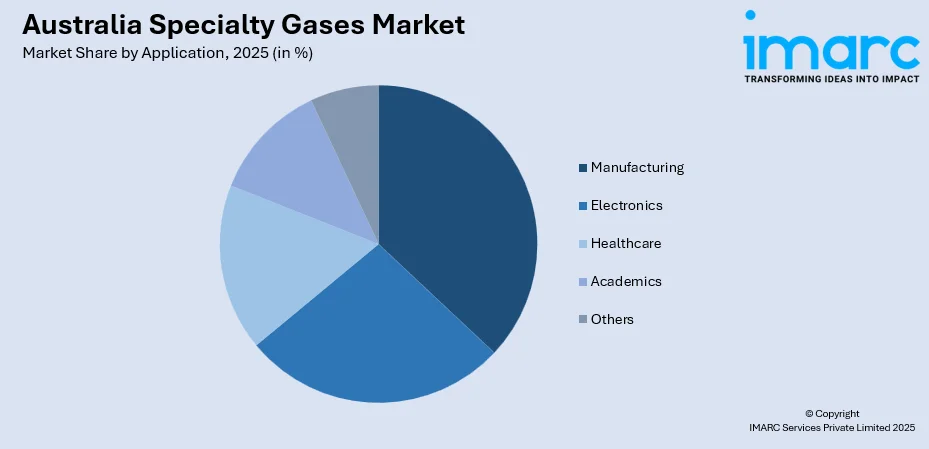

Application Insights:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- Electronics

- Healthcare

- Academics

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes manufacturing, electronics, healthcare, academics, and others.

Packaging Type Insights:

- Packaged

- Bulk and On-site

A detailed breakup and analysis of the market based on the packaging type have also been provided in the report. This includes packaged and bulk and on-site.

Sales Type Insights:

- Merchant

- Captive

A detailed breakup and analysis of the market based on the sales type have also been provided in the report. This includes merchant and captive.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Specialty Gases Market News:

- In December 2024, Air Liquide expanded its specialty gases portfolio, introducing high-purity gases like argon, helium, and nitrogen for applications in analytical labs and industries. The company also enhanced cylinder technology with the SMARTOP™ cap, featuring an on/off lever and permanent content gauge for better safety and efficiency.

- In February 2024, BOC announced the opening of an $18M specialty gases production facility in Australia. Leveraging Linde's expertise, the facility will produce high-quality, locally made gas mixtures, including acid gases, liquid hydrocarbons, and calibration standards, improving lead times and meeting evolving industry demands.

Australia Specialty Gases Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | High Purity Gases, Noble Gases, Carbon Gases, Halogen Gases, Others |

| Elements Covered | Argon, Nitrogen, Helium, Carbon Monoxide, Methane, Oxygen, Hydrogen, Others |

| Applications Covered | Manufacturing, Electronics, Healthcare, Academics, Others |

| Packaging Types Covered | Packaged, Bulk and On-Site |

| Sales Types Covered | Merchant, Captive |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia specialty gases market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia specialty gases market on the basis of type?

- What is the breakup of the Australia specialty gases market on the basis of element?

- What is the breakup of the Australia specialty gases market on the basis of application?

- What is the breakup of the Australia specialty gases market on the basis of packaging type?

- What is the breakup of the Australia specialty gases market on the basis of sales type?

- What is the breakup of the Australia specialty gases market on the basis of region?

- What are the various stages in the value chain of the Australia specialty gases market?

- What are the key driving factors and challenges in the Australia specialty gases?

- What is the structure of the Australia specialty gases market and who are the key players?

- What is the degree of competition in the Australia specialty gases market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia specialty gases market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia specialty gases market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia specialty gases industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)