Australia Stock Market Size, Share, Trends and Forecast by Market Capitalization, Industry Sector, and Region, 2026-2034

Australia Stock Market Summary:

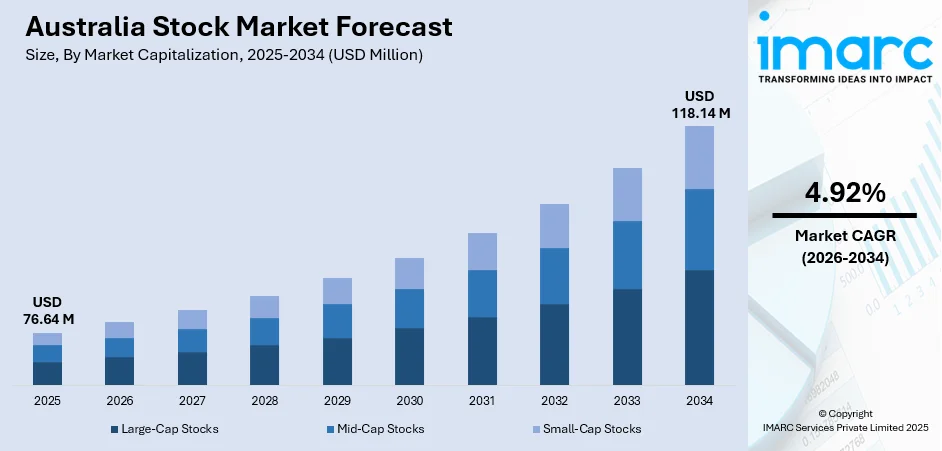

The Australia stock market size was valued at USD 76.64 Million in 2025 and is projected to reach USD 118.14 Million by 2034, growing at a compound annual growth rate of 4.92% from 2026-2034.

The Australia stock market continues to demonstrate robust performance driven by strong economic fundamentals and favorable policy environments. Growing commodity demand from Asia-Pacific economies, particularly China and India, sustains export-oriented sectors listed on the Australian Securities Exchange. The mandatory superannuation system ensures consistent domestic capital flows into equities, while technological innovation and renewable energy investments diversify opportunities beyond traditional mining and financial sectors, strengthening Australia stock market share.

Key Takeaways and Insights:

- By Market Capitalization: Large-cap stocks dominate the market with a share of 71% in 2025, reflecting investor preference for established mining, banking, and energy corporations offering stable returns and lower volatility.

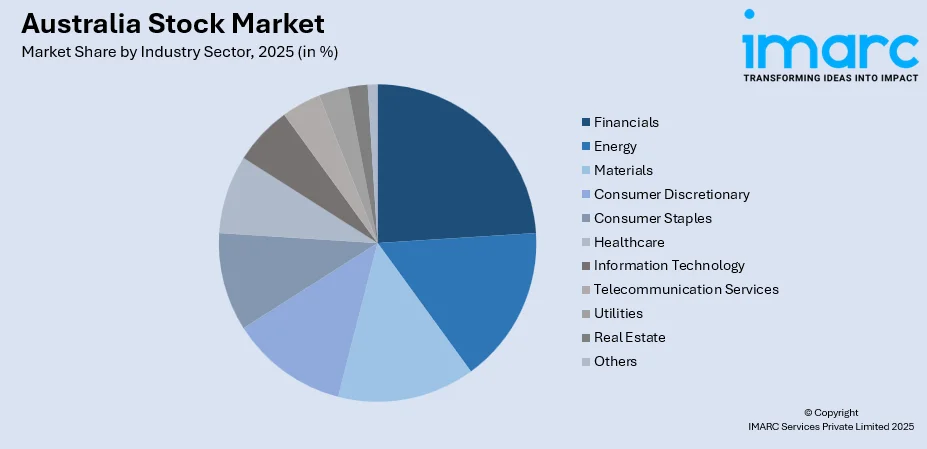

- By Industry Sector: Financials lead the market with a share of 28% in 2025, driven by the nation's sophisticated banking system and mandatory superannuation funds channeling substantial capital into equity markets.

- By Region: Australia Capital Territory & New South Wales represent the largest segment with a market share of 28% in 2025, attributed to Sydney's position as the nation's financial hub, hosting the ASX and major institutional headquarters.

- Key Players: The Australia stock market exhibits strong competitive intensity with established domestic corporations and international investment firms driving market activity. Leading players focus on portfolio diversification, technological integration, sustainable investment practices, and strategic acquisitions to strengthen market positioning across mining, financial services, and emerging technology sectors.

To get more information on this market Request Sample

Australia’s stock market continues to advance as investors, both institutional and retail, leverage the country’s strategic position connecting Asian growth markets with established Western regulatory standards. The national exchange provides a leading platform for companies across diverse sectors, including resources, financial services, healthcare, and technology. The compulsory superannuation system ensures steady domestic investment flows, supporting market stability even during periods of volatility. Strong corporate governance, transparent regulatory frameworks, and the nation’s role within the Indo-Pacific economic corridor attract growing international interest, reinforcing confidence in Australian equities and creating a robust environment for long-term capital market growth. For instance, in December 2025, the Australian Prudential Regulation Authority (APRA) introduced extra licensing requirements for Equity Trustees Superannuation Limited (ETSL) to address regulatory concerns regarding its investment governance structures and operational practices. These measures specifically focus on enhancing the oversight of the investment options offered through its platforms to members, ensuring stronger compliance, risk management, and adherence to prudential standards across its superannuation operations.

Australia Stock Market Trends:

Expansion of Renewable Energy and Critical Minerals Investment

Australia’s stock market is increasingly benefiting from rising momentum in renewable energy and critical minerals as global decarbonisation efforts gather pace. Companies focused on materials essential for clean energy technologies and electric mobility are drawing heightened investor interest due to their strategic importance in future supply chains. At the same time, policy support for long-term emissions reduction is encouraging investment in renewable power and alternative energy projects, expanding capital market activity, and creating fresh growth opportunities within the equity landscape. For instance, in December 2025, the Melbourne Renewable Energy Hub, a large-scale energy storage project jointly owned by Singapore-based clean energy firm Equis and Victoria’s state-owned electricity entity, completed commissioning and is now fully operational.

Rise of Technology and Innovation-Focused Listings

Australian technology companies are becoming increasingly prominent in investor portfolios as digital transformation drives change across traditional industries. Major cities such as Sydney and Melbourne have developed into technology hubs, supporting a growing ecosystem of startups in fintech, healthtech, cybersecurity, and software services. The success of local tech firms demonstrates that Australian companies can scale globally while remaining listed domestically, attracting both domestic and international capital seeking opportunities in the expanding Asia-Pacific digital economy. For instance, in June 2025, Amazon has revealed plans to invest a total of AU$20 billion between 2025 and 2029 to expand, operate, and maintain its data center network in Australia. This substantial technology investment, the largest of its kind publicly announced in the country, aims to meet rising demand for cloud computing and artificial intelligence services. The initiative is expected to accelerate AI adoption, enhance digital capabilities, and support the ongoing technological modernization of organizations across Australia.

Strengthening ESG Integration and Sustainable Investing

Environmental, social, and governance considerations are fundamentally reshaping investment strategies within the Australian equity market. Superannuation funds increasingly mandate ESG compliance in their portfolio selections, pressuring listed companies to enhance sustainability disclosures and operational practices. This shift has created demand for ESG-focused exchange-traded funds and responsible investment products, while encouraging corporations to adopt transparent reporting frameworks that align with international sustainability standards. For instance, in November 2025, Federation Asset Management announced its intention to strengthen the incorporation of environmental, social, and governance (ESG) principles across its range of investment strategies, including its dedicated private markets funds, through the addition of two new senior appointments.

Market Outlook 2026-2034:

The Australia stock market outlook remains positive as structural advantages position the nation for sustained growth through the forecast period. Continued Asian industrialization will maintain demand for Australian commodities while the superannuation system ensures persistent domestic capital allocation to equities. Diversification into technology, healthcare, and renewable energy sectors reduces reliance on traditional mining and finance, broadening investment opportunities. Regulatory stability and transparent governance frameworks continue attracting international capital flows. The market generated a revenue of USD 76.64 Million in 2025 and is projected to reach a revenue of USD 118.14 Million by 2034, growing at a compound annual growth rate of 4.92% from 2026-2034.

Australia Stock Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Market Capitalization |

Large-Cap Stocks |

71% |

|

Industry Sector |

Financials |

28% |

|

Region |

Australia Capital Territory & New South Wales |

28% |

Market Capitalization Insights:

- Large-Cap Stocks

- Mid-Cap Stocks

- Small-Cap Stocks

Large-cap stocks dominate the Australia stock market with a 71% share of total market capitalization in 2025.

Large-cap equities dominate the Australian stock market, reflecting strong investor preference for well-established companies with long operating histories and significant market presence. These firms typically offer high liquidity, stable dividend potential, and lower price volatility compared with smaller-cap alternatives, making them attractive to institutional investors. The substantial allocation of retirement and long-term investment funds toward large-cap equities further reinforces their leadership, contributing to sustained demand and continued influence over overall market direction.

The prominence of large-cap stocks mirrors Australia’s economic structure, where capital-intensive industries and mature service sectors hold significant economic weight. These companies benefit from scale efficiencies, diversified income sources, and global operations that help offset domestic economic risks. Their financial resilience and operational breadth allow them to better navigate economic cycles, meaning movements within this segment often exert a strong influence on overall market performance and investor sentiment.

Industry Sector Insights:

Access the comprehensive market breakdown Request Sample

- Energy

- Materials

- Consumer Discretionary

- Consumer Staples

- Healthcare

- Financials

- Information Technology

- Telecommunication Services

- Utilities

- Real Estate

- Others

Financials lead the Australia stock market with a 28% share in 2025.

The financials sector maintains its leadership position within the Australian equity market, anchored by the nation's four major banks and extensive insurance and wealth management industries. The mandatory superannuation system channels significant capital through financial institutions, creating self-reinforcing demand for financial sector equities. Australian banks benefit from oligopolistic market structures, strong capital adequacy ratios, and conservative lending practices that have historically protected them during global financial disruptions.

Beyond conventional banking activities, the financial sector includes insurers, investment managers, and a growing range of financial technology firms, adding breadth and diversity to the industry. Due to its heavy weighting within major equity indices, performance in this sector has a strong influence on overall market direction. Financial sector conditions also tend to reflect and support wider corporate health, as profitability across different industries reinforces investor confidence and highlights the interconnected nature of Australia’s broader equity market.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales represent the largest share of the Australia stock market at 28% in 2025.

Australian Capital Territory and New South Wales represent a leading position within the national equity market, largely driven by Sydney’s role as Australia’s primary financial hub. The city concentrates a wide range of financial institutions, corporate headquarters, and professional service providers, creating strong network effects. Access to skilled talent, specialised expertise, and close interaction with regulatory authorities strengthens the region’s influence, supporting its continued importance within the country’s broader capital market framework.

This regional leadership extends beyond finance into technology, healthcare, and professional services, which increasingly contribute to equity market activity. Sydney also functions as a key entry point for global investors seeking exposure to Australian equities, reinforcing regional prominence. A strong base of universities, research centres, and innovation districts fosters entrepreneurial growth, supplying a steady pipeline of emerging companies that sustain the region’s long-term relevance within the national stock market.

Market Dynamics:

Growth Drivers:

Why is the Australia Stock Market Growing?

Resource-Based Economy and Global Commodity Demand

Australia's abundant natural resource endowment positions the nation as a critical supplier to global commodity markets, directly driving stock market growth through mining and energy sector performance. The country possesses vast deposits of iron ore, natural gas, coal, lithium, and rare earth elements essential for construction, manufacturing, and emerging technology applications. Asian economies, particularly China and India, maintain a strong demand for Australian raw materials to support infrastructure development and industrial expansion. This export relationship generates substantial corporate revenues for ASX-listed mining giants, translating into dividend payments and capital appreciation that attract both domestic and international investors seeking commodity exposure.

Superannuation System Providing Consistent Capital Flows

Australia’s compulsory superannuation framework provides a structural advantage that consistently channels domestic capital into the equity market, independent of wider economic fluctuations. Employers are obligated to contribute a portion of employee earnings into retirement savings accounts, which are professionally managed and systematically invested. A substantial share of these funds is directed toward local equities, generating steady demand that underpins market stability and liquidity. This automatic and collective investment approach contrasts with countries that rely on voluntary retirement savings, where equity market participation is more dependent on individual choices and prevailing economic confidence.

Innovation Ecosystem and Technology Sector Emergence

Government backing for innovation and technology entrepreneurship is playing an increasingly important role in driving equity market growth, as emerging companies in new-economy sectors gain visibility. Policies offering research and development incentives, innovation grants, and support for startup incubators have fostered the development of competitive technology enterprises that attract investor interest. The shift from traditional resource and financial sectors toward technology, healthcare, and renewable energy broadens investment opportunities, enhances market diversification, and helps mitigate the risks associated with historical sector concentration.

Market Restraints:

What Challenges the Australia Stock Market is Facing?

Trade Dependency and Geopolitical Tensions

Australia’s heavy reliance on trade with China exposes its economy and equity markets to shifts in bilateral relations, which can quickly affect export-driven industries. Past diplomatic disputes have triggered informal trade barriers on products such as coal, wine, and barley. These actions highlight how geopolitical tensions can disrupt corporate earnings and dampen investor confidence in affected sectors.

Market Concentration and Sector Imbalances

The equity market of Australia is largely concentrated in a few sectors, especially in the fields of mining, financial services, and real estate, which brings about the structural concentration risk. This is the lack of sectoral diversification that undermines the portfolio diversification of the local investors and increases susceptibility to local investors during industry-specific declines. Consequently, adverse events that must occur in key industries or firms can have a disproportionate impact on the overall volatility in the market.

Currency and Commodity Price Volatility

The Australian dollar’s close linkage to global commodity cycles contributes to frequent exchange rate fluctuations, influencing both company earnings and foreign investor returns. Changes in commodity prices directly affect mining sector profitability, often producing sharp expansion and contraction phases. These boom-and-bust dynamics complicate long-term investment strategies and challenge consistent portfolio performance across market cycles.

Competitive Landscape:

The Australia stock market maintains a competitive environment characterized by established domestic financial institutions competing alongside international investment managers for market share. Major banks dominate trading volumes and advisory services, while global asset managers increasingly allocate capital to Australian equities seeking Asia-Pacific exposure through a well-regulated market. Competition extends to listing services, where the ASX competes with international exchanges for company domiciles. Market participants differentiate through research capabilities, technology infrastructure, sustainable investment offerings, and client service quality as investor sophistication increases and fee compression pressures traditional revenue models.

Recent Developments:

- January 2026: Webull Securities (Australia) Pty Ltd, operating as Webull Australia and wholly owned by Webull Corporation introduced Vega AI to the Australian market. The newly launched AI-driven assistant is designed to elevate the investing experience for local users by providing smarter, more intuitive support across the Webull trading platform.

- August 2024: Coles Group reported AUD 1.1 billion in full-year profit, driven by strong supermarket sales and successful efforts to reduce losses from theft. Woodside Energy shares increased by 4% following the release of its half-year results, while the ASX 200 index reflected mixed results from US markets.

Australia Stock Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Market Capitalizations Covered | Large-Cap Stocks, Mid-Cap Stocks, Small-Cap Stocks |

| Industry Sectors Covered | Energy, Materials, Consumer Discretionary, Consumer Staples, Healthcare, Financials, Information Technology, Telecommunication Services, Utilities, Real Estate, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia stock market size was valued at USD 76.64 Million in 2025.

The Australia stock market is expected to grow at a compound annual growth rate of 4.92% from 2026-2034 to reach USD 118.14 Million by 2034.

Large-cap stocks represent the largest share at 71% in 2025, reflecting investor preference for established corporations offering dividend stability, liquidity advantages, and lower volatility compared to mid-cap and small-cap alternatives within the Australian equity market.

Key factors driving the Australia stock market include strong global commodity demand, the mandatory superannuation system ensuring consistent capital flows, technological innovation and startup growth, favorable regulatory environments, and increasing international investment seeking Asia-Pacific exposure.

Major challenges include trade dependency on China creating geopolitical exposure, market concentration in limited sectors increasing systemic risk, currency volatility affecting international returns, commodity price fluctuations impacting mining revenues, and competition for listings from international exchanges.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)