Australia Student Information System Market Size, Share, Trends and Forecast by Component, Deployment Type, End-User, and Region, 2025-2033

Australia Student Information System Market Size and Share:

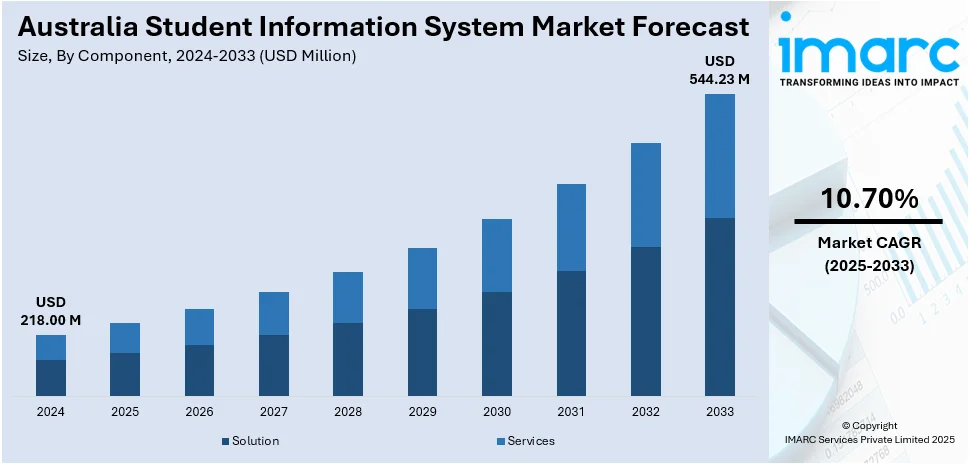

The Australia student information system market size reached USD 218.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 544.23 Million by 2033, exhibiting a growth rate (CAGR) of 10.70% during 2025-2033. The increasing adoption of cloud-based platforms, artificial intelligence (AI)-driven analytics, expanding mobile accessibility, the surging focus on enhancing administrative efficiency and personalized learning, and growing need to comply with stringent data privacy regulations are fueling the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 218.00 Million |

| Market Forecast in 2033 | USD 544.23 Million |

| Market Growth Rate 2025-2033 | 10.70% |

Australia Student Information System Market Trends:

Cloud-Based SIS Adoption Enhancing Scalability and Accessibility

Australian educational institutions are increasingly adopting cloud-based Student Information Systems (SIS) to capitalize on scalability, cost-efficiency, and remote accessibility. These platforms deliver real-time data updates, robust security protocols, and seamless interoperability with learning management and analytics tools, streamlining administrative workflows and fostering collaboration across departments. A prominent example is TechnologyOne’s SaaS+ solution, which now underpins multiple TAFE campuses nationwide. Its integrated architecture reduces implementation complexity and lowers ongoing operational overhead. By concentrating on vertical market specialization, particularly in education, TechnologyOne has achieved a 21% increase in annual recurring revenue from the sector, underscoring the commercial viability of tailored cloud offerings. As institutions seek to modernize legacy infrastructures and support hybrid learning models, cloud-based SIS deployments are poised to accelerate, driving further innovation in student engagement, data-driven decision-making, and institutional agility.

To get more information on this market, Request Sample

Integration of AI and Analytics for Personalized Learning and Operational Efficiency

The incorporation of artificial intelligence and advanced analytics into Student Information Systems is revolutionizing institutional data management and personalized learning in Australia’s higher education sector. AI-powered capabilities, such as predictive analytics to identify at-risk students, automated administrative workflows, and adaptive learning pathways are driving improvements in engagement and retention while streamlining operational costs. Workday Student, an AI-driven engagement platform now being deployed at several Australian universities, exemplifies this shift by replacing legacy systems and reducing overhead associated with manual processes. Furthermore, a recent study of Australian universities revealed that 75% of academic staff are leveraging generative AI tools in teaching, research, or administration, underscoring the technology’s rapid integration into academic practice. As institutions pursue hybrid and competency-based learning models, the fusion of AI and SIS platforms will continue to enhance decision-making, foster individualized student support, and promote institutional agility in an increasingly data-centric environment.

Australia Student Information System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, deployment type, and end-user.

Component Insights:

- Solution

- Enrollment

- Academics

- Financial Aid

- Billing

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution (enrollment, academics, financial aid, and billing) and services (professional services and managed services).

Deployment Type Insights:

- On-premises

- Cloud

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes on-premises and cloud.

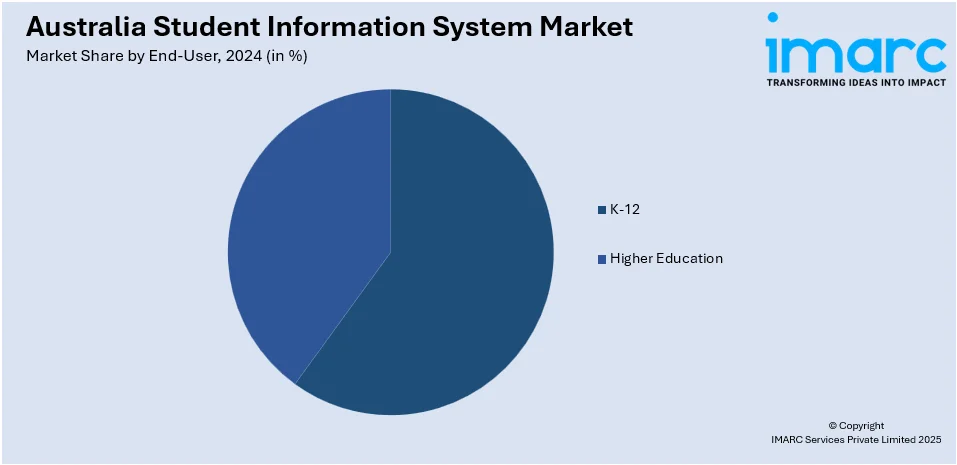

End-User Insights:

- K-12

- Higher Education

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes K-12 and higher education.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Student Information System Market News:

- December 2024: Atturra launched four key modules of its Microsoft Dynamics-based Scholarion Student Information System at Brisbane Grammar School, replacing 42 legacy apps. The go-live includes modules for profiles, student tracking, communications, and resource management, streamlining school operations and engagement.

- August 2024: Xavier College overhauled legacy student information systems by adopting Microsoft Dynamics 365 and Azure, consolidating data from 130 to 60 platforms. The unified cloud-based SIS centralizes student, staff, parent, alumni data, enabling portals tailored for each group. This transformation streamlines profiles, timetables, applications, and analytics, while paving the way for AI-driven automation and smarter decision-making in higher education.

Australia Student Information System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Types Covered | On-premises, Cloud |

| End-Users Covered | K-12, Higher Education |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia student information system market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia student information system market on the basis of component?

- What is the breakup of the Australia student information system market on the basis of deployment type?

- What is the breakup of the Australia student information system market on the basis of end-user?

- What is the breakup of the Australia student information system market on the basis of region?

- What are the various stages in the value chain of the Australia student information system market?

- What are the key driving factors and challenges in the Australia student information system market?

- What is the structure of the Australia student information system market and who are the key players?

- What is the degree of competition in the Australia student information system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia student information system market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia student information system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia student information system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)