Australia Sun Care Products Market Size, Share, Trends and Forecast by Product Type, Product Form, Gender, Distribution Channel, and Region, 2025-2033

Australia Sun Care Products Market Overview:

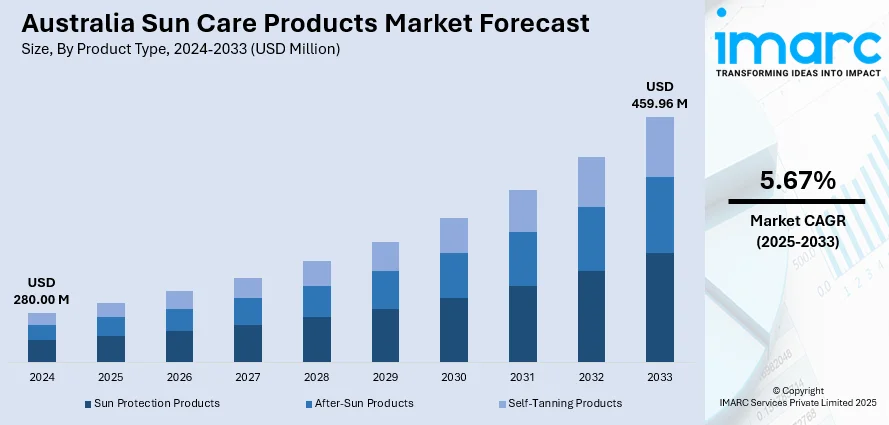

The Australia sun care products market size reached USD 280.00 Million in 2024. Looking forward, the market is expected to reach USD 459.96 Million by 2033, exhibiting a growth rate (CAGR) of 5.67% during 2025-2033. Rising ultraviolet (UV) radiation awareness, high sun exposure levels, rapid product innovations, growing men’s grooming, development of child-specific offerings, escalating demand for sensitive-skin products, and online retail growth are factors facilitating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 280.00 Million |

| Market Forecast in 2033 | USD 459.96 Million |

| Market Growth Rate 2025-2033 | 5.67% |

Key Trends of Australia Sun Care Products Market:

Rising Awareness about UV-Related Health Risks

The increasing public awareness about the health effects of exposure to ultraviolet (UV) radiation is one of the key factors driving the Australia sun care market growth. The country has one of the highest rates of skin cancer in the world, and due to this, there has been extensive government and non-government campaigns about sun protection. In 2023, approximately 18,257 new melanoma diagnoses were made, comprising 10,639 men and 7,618 women. Programs such as "Slip-Slop-Slap" have encouraged sun-safe behavior from a young age, with sunscreen used as an every-day product. Individuals are adopting a more active role in prevention of skin cancer, and premature photoaging and solar-induced pigmentation, which has surged the demand for sun protection factor (SPF) products, broad-spectrum products, and infrared and blue light protection sunscreens. The industry has responded with dermatologist-tested and clinical-grade sun protection products, particularly in coastal and city locations, which is another growth-inducing factor.

To get more information on this market, Request Sample

Innovation in Product Formulations and Formats

Innovation in product formulation is influencing the consumer buying behavior, which is creating a positive Australia sun care products market outlook. The key players are investing in research to launch sophisticated formulas that offer optimum sun protection. These consist of lightweight, non-greasy, quickly absorbed textures that are appropriate for every day used underneath makeup or within skin care regimens. Additionally, mineral-based sunscreens, containing zinc oxide or titanium dioxide, are witnessing massive popularity among the consumers looking for natural or sensitive-skin friendly alternatives. In line with this, innovative application formats, such as sunscreen mists, sticks, powders, and serums, are offering user convenience, which is further bolstering the market growth. Furthermore, dermatologist endorsements and clinical trials for the products are creating credibility among health-conscious and hyper-informed consumers.

Growth of Environmentally Conscious and Reef-Safe Sunscreens

Environmental sustainability is emerging as a major influence on product development and consumer choice in the Australia sun care sector. With public concern growing over coral reef degradation, particularly in sensitive ecosystems like the Great Barrier Reef, demand is rising for reef-safe sunscreens that avoid ingredients linked to marine toxicity. Consumers are seeking transparent formulations that exclude oxybenzone, octinoxate, and parabens, pushing brands to reformulate existing products or introduce entirely new lines. Additionally, the introduction of biodegradable packaging, cruelty-free testing, and carbon-neutral production processes is another factor boosting the Australia sun care products market share. In line with this, retailers and e-commerce platforms are labeling eco-friendly products more clearly, improving visibility and aiding ethical purchase decisions. This trend aligns with the broader sustainability momentum across the Australia beauty and personal care market, further accelerating the market growth.

Growth Drivers of Australia Sun Care Products Market:

Expansion of Outdoor Lifestyle and Sports Culture

Australia’s vibrant outdoor lifestyle and strong sports culture significantly fuel demand for sun care products. Activities such as surfing, swimming, hiking, and outdoor fitness routines increase the need for reliable UV protection. Consumers prefer water-resistant, long-lasting sunscreens that complement active lifestyles. This behavioral trend ensures consistent product usage, especially during summer and holiday seasons. In addition, rising disposable incomes allow consumers to invest in premium sun care solutions offering both protection and comfort. Brands that market sunscreens as essential companions for outdoor recreation continue to capture market share. This alignment with lifestyle patterns has cemented sunscreen as an indispensable daily product, beyond just beach or holiday use.

Influence of Dermatologist Recommendations and Skin Care Professionals

Dermatologists and healthcare professionals play a pivotal role in driving the Australia sun care products market demand. Regular campaigns and endorsements highlighting the risks of prolonged sun exposure encourage consumers to use sun protection products consistently. Medical professionals increasingly recommend broad-spectrum sunscreens as part of daily skincare routines, not just seasonal essentials. Such endorsements build credibility, driving demand for trusted and clinically tested formulations. Moreover, dermatologists are advocating products suitable for sensitive skin, children, and those with pre-existing skin conditions, which further diversifies product demand. The growing reliance on professional advice for skincare decisions strengthens consumer confidence, creating steady growth opportunities for both mass-market and premium sunscreen brands.

Growth of Men’s Grooming and Gender-Inclusive Products

The rising popularity of men’s grooming and gender-neutral skincare is contributing to sun care market expansion in Australia. Men are becoming more conscious of skin health and UV protection, driving higher adoption of sun care products tailored to male preferences, such as lightweight, non-greasy, and quick-absorbing formulas. Simultaneously, brands are introducing gender-inclusive sun care ranges to attract a wider audience. This inclusivity not only boosts acceptance among different consumer groups but also aligns with evolving beauty norms that prioritize functionality over gendered marketing. By addressing new demographics, brands tap into previously under-served segments, fueling additional growth in the sun care industry across Australia.

Government Initiatives of Australia Sun Care Products Market:

Nationwide Skin Cancer Awareness and Prevention Campaigns

The Australian government actively promotes sun safety through nationwide campaigns such as “Slip-Slop-Slap” and other educational initiatives that emphasize sunscreen use. These programs raise awareness about the risks of skin cancer, encouraging both adults and children to adopt sun care as a daily habit. Continuous messaging through schools, workplaces, and media helps normalize sunscreen use across age groups. By reinforcing prevention over treatment, these campaigns create long-term behavioral shifts that directly benefit the sun care industry. Such public health efforts not only protect citizens but also stimulate steady demand for high-quality sunscreen products in both urban and regional markets.

Regulatory Standards and Product Labeling Guidelines

Strict government regulations around sunscreen formulation and labeling strengthen consumer trust in the Australian sun care market. Products must comply with standards set by the Therapeutic Goods Administration (TGA), ensuring they are safe, effective, and accurately labeled with SPF and broad-spectrum protection. Clear labeling requirements help consumers make informed choices, while regulatory oversight minimizes the risk of counterfeit or substandard products entering the market. According to the Australia sun care products market analysis, these standards give reputable brands an advantage, as compliance demonstrates quality and reliability. By maintaining stringent regulations, the government indirectly supports market growth by ensuring consumers feel confident about the efficacy and safety of sunscreens sold in Australia.

School and Community-Based Sun Protection Programs

Government-backed initiatives in schools and communities play a vital role in instilling lifelong sun safety habits. Many educational institutions mandate the use of sunscreen and hats as part of daily routines, embedding protective practices among children from an early age. Community programs further reinforce these habits by distributing free sunscreen at public events, beaches, and sporting venues. These grassroots-level efforts ensure widespread accessibility and encourage collective responsibility toward sun safety. By targeting young Australians and local communities, such programs not only reduce future healthcare burdens but also sustain continuous demand for sun care products across multiple generations.

Australia Sun Care Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, product form, gender, and distribution channel.

Product Type Insights:

- Sun Protection Products

- After-Sun Products

- Self-Tanning Products

The report has provided a detailed breakup and analysis of the market based on the product type. This includes sun protection products, after-sun products, and self-tanning products.

Product Form Insights:

- Cream

- Gel

- Lotion

- Wipes

- Spray

- Others

A detailed breakup and analysis of the market based on the product form have also been provided in the report. This includes cream, gel, lotion, wipes, spray, and others.

Gender Insights:

- Female

- Male

- Unisex

The report has provided a detailed breakup and analysis of the market based on the gender. This includes female, male, and unisex.

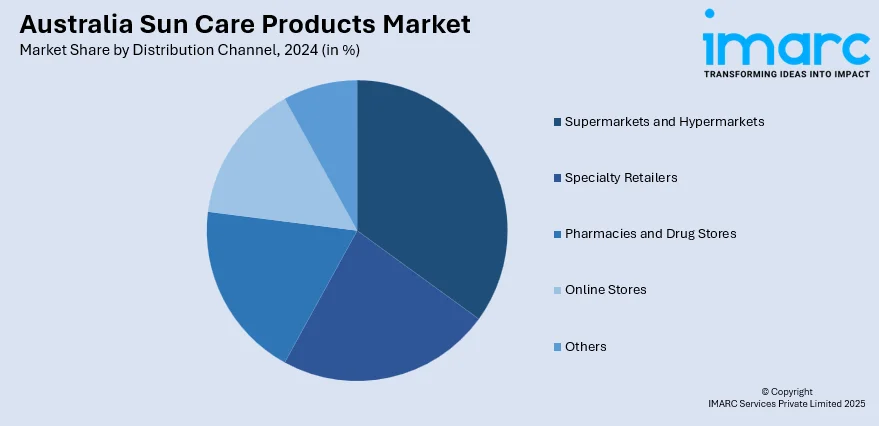

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Retailers

- Pharmacies and Drug Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty retailers, pharmacies and drug stores, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Advanced Skin Technology

- Beiersdorf

- Bondi Sands

- Invisible Zinc

- L'Oréal Paris

- Standard Procedure

- Ultra Violette

- Ultraceuticals

- We Are Feel Good Inc.

Australia Sun Care Products Market News:

- In 2025, Ultra Violette announced its entry into the U.S. market through a partnership with Sephora. Their products became available on Sephora.com and are scheduled to launch in 592 Sephora stores nationwide.

- In 2024, Ultra Violette secured a USD 15 million investment from Aria Growth Partners. This funding aimed to support the brand's expansion into North America, with plans to launch in Sephora Canada in March 2024.

Australia Sun Care Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Million |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sun Protection Products, After-Sun Products, Self-Tanning Products |

| Product Forms Covered | Cream, Gel, Lotion, Wipes, Spray, Others |

| Genders Covered | Female, Male, Unisex |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Retailers, Pharmacies and Drug Stores, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Advanced Skin Technology, Beiersdorf, Bondi Sands, Invisible Zinc, L'Oréal Paris, Standard Procedure, Ultra Violette, Ultraceuticals, We Are Feel Good Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia sun care products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia sun care products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia sun care products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sun care products market in Australia was valued at USD 280.00 Million in 2024.

The Australia sun care products market is projected to exhibit a CAGR of 5.67% during 2025-2033.

The Australia sun care products market is projected to reach a value of USD 459.96 Million by 2033.

The Australia sun care products market is witnessing trends like rising demand for multifunctional sunscreens with skincare benefits, growing preference for natural and reef-safe formulations, and strong uptake of spray and stick formats. Increased consumer awareness about UV protection and sustainability initiatives further shapes product innovation and market growth.

The Australia sun care products market is driven by high UV exposure and skin cancer awareness, boosting sunscreen adoption. Growing tourism and outdoor lifestyle trends increase demand, while innovations in formulations, such as lightweight textures and eco-friendly ingredients, further accelerate market expansion across diverse consumer segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)