Australia Textile Recycling Market Size, Share, Trends and Forecast by Product Type, Textile Waste, Distribution Channel, End Use, and Region, 2025-2033

Australia Textile Recycling Market Size and Share:

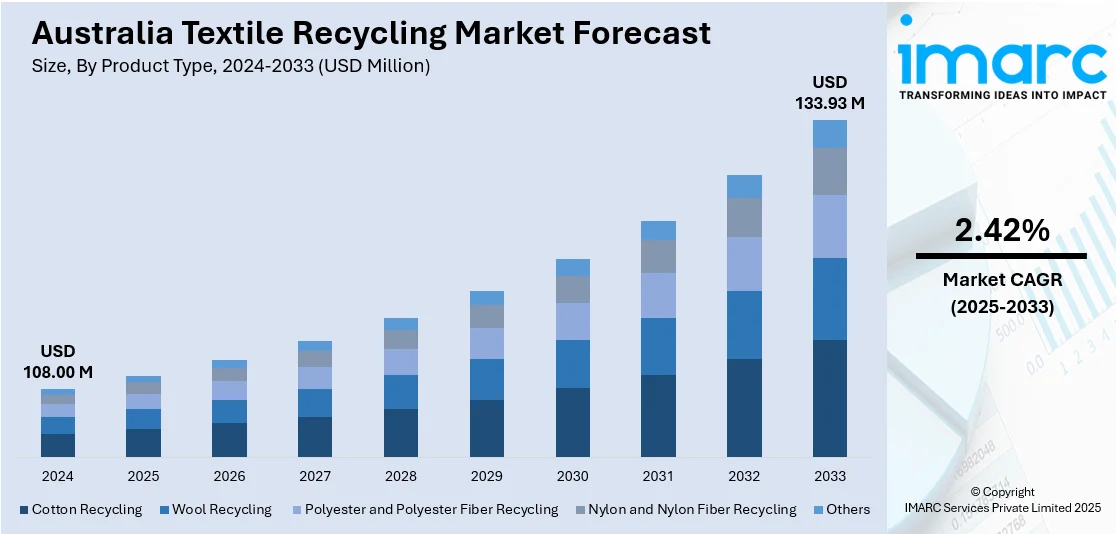

The Australia textile recycling market size reached USD 108.00 Million in 2024. Looking forward, the market is expected to reach USD 133.93 Million by 2033, exhibiting a growth rate (CAGR) of 2.42% during 2025-2033. The market is being propelled by escalating consumer demand for sustainable fashion, stringent government regulations promoting circular economy practices, and technological advancements enhancing recycling processes, collectively aiming to reduce textile waste and foster a more sustainable and efficient textile industry, thereby positively influencing the Australia textile recycling market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 108.00 Million |

| Market Forecast in 2033 | USD 133.93 Million |

| Market Growth Rate 2025-2033 | 2.42% |

Key Trends of Australia Textile Recycling Market:

Growing Environmental Awareness and Sustainability Initiatives

Australia's textile recycling industry is significantly driven by a higher public and governmental interest in environmental sustainability. In the last ten years, mounting concerns over the environmental contribution of textile waste - most notably its role in filling up landfills as well as adding to greenhouse emissions – have motivated consumers as well as policymakers towards more sustainable choices. Australians throw away an estimated 800,000+ tons of textiles and clothing each year, with most of it finding its way into landfills. The eco-footprint of textile manufacturing (overuse of water, chemical contamination, and greenhouse gas emissions) is also facing increasing scrutiny. This is being translated into real action through government-backed sustainability initiatives, including the National Waste Policy Action Plan and multiple state-based circular economy initiatives. These efforts focus on the value of textile recovery and encourage extended producer responsibility (EPR) programs, which ask clothing manufacturers to take responsibility for the end-of-life phase of the product. Educational campaigns are increasingly being done by schools, charities, and independent businesses in an attempt to change consumer habits towards reuse and recycling.

To get more information on this market, Request Sample

Advancements in Textile Recycling Technologies and Infrastructure

Australia's textile recycling industry is also witnessing rapid development as a result of technological leaps and enhanced infrastructure. Conventional textile recycling processes—like downcycling into rags or insulation—were not very scalable or economically feasible. Recent developments in fiber-to-fiber recycling and chemical separation technologies have created new avenues for recovering raw materials from used clothing and recycling them into high-quality textiles. Australian startups and research centers are actively developing technologies like enzymatic sorting of mixed textiles and mechanical fiber recovery technologies that maintain the integrity of natural fibers like cotton and wool. For example, textile recovery plants now have AI-assisted sorting technologies that automatically detect and sort the type of fabric for proper processing. This has made textile recycling more economical and efficient.

Corporate Collaboration and Circular Economy Integration

A key trend in the market is the strengthening of strategic partnerships between retailers, recycling firms, and policy stakeholders to foster circular economy practices, thereby boosting Australia textile recycling market demand through collaborative innovation and sustainable resource management. Major clothing brands and department stores are setting up nationwide take-back schemes, enabling customers to return used garments in exchange for rewards. Partnerships with textile recyclers and local councils facilitate the efficient collection, reselling, or repurposing of fabrics. Additionally, public-private collaborations—such as those recognized through industry councils—are developing closed-loop systems where end-of-life garments are processed into raw materials for new textile production. These collective efforts integrate recycling within mainstream retail and manufacturing channels, driving scale and reducing landfill waste. As the circular model takes hold, textile reuse becomes a normalized part of the broader fashion lifecycle in Australia.

Growth Drivers of Australia Textile Recycling Market:

Rising Textile Waste Generation and Landfill Pressure

Australia’s growing population and fast fashion consumption have led to a significant increase in textile waste, prompting urgent action to divert fabrics from landfills. Australians discard hundreds of thousands of tonnes of clothing annually, with most ending up in landfills. This mounting pressure on waste management systems is pushing both the public and private sectors to seek sustainable alternatives. As landfill costs rise and capacity decreases, textile recycling emerges as a practical solution to mitigate environmental impacts. Increasing government data transparency and reporting on textile waste generation further encourages action. The visible strain on municipal waste services and land ecosystems is accelerating demand for large-scale recycling initiatives across Australia.

Consumer Shift Toward Ethical and Circular Fashion

Australian consumers are becoming increasingly conscious of the social and environmental costs of their fashion choices, leading to a growing preference for brands that support ethical production and recycling. According to the Australia textile recycling market analysis, this shift is creating demand for circular fashion models that prioritize recycled fabrics and second-hand clothing. Social media influencers, documentaries, and sustainability campaigns are shaping consumer behavior, encouraging textile reuse and responsible purchasing. As thrift shopping, garment-swapping, and upcycled fashion become mainstream, textile recycling sees heightened support from retail and individual channels. This consumer-driven movement is not only influencing product offerings but also motivating brands to invest in recycling infrastructure and partnerships, significantly fueling market expansion.

Government Funding and Research Support for Textile Innovation

The Australian government’s increased investment in research and innovation is acting as a major catalyst for the textile recycling industry. Grants and funding programs aimed at sustainable materials research, waste reduction, and green innovation are encouraging startups and academic institutions to develop scalable recycling solutions. Research collaborations between universities and private enterprises are exploring new fiber regeneration techniques, biodegradable textiles, and high-efficiency sorting systems. These efforts are complemented by policy incentives and tax benefits for companies adopting eco-friendly practices. By fostering a supportive environment for experimentation and commercialization of textile recycling technologies, the government is laying a strong foundation for long-term growth in the sector.

Australia Textile Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, textile waste, distribution channel, end use, and region.

Product Type Insights:

- Cotton Recycling

- Wool Recycling

- Polyester and Polyester Fiber Recycling

- Nylon and Nylon Fiber Recycling

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cotton recycling, wool recycling, polyester and polyester fiber recycling, nylon and nylon fiber recycling, and others.

Textile Waste Insights:

- Pre-consumer Textile

- Post-consumer Textile

A detailed breakup and analysis of the market based on the textile waste have also been provided in the report. This includes pre-consumer textile and post-consumer textile.

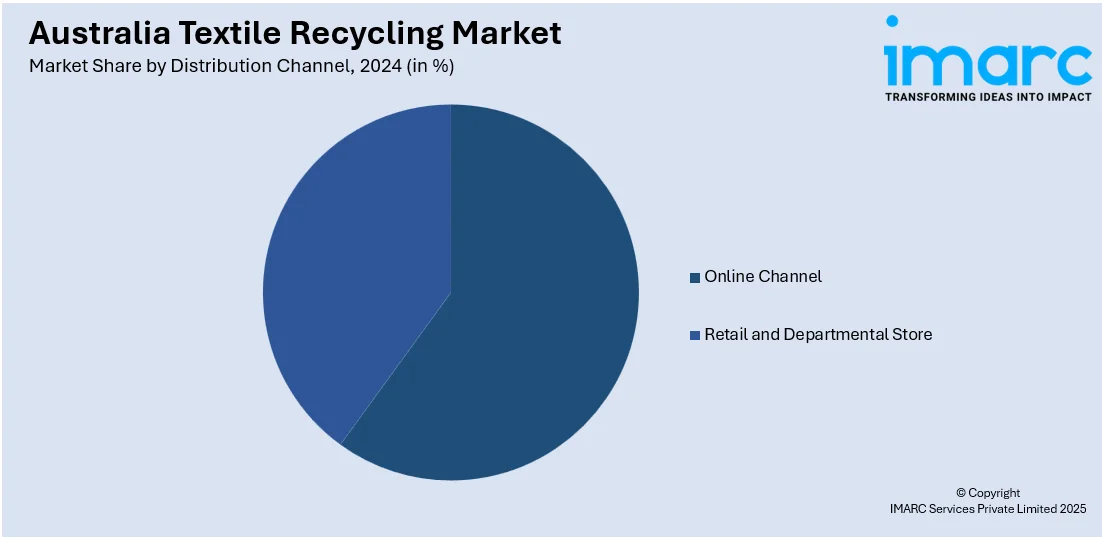

Distribution Channel Insights:

- Online Channel

- Retail and Departmental Store

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online channel and retail and departmental store.

End Use Insights:

- Apparel

- Industrial

- Home Furnishings

- Non-woven

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes apparel, industrial, home furnishings, non-woven, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Textile Recycling Market News:

- February 2025: Pact Group and BlockTexx signed a memorandum of understanding to assess the feasibility of establishing a comprehensive recycling operation for polyester and cotton-blend garments in Australia. The proposed system would encompass collection, sorting, and chemical recycling of textiles into raw materials suitable for new clothing, packaging, or other sustainable applications.

- April 2024: Textile Recyclers Australia (TRA) partnered with the ARC Research Hub for Microrecycling of Battery and Consumer Wastes, directed by the UNSW SMaRT Centre, to develop scalable technologies that transform textile waste into new materials and products. This collaboration aims to address Australia's high textile consumption and landfill rates by advancing circular solutions for hard-to-recycle fabrics. By integrating TRA's recycling expertise with the Hub's research capabilities, the initiative strengthens the textile recycling market through innovation, industry collaboration, and the promotion of sustainable manufacturing practices.

Australia Textile Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cotton Recycling, Wool Recycling, Polyester and Polyester Fiber Recycling, Nylon and Nylon Fiber Recycling, Others |

| Textile Wastes Covered | Pre-consumer Textile, Post-consumer Textile |

| Distribution Channels Covered | Online Channel, Retail and Departmental Store |

| End Uses Covered | Apparel, Industrial, Home Furnishings, Non-woven, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia textile recycling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia textile recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia textile recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The textile recycling market in Australia was valued at USD 108.00 Million in 2024.

The Australia textile recycling market is projected to exhibit a CAGR of 2.42% during 2025-2033.

The Australia textile recycling market is projected to reach a value of USD 133.93 Million by 2033.

Australia’s textile recycling market is witnessing increased investment in circular fashion, advanced fiber recovery technologies, and brand-led sustainability initiatives. Growing public awareness, government-backed recycling targets, and demand for eco-friendly apparel are accelerating the shift toward a more sustainable textile economy.

Australia’s textile recycling market is propelled by heightened environmental concerns among consumers, government mandates promoting circular economy practices, and scalable collection-and-sorting infrastructure. Technological advancements in fiber regeneration, coupled with corporate sustainability commitments from fashion brands, are further accelerating recycling activity and infrastructure investment.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)