Australia Theme Parks and Amusement Parks Market Report by Type (Theme Park, Water Park, Amusement Arcades), Ride (Mechanical Rides, Water Rides, and Others), Gender (Female, Male), Age Group (Up to 18 Years, 19-35 Years, 36-50 Years, 51-65 Years, More than 65 Years), Revenue Source (Ticket, Food and Beverages, Hotels/Resorts, Merchandise, and Others), and Region 2025-2033

Australia Theme Parks and Amusement Parks Market Overview:

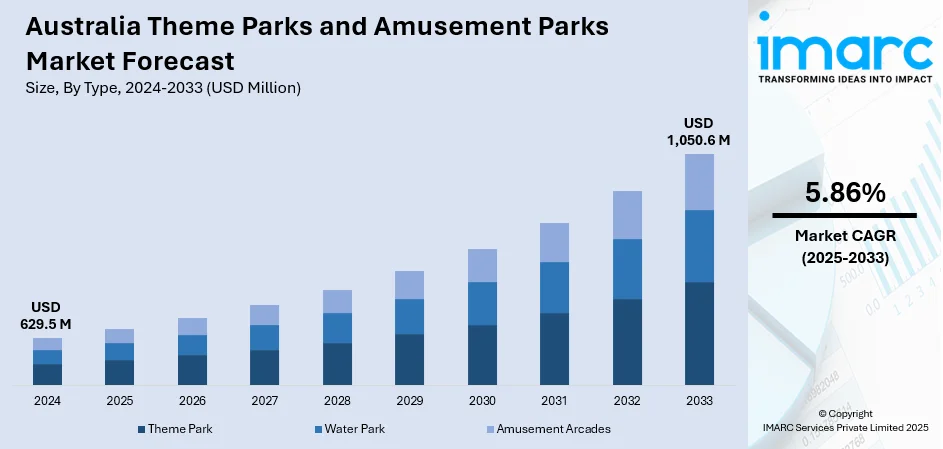

The Australia theme parks and amusement parks market size reached USD 629.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,050.6 Million by 2033, exhibiting a growth rate (CAGR) of 5.86% during 2025-2033. The market is growing due to rising domestic tourism, family-oriented entertainment preferences, expanding park facilities, the integration of innovative rides, immersive experiences, and seasonal events.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 629.5 Million |

| Market Forecast in 2033 | USD 1,050.6 Million |

| Market Growth Rate 2025-2033 | 5.86% |

Australia Theme Parks and Amusement Parks Market Trends:

Rising Popularity of Family-Oriented Experiences

Australia's theme parks and amusement parks are increasingly focusing on family-friendly attractions to tap into the growing demand for wholesome entertainment. Parks are diversifying their offerings with rides, shows, and interactive experiences aimed at children and multi-generational groups. According to the Australian Bureau of Statistics (ABS), couples with children make up approximately 43.7% of all households in Australia. This demographic shift is prompting theme parks to create more engaging environments for family bonding. Parks are now offering diverse dining options, toddler-specific rides, and special family packages to enhance the experience. This focus on families is a major trend in the market, as it attracts repeat visitors who seek quality time together in fun, safe environments. Moreover, special events, such as holiday festivals and family-friendly movie-themed attractions, are further solidifying parks as key destinations for family vacations. This shift is anticipated to drive long-term growth, especially with Australian families favoring domestic leisure activities.

To get more information on this market, Request Sample

Investment in Smart Technology and Digital Transformation

The integration of smart technology in Australia’s theme parks is revolutionizing visitor experiences and operational efficiency. Many parks are adopting digital ticketing, mobile apps, and virtual queuing systems, minimizing wait times, and improving crowd management. As per Australian Communications and Media Authority, nearly all people living in Australia (99%) accessed the internet in 2020 (up from 90% in 2019). Theme parks now use this to their advantage, including app-based services that range from virtual maps and the wait times of rides to real-time notifications regarding events. This increases visitor convenience. Further, some parks have initiated the usage of augmented and virtual reality attractions, wherein the incorporation of technology in traditional rides enables these immersive experiences. These appeal to techno-savvy audiences and increase park attendance with unique and interactive forms of entertainment. Similarly, smart technology aids in collecting information regarding visitor preferences; hence, it helps parks market themselves better and plan future attractions. As digital transformation development proceeds, this trend is expected to continue growing in the entertainment industry within the country.

Focus on Sustainable Practices and Eco-Friendly Attractions

Sustainability is emerging as a significant trend in Australia’s theme parks and amusement parks. Parks are adopting eco-friendly practices to reduce their environmental impact and align with the growing demand for sustainable tourism. In response, parks are introducing energy-efficient rides, recycling programs, and water conservation measures to meet these expectations. Some parks are also investing in solar energy to power their operations and using sustainable building materials for new developments. Beyond environmental benefits, these initiatives appeal to eco-conscious consumers, who are increasingly seeking experiences that align with their values. Additionally, parks are launching green-themed attractions and educational programs focused on conservation, creating a dual benefit of entertainment and environmental awareness. This commitment to sustainability is improving the operational efficiency of the parks and enhancing their brand image, attracting a wider audience interested in responsible tourism.

Australia Theme Parks and Amusement Parks Market News:

- On January 12, 2024: a number of announcements have been made over the past couple of years suggesting the completion and opening of new theme park rides across Australia and Asia. The anticipated opening for The Jungle Rush roller coaster at Dreamworld in Australia is late 2024. The $35 million Jungle Rush rollercoaster to be built by Dutch ride specialist Vekoma will feature a 'world-first inclined turntable', which can be used to rotate the individual cars in the ride.

- On 29 Jan 2024, Dreamworld, a leading Australian summer attraction, has teamed up with Origin Zero to install the largest solar power system in any Australian theme park. The 708-kilowatt system marks a major milestone in the park's efforts to lower carbon emissions and adopt renewable energy initiatives.

Australia Theme Parks and Amusement Parks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, rides, gender, age group, and revenue sources.

Type Insights:

- Theme Park

- Water Park

- Amusement Arcades

The report has provided a detailed breakup and analysis of the market based on the type. This includes theme park, water park, and amusement arcades.

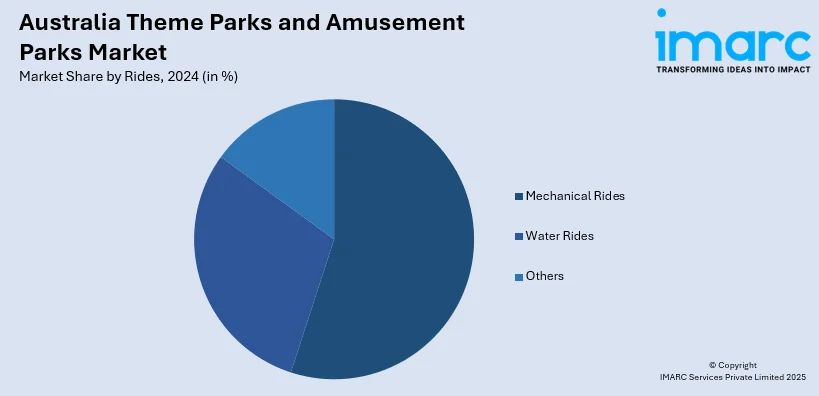

Rides Insights:

- Mechanical Rides

- Water Rides

- Others

A detailed breakup and analysis of the market based on the rides have also been provided in the report. This includes mechanical rides, water rides, and others.

Gender Insights:

- Female

- Male

The report has provided a detailed breakup and analysis of the market based on the gender. This includes female and male.

Age Group Insights:

- Up to 18 Years

- 19-35 Years

- 36-50 Years

- 51-65 Years

- More than 65 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes up to 18 years,19-35 years, 36-50 years, 51-65 years, and more than 65 years.

Revenue Sources Insights:

- Ticket

- Food and Beverages

- Hotels/Resorts

- Merchandise

- Others

The report has provided a detailed breakup and analysis of the market based on the revenue sources. This includes ticket, food and beverages, hotels/resorts, merchandise, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Theme Parks and Amusement Parks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Theme Park, Water Park, Amusement Arcades |

| Rides Covered | Mechanical Rides, Water Rides, Others |

| Genders Covered | Female, Male |

| Age Groups Covered | Up to 18 Years, 19-35 Years, 36-50 Years, 51-65 Years, More than 65 Years |

| Revenue Sources Covered | Ticket, Food and Beverages, Hotels/Resorts, Merchandise, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia theme parks and amusement parks market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Australia theme parks and amusement parks market?

- What is the breakup of the Australia theme parks and amusement parks market on the basis of type?

- What is the breakup of the Australia theme parks and amusement parks market on the basis of rides?

- What is the breakup of the Australia theme parks and amusement parks market on the basis of gender?

- What is the breakup of the Australia theme parks and amusement parks market on the basis of age group?

- What is the breakup of the Australia theme parks and amusement parks market on the basis of revenue sources?

- What are the various stages in the value chain of the Australia theme parks and amusement parks market?

- What are the key driving factors and challenges in the Australia theme parks and amusement parks?

- What is the structure of the Australia theme parks and amusement parks market and who are the key players?

- What is the degree of competition in the Australia theme parks and amusement parks market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia theme parks and amusement parks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia theme parks and amusement parks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia theme parks and amusement parks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)