Australia Tissue Paper Market Size, Share, Trends, and Forecast by Product Type, Raw Material, Distribution Channel, Application, and Region, 2025-2033

Australia Tissue Paper Market Overview:

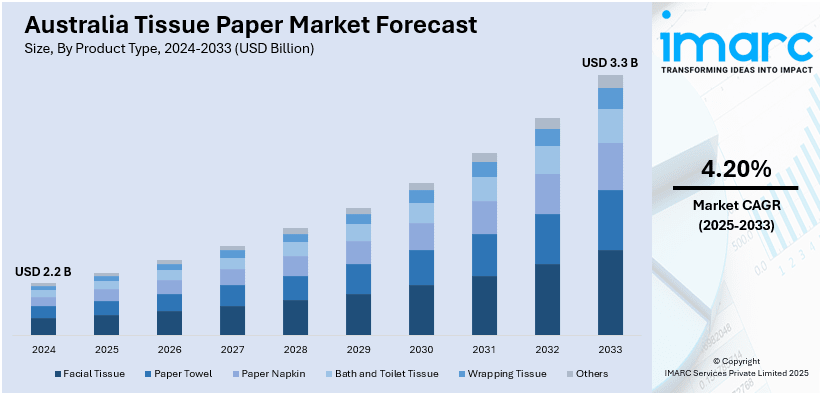

The Australia tissue paper market size reached USD 2.2 Billion in 2024. Looking forward the market is expected to reach USD 3.3 Billion by 2033, exhibiting a growth rate (CAGR) of 4.20% during 2025-2033. The market is driven by increasing hygiene awareness, rising demand for sustainable and eco-friendly products, population growth, and expanding hospitality and healthcare sectors. Technological advancements in production and e-commerce growth also contribute to Australia tissue paper market growth, enhancing accessibility and consumer convenience.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.2 Billion |

| Market Forecast in 2033 | USD 3.3 Billion |

| Market Growth Rate 2025-2033 | 4.20% |

Key Trends of Australia Tissue Paper Market:

Increasing Hygiene Awareness and Health Concerns

The increasing awareness about personal hygiene and sanitation boosts the demand for tissue paper in Australia. Consumers are more conscious of preventing germs and infections, especially after the COVID-19 pandemic, leading to higher consumption of facial tissues, toilet paper, and hand towels. The preference for disposable hygiene products in homes, workplaces, and public spaces further fuels the Australia tissue paper market share. The continuous focus on cleanliness throughout restaurants, as well as schools and offices, creates reliable market demand. As hygiene habits continue to evolve, tissue paper products remain essential for maintaining public health and personal well-being across various industries and households. For instance, in July 2024, Yarn’n, an Australian company owned by First Nations, launched its fully recycled toilet paper obtained solely from Forest Stewardship Council (FSC) certified forests. The company stated that its production processes focus on resource conservation, utilizing 50% less water and 90% less energy compared to conventional methods. Yarn’n remarked that this pledge lessens environmental harm and also promotes sustainable forestry methods that honor Indigenous Peoples’ rights and protect local wildlife.

To get more information on this market, Request Sample

Rising Demand for Sustainable and Eco-Friendly Products

Environmental concerns and consumer preferences for sustainable products are driving the shift toward eco-friendly tissue paper. Many Australians are opting for recycled, biodegradable, and bamboo-based tissues to reduce environmental impact, which is creating a positive impact on the Australia tissue paper market outlook. The manufacturing industry implements green practices by selecting sustainable materials along with adopting efficient water conservation techniques and switching to plastic-free packaging. Government policies and activities that encourage sustainability help to provide the conditions for this trend. Supermarkets and retailers introduce additional options of sustainable tissue products to fulfill their customers' environmental concerns. As sustainability continues to influence purchasing decisions, the market for green alternatives in tissue paper products is expected to grow significantly in the coming years. According to a Monash University survey, nearly half of Australian consumers (46%) think that sustainability is now a significant consideration when making retail purchases. Australia is one of the biggest markets for toilet paper in terms of volume growth. Toilet paper is predicted to increase in volume by 1.8% in 2025, with a total import of 95.7 million USD in 2023. As consumers place a greater emphasis on making environmentally friendly decisions, the market for sustainable and eco-friendly hygiene tissue and paper is continuously expanding.

Multifunctional Tissue Paper Formats

The tissue paper market in Australia is experiencing a trend towards versatile products that provide greater convenience. Consumers are increasingly choosing tissue items that fulfill multiple functions such as wet wipes for hygiene, facial rounds for skincare, and combination packs for various household needs. These options cater to busy lifestyles and deliver value through their adaptability in personal and home care routines. Brands are innovating in packaging and design to introduce compact, user-friendly, and travel-ready products. This trend is broadening consumer interest and promoting diversification in the Australian tissue paper market.

Growth Factors of Australia Tissue Paper Market:

Growth in Hospitality and Healthcare Industries

The expanding hospitality and healthcare sectors in Australia are significantly driving the demand for tissue paper products. Establishments like hotels, restaurants, clinics, and hospitals require a regular supply of tissues for sanitization, patient care, and guest services. Stringent hygiene requirements in these fields have turned tissue paper into a basic necessity. From napkins and facial tissues to paper towels and toilet paper, institutional demand is rapidly rising. This bulk consumption from commercial entities ensures consistent and large-scale demand, playing a significant part in the overall growth of the Australian tissue paper market.

Increasing Demand for Convenience Products

Australian consumers are living increasingly busy lifestyles, and this is creating a high demand for handy, easy-to-use tissue products. Products such as pocket-sized facial tissues, kitchen rolls, and wet wipes cater to individuals' and families' everyday hygiene requirements with minimal effort. Their convenience, portability, and ready availability make them ideal to take along when traveling, commuting, or participating in outdoor sports. This trend is especially prominent in working professionals, students, and families looking for convenient hygiene solutions. With convenience emerging as a key driver in buying choices, tissue paper brands are optimizing packaging and product forms to cater to this demand, complementing growth in the Australian tissue paper market.

Rising Preference for Premium Products

Australian consumers are increasingly seeking premium tissue products that offer better softness, strength, and comfort. This trend is driven by increased disposable incomes and a desire for higher quality and performance expectations. Premium products tend to have multi-ply construction, advanced embossing, and dermatologically tested materials, which make them appealing for personal care. Brands also market the products with added features such as fragrances and sustainable sourcing. This willingness to pay for improved quality tissue products is not just building loyalty but also increasing average unit price, which alone contributes the most towards the Australian tissue paper market's value growth.

Key Market Factors of Australia Tissue Paper Market:

Advancements in Technology

Technological innovation in the tissue paper manufacturing sector is crucial for enhancing overall efficiency, consistency, and product quality. Modern paper processing machinery allows for faster production, reduced waste, and lower energy consumption. Automation has streamlined different stages of production such as cutting, embossing, folding, and packaging resulting in improved precision and uniformity. These technological advancements also enable innovation in product characteristics such as texture, softness, and strength, aligning with changing consumer expectations. Additionally, technology facilitates scalable and cost-efficient operations, helping manufacturers to remain competitive in a sensitive pricing environment. Continuous investment in machinery and smart manufacturing solutions is, therefore, boosting output and profitability in the Australian tissue paper market.

Evolving Consumer Preferences

Consumer expectations in Australia are shifting towards premium, specialized, and multifunctional tissue products. Shoppers are no longer satisfied with basic functionality; they now desire options that provide softness, durability, skin-friendliness, and even extra benefits like fragrance or antibacterial properties. There is also a growing preference for hypoallergenic and chemical-free products, particularly among families and individuals with sensitive skin. As awareness of health and environmental issues rises, consumers are favoring responsibly sourced and eco-labeled tissue brands. These changing demands are prompting manufacturers to reconsider product development, packaging design, and marketing strategies. Adapting to these evolving preferences is crucial for remaining relevant and achieving growth in the competitive Australian tissue paper market.

Expansion of Retail Channels

The ongoing development of retail infrastructure across Australia ranging from large supermarket chains to smaller convenience stores and online platforms is significantly improving the availability and visibility of tissue paper products. Consumers now have access to a wider variety of brands and options than ever before, enhancing their purchasing experience. E-commerce platforms, in particular, are driving growth by offering home delivery, subscription services, and discounts, making tissue paper purchases more convenient than ever. Retailers are also providing private label options, appealing to value-driven buyers. This widespread access across multiple retail channels is increasing consumer reach, encouraging impulse buying, and strengthening market penetration making retail expansion a key enabler in the growth of the Australia tissue paper market.

Australia Tissue Paper Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, raw material, distribution channel, and application.

Product Type Insights:

- Facial Tissue

- Paper Towel

- Paper Napkin

- Bath and Toilet Tissue

- Wrapping Tissue

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes facial tissue, paper towel, paper napkin, bath and toilet tissue, wrapping tissue, and others.

Raw Material Insights:

- Woodfree Pulp

- Wood-containing Pulp

- Recovered Paper

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes woodfree pulp, wood-containing pulp, and recovered paper.

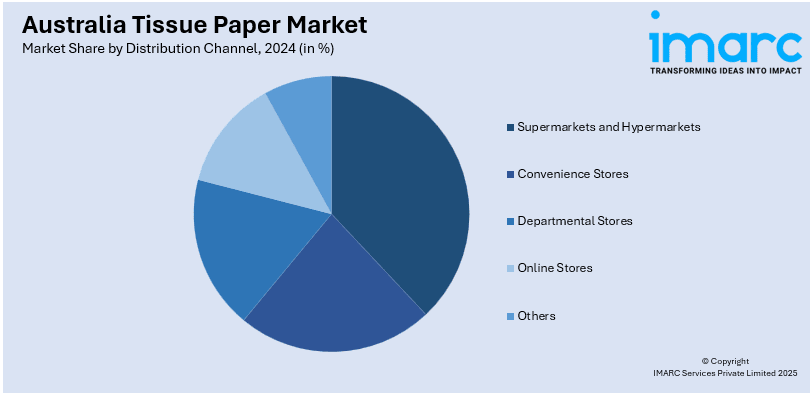

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Departmental Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, departmental stores, online stores, and others.

Application Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and commercial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Tissue Paper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Facial Tissue, Paper Towel, Paper Napkin, Bath and Toilet Tissue, Wrapping Tissue, Others |

| Raw Materials Covered | Woodfree Pulp, Wood-Containing Pulp, Recovered Paper |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Departmental Stores, Online Stores, Others |

| Applications Covered | Residential, Commercial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia tissue paper market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia tissue paper market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia tissue paper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tissue paper market in the Australia was valued at USD 2.2 Billion in 2024.

The Australia tissue paper market is projected to exhibit a compound annual growth rate (CAGR) of 4.20% during 2025-2033.

The Australia tissue paper market is expected to reach a value of USD 3.3 Billion by 2033.

The market is evolving with a push toward eco-friendly, recycled materials and plastic-free packaging. Multi-functional formats like wet wipes, facial rounds, and kitchen towels are gaining popularity. Additionally, consumers are drawn to premium offerings emphasizing softness and strength, driven by lifestyle and quality preferences.

Increasing hygiene awareness and urban population growth are boosting per capita usage of tissue papers. Expansion across hospitality, healthcare, and retail sectors, and busy modern lifestyles also fuel preferences for convenient, disposable formats. Rising environmental consciousness is also driving consumer interest in recycled and sustainably sourced tissue products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)