Australia Tomato Ketchup Market Size, Share, Trends and Forecast by Type, Packaging, Distribution Channel, Application and Region, 2025-2033

Australia Tomato Ketchup Market Overview:

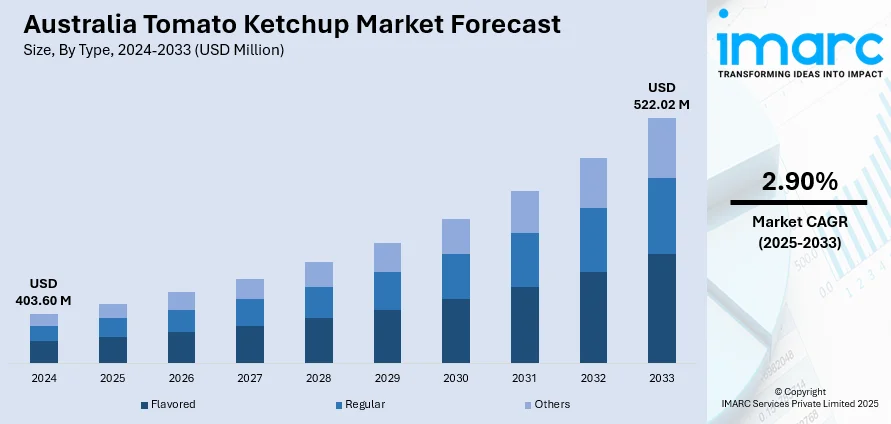

The Australia tomato ketchup market size reached USD 403.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 522.02 Million by 2033, exhibiting a growth rate (CAGR) of 2.90% during 2025-2033. The market is fueled by changing consumer preferences, growing multicultural food influences, and expanding demand for gourmet and artisanal condiments. Consumers are also seeking out premium ketchup brands with distinctive ingredients such as indigenous spices and exotic fruits. The trend toward locally sourced ingredients and eco-friendly packaging options, along with growth in foodservice sector and increasing popularity of home cooking are also fueling the Australia tomato ketchup market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 403.60 Million |

| Market Forecast in 2033 | USD 522.02 Million |

| Market Growth Rate 2025-2033 | 2.90% |

Australia Tomato Ketchup Market Trends:

Rise of Private Labels and Local Handcraft Brands

One of the recent trends in the Australian ketchup market is the swift growth of private label and local artisanal brands. Consumers are now more inclined toward supermarket-owned or independent Australian-produced ketchup products that provide value for money, honesty, and community support. Private labels are enhancing their quality and expanding their flavor ranges to compete with well-established global brands. Concurrently, artisanal and small-batch producers are gaining popularity by highlighting local ingredients, manual processes, and distinctive flavor profiles that capture Australian culinary identity. This trend is most pronounced among younger, ethically aware consumers who prefer to buy from homegrown brands rather than from multinational companies. Such products are typically accompanied by clean-label credentials, sustainable packaging, and inspiring origin stories features that appeal to contemporary consumers. As loyalty shifts toward authenticity and innovation, supermarket chains and specialty producers are defining a competitive and dynamic ketchup market landscape in Australia.

To get more information on this market, Request Sample

Expansion Through Foodservice and Quick-Service Restaurants

The foodservice sector, including restaurants, cafes, and quick-service restaurants, is instrumental in propelling the Australia tomato ketchup market growth. As the culture of takeaway and eating out gathers momentum, particularly in city centers, the demand for quick and quality condiments such as ketchup is growing. According to the IMARC Group, the Australia fast food and quick service restaurant market size had reached USD 5.3 Billion in 2024. This market is further expected to reach an amount of USD 7.5 Billion by 2033, exhibiting a growth rate (CAGR) of 3.92% during 2025-2033. Hence, while several businesses are offering ketchup as a complimentary dip, they are also adding it as part of signature dishes and recipes, creating a variety of patented mixes and bespoke condiments. Most foodservice operators also demand ketchup in bulk, sustainable, or locally produced form, making suppliers accommodate individualized B2B demands. Moreover, the popularity of Australian-style fusion dishes like that of beetroot burgers or loaded fries has extended the use of ketchup in different food applications. This trend solidifies relationships among ketchup makers and the foodservice industry, resulting in co-creation of products specifically for commercial kitchens and creating steady, high-volume demand.

Impact of Global Cuisine on Local Consumption Habits

Australia's multicultural society continues to shape how consumers interact with condiments, such as tomato ketchup. As families adopt more internationally influenced meals, ketchup is increasingly being adopted to serve functions beyond classic Australian staples such as meat pies or sausage rolls. Consumers are now combining ketchup with foreign dishes or as a base for fusion sauces in American, Asian, or Middle Eastern-inspired recipes. This expansion of usage has encouraged brands to develop ketchup recipes to suit these varied needs adding spice, tangy flavorings, or local herbs to appeal to different palates. The merging of global flavors with a familiar product is boosting the relevance of ketchup, in a marketplace where consumers' choice of condiments is expanding rapidly.

Australia Tomato Ketchup Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, packaging, distribution channel, and application.

Type Insights:

- Flavored

- Regular

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes flavored, regular, and others.

Packaging Insights:

- Pouch

- Bottle

- Others

A detailed breakup and analysis of the market based on the packaging has also been provided in the report. This includes pouch, bottle, and others.

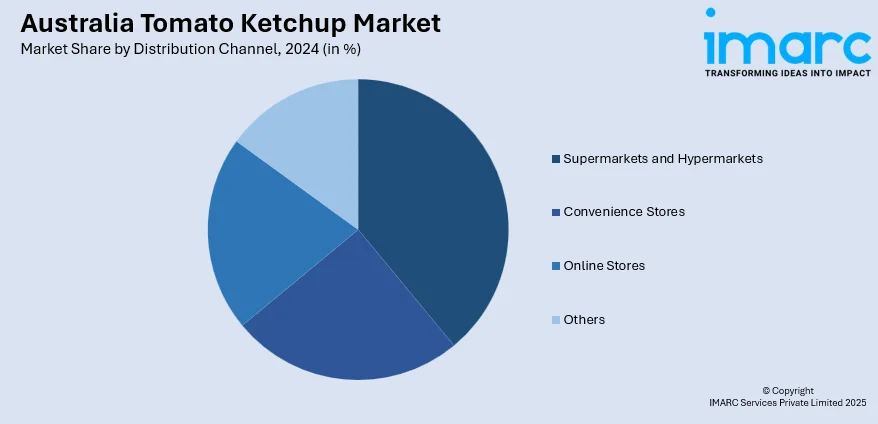

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, online stores, and others.

Application Insights:

- Household

- Commercial

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes household, commercial, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Tomato Ketchup Market News:

- In September 2024, to introduce Heinz Pickle-flavored Ketchup to Australians, TBWA\Sydney and Eleven deployed a human pickle at the La Tomatina festival, famously held in Spain – a straightforward and striking moment to honor the distinctive flavor profile. The initiative kicked off through social media, more than hundreds of candidates competing for the position, with one fortunate individual ultimately sporting the tailor-made Pickle costume and heading to Spain for the festival.

- In April 2025, Lakanto Australia, the monkfruit sweetener brand introduced the No Sugar Added Tomato Ketchup and BBQ Sauce, providing a healthy alternative. The company states that these sauces are sweetened with Lakanto’s monkfruit sweetener, which do not contain any artificial flavors or colors, and are low in carbohydrates. This makes them appropriate for those on keto, low-carb, or diabetic meal plans.

Australia Tomato Ketchup Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flavored, Regular, Others |

| Packagings Covered | Pouch, Bottle, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Applications Covered | Household, Commercial, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia tomato ketchup market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia tomato ketchup market on the basis of type?

- What is the breakup of the Australia tomato ketchup market on the basis of packaging?

- What is the breakup of the Australia tomato ketchup market on the basis of distribution channel?

- What is the breakup of the Australia tomato ketchup market on the basis of application?

- What is the breakup of the Australia tomato ketchup market on the basis of region?

- What are the various stages in the value chain of the Australia tomato ketchup market?

- What are the key driving factors and challenges in the Australia tomato ketchup market?

- What is the structure of the Australia tomato ketchup market and who are the key players?

- What is the degree of competition in the Australia tomato ketchup market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia tomato ketchup market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia tomato ketchup market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia tomato ketchup industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)