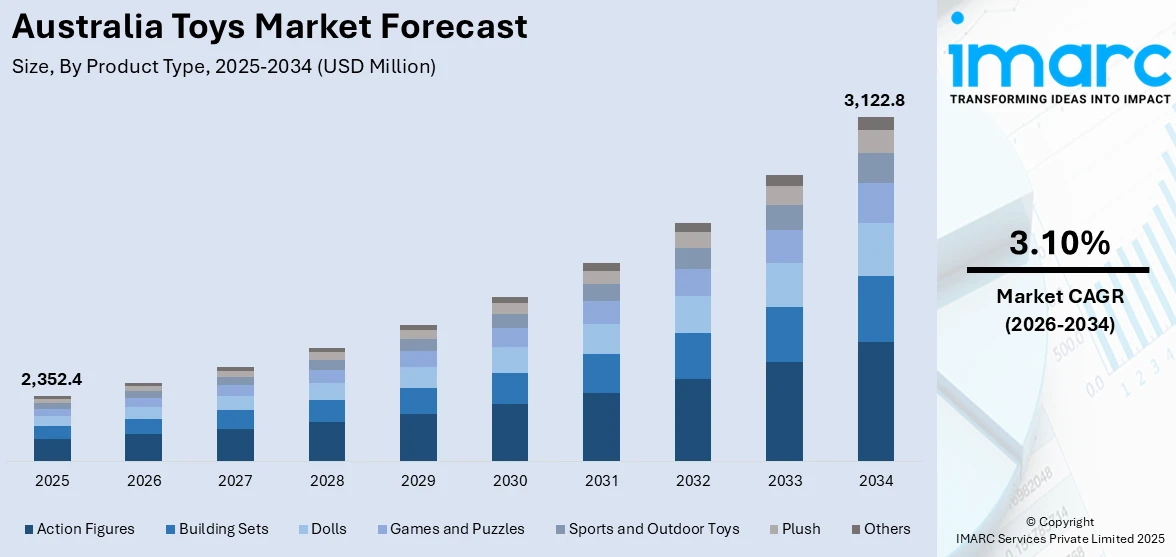

Australia Toys Market Report by Product Type (Action Figures, Building Sets, Dolls, Games and Puzzles, Sports and Outdoor Toys, Plush, and Others), Age Group (Up to 5 Years, 5 to 10 Years, Above 10 Years), Sales Channel (Supermarkets and Hypermarkets, Specialty Stores, Department Stores, Online Stores, and Others), and Region 2026-2034

Market Overview:

Australia toys market size reached USD 2,352.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,122.8 Million by 2034, exhibiting a growth rate (CAGR) of 3.10% during 2026-2034. Key players are incorporating interactive features and digital interfaces to adapt to modern learning methods, which is primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,352.4 Million |

| Market Forecast in 2034 | USD 3,122.8 Million |

| Market Growth Rate (2026-2034) | 3.10% |

Toys are objects created for the purpose of play, amusement, and education, primarily designed for children. These items have diverse functions, ranging from sparking creativity and supporting cognitive development to facilitating social interaction. Toys manifest in various forms, including action figures, dolls, puzzles, board games, building blocks, and electronic devices. They play a pivotal role in the holistic growth of a child, impacting their physical, emotional, and intellectual development. Engaging with toys aids children in refining motor skills, enhancing hand-eye coordination, and honing problem-solving capabilities. Through imaginative play with toys, children can explore different scenarios, promoting emotional expression and empathy. Educational toys are crafted to impart concepts like letters, numbers, and shapes, transforming learning into an interactive and enjoyable experience. Beyond their developmental roles, toys carry cultural significance, reflecting prevailing societal values and trends. As children interact with toys, they cultivate social skills, learning to share, cooperate, and negotiate with others.

To get more information on this market Request Sample

Key Trends of Australia Toys Market:

Ethical Sourcing and Sustainability

There is a rising cultural transition toward sustainability that profoundly affects the Australia toys market demand. Customers—particularly millennial and Gen Z parents—are increasingly becoming aware of the environmental cost of products they purchase for their kids. This increases calls for toys produced using recyclable, biodegradable, or sustainably sourced materials. Retailers are reacting by bringing eco-friendly ranges to the fore, and Australian producers are embracing plastic alternatives like FSC-certified wood and organic cotton. Toy manufacturers are also committing to waste-minimizing packaging innovation as part of Australia's wider zero-waste agenda. Brands like Happy Planet Toys in Australia are also making waves with their locally produced, recycled-plastic toys, resonating both with consumer values and local innovation. As purchasing decisions are becoming driven by sustainability, firms that believe in openness in production and sourcing are experiencing greater brand loyalty in a market where ethical consumption is rapidly becoming a family value.

Local Content, Licensing, and Cultural Relevance

According to the Australia toys market analysis, consumers have a significant preference for toys that are culturally Australian, tell stories, and are inspired by the media. Licensing agreements associated with mainstream Australian children's franchises—such as Bluey, The Wiggles, and Play School—remain at the forefront of driving sales and shaping product design. These brands are so resonant with local customers because they are familiar, edutainment-focused, and relevant to culture. This trend is being followed in board games and puzzles featuring Australian animals, landmarks, and Aboriginal themes, serving both as entertainment and learning about culture. Product design aims and brand localization are becoming the major differentiators for local and international businesses vying to capture market share. Additionally, Indigenous-owned business support by the government and the community is leading to increased representation of Aboriginal stories in children's games and activities. This increasing need for locally relevant and culturally contextualized products reflects the way that the Australian market connects not only with international trends but also with national identity and narrative.

Hybrid Play Experiences and Digital Integration

In Australia, the line between physical toys and digital experiences is becoming progressively blurred. Play patterns for children have changed with ubiquitous access to tablets, smartphones, and interactive apps, and demand for hybrid toys, which blend tactile interaction with screen-based interaction, is being stimulated. Parents are looking for products that are both entertaining and educational, leading to expansion in toys that incorporate augmented reality (AR), coding components, and app-based learning. Australian toy stores are reacting by carrying an increasing number of STEM and STEAM toys that address this move. Meanwhile, smart toys that evolve with a child's development or provide multi-sensory play are becoming popular. Stores are also taking advantage of this digital revolution in marketing by including QR codes, virtual store experiences, and influencer-driven digital campaigns. The outcome is a market in which interactivity and innovation are not nice-to-haves but necessities. For Australian businesses, incorporating technology in ways that are meaningful to the local learning culture and ethics is becoming an important differentiator, which further contributes to increasing the Australis toys market share.

Growth Drivers of Australia Toys Market:

Nostalgia and Licensing Synergy

The growth of the Australian toy market is largely driven by a return of nostalgic and licensed toys, which have a mass appeal to children and adults alike. Beloved franchises like Teenage Mutant Ninja Turtles, He‑Man, and My Little Pony are returning in great strength, with parents now introducing these timeless characters to their kids. This ensures a multigenerational appeal and increases product longevity and demand. Moreover, Australian-bred brands such as Bluey have turned into cultural icons, both locally and overseas, proving the power of indigenous content. Such characters' popularity means more toy sales and brand loyalty. Furthermore, toy libraries in places such as Melbourne are being funded by local grants, making high-quality toys available more widely, particularly for families with children with disabilities. These consumer-led resources assist with the development of robust early connections with toys that can carry over into consumer behavior as kids age. This combination of nostalgia, cultural heritage, and consumer convenience helps drive market momentum.

Innovation, STEM Education, and Digital Integration

Innovation is a key growth driver in the Australian toy industry, particularly in the spheres of STEM education and digital play. Parents and Australian schools alike are giving growing importance to toys that focus on science, technology, engineering, and mathematics abilities. This is evident in growing demand for coding kits, robot toys, and interactive learning tools. Australia's intense interest in preparing children for a technology-oriented future guarantees that teaching toys will continue to discover a welcoming market. Meanwhile, augmented reality and app-based toys are gaining popularity, providing an interactive combination of physical and digital play. Large international brands are developing partnerships that balance screen time with hands-on play, while local designers are starting to include Indigenous views and inclusive design guidelines, which ring well with multicultural Australia. While these criterias place toys as play materials, they also establish them as significant learning tools, enhancing their role in the eyes of schools and parents alike.

Collectibles Culture and Adult Involvement

One of the burgeoning developments in Australia's toy industry is the growth of collectible culture and adult consumer involvement. Collectable toys, particularly those with surprise factors such as blind boxes or limited releases, have become incredibly popular with Gen Z and Millennials. These items capitalize on the thrill of discovery and the experience of exclusivity that appeal to younger adults just as much as they do to children. Social media has accelerated this trend, as unboxing videos and fan sites fuel further engagement and interest. Additionally, domestic players such as Moose Toys are at the forefront with successful lines of collectibles featuring rich storytelling and cross-platform content. This two-pronged appeal to children and adults has served to extend the toy market beyond traditional age demographics. Adults are purchasing toys for kids while also collecting for themselves, which is fueling a larger economy of toys that encompasses events, fan conventions, and online trading networks. This increasing demographic diversification is stimulating the business and creating new opportunities for long-term growth.

Challenges of Australia Toys Market:

Supply Chain & Increasing Costs with Import Dependencies

Australia's toy industry is highly dependent on imports, especially from China, which makes it vulnerable to supply chain disruptions and currency-driven cost fluctuations. Importers have to deal with complicated logistics, high freight costs, and fluctuating exchange rates, all of which complicate planning and pricing strategies. These are made worse by strict ACCC safety standards: each toy must pass stringent requirements for materials, packaging, and production—and shipments non-compliant with standards run the risk of being delayed or rejected at the border. For small retailers without economies of scale, taking this cost hit translates into low margins, forcing them either to inflate prices or reduce product range, compromising competitiveness against their big rivals. Overall, the import reliance of Australia introduces risks that require effective risk mitigation and adaptive sourcing approaches that can accommodate both regulatory and logistical complexities.

Regulatory Pressure & Counterfeit Risks

The Australian Competition and Consumer Commission (ACCC) strictly enforces toy safety standards that are in sync with global standards, raising compliance costs for domestic players and importers. The strict regime protects consumers but necessitates ample testing and documentation, which can slow market entry for smaller or niche players. In the meantime, the imports of fake toys only add to the complexity, posing safety and brand dilution threats. Australian companies such as Moose Toys reported counterfeit knockoffs that could have hazardous materials inside them. Aside from safety concerns, counterfeit toys undermine consumer confidence and divert demand away from authentic compliant products. Distributors need to strengthen product authentication, invest in legal protection, and work with enforcement authorities to safeguard public safety and their brands.

Digital Disruption, Age Compression & E-Commerce Competition

Australian kids are increasingly relying on screens and digital play, leaving traditional physical toys in the lurch. The mobile gaming boom, video streaming, and app-based play have caused "age compression," where children rapidly progress to digital and sophisticated toys, even exiting dolls or simple playsets at earlier ages. Retailers are fighting back with app-enabled or AR-enabled toys, but these require a lot of investment—and run the risk of quick obsolescence in the face of changing tech trends. And national toy retailers are also battling intense competition from international e-commerce players and cheap imports from operators like Temu or Shein. While initiatives such as GST on overseas online buys have been instituted, these only somewhat equalize the game. To remain competitive, local toy businesses must excel in unique offerings, customer service, and omnichannel experiences while navigating evolving play patterns and digital threats.

Australia Toys Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, age group, and sales channel.

Product Type Insights:

- Action Figures

- Building Sets

- Dolls

- Games and Puzzles

- Sports and Outdoor Toys

- Plush

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes action figures, building sets, dolls, games and puzzles, sports and outdoor toys, plush, and others.

Age Group Insights:

- Up to 5 Years

- 5 to 10 Years

- Above 10 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes up to 5 years, 5 to 10 years, and above 10 years.

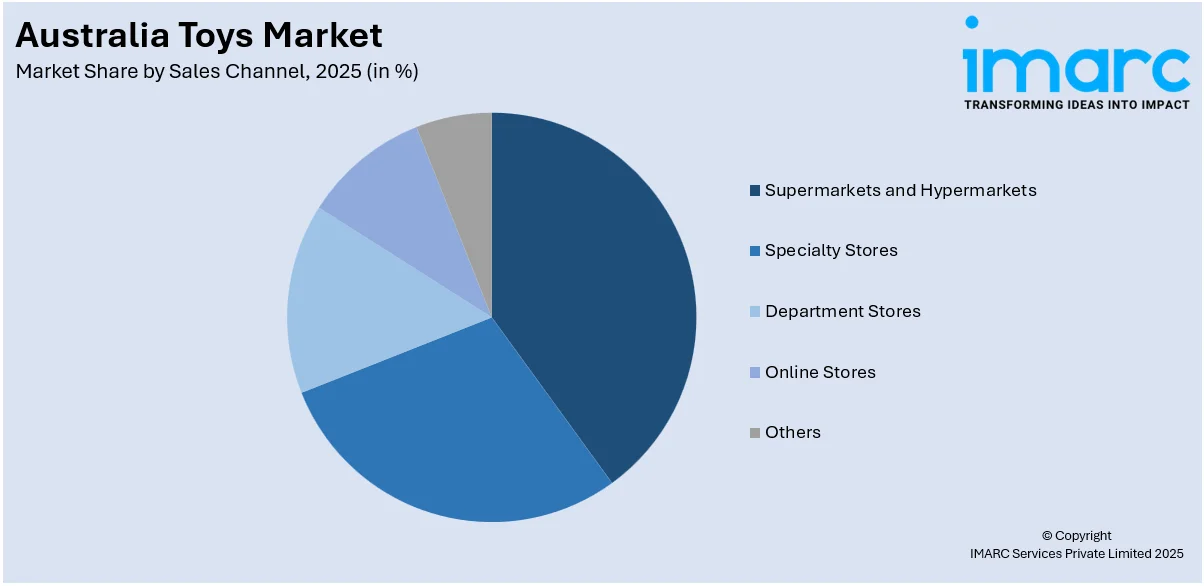

Sales Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Department Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the Sales Channel. This includes supermarkets and hypermarkets, specialty stores, department stores, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Hasbro

- Jazwares, LLC (Berkshire Hathaway Inc.)

- Mattel

- Moose Toys

- The LEGO Group

- Windmill Toys

- ZURU Toys

Australia Toys Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Action Figures, Building Sets, Dolls, Games and Puzzles, Sports and Outdoor Toys, Plush, Others |

| Age Groups Covered | Up to 5 Years, 5 to 10 Years, Above 10 Years |

| Sales Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Department Stores, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Hasbro, Jazwares, LLC (Berkshire Hathaway Inc.), Mattel, Moose Toys, The LEGO Group, Windmill Toys, ZURU Toys, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia toys market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia toys market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia toys industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia toys market is projected to exhibit a CAGR of 3.10% during 2026-2034.

Australia's toys market is sustained by high demand for educational and eco-friendly products, and increased interest in technology-integrated play. Seasonal gift-giving, solid e-commerce platforms, and knowledge about the development tools of children also propel growth, making innovation and cultural trendiness principal drivers of the market.

Australia's toy market trends are characterized by the popularity of licensed local content such as Bluey; and increased interest in hybrid play engaging the physical toy space with digital/AR aspects. Retailers are responding with omnichannel strategies and STEM-based offerings.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)