Australia Truck Market Size, Share, Trends and Forecast by Vehicle Type, Tonnage Capacity, Fuel Type, Application, and Region, 2025-2033

Australia Truck Market Overview:

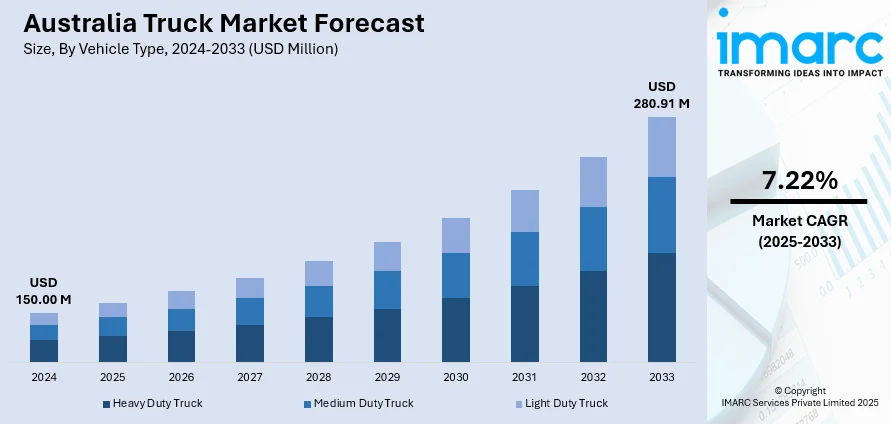

The Australia truck market size reached USD 150.00 Million in 2024. Looking forward, the market is projected to reach USD 280.91 Million by 2033, exhibiting a growth rate (CAGR) of 7.22% during 2025-2033. The market involves growing demand for freight and logistics services, rising focus on sustainability, government infrastructure investments, and technological advancements. Fleet operators are adopting cleaner, safer, and more efficient vehicles to meet regulatory standards, reduce costs, and align with shifting consumer and environmental expectations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 150.00 Million |

| Market Forecast in 2033 | USD 280.91 Million |

| Market Growth Rate 2025-2033 | 7.22% |

Key Trends of Australia Truck Market:

Rise of Electric and Zero-Emission Trucks

The Australia truck market outlook is undergoing a significant transformation as electric and zero-emission trucks become more prevalent. This shift is driven by increasing demand for cleaner transport solutions, with companies investing in electric vehicles (EVs) to meet both environmental targets and public expectations. In 2024, around 114,000 new battery electric and plug-in hybrid vehicles were sold in Australia, up from 98,000 in 2023, reflecting the growing momentum toward electrification. These trucks are quieter, use less fuel, and emit less, making them suitable for city deliveries as well as long-haul. Despite this, issues persist, such as limited charging points, expensive initial outlays, and variability in policy by state. All these notwithstanding, the transition towards sustainable transport marches on, as fleet operators seek alternative energy trucks as part of their long-term plans to decrease environmental footprint and enhance operational stability.

To get more information on this market, Request Sample

Focus on Sustainability and Autonomous Innovation

Sustainability is becoming an integral value throughout the Australian transport sector, with the trucking industry actively seeking cleaner and smarter technologies. There is a high emphasis on minimizing environmental footprint, which is creating increased interest in hydrogen fuel systems and alternative drivetrains further strengthening the Australia truck market growth. At the same time, autonomous vehicle (AVs) technology is picking up pace, especially in mining and logistics, where controlled environments make automation more practical. Technologies such as platooning in which trucks move closely together are also being experimented with to boost fuel efficiency and lower emissions. Though complete automation is still far away, pilot adoption and experimentation are changing the way companies think about transport, toward a future that is safer, cleaner, and more efficient.

Adoption of Advanced Safety and Telematics Technologies

Safety and efficiency are prime concerns in the contemporary Australia truck industry, leading to mass adoption of high-end safety systems and telematics devices. These systems enable fleets to monitor driver habits, monitor vehicle performance, and improve routes in real time, hugely improving overall productivity. Safety functions like collision alerts, lane assistance, and driver fatigue detection are being fitted as standard on new truck models to minimize accidents and improve road safety thus aiding the Australia truck market share. Notably, adaptive cruise control is now used by 44% of fleets, while autonomous emergency braking is adopted by 43%, highlighting growing industry reliance on automated safety functions. Telematics also plays a critical part in facilitating proactive maintenance, which reduces downtime and maximizes vehicle life. All these innovations complement compliance with changing regulations and underpin a culture of accountability, reliability, and operational excellence in Australia's transport and logistics industry.

Growth Factors of Australia Truck Market:

Expansion of E-commerce and Logistics

The swift growth of e-commerce in Australia has greatly heightened the necessity for effective and timely delivery services in both urban and rural areas. Online retailers, logistics firms, and courier services are bolstering their fleets to meet the rising consumer demands for same-day and next-day deliveries. This boom has especially increased the need for light and medium-duty trucks, which are well-suited for last-mile logistics. Additionally, the transportation of goods from warehouses to retail outlets has experienced growth, necessitating dependable commercial trucking solutions. As digital commerce continues to thrive, the demand for a responsive and scalable transport infrastructure becomes increasingly critical, directly impacting Australia truck market demand across the retail and logistics sectors.

Infrastructure Projects Fueling Heavy-Duty Truck Utilization

Ongoing investments in infrastructure in Australia spanning highways, bridges, mining corridors, and urban transit systems are enhancing the demand for heavy-duty trucks. These vehicles are essential for transporting construction materials, machinery, and aggregates to and from construction sites. Major initiatives from both state and federal governments aimed at improving road connectivity and promoting economic growth have established a steady demand for tippers, haul trucks, and flatbeds. Furthermore, infrastructure enhancements in remote and resource-rich regions require long-haul transport capabilities, driving up demand. As these extensive developments progress, they present significant growth prospects for truck manufacturers and fleet operators across Australia.

Rising Demnad from Agriculture and Mining Sectors

Australia’s economy heavily relies on its agriculture and mining industries, both of which depend on strong and dependable transportation solutions. Trucks play a vital role in moving harvested crops, livestock, fertilizers, and equipment within the agricultural supply chain. In mining as well, trucks are crucial for transporting minerals, ores, and machinery between various locations, processing facilities, and ports. Seasonal spikes in harvest and consistent resource extraction ensure ongoing demand for both light and heavy-duty trucks throughout the year. Moreover, the remote positioning of many farms and mining sites makes road transport the most feasible option. This consistent demand supports long-term stability in the industry, according to Australia truck market analysis, offering ongoing growth potential for truck manufacturers and service providers.

Australia Truck Market Dynamics:

Aging Fleet Replacement Needs

A considerable segment of Australia’s commercial truck fleet is aging, with many vehicles failing to meet contemporary fuel efficiency, safety, or emissions standards. To comply with changing regulations and reduce maintenance interruptions, fleet operators are replacing older trucks with newer, technologically advanced models. Modern trucks provide enhanced reliability, improved fuel efficiency, lower emissions, and better driver comfort—key factors for operators who prioritize cost-effectiveness and safety. Additionally, the rising costs associated with maintaining outdated vehicles are encouraging businesses to invest in new trucks to reduce long-term operational expenses. This trend in fleet modernization is driving substantial demand in the truck market and motivating original equipment manufacturers (OEMs) to release advanced models equipped with compliance-ready features.

Rapid Urbanization

The growth of urban areas in Australia and ongoing infrastructure development are significantly escalating the demand for commercial trucks. As cities expand, the necessity for effective last-mile delivery services increases, creating more opportunities for light and medium-duty trucks. At the same time, large-scale infrastructure projects such as road construction, housing developments, and commercial buildings are stimulating demand for heavy-duty trucks, including dumpers, tippers, and cement mixers. Urban expansion also results in greater consumption of goods and services, requiring a robust logistics and transport network. This dual effect of urban growth and construction activity is producing consistent demand across multiple truck segments, reinforcing the role of commercial vehicles in Australia’s expanding economy.

Cost Pressures and Fuel Volatility

Rising fuel costs and overall operational expenses are exerting financial pressure on truck fleet operators throughout Australia. Fluctuating fuel prices make budget forecasting challenging for businesses, driving a shift toward more fuel-efficient and low-maintenance truck models. Operators are increasingly in search of vehicles that offer better mileage, lower emissions, and extended service intervals to reduce total ownership costs. These considerations are also prompting interest in alternative fuel technologies, such as electric or hybrid trucks, particularly among companies pursuing sustainability objectives. In response, truck manufacturers are adapting their offerings to align with these emerging trends.

Australia Truck Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on vehicle type, tonnage capacity, fuel type, and application.

Vehicle Type Insights:

- Heavy Duty Truck

- Medium Duty Truck

- Light Duty Truck

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes heavy duty truck, medium duty truck, and light duty truck.

Tonnage Capacity Insights:

- 3.5 – 7.5 Tons

- 7.5 – 16 Tons

- 16 – 30 Tons

- Above 30 Tons

A detailed breakup and analysis of the market based on the tonnage capacity have also been provided in the report. This includes 3.5 – 7.5 tons, 7.5 – 16 tons, 16 – 30 tons, and above 30 tons.

Fuel Type Insights:

- Diesel

- Petrol

- CNG & LNG

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes diesel, petrol, and CNG & LNG.

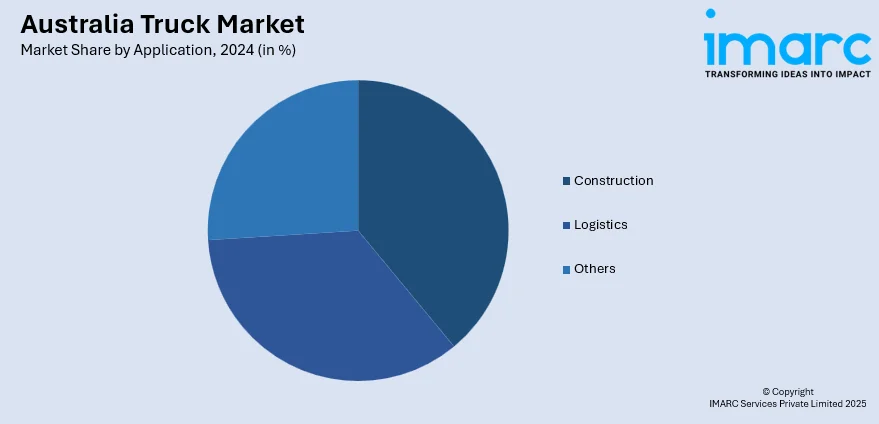

Application Insights:

- Construction

- Logistics

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes construction, logistics, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Daimler Truck Australia Pacific Pty Ltd

- Hyundai Trucks Australia

- Isuzu Australia Limited

- Komatsu Australia Pty Ltd

- PACCAR Australia

- Scania Australia

- Volvo Trucks Australia

Australia Truck Market News:

- In April 2025, Isuzu Australia Limited (IAL) unveiled its all-new 2025 truck range at a major launch event in Melbourne, coinciding with its annual National Dealer Business Meeting. Celebrating 36 years of market leadership, IAL highlighted the significance of new safety and emissions standards shaping the range. Described as a “once in a generation” launch, the models reflect extensive R&D tailored for Australian conditions, marking a bold new era for the brand.

- In March 2025, The first Australian-built Volvo FH16 780 XXL been produced at Volvo Group Australia’s Wacol facility, showcasing local manufacturing with advanced features like the new I-Shift transmission and Volvo Dynamic Steering. The truck, equipped with the most powerful engine in Australia, will be delivered to SRH Milk Haulage for transporting milk across NSW. SRH’s Scott Harvey highlighted the importance of locally engineered trucks for uptime and productivity, vital for their 24/7 operations.

Australia truck Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Heavy Duty Truck, Medium Duty Truck, Light Duty Truck |

| Tonnage Capacities Covered | 3.5 – 7.5 Tons, 7.5 – 16 Tons, 16 – 30 Tons, Above 30 Tons |

| Fuel Types Covered | Diesel, Petrol, CNG & LNG |

| Applications Covered | Construction, Logistics, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Daimler Truck Australia Pacific Pty Ltd, Hyundai Trucks Australia, Isuzu Australia Limited, Komatsu Australia Pty Ltd, PACCAR Australia, Scania Australia, Volvo Trucks Australia, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia truck market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia truck market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia truck industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The truck market in Australia was valued at USD 150.00 Million in 2024.

The Australia truck market is projected to exhibit a compound annual growth rate (CAGR) of 7.22% during 2025-2033.

The Australia truck market is expected to reach a value of USD 280.91 Million by 2033.

The key trend of the Australia truck market is increased adoption of telematics, rising interest in electric and hybrid trucks, and growing demand for application-specific models. Fleet automation, digital fleet tracking, and driver-assist technologies are also gaining traction as logistics and infrastructure sectors modernize operations.

Key growth drivers include expanding construction and mining activities, rising e-commerce deliveries, and the need for long-haul freight transport across vast distances. Fleet replacement due to stricter emission norms and the demand for fuel-efficient, low-maintenance trucks are also pushing new vehicle sales across commercial and industrial sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)