Australia Urban Mobility Market Size, Share, Trends and Forecast by Type, Mode, and Region, 2025-2033

Australia Urban Mobility Market Overview:

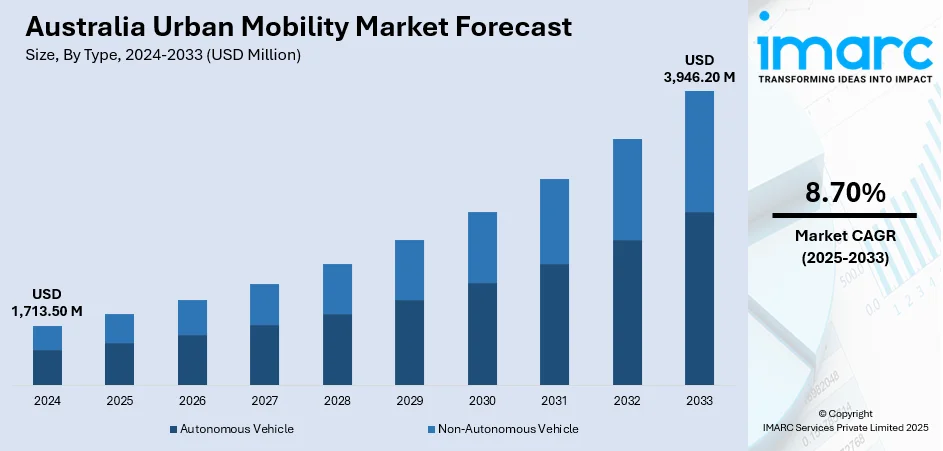

The Australia urban mobility market size reached USD 1,713.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,946.20 Million by 2033, exhibiting a growth rate (CAGR) of 8.70% during 2025-2033. The market is driven by increasing demand for sustainable transportation, numerous government incentives, continuous technological advancements, enhanced infrastructure, and consumer preference for shared mobility solutions, electric vehicles (EVs), and smart transportation systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,713.50 Million |

| Market Forecast in 2033 | USD 3,946.20 Million |

| Market Growth Rate 2025-2033 | 8.70% |

Australia Urban Mobility Market Trends:

Rise of EVs and Charging Infrastructure

One of the main factors propelling Australia's urban transportation sector is the increasing use of EVs. Australia's EV sales have been steadily increasing, and by the end of September 2024, around 85,319 units had been sold. A report by the Electric Vehicle Council reveals that electric vehicles (EVs) account for 9.5% of all new car sales in Australia, up from 8.4% in 2023, marking a 150% hike. The Australian government's commitment to reaching net-zero emissions by 2050, along with substantial investments in EV infrastructure like fast-charging stations, has further accelerated the push for electric vehicle adoption. According to a report by the Electric Vehicle Council, Australia's public charging station network is projected to expand by over 70% from 2023 to 2025. By mid-2024, there were 1,059 high-power public charging stations and 1,849 individual high-power public EV chargers in operation, marking a 90% increase in the number of charging stations since 2023. It is anticipated that this investment would facilitate the switch from internal combustion engines to electric cars, hence increasing customer trust in EVs. Improvements in EV technology, such as longer battery life, quicker charging times, and cheaper car prices, are also propelling the demand for EVs by making them a more appealing choice for buyers.

To get more information on this market, Request Sample

Expansion of Shared Mobility Solutions

Another key trend fueling growth in Australia's urban mobility sector is the rise of shared mobility services, including ride-hailing, bike-sharing, and car-sharing. With increased urbanization, congestion, and rising automobile ownership costs, Australians are increasingly turning to shared mobility as a more efficient and cost-effective mode of transportation. To address this growing demand, GM Cabs Australia has launched Taxi-Share 2023, a hybrid taxi service that combines the advantages of traditional taxis and ridesharing under the GM Cabs brand. The startup intends to change Australia's transportation market by providing a set metering system, premium safe trips, and clear pricing with no hidden fees. The emergence of integrated, multimodal transportation systems encourages this change even more. For example, public transportation agencies and commercial shared mobility companies have partnered to create seamless, on-demand mobility options in major Australian cities like Sydney and Melbourne. Toyota Australia and the NSW Taxi Council said in 2023 that they will keep working together. As a Platinum Partner of the NSW Taxi Council, Toyota Australia is an essential provider of cars to the NSW taxi sector. The partnership is expected to last as long as Toyota Australia supports the sustainable development of the global economy and society.

Australia Urban Mobility Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and mode.

Type Insights:

- Autonomous Vehicle

- Non-Autonomous Vehicle

The report has provided a detailed breakup and analysis of the market based on the type. This includes autonomous and non-autonomous vehicles.

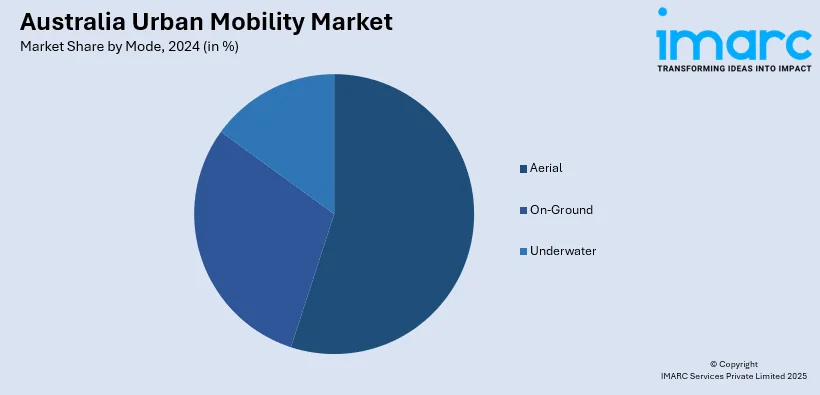

Mode Insights:

- Aerial

- Air Ambulance

- Air Taxi

- Cargo Air Vehicle

- Personal Air Vehicle

- Unmanned Air Vehicle

- On-Ground

- Underwater

A detailed breakup and analysis of the market based on the mode have also been provided in the report. This includes aerial (air ambulance, air taxi, cargo air vehicle, personal air vehicle, and unmanned air vehicle), on-ground, and underwater.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Urban Mobility Market News:

- December 2024: The former NSW Premier Mike Baird unveiled the Sydney Metro project consisting of four sections: Sydney Metro North West, Sydney Metro City & South West, Sydney Metro West, and Sydney Metro Western Sydney Airport. The fully automated railway can transport up to 40,000 passengers per hour and is designed for accessibility. The project has significantly impacted Sydney's urban mobility landscape, supporting job development and housing supply.

- October 2024: Uber announced the transition of its green product, which connects customers with low- or no-emissions journeys in a hybrid or EV, to a fully electric product beginning in April 2025. Uber Green will become Australia's second fully electric rideshare product, after Comfort Electric. The focus is primarily on transforming urban mobility by reducing emissions in the rideshare industry.

- April 2024: Nissan and ACCIONA's Silence have teamed together to introduce electric micro-mobility vehicles (EVs) to city streets. Through the arrangement, Nissan offered the Silence Nano S04 and e-motorcycles starting in June 2024 through retail partners in France, Italy, and Germany. The L6e and L7e versions of the S04 Nano vehicle, which is built for agility in urban settings, have peak speeds of 45 km/h (L6e) and 85 km/h (L7e), respectively, with a powerful electric-powered range of 149 km (L7e) to 175 km (L6e).

Australia Urban Mobility Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Autonomous Vehicle, Non-Autonomous Vehicle |

| Modes Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia urban mobility market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia urban mobility market on the basis of type?

- What is the breakup of the Australia urban mobility market on the basis of mode?

- What are the various stages in the value chain of the Australia urban mobility market?

- What are the key driving factors and challenges in the Australia urban mobility market?

- What is the structure of the Australia urban mobility market and who are the key players?

- What is the degree of competition in the Australia urban mobility market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia urban mobility market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia urban mobility market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia urban mobility industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)