Australia Vegan Cosmetics Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Australia Vegan Cosmetics Market Overview:

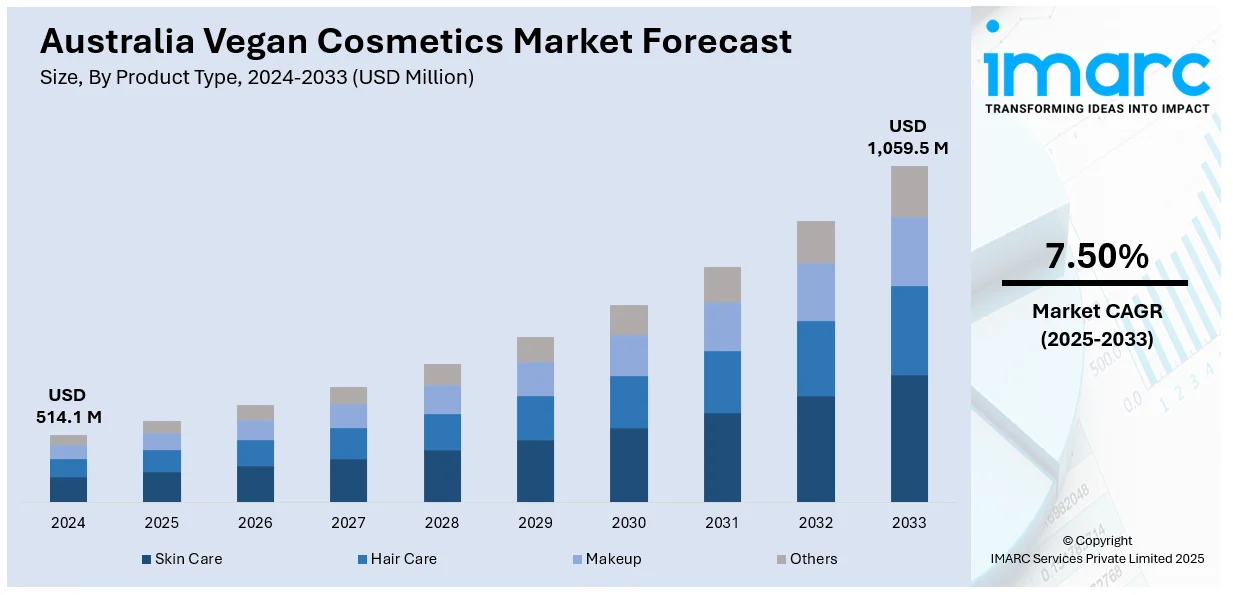

The Australia vegan cosmetics market size reached USD 514.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,059.5 Million by 2033, exhibiting a growth rate (CAGR) of 7.50% during 2025-2033. Rising ethical consumerism, growing vegan lifestyle adoption, increasing demand for product transparency, escalating social media influence, clean beauty trends, innovation in plant-based formulations, and growth of e-commerce are some of the factors supporting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 514.1 Million |

| Market Forecast in 2033 | USD 1,059.5 Million |

| Market Growth Rate 2025-2033 | 7.50% |

Australia Vegan Cosmetics Market Trends:

Growing Demand for Cruelty-Free and Animal-Free Products

Consumer sensitivity towards the welfare of animals is one of the key factors supporting the market growth. Increasing numbers of consumers are consciously choosing products that are not tested on animals or products with animal ingredients, which has generated a significant shift in consumer behavior. Moreover, regulatory progress and activism from animal welfare groups have also played a role in shaping attitudes, prompting retailers and producers to expand vegan-certified products. In line with this, store managers are responding by stocking more cruelty-free products and displaying certifications in prominent places, which additionally is further propelling the Australia vegan cosmetic market growth. Recently, Adore Beauty opened its first physical store in Melbourne, launching a national retail expansion. The store offers over 300 brands and tech-enabled skin analysis. A strong focus is placed on vegan, cruelty-free, and clean beauty products, aligning with growing consumer demand for ethical skincare.

To get more information on this market, Request Sample

Rise of Plant-Based Lifestyles Among Millennials and Gen Z

The growth in plant-based lifestyles among young consumers is another factor boosting the Australia vegan cosmetics market share. Millennials and Gen Z consumer base hold a considerable portion of the beauty and personal care consumer market. They are increasingly inclined to prioritize sustainability, social responsibility, and clean beauty, making them more likely to choose vegan cosmetics over conventional alternatives. Consequently, key market players are reformulating existing lines or launching full vegan ranges to address this sector. This consumer actively engages directly with brands on the internet, providing feedback and expressing preferences through social media and reviews. They are creating a ripple effect beyond their own shopping, affecting broader consumer trends and forcing conventional brands to adapt.

Expansion of E-Commerce Platforms Supporting Niche and Ethical Brands

The growth of e-commerce in Australia has been a key driver in expanding the vegan cosmetics market by way of improved product availability and brand recognition. The Australia e-commerce market is expected to reach USD 1,568.60 Billion by 2033, with a CAGR of 12.70% from 2025-2033. Online platforms have allowed new vegan and cruelty-free brands to bypass traditional retail channels and reach target markets directly. This is particularly pertinent to small and independent companies that ease to have the resources for country-wide physical distribution but can build loyal consumer bases through online marketing and e-commerce. Online stores such as Amazon Australia, Nourished Life, and The Iconic, contain a section on vegan-certified beauty products that customers can find and purchase ethically aligned products. In addition, online shopping enables companies to provide specific ingredient information, third-party attestations, and consumer feedback, which is providing a positive Australia vegan cosmetics market outlook.

Australia Vegan Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Skin Care

- Hair Care

- Makeup

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes skin care, hair care, makeup, and others.

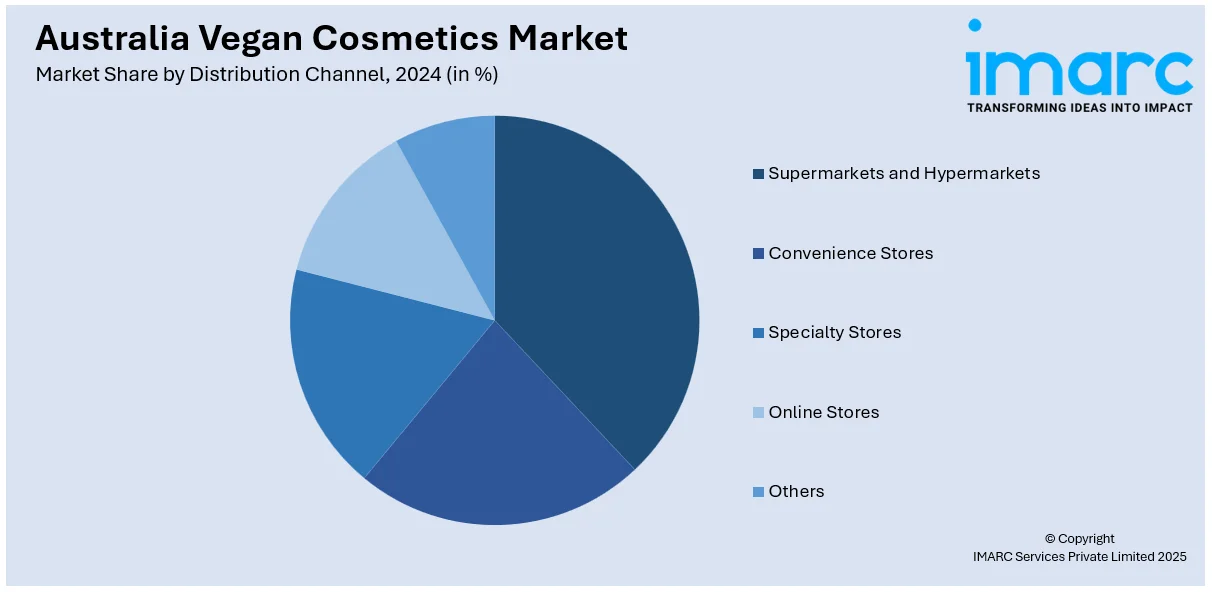

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Vegan Cosmetics Market News:

- In 2024, VidaCorp, a consumer health and beauty enterprise, completed the acquisition of Nude by Nature from Crescent Capital Partners. This strategic move aimed to leverage VidaCorp's marketing capabilities to rejuvenate Nude by Nature's market presence.

- In 2023, Kao Corporation, Japanese beauty conglomerate, announced its acquisition of Bondi Sands, an Australian brand renowned for its self-tanning, suncare, skincare, and cosmetic products. This strategic acquisition aims to enhance Kao's global portfolio by leveraging Bondi Sands' strong market position and innovative product offerings.

Australia Vegan Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin Care, Hair Care, Makeup, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia vegan cosmetics market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia vegan cosmetics market on the basis of product type?

- What is the breakup of the Australia vegan cosmetics market on the basis of distribution channel?

- What is the breakup of the Australia vegan cosmetics market on the basis of region?

- What are the various stages in the value chain of the Australia vegan cosmetics market?

- What are the key driving factors and challenges in the Australia vegan cosmetics?

- What is the structure of the Australia vegan cosmetics market and who are the key players?

- What is the degree of competition in the Australia vegan cosmetics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia vegan cosmetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia vegan cosmetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia vegan cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)