Australia Vegetable Oil Market Size, Share, Trends and Forecast by Oil Type, Application, and Region, 2025-2033

Australia Vegetable Oil Market Overview:

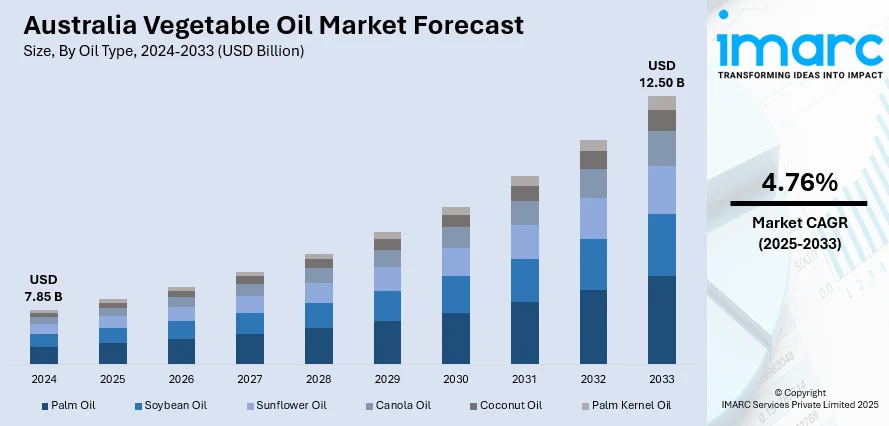

The Australia vegetable oil market size reached USD 7.85 Billion in 2024. Looking forward, the market is expected to reach USD 12.50 Billion by 2033, exhibiting a growth rate (CAGR) of 4.76% during 2025-2033. The market is driven by growing consumer preference for heart-healthy, clean-label oils across both retail and food processing segments. Domestic oilseed cultivation and export-oriented refining systems support stable supply and international trade access. Expanding industrial applications in biodiesel, cosmetics, and feed further augment the Australia vegetable oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.85 Billion |

| Market Forecast in 2033 | USD 12.50 Billion |

| Market Growth Rate 2025-2033 | 4.76% |

Key Trends of Australia Vegetable Oil Market:

Rising Demand for Health-Oriented Edible Oils

Australian consumers are increasingly selecting vegetable oils based on health attributes, such as low saturated fat content and the presence of omega fatty acids. Oils like canola, olive, sunflower, and avocado are favored for their cardiovascular benefits and compatibility with clean-label food formulations. Between January and September 2023, Australia imported 44,350 tons of vegetable oil from Argentina, making it the top supplier, followed closely by Malaysia with 42,205 tons, primarily refined, bleached, and deodorized (RBD) palm oil and olein. Cumulative imports reached 90,557 tons during the period. The average shipment volume stood at 2,829 tons. The growing popularity of Mediterranean and plant-based diets, along with rising awareness about trans fats and cholesterol, has led both consumers and food manufacturers to prefer cold-pressed and unrefined oils. Supermarkets and specialty grocers are expanding shelf space for premium domestic and imported vegetable oils, including those with organic or spray-free certifications. Additionally, cooking shows, nutrition influencers, and public health campaigns continue to educate consumers about choosing oils that support long-term wellness. This shift is also evident in bakery and snack manufacturing, where vegetable oils are used as healthier alternatives to animal fats or hydrogenated oils. Producers are reformulating products to meet consumer demand for reduced saturated fat and natural ingredients, ensuring that vegetable oil remains central to food innovation. These changing dietary values and preferences around nutritional quality are playing a pivotal role in the Australia vegetable oil market growth, especially within the higher-value segments of the food industry.

To get more information of this market, Request Sample

Integration of Oilseeds into Domestic Agribusiness and Export Value Chain

Australia is a leading global producer and exporter of canola, and this agricultural strength underpins its vegetable oil sector. Domestic refining capacity, centered around key regions in New South Wales and Victoria, enables efficient processing of oilseeds into edible oils for local consumption and international trade. Australian canola is highly valued in export markets—especially Japan and the EU—for its low erucic acid levels and non-GMO certification. In recent years, farmers have diversified rotations to include sunflower and safflower in select areas, enhancing raw material flexibility. Government-backed research through bodies like CSIRO focuses on crop improvement, yield stability, and sustainable cultivation practices, which help maintain Australia’s competitive edge. On November 27, 2024, Riverina Oils, one of Australia’s major canola oil producers, began operating its Bomen, NSW facility with solar power through a new partnership with renewable energy provider Flow Power. The solar installation, featuring 2.8 MW of solar PV and a 2.6 MVA inverter, powers a facility that annually produces over 80,000 tons of refined vegetable oil and 120,000 tons of canola meal. This project marks Flow Power’s largest behind-the-meter initiative and aligns with broader efforts to decarbonize the Australian vegetable oil market. Meanwhile, trade agreements and favorable biosecurity standards ensure that oilseed exports face minimal tariff or compliance barriers. These factors support both upstream growers and downstream processors by offering stability and access to high-demand markets. The vertically integrated oilseed-to-oil system, reinforced by strong quality standards and export competitiveness, plays a crucial role in shaping long-term resilience and profitability across the Australian vegetable oil supply chain.

Growth Drivers of Australia Vegetable Oil Market:

Shifting Culinary Habits and Ethnic Diversity

One of the key drivers of growth in the Australian vegetable oil market is Australia's more diverse culinary scene, which is being driven by a multicultural society and shifting food habits. The cuisine of Australia has adopted an array of international influences, including Asian, Mediterranean, and Middle Eastern cuisines, several of which make liberal use of vegetable oils such as sesame, peanut, olive, and sunflower oil. Such cultural diversity has created a higher level of household and foodservice usage of various cooking oils that meet a range of flavor profiles and cooking methods. There is also more Australian consumer experimentation with international recipes from home, prompted by food media and expanding availability of specialty ingredients. Characteristic of the Australian environment is the combination of ethnic and traditional Western food preparation with ethnic foods, generating consistent demand for a range of vegetable oils. This transition in culinary practices facilitates consistent Australia vegetable oil market growth, with consumers demanding both authenticity and functionality in their cooking oils.

Agricultural Production and Domestic Processing Capacity

Australia's strong agricultural economy plays an important role in the cultivation of its vegetable oil market growth. Australia is a leading producer of oilseed crops including canola, sunflower, and cottonseed, which is a strong support base for domestic oil manufacture. Canola, specifically, is widely cultivated in regions such as Western Australia and New South Wales, which makes a significant contribution to raw material availability for oil production. What is distinctive for the Australian market is being both a consumer and an exporter of vegetable oils, possessing domestic processing facilities through which value addition is possible domestically. Investment in refining and bottling facilities has enabled domestic manufacturers to satisfy the increasing demand effectively as well as compete in export markets. Domestic processing of oil lowers dependence on imports and provides better freshness and quality control, which are valued by Australian consumers. This vertically integrated supply chain provides Australia with a competitive edge in its local market.

Sustainability Initiatives and Export Opportunities

According to the Australia vegetable oil market analysis, environmental concern and sustainability are increasingly influencing consumer choice and business practice in the region and opening new growth opportunities for the market. Australian farmers are placing greater importance on sustainable farming practices, such as less use of pesticides and water-conserving cultivation of crops, specifically oilseeds. There is increased demand to produce non-GM and organic oils, which are sought after in both local and foreign markets. Australian vegetable oils, particularly canola oil, are also becoming popular in Asia-Pacific overseas markets because of their quality, traceability, and environmentally friendly production. The nation's green and clean agriculture image provides a competitive advantage for its produce in the market where food safety and environmental concerns are of prime importance. Moreover, the Australian government's promotion of sustainable agriculture and its global trade agreements continue to provide new markets and bring in investment for oilseed production and processing. As global demand for ethically sourced and sustainable oils rises, Australia is well-positioned to leverage this trend to expand its market.

Opportunities of Australia Vegetable Oil Market:

Expanding Function in Plant-Based and Functional Foods

Rising demand for plant-based and functional foods in Australia creates a valuable opportunity for diversifying the applications of the vegetable oil business. With more Australians turning towards vegetarian, vegan, or flexitarian diets, the market for oils from plant sources like avocado, flaxseed, and grapeseed oils keeps growing. These oils are not only employed for culinary purposes but are also blended into an increasing variety of food products such as dairy-free spreads, meat substitutes, and pre-prepared health foods. Australia's changing food industry is reflecting the consumer demand for clean-label, nutrient-dense foods that commonly promote oils high in omega content or antioxidant activity. Regional is the availability of a health-aware consuming population who consistently read labels on ingredients and opt for food products by virtue of perceived health advantages. This provides scope for premium, cold-pressed, and specialty oils to find favor, enabling local manufacturers and entrepreneurs to capture niche niches in both domestic and export-oriented foods.

Value-Added Processing and Premium Product Development

Australia also has a considerable potential to grow its vegetable oil market with value-added processing and premium oil product development. Although it already ships large quantities of raw canola and other oilseeds overseas, increasingly there are interests in refining and branding oil at home to add value to exports and meet a sophisticated domestic market. Cold-pressed, extra virgin, and organic oils are especially sought after, as Australian consumers are prepared to pay premiums for quality and origin. This is also in sync with Australia's solid farm reputation and high standards of food safety, which ensure that its foodstuff is extremely trusted locally as well as internationally. In addition, South Australian and Victorian regional producers are taking advantage of local branding to sell boutique olive and seed oils as gourmet products. With emphasis on quality, traceability, and origin, Australia can establish its oils in premium retail, hospitality, and export markets, particularly in health-oriented and high-income markets in Asia and Europe.

Sustainable Production and Bioeconomy Integration

Australia's increasing emphasis on sustainability and its shift toward a greener economy constitute a prime opportunity for the vegetable oil industry to contribute beyond food use. Vegetable oils serve multifarious industrial purposes ranging from their utilization in the manufacture of biodiesel to biodegradable lubricants and bioplastics. With mounting pressure worldwide to cut carbon emissions and dependence on fossil fuels, Australia can ride the tide by promoting sustainable oilseed cultivation and processing oil for industrial purposes. The difference is that Australia's government actively promotes sustainable agriculture, renewable energy, and the circular economy, simplifying the way for the vegetable oil sector to venture into new applications. Those regions that have robust agricultural sectors, such as New South Wales and Western Australia, can diversify their economies by incorporating vegetable oil manufacture within renewable energy plans. This diversification into the bioeconomy creates new profit opportunities for producers and enhances Australia's standing as a global leader in sustainable resource management.

Australia Vegetable Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on oil type and application.

Oil Type Insights:

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Canola Oil

- Coconut Oil

- Palm Kernel Oil

The report has provided a detailed breakup and analysis of the market based on the oil type. This includes palm oil, soybean oil, sunflower oil, canola oil, coconut oil, and palm kernel oil.

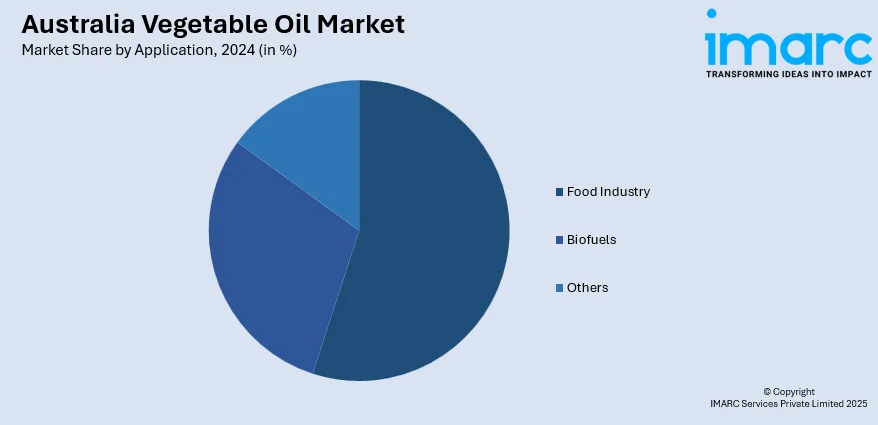

Application Insights:

- Food Industry

- Biofuels

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food industry, biofuels, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all major regional markets. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Vegetable Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Oil Types Covered | Palm Oil, Soybean Oil, Sunflower Oil, Canola Oil, Coconut Oil, Palm Kernel Oil |

| Applications Covered | Food Industry, Biofuels, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia vegetable oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia vegetable oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia vegetable oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia vegetable oil market was valued at USD 7.85 Billion in 2024.

The Australia vegetable oil market is projected to exhibit a CAGR of 4.76% during 2025-2033.

The Australia vegetable oil market is expected to reach a value of USD 12.50 Billion by 2033.

The Australia vegetable oil market trends include rising demand for premium, cold-pressed, and organic oils, driven by health-conscious consumers. There is increased use in plant-based and functional foods, growth in exports to Asia-Pacific markets, and a shift toward sustainable, locally produced oils supported by domestic processing and environment-friendly farming practices.

The Australia vegetable oil market is driven by growing health awareness, multicultural culinary influences, and strong domestic oilseed production. Government support for agriculture, increasing demand for plant-based diets, and a shift toward sustainable food choices also contribute to market growth, creating a favorable environment for both local consumption and export expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)