Australia Vehicle Financing Market Size, Share, Trends and Forecast by Vehicle Type, Loan Provider, Vehicle Condition, Purpose Type, and Region, 2025-2033

Australia Vehicle Financing Market Overview:

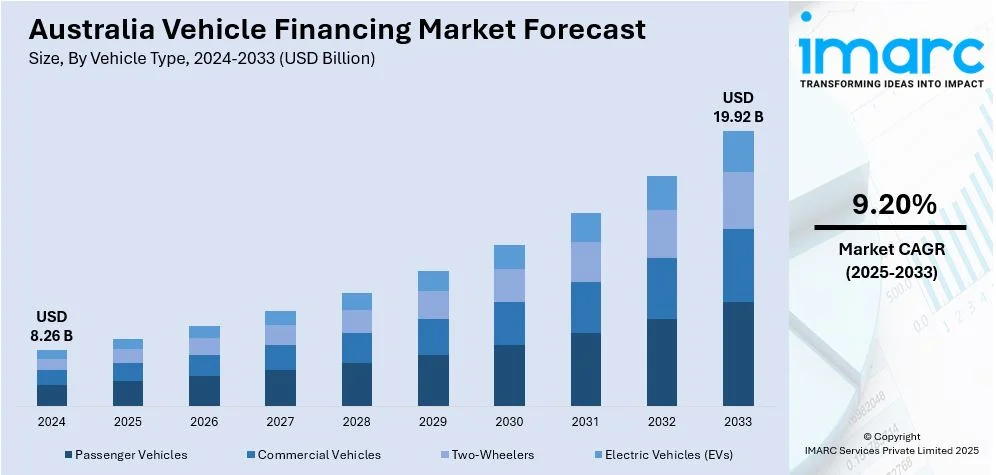

The Australia vehicle financing market size reached USD 8.26 Billion in 2024. Looking forward, the market is expected to reach USD 19.92 Billion by 2033, exhibiting a growth rate (CAGR) of 9.20% during 2025-2033. The market is shaped by digital innovation, amplified demand for used cars, and the shift towards electric mobility. Customers today prefer web apps, budget-friendly second-hand cars, and eco-friendly vehicles. Banks and other financial institutions are reacting with flexible financing terms, electric vehicle (EV) dedicated products, and efficient digital platforms. These changes are widening financing availability and improving consumer engagement nationwide. Notably, the Australia vehicle financing market share constitutes a substantial portion of total automotive transactions within the national economy.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.26 Billion |

| Market Forecast in 2033 | USD 19.92 Billion |

| Market Growth Rate 2025-2033 | 9.20% |

Key Trends of Australia Vehicle Financing Market:

Digital Loan Processing and E-Verification

Digital revolution is changing the way consumers in Australia receive vehicle finance, with lenders now more and more adopting end-to-end digital platforms. Customers are currently applying for vehicle finance via mobile applications or web portals, leveraging digital facilities to upload documents, perform credit checks, and e-sign agreements. This is more convenient, saving time for processing, and more transparent for borrowers. Artificial intelligence-driven credit scoring, biometric authentication, and instant loan disbursal are becoming increasingly popular, particularly among young, tech-empowered customers. According to the sources, in March 2025, ASIC initiated a review of motor finance lenders and brokers to strengthen consumer protections, including loan defaults and people in vulnerable circumstances, such as regional and First Nations communities. Moreover, these technologies not only streamline the borrowing process but also improve customer satisfaction. The adoption of digital infrastructure by lenders facilitates quick approvals and improved monitoring in tune with the increasing demand for ease of use. This changing environment is playing a major role in driving the market growth, as convenience and ease of access bring in a wider range of customers, such as first-time vehicle buyers and rural customers who take advantage of remote digital offerings.

To get more information on this market, Request Sample

Rising Demand for Used and Certified Pre-Owned Vehicle Finance

Australian consumers intensely prefer financing used and certified pre-owned vehicles for their affordability and ability to retain value. With inflation and cost-of-living pressures continuing, consumers are resorting to second-hand cars as a value-for-money option. Financing options have adjusted accordingly, and favorable terms and customized interest rates are now common for the purchase of used cars. Banks have reacted by creating products targeting this market, including longer tenor loans and reduced down payment rates. According to the Australia vehicle financing market analysis, this demand has generated a large increase in applications for loans on used vehicles, illustrating a trend of buyer preference for more frugal options. Better vehicle inspection requirements and certification schemes have also encouraged consumer confidence in used-car buying. As digital marketplaces and financial institutions automate the approval process, availability is also enhanced. This change in the financing behavior of consumers is one of the primary drivers of Australia vehicle financing expansion, increasing loan portfolios by asset condition.

Growth in Financing for Electric and Eco-Friendly Vehicle Options

There is a growing momentum toward electric vehicles (EVs) in Australia, and vehicle financing has started adapting to accommodate this trend. Green transport is highly being preferred by consumers with a strong focus on environment, government encouragement, and enhanced EV infrastructure. By way of counter, the lenders have launched differentiated EV financing products with reduced interest rates, extended repayment duration, and bundled insurance or charging benefits. These customized products are intended to lower the increased initial cost hurdle generally related to electric vehicles. As per the sources, in November 2023, NAB and Plenti formed a joint venture to introduce a co-branded car and electric vehicle loan, "NAB powered by Plenti," to be introduced in the first half of 2024, encouraging green finance for Australian consumers. Additionally, financial institutions are collaborating with sustainable programs to provide environmentally friendly loan products, encouraging responsible consumer conduct. With boosting demand for EVs in urban as well as regional markets, availability of inclusive financing becomes a key driver. This shift is fueling Australia vehicle financing growth not merely by increasing the size of the market for new energy vehicles but also by bringing consumer lending in line with national sustainability objectives and emission reduction measures.

Growth Factors of Australia Vehicle Financing Market:

Urban Expansion and Rising Vehicle Ownership Needs

Australia’s growing population and expanding urban footprint are creating heightened demand for personal mobility, particularly in suburban and regional communities where public transportation infrastructure remains underdeveloped. In these areas, owning a vehicle becomes essential for commuting, errands, and accessing employment or education. As cities continue to sprawl and housing affordability pushes residents farther from urban cores, the reliance on private vehicles is increasing. This growing need for mobility is driving consumers to explore financing solutions that offer affordable access to cars without large upfront payments. Vehicle loans, leasing plans, and tailored finance options are becoming more popular as they enable individuals to manage costs while meeting transportation needs, ultimately fueling the Australia vehicle financing market growth.

Favorable Interest Rate Environment (Short-Term)

In recent years, Australia has experienced periods of historically low interest rates, creating favorable borrowing conditions for consumers seeking auto loans. These reduced rates have made financing more affordable, allowing borrowers to stretch their budgets and consider higher-quality or newer vehicles. This environment has been especially appealing to first-time buyers and younger individuals, who tend to prioritize manageable monthly payments over large down payments. The affordability of credit during such periods has contributed to increased loan volumes across both new and used vehicle markets. Although interest rates may fluctuate, the lingering effects of previous low-rate periods continue to influence borrower behavior, keeping demand for vehicle financing steady, particularly when paired with promotional offers or dealer incentives.

Expansion of Auto Dealership Financing Services

Australian car dealerships are increasingly adopting integrated financing models, offering customers direct access to loan options through partnerships with banks, credit unions, and non-bank lenders. These point-of-sale financing services streamline the vehicle purchasing process by allowing buyers to secure approval and complete transactions all in one place. This convenience significantly improves the overall customer experience and boosts conversion rates for dealerships. Instant approval processes, bundled deals, and promotional financing packages are particularly attractive to buyers looking for quick, hassle-free solutions. By offering in-house or third-party loan options on-site, dealerships not only increase their competitive advantage but also support the broader vehicle financing ecosystem, driving more Australians toward financed vehicle ownership rather than outright purchases.

Opportunities of Australia Vehicle Financing Market:

Rise of Peer-to-Peer and Crowd-Based Lending Platforms

Alternative financing models like peer-to-peer (P2P) lending and crowdfunding are gaining traction in Australia’s vehicle financing market. These online platforms enable borrowers to access funding by linking them straight to institutional or individual investors, eliminating the need for conventional banking intermediaries and providing more attractive or competitive lending conditions. For consumers with limited credit history or those underserved by mainstream lenders, these models provide accessible options with flexible repayment structures and lower interest rates. The technology-driven nature of these platforms also allows for faster approval processes and greater customization. As awareness grows and trust in digital finance increases, these non-traditional lending avenues are becoming a viable choice for a wider audience. This trend is not only democratizing auto finance access but also intensifying competition in the broader lending landscape.

Growing Demand from Rideshare and Fleet Operators

The rise of ride-hailing platforms like Uber and DiDi, along with the broader gig economy, is fueling demand for customized vehicle financing among independent drivers and small fleet operators in Australia. These individuals often need access to reliable vehicles without large upfront costs and require loan products that account for high usage and variable income. Traditional financing models may not align with these needs, creating a gap for specialized loan offerings. Financial institutions and fintechs that develop low-entry, usage-based financing plans with flexible terms can capitalize on this growing market. As the mobility-as-a-service sector expands, tailored auto finance products will become increasingly essential for supporting the unique requirements of professional, on-demand drivers and micro fleet businesses.

Insurance-Integrated Loan Packages

A growing number of Australian car buyers are seeking all-in-one vehicle financing solutions that extend beyond the loan itself. Integrated packages that combine auto finance with insurance, maintenance plans, roadside assistance, and registration services are gaining popularity due to their convenience and perceived value. These bundled offerings streamline the vehicle ownership process, reduce administrative hassle, and provide predictable monthly costs. For lenders, such value-added services improve customer satisfaction, reduce loan default risk through insured assets, and increase retention by embedding customers into a broader ecosystem of services. As consumers gravitate toward simplicity and transparency, offering holistic loan packages positions lenders competitively and aligns with evolving preferences in the Australian automotive finance landscape.

Government Support of Australia Vehicle Financing Market:

Consumer Credit Law and Lending Transparency

Australia’s National Consumer Credit Protection Act plays a vital role in ensuring transparency and accountability in lending practices. It mandates that lenders conduct thorough affordability checks, disclose all loan terms clearly, and provide fair contract conditions. These measures are designed to safeguard consumers from predatory lending and financial overextension. By fostering a more secure borrowing environment, the Act boosts consumer confidence in vehicle financing options and encourages responsible borrowing behavior. It also helps standardize practices across financial institutions, ensuring a level playing field for both traditional lenders and emerging digital platforms. As a result, more Australians feel confident engaging in auto financing, knowing that regulatory protections are in place to support informed and fair financial decisions.

Financial Literacy and Awareness Campaigns

Government-backed financial literacy initiatives across Australia are empowering consumers to make smarter borrowing choices, particularly in vehicle financing, which is further boosting the Australia vehicle financing market demand. These programs educate individuals on essential financial topics, including credit scores, interest rates, repayment planning, and understanding loan agreements. By equipping consumers with this knowledge, the campaigns help reduce the risk of overborrowing and defaults, while promoting long-term financial health. These efforts are particularly beneficial for first-time buyers and young adults entering the vehicle financing space. Through online resources, workshops, and school programs, the government is fostering a more financially aware population. In turn, this creates a more stable and informed borrower base, contributing to healthier lending environments and increased trust in Australia’s auto financing ecosystem.

Transport Infrastructure and Automotive Policy Alignment

Australia’s ongoing investments in transport infrastructure, such as new highways, upgraded roads, and expanded regional connectivity, are making vehicle ownership more practical and necessary across broader geographies. These improvements support mobility for both personal and commercial use, driving greater interest in vehicle acquisition and, consequently, financing solutions. Moreover, national transport policies align with automotive sector goals, encouraging fleet upgrades and modernization. As connectivity improves, especially in underserved areas, demand rises for affordable financing to purchase reliable vehicles. This synergy between infrastructure development and vehicle financing enhances accessibility and fuels market growth. By integrating automotive policies with broader mobility strategies, the government indirectly stimulates the auto finance sector, creating opportunities for lenders and increasing financing uptake across the country.

Australia Vehicle Financing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on vehicle type, loan provider, vehicle condition, and purpose type.

Vehicle Type Insights:

- Passenger Vehicles

- Commercial Vehicles

- Two-Wheelers

- Electric Vehicles (EVs)

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger vehicles, commercial vehicles, two-wheelers, and electric vehicles (EVs).

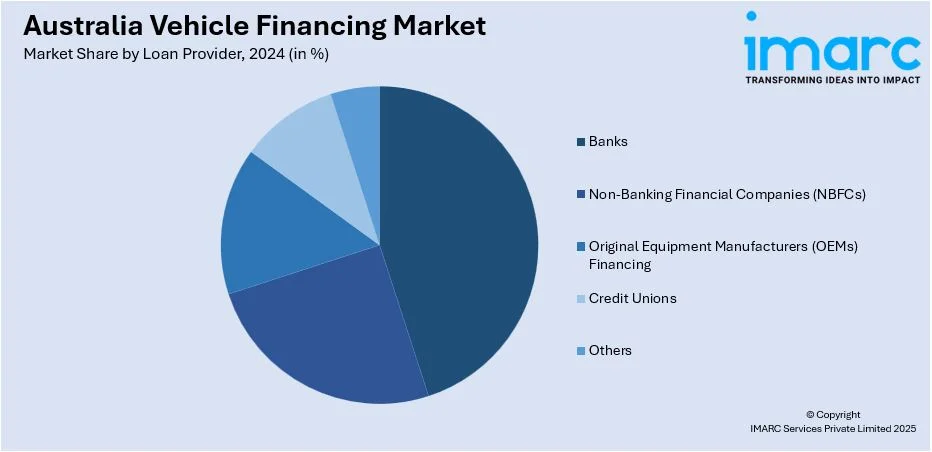

Loan Provider Insights:

- Banks

- Non-Banking Financial Companies (NBFCs)

- Original Equipment Manufacturers (OEMs) Financing

- Credit Unions

- Others

A detailed breakup and analysis of the market based on the loan provider have also been provided in the report. This includes banks, non-banking financial companies (NBFCs), original equipment manufacturers (OEMs) financing, credit unions, and others.

Vehicle Condition Insights:

- New Vehicles

- Used Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle condition. This includes new vehicles and used vehicles.

Purpose Type Insights:

- Loan

- Leasing

A detailed breakup and analysis of the market based on the purpose type have also been provided in the report. This includes loan, and leasing.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Vehicle Financing Market News:

- In July 2024, Allied Credit and Chery Australia introduced an ongoing finance alliance under the Chery Motor Finance marque. Accredited dealers now provide new vehicle financing with customer-centric programs, such as guaranteed future value, to improve Chery ownership experiences and assist dealer networks throughout Australia.

- In April 2024, CommBank teamed up with carsales and Vyro to introduce a car purchase service through its app, providing vehicle searching, finance approval, and management. The service comes with special electric vehicle discounts and easy loan applications, catering to the increasing demand for cheap, environmentally friendly vehicle financing in Australia.

Australia Vehicle Financing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Electric Vehicles (EVs) |

| Loan Providers Covered | Banks, Non-Banking Financial Companies (NBFCs), Original Equipment Manufacturers (OEMs) Financing, Credit Unions, Others |

| Vehicle Conditions Covered | New Vehicles, Used Vehicles |

| Purpose Types Covered | Loan, Leasing |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia vehicle financing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia vehicle financing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia vehicle financing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The vehicle financing market in Australia was valued at USD 8.26 Billion in 2024.

The Australia vehicle financing market is projected to exhibit a CAGR of 9.20% during 2025-2033.

The Australia vehicle financing market is projected to reach a value of USD 19.92 Billion by 2033.

Key drivers include the surge in demand for both new and used vehicles amid population growth and changing mobility needs. Government incentives promoting low-emission and electric vehicles are boosting the financing segment with new EV-friendly loan structures. Additionally, the entry of fintech players and digital lenders has enhanced competition, offering quicker, more personalized, and accessible financing experiences. This growing digital presence is streamlining approval processes and attracting tech-savvy consumers, further accelerating market growth.

The Australian vehicle financing landscape is rapidly evolving with increased adoption of digital tools such as AI-driven credit assessments, online loan approvals, and mobile-first application platforms. There is a noticeable rise in financing solutions tailored for electric vehicles and hybrids. Additionally, consumers are increasingly opting for flexible models like vehicle subscriptions and operating leases, reflecting shifting preferences away from traditional ownership. These trends highlight a growing demand for convenience, sustainability, and adaptability in financing solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)