Australia Vending Machine Market Size, Share, Trends and Forecast by Type, Technology, Payment Mode, Application, and Region, 2025-2033

Australia Vending Machine Market Overview:

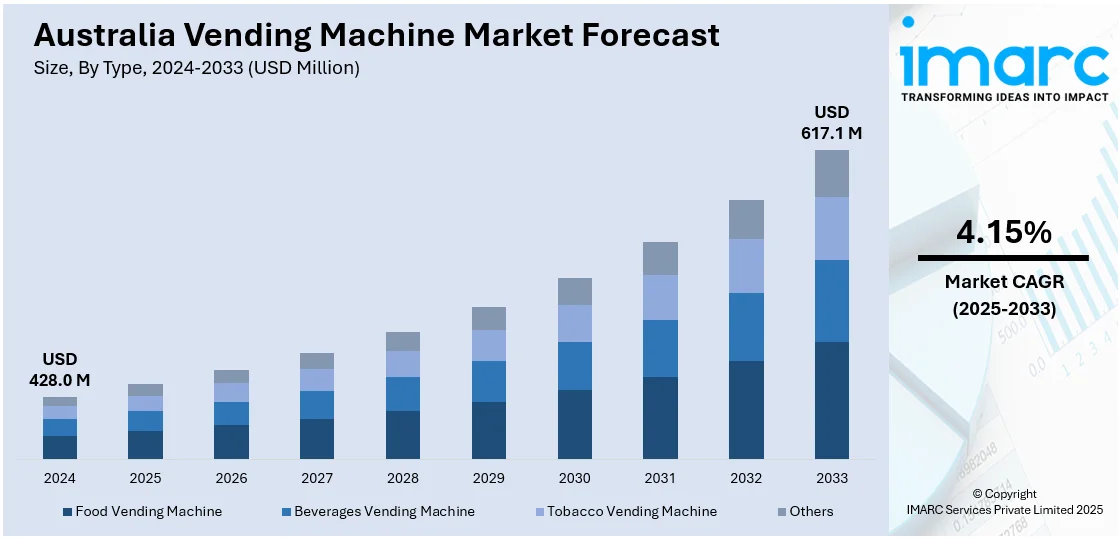

The Australia vending machine market size reached USD 428.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 617.1 Million by 2033, exhibiting a growth rate (CAGR) of 4.15% during 2025-2033. The market involves rising demand for contactless and cashless payment options, growing preference for convenient on-the-go food and beverages (F&B) and increasing consumer interest in healthier product offerings thus impelling the market growth. Additionally, technological advancements and sustainable machine innovations are further fueling market expansion across urban and semi-urban areas.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 428.0 Million |

| Market Forecast in 2033 | USD 617.1 Million |

| Market Growth Rate 2025-2033 | 4.15% |

Australia Vending Machine Market Trends:

Integration of Smart Technologies

The vending machine landscape in Australia is rapidly evolving with the widespread adoption of smart technologies. Machines are being enhanced with digital touchscreens, AI-powered analytics, and remote inventory monitoring, allowing operators to optimize restocking and maintenance processes. This aligns with broader trends, as over 35% of Australian businesses had embraced AI or automation technologies by 2024, particularly in tech-driven sectors. Vending machines now cater to modern consumer preferences through features like cashless payments using mobile wallets and contactless cards, which are becoming standard amid growing hygiene and convenience expectations. Some units even integrate facial recognition and mobile app connectivity to offer personalized interactions. This transformation toward intelligent automation is positioning vending businesses for greater operational efficiency, while also enhancing user experience and remaining competitive in an increasingly digital retail environment.

To get more information on this market, Request Sample

Emphasis on Health and Wellness Products

Australian consumers are increasingly focusing on health and well-being, leading vending machine operators to expand their range with healthier alternatives further resulting in increasing Australia vending machine market share. Classic snacks and sweetened beverages are slowly being complemented or substituted with fresh products, organic snacks, low-sodium products, and natural ingredient-based beverages. This is part of a larger shift in consumer behavior, where convenience needs to be balanced with nutritional value. Some machines now even offer ready-to-eat (RTE) meals like salads and protein-packed snacks catering to gym-goers and office workers seeking healthier alternatives. Vending operators are responding to these demands by partnering with health-conscious brands and curating selections that promote better eating habits, contributing to a more wellness-oriented retail environment.

Adoption of Sustainable Practices

Environmental sustainability is becoming a central theme in Australia vending machine market outlook. Operators are increasingly adopting eco-conscious practices, such as integrating energy-efficient cooling systems and minimizing single-use plastic packaging. Many machines are now constructed with recyclable materials and feature enhanced insulation to cut energy consumption. Broader national efforts, such as the near elimination of 31,000 tonnes of single-use HDPE shopping bags, reflect a growing shift toward waste reduction that complements vending industry initiatives. In line with this, vendors are offering product lines with biodegradable packaging or sourcing items locally to reduce carbon footprints. These actions align with the values of environmentally aware consumers who prioritize ethical purchasing decisions. As sustainability continues to influence buying behavior, vending businesses are innovating to meet these expectations while reducing their environmental impact and reinforcing their commitment to responsible retailing.

Australia Vending Machine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, technology, payment mode, and application.

Type Insights:

- Food Vending Machine

- Beverages Vending Machine

- Tobacco Vending Machine

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes food vending machine, beverages vending machine, tobacco vending machine, and others.

Technology Insights:

- Automatic Machine

- Semi-Automatic Machine

- Smart Machine

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes automatic machine, semi-automatic machine, and smart machine.

Payment Mode Insights:

- Cash

- Cashless

The report has provided a detailed breakup and analysis of the market based on the payment mode. This includes cash, and cashless.

Application Insights:

- Hotels and Restaurants

- Corporate Offices

- Public Places

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes hotels and restaurants, corporate offices, public places, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Vending Machine Market News:

- In December 2024, Coca-Cola launched its AI-powered Coke&Go smart coolers at Sydney Airport’s T2 Domestic terminal. These innovative vending units use image recognition and AI to offer a seamless, self-service experience. Customers can access the cooler via QR code or credit card, select items directly, and complete purchases automatically. The initiative reflects Coca-Cola Europacific Partners’ focus on enhancing convenience and catering to digitally savvy, on-the-go consumers through cutting-edge vending technology.

Australia Vending Machine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Food Vending Machine, Beverages Vending Machine, Tobacco Vending Machine, Others |

| Technologies Covered | Automatic Machine, Semi-Automatic Machine, Smart Machine |

| Payment Modes Covered | Cash, Cashless |

| Applications Covered | Hotels and Restaurants, Corporate Offices, Public Places, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia vending machine market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia vending machine market on the basis of type?

- What is the breakup of the Australia vending machine market on the basis of technology?

- What is the breakup of the Australia vending machine market on the basis of payment mode?

- What is the breakup of the Australia vending machine market on the basis of application?

- What is the breakup of the Australia vending machine market on the basis of region?

- What are the various stages in the value chain of the Australia vending machine market?

- What are the key driving factors and challenges in the Australia vending machine market?

- What is the structure of the Australia vending machine market and who are the key players?

- What is the degree of competition in the Australia vending machine market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia vending machine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia vending machine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia vending machine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)