Australia Veterinary Healthcare Market Size, Share, Trends and Forecast by Product, Animal Type, End User, and Region, 2026-2034

Australia Veterinary Healthcare Market Overview:

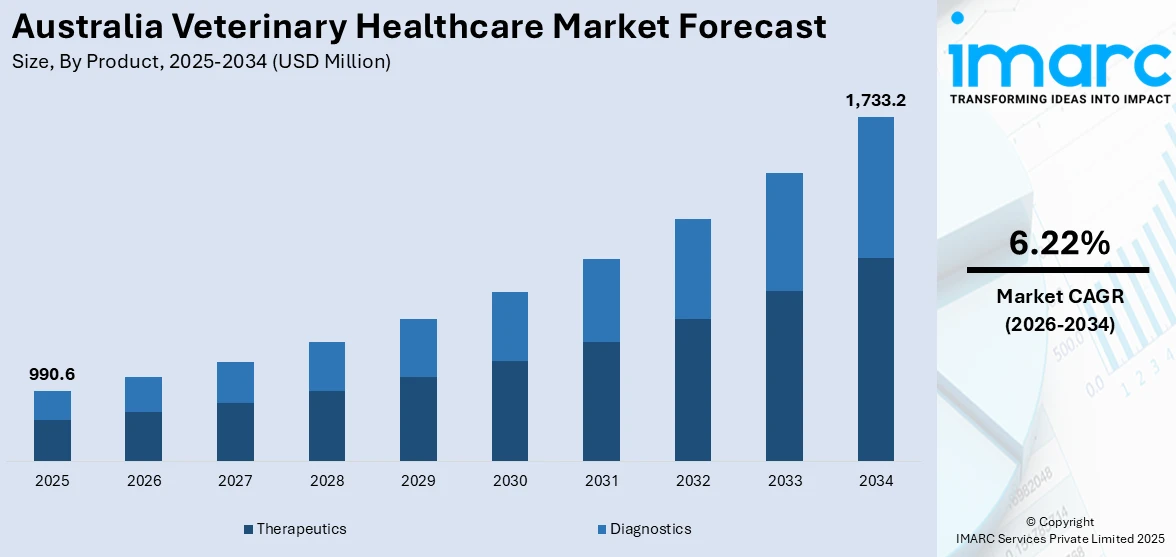

The Australia veterinary healthcare market size reached USD 990.6 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,733.2 Million by 2034, exhibiting a growth rate (CAGR) of 6.22% during 2026-2034. The market is witnessing significant growth, driven by rising pet ownership, growing awareness about animal health, and increased spending on preventive and therapeutic care. Advancements in veterinary diagnostics, pharmaceuticals, and surgical procedures are enhancing treatment outcomes for both companion and livestock animals. Government support for animal disease control and livestock management are also contributing positively to the Australia veterinary healthcare market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 990.6 Million |

| Market Forecast in 2034 | USD 1,733.2 Million |

| Market Growth Rate 2026-2034 | 6.22% |

Australia Veterinary Healthcare Market Trends:

Rising Pet Ownership

The surge in pet ownership across Australia is a major driver of growth in the veterinary healthcare market. More households are adopting dogs, cats, and other companion animals leading to increased demand for veterinary services, diagnostics, and preventive care. According to industry reports, 58% of Victorians own pets, totaling 1.4 million households. Most pet owners (64%) cite companionship as the primary reason. Dogs are the most popular, with 41% ownership, followed by 24% for cats. As pets are now being seen more and more as part of the family owners are also willing to invest in their welfare and health including check-ups regularly, immunization, and advanced treatments. The demand is generating consumption of veterinary medicines, pet grooming centres, and well-being products. The trend can especially be seen with millennials and city dwellers, who like to buy high-standard, tailor-made pet care. Pet adoption campaigns and heightened awareness of animal welfare have also been contributors to the growing number of pets. This overall change in lifestyle and attitude is contributing significantly to influencing healthcare spending patterns and supporting overall demand throughout the Australia veterinary healthcare market.

To get more information on this market Request Sample

Growing Demand for Digital Veterinary Services

Digital veterinary services are rapidly transforming animal healthcare in Australia, with telemedicine and mobile vet services gaining popularity among pet owners seeking convenience and timely care. For instance, in September 2024, Dial A Vet, Australia’s leading telehealth service, announced its plans to offer 24/7 access to licensed veterinarians for 7 million households nationwide. With affordable 25 AUD consultations, the platform aims to enhance pet care accessibility, particularly in remote areas, ensuring pet owners can seek help anytime, from home. Virtual consultations allow pet owners to connect with veterinarians from home, reducing the need for travel and wait times especially valuable in remote or underserved areas. Mobile veterinary clinics provide on-site services like vaccinations, health check-ups, and minor treatments, catering to busy urban lifestyles and improving access in rural communities. These services also enable better follow-up care, chronic condition management, and behavioral consultations without disrupting the pet’s environment. The COVID-19 pandemic accelerated the adoption of digital platforms, and the shift has persisted due to ongoing demand for flexible, tech-enabled solutions. This digital transformation is playing a crucial role in improving service accessibility and efficiency, directly contributing to Australia veterinary healthcare market growth by expanding care reach and consumer engagement.

Australia Veterinary Healthcare Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product, animal type, and end user.

Product Insights:

- Therapeutics

- Vaccines

- Parasiticides

- Anti-Infectives

- Medical Feed Additives

- Others

- Diagnostics

- Immunodiagnostic Tests

- Molecular Diagnostics

- Diagnostic Imaging

- Clinical Chemistry

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes therapeutics (vaccines, parasiticides, anti-infectives, medical feed additives, and others) and diagnostics (immunodiagnostic tests, molecular diagnostics, diagnostic imaging, clinical chemistry, and others).

Animal Type Insights:

- Dogs and Cats

- Horses

- Ruminants

- Swine

- Poultry

- Others

A detailed breakup and analysis of the market based on the animal type have also been provided in the report. This includes dogs and cats, horses, ruminants, swine, poultry, and others.

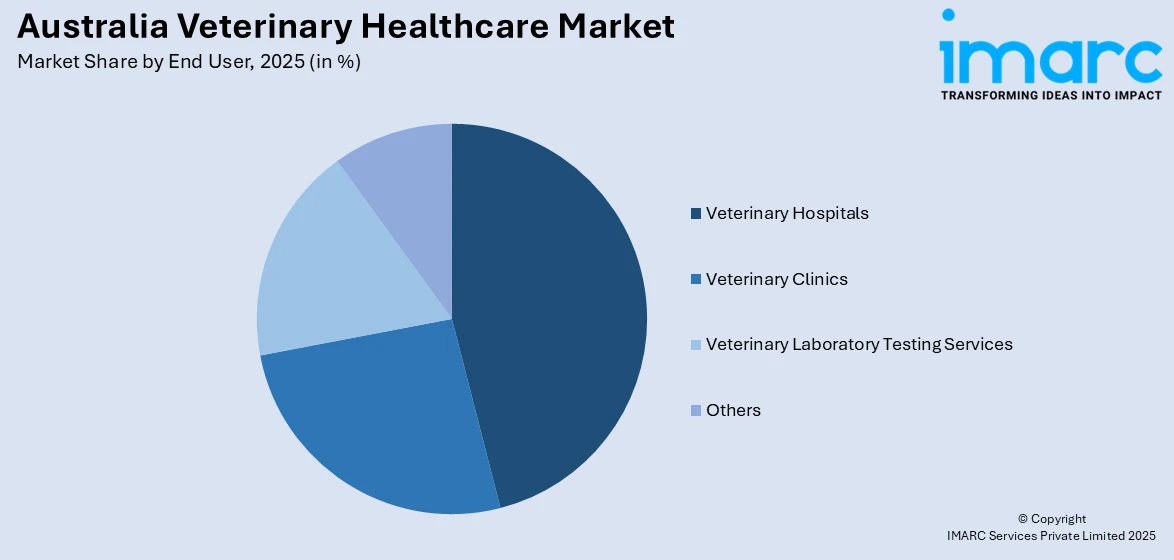

End User Insights:

Access the comprehensive market breakdown Request Sample

- Veterinary Hospitals

- Veterinary Clinics

- Veterinary Laboratory Testing Services

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes veterinary hospitals, veterinary clinics, veterinary laboratory testing services, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Veterinary Healthcare Market News:

- In November 2024, NOVUS announced the launch of new dairy nutrition solutions in Australia and New Zealand to boost milk yields, income, and animal health. Key products include MFP® Feed Supplement for optimizing milk components, MINTREX® trace minerals for reproductive health, and ZORIEN® SeY 3000 Prilled Yeast for improved selenium absorption and overall cow wellness.

- In May 2024, SK Telecom announced the launch of its AI-powered veterinary diagnostic service, X Caliber, in Australia, enabling rapid analysis of X-ray images for pets. Collaborating with ATX Medical Solutions, the service will be available in over 100 clinics. SKT has also secured a deal with MEDIVET in Indonesia to expand further in Southeast Asia.

Australia Veterinary Healthcare Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Animal Types Covered | Dogs and Cats, Horses, Ruminants, Swine, Poultry, Others |

| End Users Covered | Veterinary Hospitals, Veterinary Clinics, Veterinary Laboratory Testing Services, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia veterinary healthcare market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia veterinary healthcare market on the basis of product?

- What is the breakup of the Australia veterinary healthcare market on the basis of animal type?

- What is the breakup of the Australia veterinary healthcare market on the basis of end user?

- What is the breakup of the Australia veterinary healthcare market on the basis of region?

- What are the various stages in the value chain of the Australia veterinary healthcare market?

- What are the key driving factors and challenges in the Australia veterinary healthcare market?

- What is the structure of the Australia veterinary healthcare market and who are the key players?

- What is the degree of competition in the Australia veterinary healthcare market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia veterinary healthcare market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia veterinary healthcare market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia veterinary healthcare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)