Australia Water Purifier Market Size, Share, Trends and Forecast by Technology Type, Distribution Channel, End User, and Region, 2025-2033

Australia Water Purifier Market Overview:

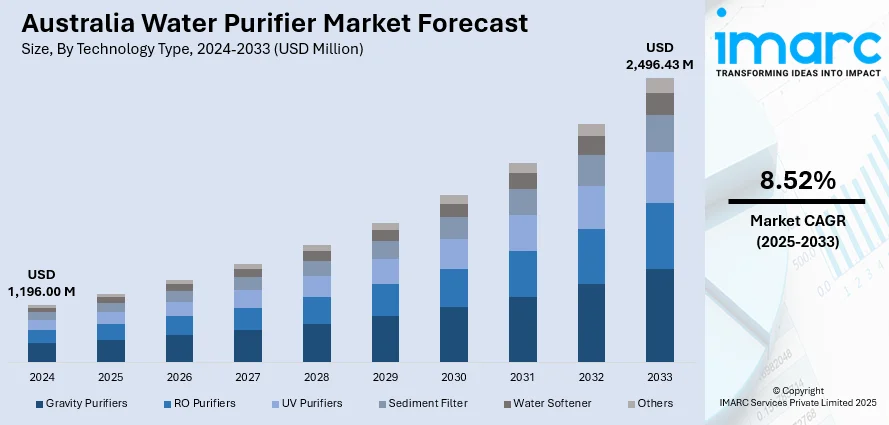

The Australia water purifier market size reached USD 1,196.00 Million in 2024. Looking forward, the market is expected to reach USD 2,496.43 Million by 2033, exhibiting a growth rate (CAGR) of 8.52% during 2025-2033. The market is witnessing significant growth due to rising health awareness, demand for clean drinking water, and adoption of advanced filtration technologies. Moreover, increasing urbanization, portable solutions, and online distribution are further driving market expansion across residential and commercial segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,196.00 Million |

| Market Forecast in 2033 | USD 2,496.43 Million |

| Market Growth Rate 2025-2033 | 8.52% |

Key Trends of Australia Water Purifier Market:

Rising Health and Safety Awareness

Growing public concern over water quality in Australia is significantly driving adoption of home water purifiers. Contaminants such as microplastics, heavy metals, chlorine byproducts, and PFAS have raised health-related anxieties, contributing to the expansion of Australia water purifier market share across residential segments. For instance, in September 2024, Northern Territory manufacturer Life Ho announced its plans to launch the Life-Port water purification system, backed by a $434,978 investment from the NT Government. Designed to eliminate contaminants like heavy metals, it aims to enhance water security in Australia, generate $5.5 million in revenue, and create 15 jobs in Darwin. With media reports and community-level testing revealing the presence of such pollutants in municipal supplies, consumers are prioritizing water safety in daily life. Households are shifting to advanced purification systems that combine reverse osmosis, UV, and activated carbon technologies to ensure safe drinking water. This trend is not limited to cities semi-urban and rural regions are also seeing uptake, especially where infrastructure is outdated or lacking. Health-conscious parents, elderly consumers, and renters are key adopters of compact purifier solutions. Rising awareness and preventive health attitudes are expected to shape the Australia water purifier market outlook.

To get more information on this market, Request Sample

Growth in Portable and Bottle-Based Purifiers

Australia’s growing population of renters, students, and outdoor enthusiasts is fueling demand for compact, portable water purification solutions. Filter bottles, gravity-based purifiers, and countertop units are gaining traction due to their affordability, mobility, and ease of use particularly in urban apartments, university housing, and during travel or camping. For instance, in December 2023, a new water filtration cartridge developed by Deakin University in Australia, in collaboration with Filtertech, aims to enhance global drinking water safety. This cartridge is designed to be integrated into water bottles and other devices, with a target of producing over 50,000 units annually. The sustainable filter reduces water pressure and also minimizes wastewater, directly addressing the urgent need for clean water worldwide. These products require minimal installation and are ideal for users who cannot modify plumbing or invest in large systems. Health-conscious consumers are also embracing them as a sustainable alternative to single-use plastic bottles. Manufacturers are responding with sleek, reusable designs featuring activated carbon, UV-C LEDs, and replaceable filters that fit modern convenience-focused lifestyles. The ability to access clean, safe water on-the-go or in temporary living situations is becoming a key value proposition. As flexible living and mobility trends continue, this segment will play a strong role in driving Australia water purifier market growth.

Growth Drivers of Australia Water Purifier Market:

Climate Change Effect and Water Shortage Issues

One of the major factors propelling the escalating use of water purifiers in Australia is an escalation of concern over climate change and its effects on water security. Being one of the dry inhabited continents on the planet, Australia often faces drought, unpredictable patterns of rain, and water restrictions, particularly among regional and rural communities. Such environmental conditions subject immense stress to existing water infrastructure and cause inconsistency in the quality of available sources of water. With changing climate patterns, most Australians are increasingly becoming aware of water purity when they use bore water, rainwater tanks, or recycled water, which can be contaminated with sediment, organic content, or microbial contaminants. This has prompted families and companies alike to invest in dependable water purification systems that provide constant safety and flavor. Purifier use is no longer limited to urban environments and is found in agricultural areas, rural properties, and seaside communities where salinity of the groundwater or environmental runoff is an issue. Australians are also seeking purification technologies to guarantee safe drinking as a matter of self-sufficiency and resilience in an evolving climate environment.

Regional Adaptation and Value‑Driven Innovation

Another significant driver for Australia water purifier market demand arises from technology adapted to the continent's distinctive environmental and lifestyle conditions. Australian makers and suppliers are developing solutions that react to local water conditions, from coastal saltwater intrusion in a few areas to hard water issues in others. Purifiers designed to filter out certain toxins such as naturally found fluorides or isolated tannins donated by native plant life show a particular responsiveness to regional water profiles. Design improvements like modular units appropriate for small Kiwi‑type dwellings or caravan‑oriented units for outdoor activity enthusiasts, emphasize the value of flexibility. In addition, offers that integrate purification with eco-sensitivity, like low-waste filter cartridges or recyclable parts, register very much with environmentally conscious Australian consumers who give high priority to sustainable living. Such innovations take advantage of the nation's wide geography and ecological diversity, infusing functionality with flexibility. The outcome is a market that values products created to fit any house and to actually blend into the diverse landscape and lifestyle requirements of Australia, from city flats to rural homesteads, from seaside hubs to outback retreats.

Policy Influence and Market Accessibility

Another driving force behind market growth exists in the shifting regulatory landscape and improved retail infrastructure that raises visibility and access to purifiers throughout Australia. Government authorities, utilities boards, and public education campaigns increasingly actively encourage families to think about point-of-use purification systems, especially where municipal water supplies might not meet the subtle requirements for taste or mineral neutrality. This relaxed regulation environment encourages manufacturers to invest on compliance-ready designs, which creates consumer confidence in safety and product consistency. At the same time, expansion of distribution channels, from specialty home‑improvement stores and environmentally oriented retailers to mainstream supermarket chains and digital platforms, allows a wide range of consumers to compare choices, test products, and make informed buying decisions. Furthermore, there is expanding collaboration among regional producers, water treatment specialists, and universities to further national standards for performance and testing, which facilitates ongoing improvement and industry credibility. Combined, this environment of regulatory clarity, retail reach, and institutional partnership transforms water purifiers into household essentials, seamlessly accessible across Australia’s metropolitan and remote regions alike.

Opportunities of Australia Water Purifier Market:

Rural and Remote Community Penetration Through Decentralized Solutions

The vast geography of Australia presents both challenges and opportunities for water purification, particularly in rural, regional, and remote communities. In these areas, traditional centralized water networks may be unreliable, costly to maintain, or simply non-existent. This presents a special opportunity for decentralized purification technology—point-of-use filters, countertop purifiers, and portable units that allow households to obtain clean drinking water on their own. The potential is in technology being applied to harsh topography: products that are robust, low-maintenance, and capable of dealing with uncertain water sources like rainwater tanks, boreholes, and streams. Technologies such as solar-powered or gravity-fed filter units can serve off-grid homes, outback homesteads, and remote settlements where electricity supply is intermittent. In addition, community-based initiatives—e.g., mobile purification units or collective systems for Indigenous communities—emphasize the potential for culturally suited, scalable solutions. Manufacturers and providers can engage in partnerships with local councils, regional suppliers, and non-profits to install and manage these systems, augmenting water security while establishing trust among diverse populations who prioritize self-reliance and environmental care.

Smart Homes and Sustainability-Focused Lifestyles

Australia's high smart home growth rate and robust green-conscious culture present a promising opportunity for water purifiers to become an integral part of networked living systems. More urban Australians are embracing sustainable, technology-enabled homes—smart thermostats, automated lights, energy monitors, and now, the promise of smart water filters. These filters might be integrated into home automation systems, letting customers monitor filter life, water quality, consumption habits, and even get alerts for maintenance. Another appealing field of integration is rainwater harvesting systems, especially in urban areas where people harvest water from rooftops for use in the garden; smart purifiers can automatically channel collected water for drinking purposes after cycling through purification levels. In the meantime, since Australians are gravitating toward environmental conservation, emphasizing zero-waste living, less single-use plastic, and product durability, smart purifiers with green filter materials, recyclable casings, or cartridge-optimize technologies align closely with consumer beliefs. Providing glitch-free smart control and eco-friendly design places water purifiers as much as appliances, and as lifestyle improvers integrated into comprehensive, eco-conscious home systems.

Cross-Sector Expansion through Hospitality, Health, and Tourism Channels

Australia's heterogeneous economy and booming hospitality industry provide a significant opportunity to expand water purifier use beyond homes. In boutique hotels, farm stays, wellness retreats, and ecolodges, particularly those in unspoiled coastal or bushland environments, there is a high value placed on guest experience and authenticity. Placing water purifiers in-room or at the community dining space offers guests clean, crisp water, consistent with the driving ethos of place-based hospitality. Building on this, water purifier companies can partner with boutique hospitality operators and provide branded systems or bespoke purifiers with designs that match rural rustic or minimalist interior design themes. Likewise, health clinics, gyms, and spas, situated in profuse numbers in the urban and regional Australian setting, are open frontiers too. Providing purified water as an added value, perhaps in conjunction with hydration stations or refillable bottle programs, is an ideal fit with the health-focused customer. Tourism-related outlets, particularly in outback national parks or off-track coastal tourist circuits, might highlight purifiers as add-ons to eco-tourism packages, emphasizing environmental stewardship while providing tangible benefits. Water purifier suppliers by venturing into these commercial and lifestyle-related domains can emphasize convenience, eco friendliness, and local appeal, thus taking their market away from the conventional retail channels.

Government Initiatives of Australia Water Purifier Market:

Regulatory Policies and Safety Standards

According to the Australia water purifier market analysis, the government of Australia proactively influences the water purifier industry with strong regulatory policies and safety standards specific to the country's varied environmental and infrastructure profile. From Australia's diverse regions, water quality issues, varied from high mineral levels in dry inland settlements to saltwater contamination in coastal areas, require a regulatory climate that allows consumers to access purification products that adhere to stringent safety and performance standards. Regulatory bodies have provided detailed guidelines that compel manufacturers to conform to national drinking water standards, building consumer confidence. The standards address criteria like removal of naturally occurring chemicals from sources of groundwater or minimizing impurities introduced during rainfall recharge schemes. By imposing clear labeling requirements, making consumers aware of the abilities and limitations of products, the government increases transparency as well as accountability. This drive toward transparency invites suppliers to innovate against local water chemistry profiles, including tannin remediation of native vegetation or pH balance in outback water. The regulatory environment empowers the consumer and supports market maturity by providing a uniform baseline for quality, safety, and trust across Australia's diverse environmental regions.

Community Programs in Remote and Indigenous Areas

Australia's regional and federal governments also promote the adoption of water purifiers through focused community initiatives targeting disparities in remote and Indigenous communities. Due to vast distances and diverse terrain, some remote communities depend on erratic water sources or infrastructure that might not guarantee safety and taste. These are answered with government agencies in partnership with local councils, health departments, and indigenous organizations rolling out subsidized programs and pilot projects providing purification solutions appropriate for decentralized purposes. These focus on culturally appropriate implementation like community leaders in the selection of purifier types that are long-lasting, simple to maintain, and compatible with local lifestyles, such as those that do not consume constant electricity or replacement parts. Training schemes are aligned with equipment deployment, equipping residents to effectively control purification processes in a sustainable manner while guaranteeing equipment lifespan and water safety. With this foundation, government-initiated intervention improves water security, and local leaders have ownership of health-promoting infrastructure. The availability of such intervention imposes a marketplace motivation on purifier vendors to develop community-friendly, low-footprint solutions that are economical, robust, and attuned to the decentralized nature of rural life throughout Australia.

Sustainability-Driven Funding and Innovation Partnerships

Another government initiative in driving Australia's water purifier industry includes funding and partnership programs that facilitate sustainable innovation among both the private sector and research centers. Federal and state governments increasingly promote environmental resilience, water conservation, and technological innovation, providing grants or collaborative initiatives to create next-generation purification systems. These can be aimed at concepts such as solar-powered purification units integrated into schemes, designs minimizing plastic waste using reusable cartridges, or pilot projects in universities experimenting with advanced filtration media from indigenous Australian sources. Such a collaborative environment allows for small and mid-sized businesses to expand ideas with speed, moving from laboratory breakthroughs to real-world application, particularly in communities where sustainability is both an environmental imperative and a cultural value. Incubator programs supported by governments also allow pilot testing of new purifier designs in urban peripheries or eco-retreats, as live demonstrations of greener, smarter water solutions. By promoting public–private partnerships, government players assist in merging economic growth with ecological protection, driving the market's direction toward cleaner, stronger water cleaning solutions better adapted to Australia's diverse climate and way of life requirements.

Challenges of Australia Water Purifier Market:

Varied Water Quality and Geographic Difference

Among the major issues confronting the Australian water purifier industry is the extremely diverse character of water quality throughout the nation. Australia's extensive geography includes everything from dry outback areas and coastal regions to city and mountainous areas, each having its own distinct water conditions. This makes it more challenging to develop and distribute "one-size-fits-all" purification systems. Bore water in the Northern Territory areas, for instance, might be high in minerals, while the eastern seaboard properties can have agricultural runoff or rotten infrastructure contamination. In rainwater tank-dependent areas, particularly in Tasmania and some of South Australia, the water can encounter organic material or bacteria carried by wildlife or as debris from rooftops. These various issues make consumers frequently need highly specialized filtration abilities, which as a result drives up prices for manufacturers and customers alike. Customization and technical expertise become essential, complicating scalability for suppliers and potentially hindering market penetration in low-density population areas or areas of limited infrastructure support.

Consumer Awareness and Perception Barriers

Even with increasing concerns regarding health and sustainability, consumer awareness and perception still present a major barrier in the Australian water purifier market. Most Australians—especially urban Australians—are optimistic about the safety of urban water supplies and might view water purifiers as unnecessary or redundant. This is also supported by comparatively good standards of government water treatment, rendering it difficult to communicate additional advantages of point-of-use purification technology. Additionally, confusion pervades as to what various purifier types can do, and with this, customers hold back from purchasing sediment filters, UV, reverse osmosis, or activated carbon units due to uncertainty. This gap in knowledge is even greater in rural areas, where access to a variety of models at retail may be poor, and professional advice is not always forthcoming. Educational promotions or product demonstrations are yet to reach large-scale levels, thus hindering brands from conveying value in tangible, everyday language. Consequently, even if there are water quality problems, a lack of knowledge regarding the possible health or lifestyle advantages discourages consumers from making rational choices.

Exorbitant Installation and Maintenance Fees

Yet another challenge preventing the widespread use of water purification systems throughout Australia is the cost of ownership, both in terms of installation and regular maintenance. Although simple filters can be quite affordable at the point of purchase, more sophisticated systems like whole-house or reverse osmosis systems tend to have costly installation complexities, particularly on older homes or rural areas with older pipes. Labor prices in Australia are relatively high and qualified installers might be hard to find in remote or rural communities, adding additional logistical challenges. Even post-installation, several systems need maintenance, filter changes, or specialist service, which might not be easily available or within reach in less densely populated areas. This is especially challenging for customers who are using rainwater or bore supplies, where filters will clog earlier or require more frequent maintenance. Under these circumstances, even environmentally friendly or health-sensitive consumers can be deterred by the long-term financial and logistical commitments of having a purifier. For producers and retailers, this cost sensitivity constrains the market for high-end models and requires attention to affordability, ease of use, and low-maintenance technology, which is a category that is still underdeveloped in much of the nation.

Australia Water Purifier Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on technology type, distribution channel, and end user.

Technology Type Insights:

- Gravity Purifiers

- RO Purifiers

- UV Purifiers

- Sediment Filter

- Water Softener

- Others

The report has provided a detailed breakup and analysis of the market based on the technology type. This includes gravity purifiers, RO purifiers, UV purifiers, sediment filter, water softener, and others.

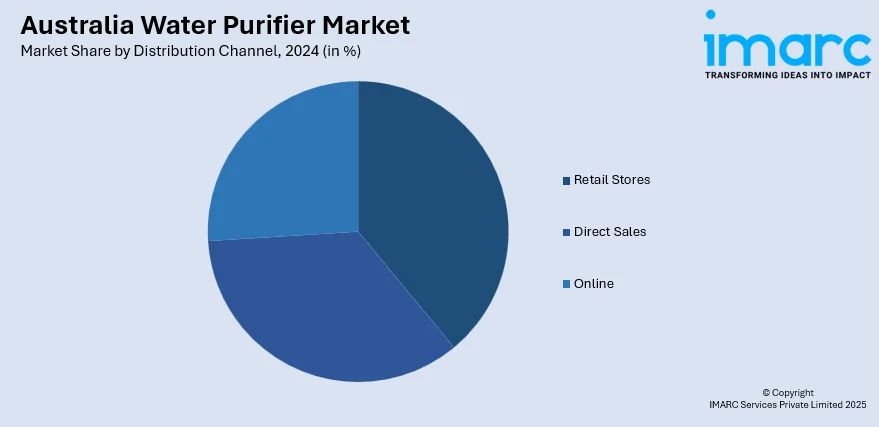

Distribution Channel Insights:

- Retail Stores

- Direct Sales

- Online

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes retail stores, direct sales, and online.

End User Insights:

- Industrial

- Commercial

- Household

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes industrial, commercial, and household.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Water Purifier Market News:

- In December 2024, a new $3.5 million mobile PFAS treatment system was installed at the Cascade Water Filtration Plant in the Blue Mountains after elevated levels of "forever chemicals" were detected in local dams. The authorities aimed to reduce PFAS contamination in drinking water, and initial results were expected in early 2025.

- In December 2024, ACCIONA, in partnership with SUEZ, was awarded an AUS $322M contract by Sydney Water to build the Prospect Pre-Treatment Plant, a crucial facility for ensuring safe drinking water in Sydney. The plant will support the Prospect Water Filtration Plant, enhancing water quality during storms and droughts.

Australia Water Purifier Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technology Types Covered | Gravity Purifiers, RO Purifiers, UV Purifiers, Sediment Filter, Water Softener, Others |

| Distribution Channels Covered | Retail Stores, Direct Sales, Others |

| End Users Covered | Industrial, Commercial, Household |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia water purifier market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia water purifier market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia water purifier industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia water purifier market was valued at USD 1,196.00 Million in 2024.

The Australia water purifier market is projected to exhibit a CAGR of 8.52% during 2025-2033.

The Australia water purifier market is expected to reach a value of USD 2,496.43 Million by 2033.

The Australia water purifier market trends include rising adoption in rural and off-grid areas, growing demand for sustainable and smart purification systems, and increased integration with eco-friendly lifestyles. Consumers prefer compact, low-maintenance solutions, while local innovations cater to diverse water sources influenced by the country’s climate variability and geographic diversity.

The Australia water purifier market is driven by a strong cultural emphasis on sustainability and health, growing awareness about water quality, and water scarcity brought on by climate change. Demand is rising in both urban and remote areas, supported by innovation tailored to regional water conditions and growing interest in eco-friendly, low-maintenance purification solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)