Australia Wearable Medical Devices Market Size, Share, Trends and Forecast by Device Type, Product, Distribution Channel, Application, and Region, 2025-2033

Australia Wearable Medical Devices Market Overview:

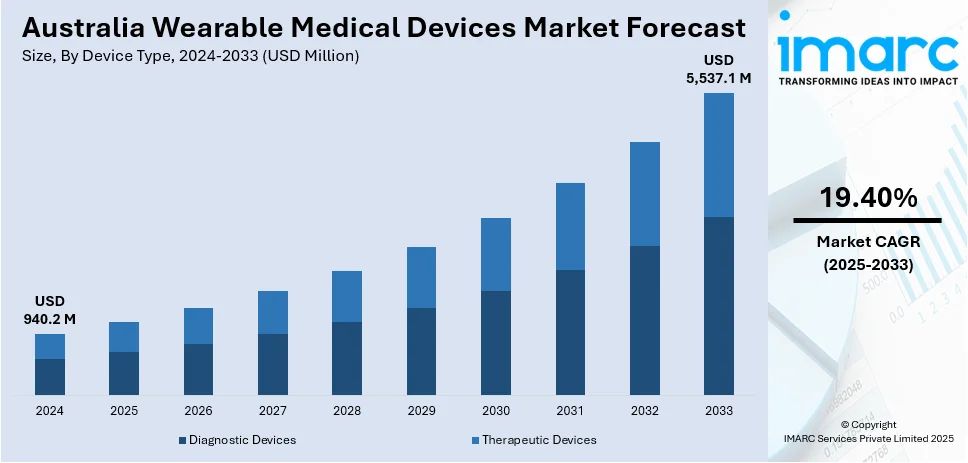

The Australia wearable medical devices market size reached USD 940.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,537.1 Million by 2033, exhibiting a growth rate (CAGR) of 19.40% during 2025-2033. Rising chronic disease prevalence, ageing demographics, improved sensor technology, digital health integration, remote patient monitoring, surging fitness awareness, telehealth adoption, corporate wellness initiatives, and government support for healthcare are some of the factors facilitating the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 940.2 Million |

| Market Forecast in 2033 | USD 5,537.1 Million |

| Market Growth Rate 2025-2033 | 19.40% |

Australia Wearable Medical Devices Market Trends:

Ageing Population Driving Demand for Chronic Disease Management

Australia’s ageing demographic is a key catalyst behind the growing adoption of wearable medical devices. As of 2024, over 17% of the population is aged 65 and above, a figure expected to rise steadily over the next decade. This shift is intensifying the burden of age-related chronic conditions such as hypertension, diabetes, and cardiovascular disorders, which require continuous health monitoring and timely interventions. Wearable devices, including electrocardiogram (ECG) monitors, blood pressure trackers, and glucose sensors, provide older adults with real-time insights into their health metrics, enabling early detection of anomalies and reducing hospital visits. Moreover, these devices are increasingly integrated with remote care platforms, empowering healthcare professionals to monitor patients outside of clinical settings, which is further boosting the Australia wearable medical devices market growth.

To get more information on this market, Request Sample

Rising Incidence of Chronic Diseases

Australia is witnessing a marked rise in chronic illnesses, particularly diabetes and heart disease, which are leading causes of morbidity and mortality. According to the Australian Institute of Health and Welfare, nearly 1.3 million Australians are living with diabetes, with many requiring daily glucose monitoring and lifestyle management. Similarly, over 1.2 million adults suffer from cardiovascular conditions. These trends underscore the growing need for medical-grade wearable technologies that support round-the-clock health tracking. Devices capable of measuring heart rate variability, arrhythmia events, or glucose fluctuations are being adopted not only by patients but also recommended by clinicians as adjunct tools for disease management. Moreover, the convenience of non-invasive, wearable options ensures higher adherence to monitoring regimens compared to traditional diagnostic methods, which is boosting the Australia wearable medical devices market share. This shift towards proactive and preventive healthcare, enabled by wearables, is fostering a more engaged patient base and driving robust commercial interest across manufacturers and digital health startups.

Technological Advancements in Sensor Design and Miniaturization

As per the Australia wearable medical devices market forecast, rapid development in sensor engineering and device miniaturization has transformed wearable medical devices from basic fitness tools into sophisticated clinical instruments. Australian developers and international companies operating in the region are investing in smaller, smarter, and more power-efficient biosensors that can be comfortably worn for extended periods without compromising data accuracy. Innovations such as flexible electronics, multi-parameter sensors, and wireless charging are improving the durability, usability, and scope of medical-grade wearables. These advancements are crucial in making the devices suitable for long-term health management, especially for patients requiring continuous physiological data collection. For instance, compact continuous glucose monitors and wearable ECG patches now offer hospital-grade performance in outpatient settings. The enhanced functionality has also led to growing trust among healthcare providers, spurring adoption in both clinical trials and routine care. Apart from this, the research and development (R&D) incentives and local partnerships and the development of next-gen wearable healthcare solutions are factors providing Australia wearable medical devices market outlook.

Australia Wearable Medical Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on device type, product, distribution channel, and application.

Device Type Insights:

- Diagnostic Devices

- Vital Sign Monitoring Devices

- Sleep Monitoring Devices

- Electrocardiographs And Obstetric Devices

- Neuromonitoring Devices

- Therapeutic Devices

- Pain Management Devices

- Insulin Delivery Devices

- Rehabilitation Devices

- Respiratory Therapy Devices

The report has provided a detailed breakup and analysis of the market based on the device type. This includes diagnostic devices (vital sign monitoring devices, sleep monitoring devices, electrocardiographs and obstetric devices, and neuromonitoring devices) and therapeutic devices (pain management devices, insulin delivery devices, rehabilitation devices, and respiratory therapy devices).

Product Insights:

- Activity Monitors

- Smartwatches

- Patches

- Smart Clothing

- Hearing Aids

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes activity monitors, smartwatches, patches, smart clothing, hearing aids, and others.

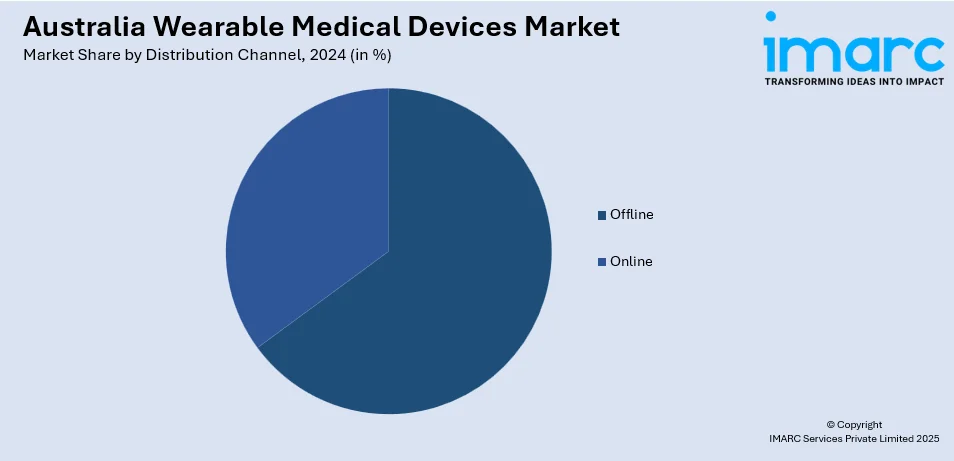

Distribution Channel Insights:

- Offline

- Online

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes offline and online.

Application Insights:

- Sports And Fitness

- Remote Patient Monitoring

- Home Healthcare

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes sports and fitness, remote patient monitoring, and home healthcare.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Wearable Medical Devices Market News:

- In 2024, CardieX introduced the CONNEQT Band, a wearable device featuring a unique photoplethysmography (PPG) sensor designed to capture arterial signals from the fingertips. This innovation aims to enhance the precision of vascular health monitoring, offering a non-invasive solution for tracking key biometric indicators.

- In 2024, In 2024, My Medic Watch joined the NSW Smart Sensing Network Grand Challenge Fund project, partnering with organizations like InteliCare and United for Care. The collaboration focuses on enhancing at-home care through smart sensor data, aiming to improve health outcomes for individuals requiring remote monitoring.

Australia Wearable Medical Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered |

|

| Products Covered | Activity Monitors, Smartwatches, Patches, Smart Clothing, Hearing Aids, Others |

| Distribution Channels Covered | Offline, Online |

| Applications Covered | Sports and Fitness, Remote Patient Monitoring, Home Healthcare |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia wearable medical devices market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia wearable medical devices market on the basis of device type?

- What is the breakup of the Australia wearable medical devices market on the basis of product?

- What is the breakup of the Australia wearable medical devices market on the basis of distribution channel?

- What is the breakup of the Australia wearable medical devices market on the basis of application?

- What is the breakup of the Australia wearable medical devices market on the basis of region?

- What are the various stages in the value chain of the Australia wearable medical devices market?

- What are the key driving factors and challenges in the Australia wearable medical devices market?

- What is the structure of the Australia wearable medical devices market and who are the key players?

- What is the degree of competition in the Australia wearable medical devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia wearable medical devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia wearable medical devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia wearable medical devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)