Australia Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2025-2033

Australia Whiskey Market Overview:

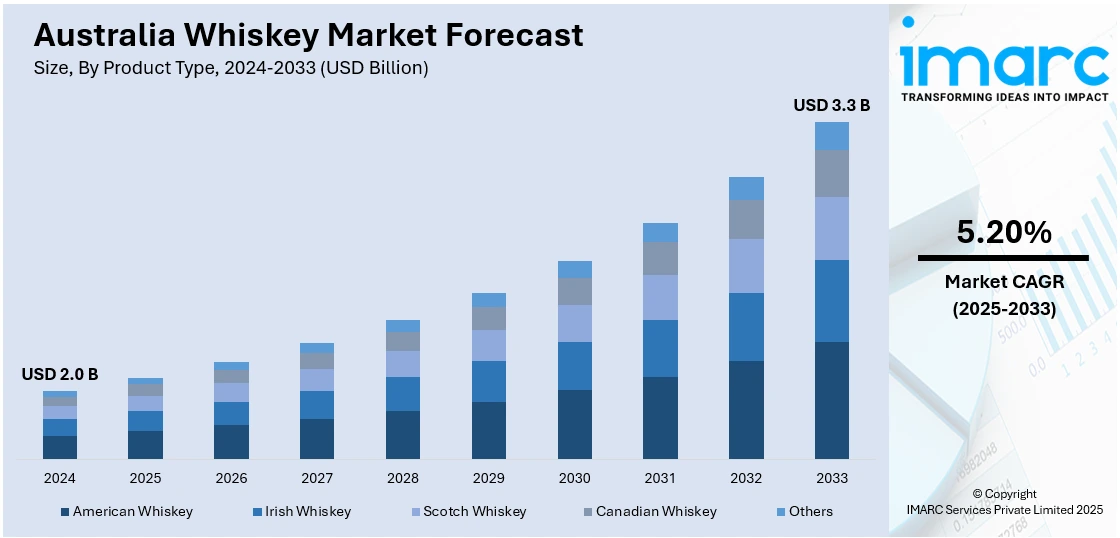

The Australia whiskey market size reached USD 2.0 Billion in 2024. Looking forward, the market is expected to reach USD 3.3 Billion by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The market is led by growing domestic consumption and export demand, and is driven by a high premium positioning to its enhanced popularity and worth in the international alcoholic drinks market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.0 Billion |

| Market Forecast in 2033 | USD 3.3 Billion |

| Market Growth Rate 2025-2033 | 5.20% |

Key Trends of Australia Whiskey Market:

Increased Demand for Craft and Small-Batch Whiskey

Interest in high-quality, hand-crafted products has boosted the profile of craft and small-batch whiskey throughout Australia. Distillers emphasizing high-quality ingredients, innovative aging procedures, and domestic production are gaining more attention. For instance, in April 2024, South Australia's 23rd Street Distillery launched its first Australian Whisky and Whisky & Cola RTDs, in a local thrust in a market where 95% of whisky is imported. Moreover, as consumers learn more about whiskey, tastes are moving toward limited release and artisanal offerings. Retailers and specialty pubs have responded with carefully crafted offerings that highlight regional profiles and production stories. Distillery visitation-based tourism has also aided awareness and experimentation of craft brands. Origin traceability and sustainability also drive purchasing decisions in this category. Australia whiskey market growth is being fueled by this demand for differentiation and higher taste profiles, particularly among millennials and urban professionals. The growing value placed on process openness and authenticity keeps driving this trend forward, making Australian craft whiskey a unique choice in both domestic and export markets.

To get more information on this market, Request Sample

Impact of Asian Palates on Flavor Innovation

Australian distillers are increasingly testing out flavors and cask finishes based on Asian culinary profiles. There is a discernible trend towards whiskeys that are infused with light umami notes, hints of exotic spice, and aging in casks that once stored plum wine, sake, or soy-based liqueurs. The innovation is commensurate with Australia's multicultural consumers and growing exports to adjacent Asian nations. Innovation in flavor is not just expanding portfolios but also winning the attention of newer consumers looking for smoother and more nuanced taste profiles. This is evident in both off-trade and on-trade markets, with tasting menus and mixology reflecting these modern flavors. Australia whiskey market share has been enhanced through this cross-cultural innovation, making it more competitive in the global market and gaining popularity beyond the core whiskey customers. The combination of Australian know-how and Asian sensibilities for flavor continues to evolve as the hallmark of the local whiskey culture.

Emergence of Barrel Experimentation and Indigenous Wood Aging

Australian distillers are experimenting with aging methods employing native woods like red gum, stringybark, and ironbark to create whiskeys with their own flavor signatures. These woods convey distinct smoky, earthy, or spicy flavors that vary significantly from those produced through the use of conventional oak barrels. Moreover, certain producers are reconditioning Australian wine or fortified wine origin barrels, enriching the whiskey with rich undertones. For example, in April 2024, Bright Brewery and Backwoods Distilling Co. released the 2024 Stubborn Imperial Stout Whisky (Batch 3), a limited-edition expression aged in American and French oak casks, offering a distinctive, full-bodied profile. Furthermore, this innovative method is gaining attention from connoisseurs seeking uniqueness and complexity. The incorporation of local environmental conditions like coastal humidity and temperature variation contributes additional layers to the maturation process. Australia whiskey market outlook looks bright with producers ongoing to encourage the boundaries of flavor and create a regional character through innovation in barrel. Such an investigation of indigenous aging materials not only deepens brand distinction but also expresses a larger trend of terroir-based narrative within the premium spirits category.

Growth Drivers of Australia Whiskey Market:

Rising Premiumization Trends

Australia whiskey market demand is experiencing a notable increase due to a strong shift towards premiumization. Whiskey buyers are increasingly gravitating toward premium, small-batch, and mature whiskey offerings that provide distinctive flavor profiles and craftsmanship. The trend is a result of the search for authenticity, luxury, and higher quality, especially among urban and upper-income consumers. With increasing awareness about the art of whiskey production consumers are increasingly becoming more educated and sophisticated actively searching for brands that have strong heritage or even new approaches to production. High-end whiskeys are also viewed as symbols of status and perfect for present-giving further increasing their popularity. This mindset shift is leading producers to focus on craft production and high-end branding to meet mounting expectations.

Changing Consumer Preferences

Shifting consumer preferences are transforming the whiskey consumption landscape in Australia. Younger adults especially millennials and Gen Z are adopting whiskey not merely as a beverage but as a lifestyle. Unlike older generations they are curious about exploring new brands flavor combinations, and cocktail-friendly options. Their adventurous spirit and openness to experimentation have given rise to flavored whiskeys, limited editions, and unconventional blends. Social media and digital platforms significantly influence purchasing decisions as consumers seek brands that resonate with their identity and values. This demographic transition is paving the way for innovation cultivating a more vibrant and inclusive whiskey culture within the Australian market.

Growing Tourism and Tasting Experiences

According to Australia whiskey market analysis, the increasing trend of whiskey tourism and tasting experiences is emerging as a key growth driver. Distillery tours, whiskey-pairing dinners, and guided tasting events are attracting both local enthusiasts and international tourists. These experiences offer immersive insights into production methods, ingredient sourcing, and brand narratives, enhancing appreciation for quality whiskey. Whiskey trails linked to tourism in regions like Tasmania and Victoria are becoming popular attractions. These experiential offerings boost immediate sales and foster long-term brand loyalty and encourage word-of-mouth marketing. As tourism recovers, these curated experiences are anticipated to play a crucial role in expanding consumer engagement and whiskey consumption.

Opportunities of Australia Whiskey Market:

Export Potential to Emerging Markets

Australia’s whiskey market presents considerable potential for exports to emerging markets where the appetite for premium and craft spirits is growing. As global consumers develop a preference for top-quality, small-batch whiskey, Australian distillers can take advantage of their unique climate, locally sourced ingredients, and innovative production practices to differentiate themselves. Countries in Asia, Eastern Europe, and South America show particular promise due to increasing middle-class incomes and a budding culture of whiskey appreciation. Strong branding, effective storytelling, and adherence to international quality standards can position Australian whiskey as a premium alternative to traditional Scotch or American varieties. Expanding into these markets diversifies revenue sources and enhances Australia’s standing as a significant whiskey-producing country.

Innovation in Flavored and Cask-Finished Whiskeys

The rising interest in flavor innovation offers a compelling opportunity for Australian whiskey brands to cater to changing consumer tastes, particularly among younger audiences. Experimenting with cask finishes like wine, sherry, or rum barrels and creating infused or naturally flavored expressions can set products apart in a competitive landscape. These offerings can appeal to new whiskey drinkers who might find traditional profiles overwhelming or complex. Limited editions and seasonal releases create excitement and a sense of exclusivity. Such innovations allow brands to weave creative narratives and align with cocktail culture, where mixologists are on the lookout for unique flavor bases. By responding to this demand for novelty and experimentation, brands can broaden their consumer reach and maintain market relevance.

Whiskey Tourism and Experiences

Whiskey tourism is emerging as a significant opportunity in Australia, particularly in picturesque regions like Tasmania and Victoria, which host an increasing number of craft distilleries. Providing distillery tours, tasting rooms, and interactive experiences crafts memorable engagements that extend beyond the product. These activities educate visitors about the artistry, history, and processes behind each bottle, enhancing emotional ties to the brand. Such experiences also promote direct-to-consumer sales and foster word-of-mouth advertising. Hosting events like festivals, pairing dinners, or workshops further boosts the allure, drawing both local and international travelers. As experiential travel continues to rise, whiskey tourism offers brands a platform to cultivate loyalty and enhance consumer engagement.

Challenges of Australia Whiskey Market:

High Production and Aging Costs

Creating premium whiskey in Australia incurs substantial expenses due to lengthy aging processes, climate control, and the utilization of superior ingredients. Unlike many other spirits, whiskey typically necessitates years of aging in oak barrels, which results in capital and storage being tied up for long periods. Moreover, ensuring consistent flavor profiles amidst Australia’s diverse climate conditions complicates and increases costs. For smaller and emerging distilleries, these issues present significant financial obstacles, hindering their ability to scale and compete on price. Consequently, many producers feel the pressure to find a balance between craftsmanship and cost-efficiency while striving to meet consumer demands for quality and authenticity in each bottle.

Limited Global Brand Recognition

Australian whiskey brands are currently in the initial phases of enhancing their international presence, contending with well-established players from Scotland, Ireland, and the U.S. While the quality of Australian whiskey is improving, limited global brand visibility and distribution networks constrict their growth in export markets. Consumers overseas often gravitate towards familiar labels, which poses challenges for Australian products in securing retail space and customer loyalty. Building trust in new markets necessitates strategic marketing, storytelling, and partnerships with distributors and retailers. Until these brands achieve greater recognition, many encounter difficulties in gaining a foothold in international markets, despite the distinctiveness and quality of their products.

Regulatory and Tax Burdens

Producers of whiskey in Australia are subject to strict regulatory and tax frameworks that may hinder growth, particularly for smaller and emerging distilleries. High excise taxes on alcohol, intricate licensing procedures, and persistent compliance requirements create both administrative and financial obstacles. Such pressures can postpone product launches, inflate operational costs, and stifle innovation. In addition, navigating through zoning laws and environmental regulations complicates the establishment or expansion of distillery operations. For new entrants into the market, these challenges can be intimidating and potentially suppress creativity and market access. Addressing these regulatory issues and developing clearer, more supportive guidelines could unlock greater opportunities in Australia’s burgeoning whiskey market.

Government Support of Australia Whiskey Market:

Grants for Regional Distilleries

Government grants aimed at regional distilleries serve as a vital support system that fosters the growth of the Australian whiskey industry. These funding initiatives allow small and rural producers to invest in critical infrastructure, including aging warehouses, bottling facilities, and visitor centers. By alleviating financial pressures, these grants stimulate innovation, expansion, and job creation in remote areas. They also enhance distilleries’ ability to draw in tourists through improved tasting rooms and onsite experiences, thereby uplifting local economies. Such financial support increases production capabilities and promotes community development and regional branding. Consequently, rural distilleries strengthen their positions in both domestic and international whiskey markets, contributing to the industry's diversity and sustainable growth.

Export Assistance Initiatives

Export assistance programs play a pivotal role in aiding Australian whiskey brands in establishing themselves within competitive global markets. Through government-supported trade missions, international expos, and targeted marketing support, distillers can gain visibility among buyers, distributors, and consumers worldwide. These programs lower entry barriers and position Australian whiskey as a premium and distinctive category internationally. Additionally, they provide guidance on regulatory adherence, labeling requirements, and customs procedures, thus simplifying the export process for smaller producers. With the rising international appetite for unique and artisanal spirits, such initiatives help elevate the profile of Australian whiskey globally. Ultimately, this support drives export volumes, bolsters brand recognition, and enhances Australia’s status in the premium spirits sector.

Agricultural Development Programs

Government-backed agricultural development programs offer essential support to Australia’s whiskey sector by enhancing the supply of local ingredients. Whiskey producers benefit from initiatives that encourage sustainable grain cultivation, improved barley strains, and robust agricultural practices. These programs guarantee a reliable supply of top-notch raw materials, crucial for producing premium spirits. Furthermore, such initiatives promote collaboration between distillers and local farmers, strengthening regional supply chains and providing rural employment opportunities. Support for effective water management, climate resilience, and soil health contributes to improved agricultural yields, directly influencing the quality and uniqueness of Australian whiskey. This synergy boosts production efficiency and strengthens the authenticity and local character of Australia’s spirit offerings.

Australia Whiskey Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, quality, and distribution channel.

Product Type Insights:

- American Whiskey

- Irish Whiskey

- Scotch Whiskey

- Canadian Whiskey

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes American whiskey, Irish whiskey, scotch whiskey, Canadian whiskey, and others.

Quality Insights:

- Premium

- High-End Premium

- Super Premium

A detailed breakup and analysis of the market based on the quality have also been provided in the report. This includes premium, high-end premium, and super premium.

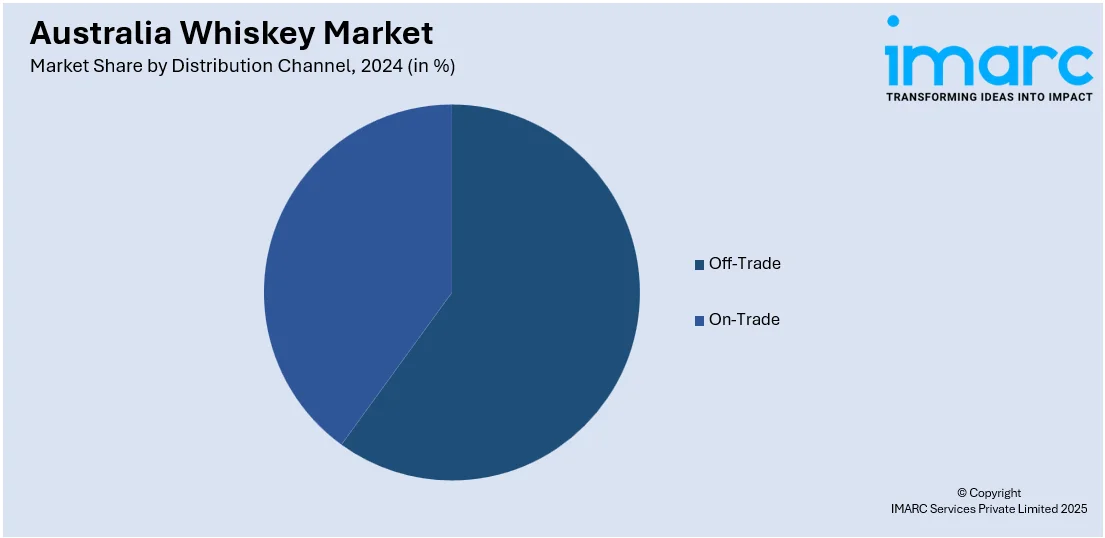

Distribution Channel Insights:

- Off-Trade

- Supermarkets and Hypermarkets

- Discount Stores

- Online Stores

- Others

- On-Trade

- Restaurants and Bars

- Liquor Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes off-trade (supermarkets and hypermarkets, discount stores, online stores, and others), and on-trade (restaurants and bars, liquor stores, and others).

Regional Insights

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Whiskey Market News:

- In November 2024, Glenfiddich and Aston Martin announced an exclusive partnership, debuting at the Las Vegas Grand Prix. To commemorate the collaboration, Glenfiddich will release a rare 1959 Sherry cask whisky. Additionally, the Glen Whisky Club will launch the exclusive Glenfiddich Gran Cortes XXII 22 year old in Australia.

- In September 2024, Speciality Brands exclusively represented Australia's award-winning Starward whisky. Founded in 2007 by David Vitale, Starward aims to enhance Australia's whisky profile. Speciality Brands plans to expand distribution and engage consumers through events, promoting four core expressions: Nova, Left Field, Solera, and Fortis.

- In August 2024, Pernod Ricard launched Skrewball peanut butter-flavored whiskey in Australia and New Zealand, expanding its global presence. The brand, co-founded by Steven and Brittany Yeng, aims to resonate with local cultures, embodying adventure and individuality since its 2019 debut.

- In May 2024, Sullivans Cove launched HH0004, a 24-year-old single-cask whisky, officially recognized as the oldest whisky ever released in Australia. With only 335 bottles, the release signifies the distillery's dedication to superior aging, craftsmanship, and excellence in high-end whisky production on its 30th anniversary.

- In February 2023, Tarac, a South Australia company, released its initial Australian single malt new-make spirit with the objective of helping local craft whisky distillers by adding to available production scalable, high-quality spirit from 100% South Australian barley. The project focuses on facilitating market access expansion and relieving capacity stress for up-and-coming producers.

Australia Whiskey Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | American Whiskey, Irish Whiskey, Scotch Whiskey, Canadian Whiskey, Others |

| Qualities Covered | Premium, High-End Premium, Super Premium |

| Distribution Channels Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia whiskey market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia whiskey market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia whiskey industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The whiskey market in Australia was valued at USD 2.0 Billion in 2024.

The Australia whiskey market is projected to exhibit a compound annual growth rate (CAGR) of 5.20% during 2025-2033.

The Australia whiskey market is expected to reach a value of USD 3.3 Billion by 2033.

The Australia whiskey market is witnessing a rise in demand for craft and small-batch whiskeys, along with growing consumer interest in cask finishes and experimental flavors. Whiskey tourism, including distillery tours and tasting events, is gaining popularity, while younger audiences are embracing whiskey through mixology and lifestyle-driven branding.

The market is driven by increasing domestic consumption, rising disposable incomes, and a growing preference for premium and locally produced spirits. Supportive government initiatives, export potential, and expansion of boutique distilleries are also fueling growth. Additionally, consumer curiosity and evolving tastes are encouraging innovation and broader market participation across age groups.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)