Australia Wind Power Market Size, Share, Trends and Forecast by Location and Region, 2025-2033

Australia Wind Power Market Size and Share:

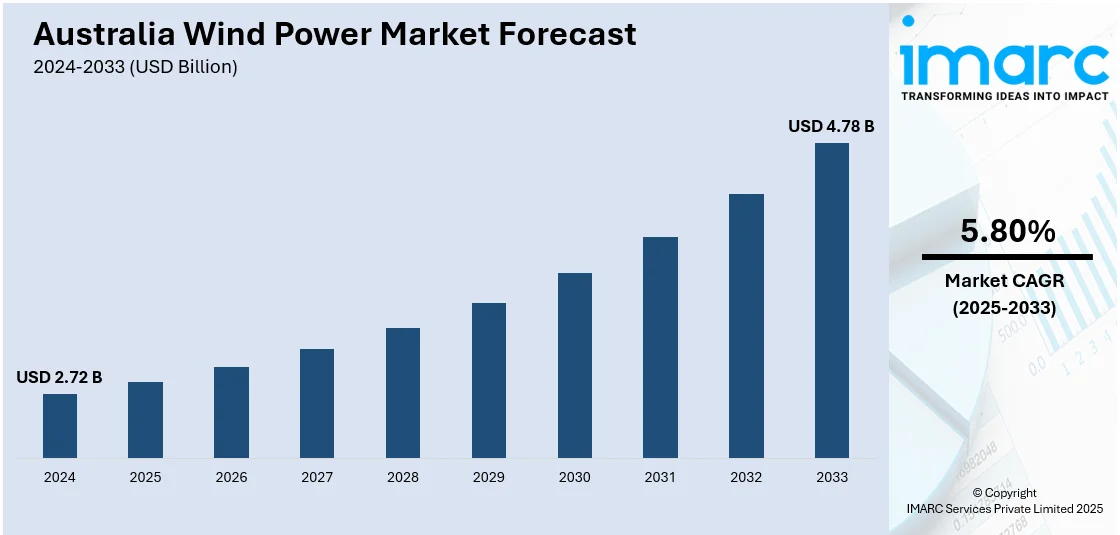

The Australia wind power market size reached USD 2.72 Billion in 2024. Looking forward, the market is projected to reach USD 4.78 Billion by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The market is driven by strong government support, ambitious renewable energy targets, declining technology costs, and growing corporate demand for clean energy. High-quality wind resources, advancements in turbine efficiency, and the urgent need for grid decarbonization further bolster the Australia wind power market share investment and expansion across both onshore and offshore wind projects.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.72 Billion |

| Market Forecast in 2033 | USD 4.78 Billion |

| Market Growth Rate 2025-2033 | 5.80% |

Key Trends of Australia Wind Power Market:

Integration with Energy Storage Systems

As Australia grows in its proportion of wind power, the addition of battery storage systems has become essential. The intermittent nature of wind energy can put pressure on grid stability during times of peaks or troughs of generation. More projects are paired with big batteries, like the Hornsdale Power Reserve in South Australia, which grew to 150 MW/194 MWh. Australia's commitment to storage is evident, with cumulative installed capacity reaching about 5,966 MWh by the end of 2023, including 2,603 MWh from utility-scale batteries. By storing excess wind energy for use when needed, these devices increase the grid's dependability. Virtual power plants (VPPs), which combine and control a number of storage devices through intelligent software, are developing fast. Declining battery prices and firm government incentives are driving this trend, making wind power more stable, flexible, and commercially viable for Australia's energy future.

To get more information on this market, Request Sample

Rapid Growth in Offshore Wind Development

Australia is experiencing a surge in offshore wind projects, driven by favorable policies and high coastal wind resources. Investments have been stimulated by the government's passage of laws such as the Offshore Electricity Infrastructure Act 2021. Regions such as Gippsland (Victoria) and Hunter (New South Wales) have been declared offshore wind zones, attracting major developers like Ørsted and BlueFloat Energy. Offshore wind offers higher, steadier output compared to onshore farms and can be placed closer to demand centers. With a goal to reach net-zero emissions by 2050, offshore wind is critical to diversify the renewable energy mix thus providing an impetus to the market growth.

Corporate Power Purchase Agreements (PPAs) Boost Demand

The need for clean energy by corporations is causing significant transformation in Australia's wind power industry. Major companies such as Woolworths, BHP, and Coles are securing long-term Power Purchase Agreements (PPAs) with wind farm operators to meet sustainability goals, hedge against energy price volatility, and support national renewable energy targets. In 2023 alone, a record volume of over 1,700 MW was contracted under corporate renewable PPA deals, marking the fourth consecutive year with deal volumes exceeding 1 GW. These agreements provide wind farms with stable, predictable revenue streams, enhancing project bankability and encouraging new developments. PPAs are evolving to include hybrid contracts combining wind and solar energy for greater reliability. As pressure for corporate decarbonization intensifies, PPAs are expected to dominate future wind project financing, playing a crucial role in Australia wind power market growth.

Growth Drivers of Australia Wind Power Market:

Government Support

Australia's wind energy sector benefits greatly from a favorable policy framework. Incentives such as renewable energy targets, reverse auctions, and funding grants create a stable environment for developers to invest in wind initiatives. These measures alleviate financial challenges and promote innovation in wind technology. Initiatives at both federal and state levels are crucial in speeding up project approvals and construction processes. By establishing long-term renewable goals the government boosts confidence among investors and developers, ensuring ongoing growth in the wind energy sector. Moreover, community benefit schemes and planning support help foster local acceptance of wind projects, further enhancing the industry's expansion in coastal and inland areas.

Grid Developments

The growth of wind power in Australia is significantly influenced by the expansion and modernization of the electricity grid. Improvements in transmission infrastructure enable wind farms in remote or high-wind areas to effectively supply electricity to urban and industrial hubs. New interconnectors, smart grid technologies, and real-time monitoring systems enhance grid stability and mitigate curtailment risks, thereby increasing the reliability and scalability of wind energy. These advancements also facilitate the integration of other renewable sources, like solar and energy storage, leading to a more balanced energy portfolio. Enhanced grid planning and cooperation between transmission operators and renewable developers are ensuring that generation capacity aligns well with network capabilities.

Growing Investor Interest

Australia's wind power sector is attracting strong investment from local and foreign sources. The long-term potential for stable returns, underpinned by power purchase agreements (PPAs) and clean energy policies, is building confidence among institutional and private investors. Wind farms are considered low-risk assets that provide diversification, owing to their reliable output and increasing demand for energy. Foreign investors are especially drawn to the high-quality wind resources and transparent regulatory environment of Australia. Climate-focused investment funds are also ramping up investment in wind power as part of their environmental, social, and governance (ESG) approach. The increased capital inflow is accelerating project development and augmenting the nation's renewable energy base.

Opportunities of Australia Wind Power Market:

Technological Innovations

Australia's wind energy industry is poised to make substantial gains from ongoing technological innovations. Significant advancements in turbine design, including taller towers, longer blades, and more efficient generators, enable the capture of greater energy, even in regions with lower wind speeds. These improvements help to reduce the cost per megawatt-hour, enhancing the financial viability of projects. Furthermore, the implementation of digital monitoring systems and predictive maintenance tools boosts performance, reduces downtime, and extends the lifespan of equipment. The use of real-time data analysis empowers operators to optimize their processes and swiftly address challenges, thereby improving overall reliability. With continuous research and development alongside global technology exchanges, Australia is ideally positioned to embrace the next wave of wind technologies, facilitating the nation's shift towards a low-emission and cost-effective energy landscape. According to Australia wind power market analysis, these technological advancements are expected to accelerate project deployment, attract greater investment, and enhance integration with the national grid, thereby playing a critical role in meeting the country’s renewable energy targets and supporting long-term energy security.

Job Creation and Economic Development

The expansion of wind power in Australia generates significant socio-economic benefits, particularly for rural and regional communities. Large-scale wind projects necessitate considerable labor for site preparation, construction, and ongoing maintenance, resulting in both temporary construction jobs and sustained employment in operations, engineering, and technical support. Local populations gain from infrastructure enhancements, land lease payments to property holders, and increased business opportunities for nearby service providers. In certain areas, wind farms directly contribute to community funds that promote education, health, and environmental projects. These initiatives aid in diversifying local economies that have historically depended on agriculture or mining. As the renewable sector continues to grow, initiatives focused on workforce training and skill enhancement are further preparing the local workforce, solidifying the impact of wind energy on economic growth and resilience in regional areas.

Hybrid Renewable Projects

Integrating wind energy with solar power and battery storage within hybrid projects presents a promising avenue for Australia's renewable energy landscape. Wind and solar resources often support each other solar energy production peaks during daylight hours, while wind energy may be stronger during nighttime or different seasons. By combining these energy sources with storage capabilities, fluctuations in power supply can be smoothed out, ensuring a more stable and consistent energy output. Hybrid systems also enable more efficient land usage, shared infrastructure, and lower grid connection costs. These configurations are increasingly appealing to developers looking for diverse energy outputs and enhanced project financials. As technology progresses and costs continue to decline, hybrid renewable models have the potential to significantly enhance grid reliability and assist Australia in achieving its long-term clean energy objectives.

Government Initiatives of Australia Wind Power Market:

Renewable Energy Targets (RETs)

Australia's federal and state governments have established Renewable Energy Targets (RETs) to promote the shift towards cleaner energy sources, particularly wind power. These targets define specific objectives for the percentage of electricity to be generated from renewable sources within a set timeframe, providing long-term stability for developers and investors. RETs boost the demand for clean energy, prompting the construction of wind farms to fulfill mandated quotas. States like Victoria and South Australia have set ambitious individual targets, frequently surpassing national standards. This demand driven by policy fosters project approvals, technological advancement, and energy diversity. Additionally, RETs support emissions reduction goals and enhance investor confidence, making them a fundamental aspect of Australia’s renewable energy strategy and a significant driver of Australia wind power market demand.

Clean Energy Finance Support

The Clean Energy Finance Corporation (CEFC), a government-owned institution, plays a crucial role in advancing Australia’s wind energy industry by offering low-cost capital and customized financial solutions. Its involvement mitigates the financial uncertainties associated with large-scale renewable projects, improving their attractiveness to investors. The CEFC partners with commercial lenders and equity investors, enabling projects to reach financial closure more rapidly and efficiently. Beyond providing direct funding for projects, the CEFC promotes innovation in wind technologies, hybrid systems, and storage solutions. By utilizing public funds to leverage private investment, this initiative accelerates the development of wind farms, bolsters investor confidence, and contributes to a more stable and diverse energy grid that aligns with Australia’s climate objectives.

Transmission Infrastructure Investments

Key to the growth of wind power in Australia is investing in transmission infrastructure. Government-supported initiatives are addressing the gap between abundant wind resources often found in remote or regional locations and urban demand centers. Enhancements and expansions of transmission networks help reduce grid congestion, enabling new wind farms to connect effectively and supply power to where it is most needed. Projects include the construction of new interconnectors, increasing grid capacity, and implementing smart grid technologies for improved integration of variable renewables. These efforts minimize curtailment risks, enhance grid reliability, and open up previously inaccessible wind areas. By investing in transmission development, the government is building the groundwork for a more interconnected, resilient, and renewable-powered national energy system.

Challenges of Australia Wind Power Market:

Intermittency Challenges

One of the main obstacles facing wind power in Australia is its unpredictability. Wind energy generation depends on weather conditions causing power output to fluctuate significantly throughout the day or across seasons. This variability complicates the task of providing a consistent and reliable power supply particularly during times of weak wind. In the absence of adequate energy storage solutions such as large batteries or pumped hydro systems maintaining a balance between energy supply and immediate demand becomes problematic. This unpredictability also increases dependency on backup generation sources which often stem from fossil fuels potentially negating some of the ecological advantages of wind energy. To mitigate this issue improved forecasting techniques, demand response initiatives, and investments in adaptable grid infrastructure are crucial for facilitating the large-scale adoption of wind power.

Growing Environmental Concerns

Though wind energy is regarded as a clean and renewable source of energy, it does come with some environmental concerns, especially when it comes to wildlife and local ecosystems. One of the most major issues widely debated is the risk of birds and bats colliding with the blades of turbines, particularly in migratory flight paths or high-biodiversity areas. Wind farm construction can also disturb habitats and change land use, affecting indigenous species. Further, noise pollution and visual interferences can be a concern for local communities. These challenges need to be met by developers conducting thorough environmental impact assessments before any construction is commenced and adopting strategies for mitigation like site selection with care, adaptive location of turbines, and wildlife monitoring programs to reduce environmental impact and enable responsible development of wind farms.

Grid Limitations

Grid congestion is a major barrier to the growth of wind power in Australia. Some of the best locations for wind farms are in remote regions with strong wind potential, but these do not always have the transmission facilities to bring new power generation into main consumption areas. Projects can face curtailment or postponements as a result of limited grid access. This condition lowers operational efficiency and discourages new investments in wind power. In addition, aged grid infrastructure and regulatory issues increase the challenge to integrating renewable energy supplies. To solve grid congestion, there needs to be concerted efforts by government agencies, regulators, and power operators to upgrade transmission lines, build interconnectors, and utilize smart grid technologies for enhanced power flow and stable system performance.

Australia Wind Power Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on location.

Location Insights:

.webp)

- Onshore

- Offshore

The report has provided a detailed breakup and analysis of the market based on the location. This includes onshore and offshore.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Acciona, S.A

- APA Group

- Ark Energy Corporation Pty Ltd

- Goldwind Science & Technology Co., Ltd

- Iberdrola, S.A.

- Neoen Australia

- RATCH Australia Corporation

- Suzlon Energy Australia

- Tilt Renewables

- Vestas Wind Systems A/S

- WestWind Energy Pty Ltd

Australia Wind Power Market News:

- In April 2025, Victoria will launch Australia’s first offshore wind energy auction in September 2025, aiming to award contracts by October 2026. The Labor Allen government outlined plans to support offshore wind development to meet its targets of 2GW by 2032, 4GW by 2035, and 9GW by 2040. According to Energy Minister Lily D'Ambrosio, the auction will close in May 2025 and will follow a private Registration of Interest (ROI) procedure for holders of feasibility licenses.

- In February 2025, Turbine Made, the first program in Australia to recycle retired wind turbine blades into new materials and products, was started by ACCIONA. A blade from Victoria's Waubra Wind Farm has been converted into a multifunctional particle for sustainable manufacturing. ACCIONA is seeking innovative ideas through an open Expressions of Interest call. With many Australian turbines aging, this initiative promotes a circular economy and sustainable solutions for blade waste in the renewable energy sector.

Australia Wind Power Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Locations Covered | Onshore, Offshore |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Acciona, S.A, APA Group, Ark Energy Corporation Pty Ltd, Goldwind Science & Technology Co., Ltd, Iberdrola, S.A., Neoen Australia, RATCH Australia Corporation, Suzlon Energy Australia, Tilt Renewables, Vestas Wind Systems A/S, WestWind Energy Pty Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia wind power market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia wind power market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia wind power industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The wind power market in the Australia was valued at USD 2.72 Billion in 2024.

The Australia wind power market is projected to exhibit a compound annual growth rate (CAGR) of 5.80% during 2025-2033.

The Australia wind power market is expected to reach a value of USD 4.78 Billion by 2033.

Favorable wind conditions and vast available land make Australia ideal for onshore wind projects. Government-backed financing and streamlined planning processes are encouraging new investments. Rising corporate demand for renewable energy and long-term power purchase agreements (PPAs) are also driving consistent market expansion across both public and private sectors.

Australia is seeing a surge in hybrid energy projects combining wind, solar, and storage for enhanced reliability. Offshore wind development is gaining momentum with supportive policy frameworks. Additionally, digital tools for remote monitoring and real-time data analysis are becoming central to wind farm operations and efficiency optimization.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)