Australia Yogurt Market Size, Share, Trends and Forecast by Product Type, Flavor, Distribution Channel, and Region, 2025-2033

Australia Yogurt Market Overview:

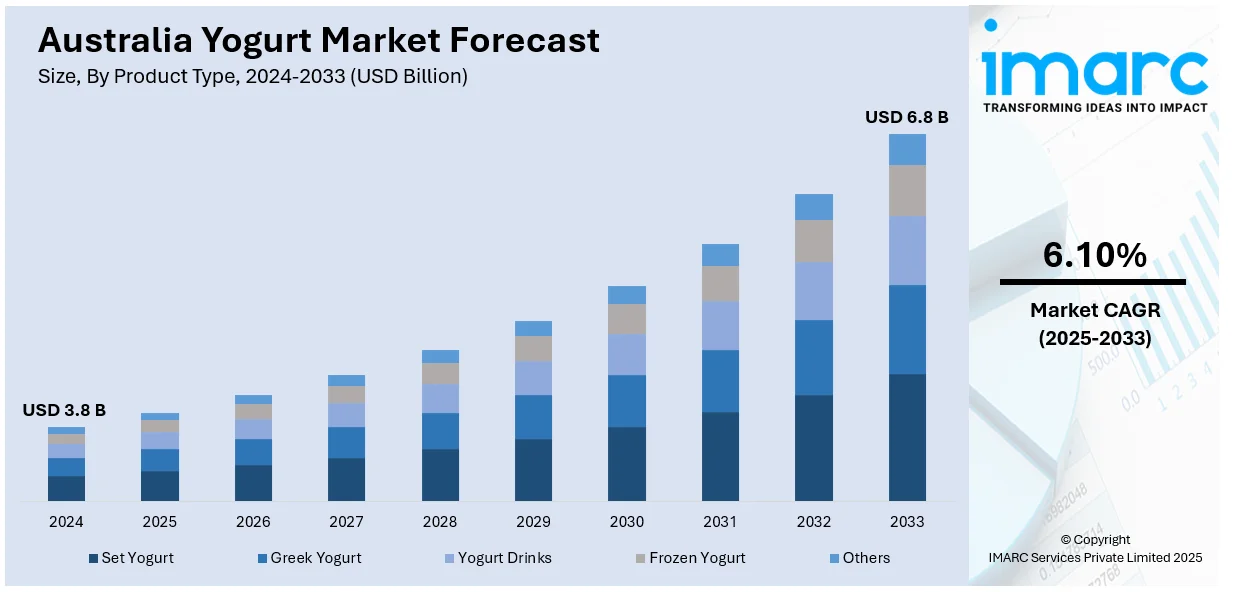

The Australia yogurt market size reached USD 3.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.8 Billion by 2033, exhibiting a growth rate (CAGR) of 6.10% during 2025-2033. The market is driven by boosting demand for healthier, plant-based, and functional products. Market growth is likely to continue, with innovation in flavor and product development, together with an increased usage of convenient distribution channels such as online outlets, all pointing towards a favorable market outlook.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 6.8 Billion |

| Market Growth Rate 2025-2033 | 6.10% |

Australia Yogurt Market Trends:

Increased Demand for Healthy Yogurt Choices

The Australia yogurt industry has been growing strongly as there is a shift in consumer interest towards healthy yogurt products. As health consciousness continues to rise among Australians, there is an increasing demand for yogurts tailored to specific dietary needs, including low-sugar, high-protein, and probiotic varieties. Greek yogurt and yogurt drinks have gained popularity especially because of the perceived health advantage of better digestion and greater protein content. In addition, consumers are demanding more functional yogurt that is supplemented with prebiotics or superfoods as they attempt to improve their gut health and overall well-being. This movement is driving Australia yogurt market growth, as more consumers are adopting yogurt as a mainstay of their health-focused diets. With the heightened emphasis on health, the future for Australia's yogurt market also looks good with continued expansion in the future years, in premium and functional categories of products.

To get more information of this market, Request Sample

Growing Popularity of Plant-Based and Non-Dairy Yogurt Alternatives

The Australia yoghurt industry is experiencing a sharp boost in the demand for non-dairy and plant-based substitutes, motivated by the rapidly rising number of people embracing dairy-free, vegan, and lactose-free lifestyles. Coconut milk, almond, soy, and oat yogurts have particularly caught on significantly since they support the growing requirement for plant-based lifestyles while ensuring a similar cream texture and flavour to regular dairy yoghurt. For example, in December 2024, Monash University scientists officially unveiled a "super-yogurt" made from Australian sweet lupins and oats, binding high protein, fiber, and probiotics together to compete with conventional dairy yogurt in terms of nutrition and consistency. Furthermore, this change is driven not just by dietary restrictions but also by heightened awareness of sustainability and ethics. Plant-based yogurts attract health-focused consumers who want dairy-free substitutes without compromising flavor or nutritional quality. This movement is increasing the Australia yogurt market share of non-dairy yogurts, with more consumers investigating these substitutes due to both health and environmental concerns. Market outlook for the plant-based yogurt is robust, with growth as demand for dairy-free products continues to grow throughout Australia.

Innovation in Flavor and Product Variety

Product innovation and flavor differentiation are key drivers of growth of the Australia yogurt market outlook. Increasingly, customers are seeking exotic and strong flavor profiles for yogurts beyond the conventional vanilla and strawberry varieties. Exotic fruit flavors, including peach, mango, and tropical fruits, are gaining acceptance, while sales of specialty yogurts, including frozen yogurts and yogurt beverages, are also accelerating. For instance, in September 2024, Chobani’s Gippsland Dairy launched its Crafted extra thick yogurt range, featuring six flavors, including Confit Strawberry, Peaches and Cream, Smooth Chocolate, and Classic Tiramisu, designed to be eaten with a fork. Moreover, such diversification responds to the increasing appetite for novelty and convenience in food. Furthermore, limited-time-only flavors and seasonals refresh and invigorate the market and drive consumer activity and repeat sales. Launches of such products have enabled brands to address niche markets and reach a wider set of consumers' tastes. Consequently, the share of the Australia yogurt market is boosting, and the growth prospects are bright. Flavour and format innovation will continue to drive consumer trends and market expansion.

Australia Yogurt Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, flavor, and distribution channel.

Product Type Insights:

- Set Yogurt

- Greek Yogurt

- Yogurt Drinks

- Frozen Yogurt

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes set yogurt, Greek yogurt, yogurt drinks, frozen yogurt, and others.

Flavor Insights:

- Strawberry Blend

- Vanilla

- Plain

- Strawberry

- Peach

- Others

A detailed breakup and analysis of the market based on the flavor have also been provided in the report. This includes strawberry blend, vanilla, plain, strawberry, peach, and others.

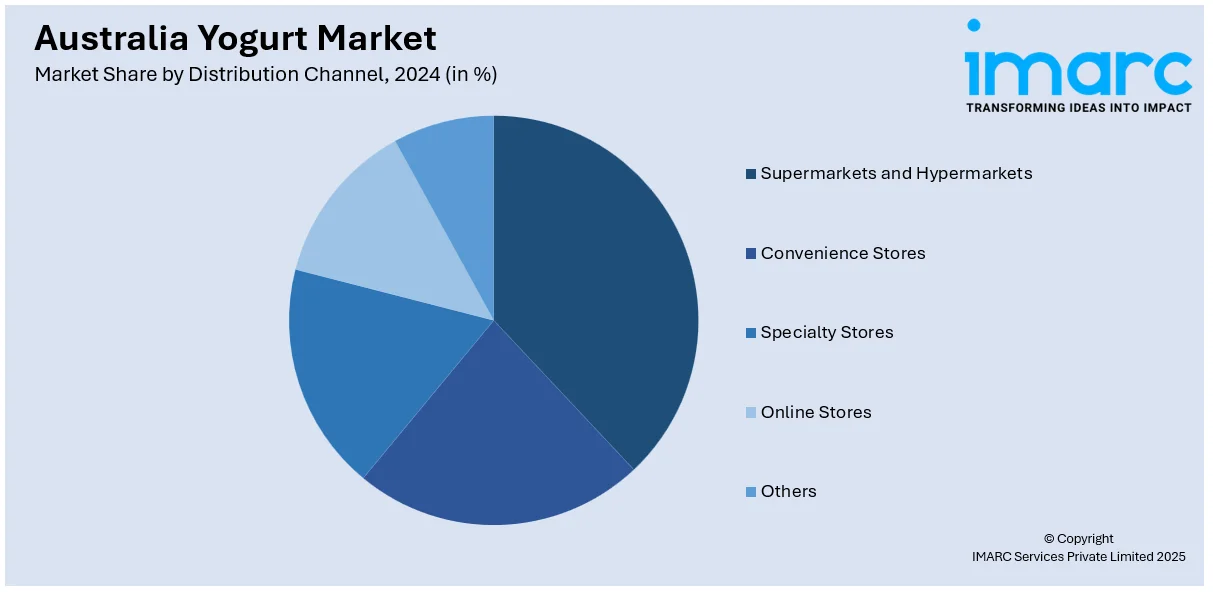

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Yogurt Market News:

- In August 2024, Yo-Chi frozen yogurt in Australia debuted its fresh Mango Greek-style frozen yogurt tub, now available in all Coles stores countrywide. Adding to current flavours Wildberry and Natural, the Mango flavour provides a tropical, creamy treat to enjoy in the home throughout Australia.

- In August 2023, a plant-based company introduced a new range of oat yogurts in Australia, featuring Blueberry, Vanilla, and Summer Fruits flavors. Protein-fortified and packed with essential nutrients, the products appeal to health-focused consumers looking for dairy-free alternatives, making a strategic move into Australia's expanding plant-based yogurt market.

Australia Yogurt Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Set Yogurt, Greek Yogurt, Yogurt Drinks, Frozen Yogurt, Others |

| Flavors Covered | Strawberry Blend, Vanilla, Plain, Strawberry, Peach, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia yogurt market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia yogurt market on the basis of product type?

- What is the breakup of the Australia yogurt market on the basis of flavor?

- What is the breakup of the Australia yogurt market on the basis of distribution channel?

- What is the breakup of the Australia yogurt market on the basis of region?

- What are the various stages in the value chain of the Australia yogurt market?

- What are the key driving factors and challenges in the Australia yogurt?

- What is the structure of the Australia yogurt market and who are the key players?

- What is the degree of competition in the Australia yogurt market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia yogurt market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia yogurt market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia yogurt industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)