Automated Material Handling Equipment Market Size, Share, Trends and Forecast by Component, Product, Function, System Type, End Use Industry, and Region, 2025-2033

Automated Material Handling Equipment Market Size and Share:

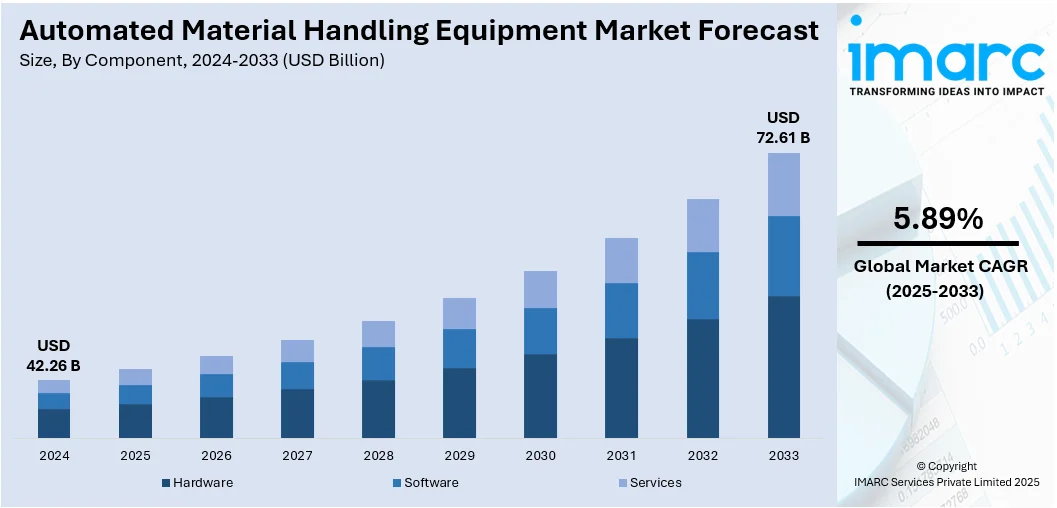

The global automated material handling equipment market size was valued at USD 42.26 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 72.61 Billion by 2033, exhibiting a CAGR of 5.89% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 39.3% in 2024. At present, e-commerce and omnichannel retail operations are growing at an all-time high pace. Moreover, the increasing labor costs and chronic shortages of workers are impelling the market growth. Apart from this, the widespread adoption of Industry 4.0 and smart manufacturing technologies is influencing the automated material handling equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 42.26 Billion |

|

Market Forecast in 2033

|

USD 72.61 Billion |

| Market Growth Rate 2025-2033 | 5.89% |

The automated material handling equipment (AMHE) market is growing steadily, driven by the escalating demand for industrial automation, cost optimization of labor, and improved operational efficiency in most sectors. Moreover, the adoption of Industry 4.0 technologies, which are embedding artificial intelligence (AI), advanced robotics, and Internet of Things (IoT) in material handling operations is impelling the market growth. This is enabling more intelligent and responsive systems that improve supply chain visibility and decision-making. E-commerce growth remains the driving force, with dense-volume fulfillment centers needing to be efficiently and scalably handled by inventory flow and delivery time reduction systems. Additionally, sustainability push is promoting investments in low-energy and space-saving AMHE solutions.

To get more information on this market, Request Sample

In the United States, the market for automated material handling equipment (AMHE) is also experiencing tremendous change, fueled by the growing demand for automation in logistics, manufacturing, and e-commerce industries. Growth in online shopping, fueled by changed end-user behavior and rapid delivery needs, is urging businesses to embrace high-throughput automated systems in warehouses. Technologies like automated storage and retrieval systems (AS/RS), conveyors, sortation systems, and mobile robots are increasingly common in US warehouses. One of the trends is increasing investments in robotics and AI-based solutions, which enhance operational efficiency, decrease dependency on labor, and facilitate 24/7 operations. Labor shortages in the logistics and manufacturing industries are also prompting companies to automate repetitive and heavy physical tasks. In addition, U.S. businesses are coupling AMHE with sophisticated software platforms, such as warehouse management systems (WMS) and real-time tracking systems, to maximize inventory control and supply chain visibility. In 2024, Manhattan Associates Inc. announced the successful deployment of Manhattan Active® Warehouse Management (WM) by Giant Eagle, the top cloud-native, evergreen, and adaptable warehouse management solution in the industry. Giant Eagle, one of the biggest food retailers and distributors in the nation, effectively migrated three of its distribution centers from an on-prem Manhattan WMS to Manhattan Active Warehouse Management. It intends to relocate its remaining four distribution centers by August 2025.

Automated Material Handling Equipment Market Trends:

Rise in E-commerce and Omnichannel Retail Operations

The market for AMHE is witnessing robust growth as e-commerce and omnichannel retail operations are growing at an all-time high pace. Companies are constantly making efforts to satisfy increasing customer demands for quicker delivery times, precise order fulfillment, and effortless customer experience. While online shopping platforms are growing, fulfillment centers are looking to leverage more automated systems like conveyors, sorters, AS/RS, and robotics-based picking systems to handle large quantities of inventory in an efficient manner. Warehouses are being planned with automation-centric methods to minimize the scope of human error and accelerate operations. In addition, businesses are combining AMHE solutions with warehouse management systems (WMS) and data analytics solutions to maximize real-time inventory monitoring and decision-making, thereby impelling the automated material handling equipment market growth. This movement is being fueled by the growing intricacy of order profiles, requiring more adaptable and scalable automation solutions. Consequently, ongoing retail logistics evolution is driving continued investment in sophisticated material handling systems. In 2025, Ranpak Holdings Corp., a worldwide frontrunner in eco-friendly paper-based packaging automation solutions for e-commerce and industrial supply chains, is poised to make an impact at ProMat 2025, the leading trade exhibition for the packaging and material handling sector, scheduled for March 17-20 at McCormick Place in Chicago, IL. Through three innovative product releases, a session led by industry experts, and being a finalist for an MHI Innovation Award, Ranpak is influencing the future of sustainable packaging and reinforcing its status among the top brands in supply chain and manufacturing.

Increasing Labor Costs and Workforce Shortages

One of the major automated material handling equipment market trends includes increasing labor costs and chronic shortages of workers. Businesses are resorting more to automation to solve these labor-linked issues by minimizing their reliance on manual labor and improving operational efficiency. As per Bureau of Labor Statistics, wages and salaries increased 1% and benefit expenses increased 0.7% from March 2025. In industries like manufacturing, logistics, and warehousing, backbreaking and repetitive work is being automated by the use of robotic arms, automated guided vehicles (AGVs), and autonomous mobile robots (AMRs). The technologies are enabling companies to sustain productivity levels even with dwindling labor pools, particularly in areas where demographic trends and skill shortages are constraining the availability of manpower. Simultaneously, automation is facilitating more secure workplaces through the elimination of human labor from hazardous zones. The need for 24/7 operational viability is also motivating businesses to make investments in automated equipment that can operate continuously without fatigue or error. As a result, the interplay between the pressures of the labor market and technical reliability is prompting extensive take up of AMHE.

Integration of Industry 4.0 and Smart Manufacturing Technologies

The market for AMH equipment is greatly benefiting from the widespread adoption of Industry 4.0 and intelligent manufacturing technologies. Businesses in several industries are embracing digital transformation strategies that include automation, data analytics, AI, and Industrial Internet of Things (IIoT) to make their operations more efficient and productive. New AMHE systems are being engineered with inbuilt sensors, real-time monitoring, and machine learning software that supports predictive maintenance, adaptive routing, and performance enhancement. These intelligent systems are progressively optimizing warehouse and production line performance through reduced downtime and improved decision-making. Additionally, coupling cloud-based platforms with digital twins is enabling companies to model, test, and control automated systems remotely. This convergence of technologies is also enabling increased customization and flexibility for material handling operations, enabling firms to accommodate shifts in the marketplace at high speed. IMARC Group predicts that the global industry 4.0 market is projected to attain USD 570.5 Billion by 2033.

Automated Material Handling Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automated material handling equipment market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, product, function, system type, and end use industry.

Analysis by Component:

- Hardware

- Software

- Services

Hardware stands as the largest component in 2024, holding 65.0% of the market. Advanced hardware components are expanding throughput by handling monotonous and time-consuming tasks automatically. Devices like conveyors, automatic sorters, and AS/RS units run round-the-clock with little downtime, which makes goods handle faster. Hardware systems' accuracy eliminates bottlenecks from warehouses and production lines, making workflow smoother and decreasing cycle times. Hardware automation eliminates human error, especially in operations like sorting, picking, and conveying materials. Advanced positioning systems and sensors guarantee accurate movement and placement of products, resulting in enhanced order fill rates and inventory accuracy. Such consistency is important in industries necessitating high quality control and compliance. Moreover, modern AMHE equipment is designed to be modular and scalable, allowing companies to adjust their systems as business requirements expand or evolve. Mobile robots and reconfigurable conveyor systems enable facilities to expand rapidly during peak demand times without extensive changes to infrastructure.

Analysis by Product:

- Conveyors and Sorting Systems

- Automated Storage and Retrieval Systems

- Robots

- Automated Guided Vehicles

- Others

Automated storage and retrieval systems lead the market with 32.2% of market share in 2024. They are bringing important advantages by maximizing space use, increasing precision, and making operations more efficient in warehouses and factories. Automated storage and retrieval systems (AS/RS) are persistently minimizing manual handling requirements by placing and retrieving products automatically in prearranged storage locations with very high accuracy. AS/RS are being used more by companies to achieve maximum vertical storage space so they can hold greater inventory in the same footprint. This is assisting firms to reduce their real estate expenses and increase inventory density. AS/RS is also improving order accuracy through reduced human error and uniform picking processes. Through real-time tracking of inventory and linking with warehouse management systems (WMS), firms are achieving enhanced visibility and control over their inventory levels. Moreover, AS/RS is boosting throughput and minimizing retrieval times, which is essential in high-demand applications. With labor shortages continuing, these systems are proving invaluable in keeping productivity levels high and warehouse operations running efficiently.

Analysis by Function:

- Assembling

- Packaging

- Storage

- Transportation

- Distribution

- Others

Storage leads the market with 36.8% of market share in 2024. The storage function in AMH systems is taking a pivotal role in maximizing inventory management and space use in different industries. Companies are increasingly adopting automated storage solutions, including vertical lift modules, carousel systems, and pallet racking with AS/RS, to store products more efficiently and safely. These systems are constantly enhancing inventory organization by classifying and stashing items according to demand frequency, size, or handling characteristics. Firms are minimizing manual intervention through dependence on automation to correctly monitor, find, and pick up items in real time. This is reducing picking errors, minimizing search time, and improving overall inventory accuracy. Storage systems are also facilitating improved space utilization by tapping vertical space and minimizing the floor space needed for inventory. As supply chains grow more sophisticated and responsive, automated storage is aiding quicker order fulfillment, better stock rotation, and improved safety. This capability is becoming indispensable in today's high-density warehousing operations.

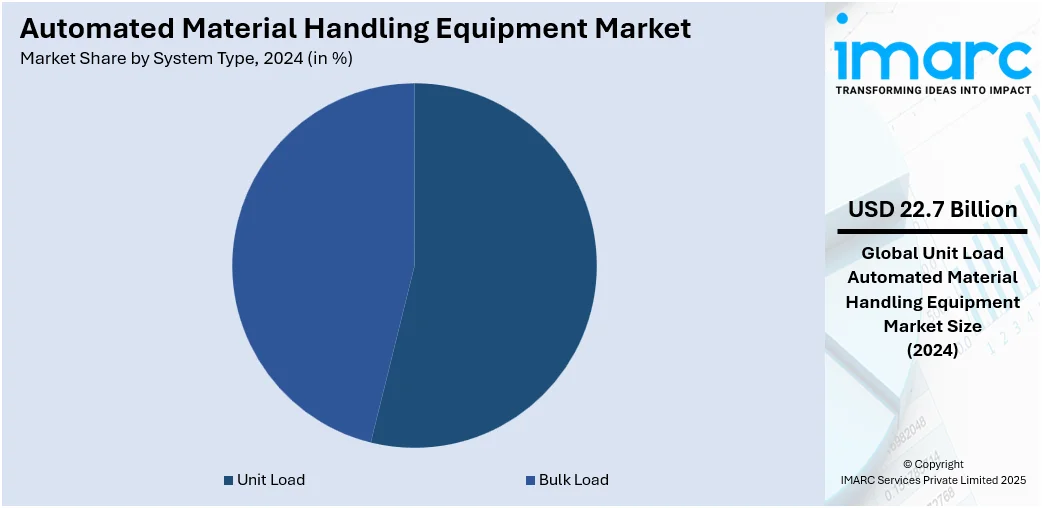

Analysis by System Type:

- Unit Load

- Bulk Load

Unit load leads the market with 53.7% of market share in 2024. Unit load function in AMH systems is simplifying goods movement and storage by collecting items into standardized loads for easy handling. Companies are more embracing unit load practices using pallets, containers, or totes to aggregate products, which is declining the number of independent handling operations and enhancing flow of operations. Automated equipment like conveyors, automated guided vehicles (AGVs), and robotic palletizers are constantly moving these unit loads with accuracy and reliability. This method is reducing product damage and providing safe handling throughout the supply chain. Space utilization and throughput are also being enhanced by companies designing storage systems exclusively for unit load dimensions. In distribution and manufacturing facilities, unit load automation is facilitating increased speed in processing, lowering the dependency on labor, and improving visibility of inventories. With the increasing demand for high-speed, high-volume operations, the role of unit load is becoming critical to ensuring efficiency, accuracy, and reliability in material handling operations.

Analysis by End Use Industry:

- Automotive

- Chemicals

- Aviation

- Semiconductor and Electronics

- E-Commerce

- Food and Beverages

- Healthcare

- Others

Automotive leads the market in 2024 as this industry is increasingly using AMH systems to enhance production efficiency, improve safety, and streamline logistics operations. Manufacturers are implementing technologies such as automated guided vehicles (AGVs), conveyors, and robotic arms to transport components like engines, transmissions, and body parts across assembly lines with precision. These systems are continuously supporting just-in-time (JIT) and just-in-sequence (JIS) manufacturing by delivering parts exactly when and where they are needed, reducing inventory levels and minimizing downtime. Automotive plants are also using AS/RS systems for storing components and finished products in an organized and space-efficient manner. By automating repetitive and labor-intensive tasks, companies are improving worker safety and reducing the risk of handling-related injuries. Real-time data collection and integration with manufacturing execution systems (MES) are further enhancing operational visibility and control.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of 39.3%. The automated material handling equipment market in Asia-Pacific is witnessing strong growth due to the heightened industrial automation and the high-speed growth of e-commerce. Companies in the region are increasingly implementing cutting-edge robots, conveyor belts, and automated storage and retrieval systems to improve operational efficiency and decrease labor costs. Logistics businesses are incorporating smart technologies, such as AI and ML, into their handling systems to maximize inventory management and speed up order fulfillment. Third-party logistics firms and retailers are increasing warehouse space and are using autonomous mobile robots to keep up with the high demand for quicker delivery. The automotive and electronics sectors are also making investments in automated material handling equipment to serve high-volume production lines and reduce downtime.

Key Regional Takeaways:

United States Automated Material Handling Equipment Market Analysis

The United States holds 83.80% share in North America. The market is experiencing a notable surge in automated material handling equipment (MHE) adoption driven by increasing investments in industrial automation. Companies across manufacturing, logistics, and warehousing sectors are integrating advanced conveyor systems, automated guided vehicles (AGVs), robotic palletizers, and sortation solutions to optimize operational efficiency and reduce labor costs. The data from industry shows that wages and salaries increased by 3.8% on an annual basis, slightly down from the 3.9% rise in the third quarter. When adjusted for inflation, overall wages saw a 0.9% increase. Rising demand for faster order fulfillment, precision in inventory management, and scalable operations is fueling this trend. Furthermore, businesses are leveraging automation to enhance workplace safety and minimize human error. The combined effect of technological advancements, strategic investments, and operational efficiency goals is accelerating MHE adoption across the U.S. industrial landscape.

Asia Pacific Automated Material Handling Equipment Market Analysis

Asia-Pacific is experiencing rapid industrialization, which is propelling the adoption of automated material handling equipment across multiple sectors. According to Ministry of Statistics & Programme Implementation India, Index of Industrial Production (IIP) saw a 1.2 % year-on-year increase in May 2025, driven by growth in manufacturing sector at 2.6%. As manufacturing and production facilities expand in scale and complexity, automation becomes essential to manage growing volumes and enhance productivity. Rapid industrialization is driving demand for efficient transport, storage, and retrieval systems that reduce operational delays and minimize labor costs. Automated systems contribute to safer workplaces and enable continuous production flows in high-demand settings. Automation in this region is not only addressing labor shortages but also improving output consistency. With increasing investments in infrastructure and technology, automated material handling equipment plays a pivotal role in enabling industrial growth and scalability.

Europe Automated Material Handling Equipment Market Analysis

Europe is seeing rising adoption of automated material handling equipment fueled by the growth of the food processing sector. For instance, in 2025, there are 3,731 food processing startups in Europe which include Novozymes, Butternut Box, Bella and Duke, Lesaffre, Greencore. Out of these, 998 startups are funded, with 645 having secured Series A+ funding. Automation supports stringent hygiene, precision, and speed requirements in food handling operations, making it crucial for maintaining safety standards. As food processing facilities aim to enhance output and reduce waste, automated solutions streamline material transfer, packaging, and storage functions. The demand for uninterrupted operations, especially in temperature-sensitive environments, is driving reliance on automated equipment. Increasing consumer demand for processed food products also necessitates higher efficiency and throughput. Automation helps manage perishable inventory with minimal human intervention, ensuring better quality control.

Latin America Automated Material Handling Equipment Market Analysis

Latin America is witnessing increased adoption of automated material handling equipment as a result of the expanding e-commerce sector. For instance, e-commerce in Latin America will reach a volume of USD 769 Billion in 2025, posting 21% growth YoY versus 2024. The surge in online shopping is pressuring fulfilment centers to handle higher order volumes efficiently and accurately. Automation supports fast picking, sorting, and order processing, addressing the logistical demands of e-commerce platforms. To meet growing customer expectations for rapid delivery, distribution centers are turning to automated material handling equipment to speed up operations and reduce errors.

Middle East and Africa Automated Material Handling Equipment Market Analysis

Middle East and Africa are adopting automated material handling equipment driven by the rising implementation of Industry 4.0. For instance, there are 107 Industry 4.0 startups in United Arab Emirates , which include Verofax, Maxbyte, Restrata, IQ Fulfilment, Flotilla IoT. Advanced technologies are being integrated into manufacturing and logistics environments to enhance operational transparency and productivity. Industry 4.0 promotes real-time data utilization, intelligent equipment coordination, and reduced manual intervention. Automated systems enable scalable, flexible operations aligned with digital transformation goals.

Competitive Landscape:

Players in the global market of automated material handling equipment are aggressively pursuing strategic initiatives like mergers and acquisitions (M&A) and partnerships to consolidate their global presence and diversify product offerings. Firms are focusing on research and development (R&D) to launch sophisticated technologies like AI-based robotics, autonomous mobile robots, and IoT-based systems. Top players are concentrating on providing integrated solutions that drive warehouse automation, optimize inventory management, and lower operation expenses. Moreover, companies are targeting high-growth industries like e-commerce, automobiles, and electronics by developing solutions based on specific industry requirements. Geographic expansion in emerging markets and the development of smart factories are other major strategies, indicating increased focus on digital transformation and supply chain effectiveness.

The report provides a comprehensive analysis of the competitive landscape in the automated material handling equipment market with detailed profiles of all major companies, including:

- BEUMER Group GmbH & Co. KG

- Daifuku Co. Ltd.

- Honeywell International Inc.

- JBT Corporation

- Kion Group AG

- KNAPP AG

- KUKA Aktiengesellschaft (Midea Group Co. Ltd.)

- Murata Machinery Ltd.

- TGW Logistics Group GmbH

- Toyota Industries Corporation

- Viastore Systems GmbH

Latest News and Developments:

- July 2025: Applied Manufacturing Technologies launched a flexible CRX-30iA-based collaborative palletizing solution featuring a custom UI and compact design that boosted material handling around distribution transformers, enhancing safety and reducing labor strain. The system offered fast ROI and simplified deployment in constrained industrial spaces.

- July 2025: SILA launched its Material Handling Equipment rental solutions in partnership with Nilkamal, expanding into warehousing and manufacturing while supporting operations involving distribution transformers. The initiative featured an all-electric fleet, aimed at enhancing logistics efficiency through SILA’s vast workforce and Nilkamal’s robust distribution capabilities.

- May 2025: Burwell Material Handling, formerly C & B Material Handling, launched with a renewed focus on smarter, safer solutions across the material handling lifecycle, including optimized use of distribution transformers. The rebranding followed the 2024 sale of its parent firm’s agri-equipment division, marking a strategic shift for the family-owned enterprise.

- April 2025: Daifuku launched a new manufacturing plant in Hyderabad to meet India’s surging automation demand, expanding production space fourfold. The facility supported local manufacturing of systems including distribution transformer components to enhance supply chain efficiency across industrial sectors.

- March 2025: Gather AI launched MHE Vision, an AI-powered camera system on material handling equipment that digitized workflows, tracked pallet movements in real time, and improved warehouse throughput. The system enhanced efficiency without infrastructure changes and supported distribution transformer operations by streamlining inventory and asset tracking.

Automated Material Handling Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Products Covered | Conveyors and Sorting Systems, Automated Storage and Retrieval Systems, Robots, Automated Guided Vehicles, Others |

| Functions Covered | Assembling, Packaging, Storage, Transportation, Distribution, Others |

| System Types Covered | Unit Load, Bulk Load |

| End Use Industries Covered | Automotive, Chemicals, Aviation, Semiconductor and Electronics, E-Commerce, Food and Beverages, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BEUMER Group GmbH & Co. KG, Daifuku Co. Ltd., Honeywell International Inc., JBT Corporation, Kion Group AG, KNAPP AG, KUKA Aktiengesellschaft (Midea Group Co. Ltd.), Murata Machinery Ltd., TGW Logistics Group GmbH, Toyota Industries Corporation and Viastore Systems GmbH |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automated material handling equipment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automated material handling equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automated material handling equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automated material handling equipment market was valued at USD 42.26 Billion in 2024.

The automated material handling equipment market is projected to exhibit a CAGR of 5.89% during 2025-2033, reaching a value of USD 72.61 Billion by 2033.

The market is driven by growing demand for industrial automation, rising labor costs, workforce shortages, rapid e-commerce expansion, and the integration of Industry 4.0 technologies such as AI, IoT, and robotics. Additionally, sustainability trends and operational efficiency requirements are promoting the adoption of scalable and energy-efficient AMHE systems.

Asia-Pacific currently dominates the automated material handling equipment market, accounting for a share of 39.3% in 2024. Rapid industrial innovation, strong e-commerce growth, and increased automation investments across logistics and manufacturing sectors are driving the region’s market dominance.

Some of the major players in the automated material handling equipment market include BEUMER Group GmbH & Co. KG, Daifuku Co. Ltd., Honeywell International Inc., JBT Corporation, Kion Group AG, KNAPP AG, KUKA Aktiengesellschaft (Midea Group Co. Ltd.), Murata Machinery Ltd., TGW Logistics Group GmbH, Toyota Industries Corporation, Viastore Systems GmbH, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)