Automated Storage and Retrieval System Market Size, Share, Trends and Forecast by Type, Load, Application, End User, and Region, 2025-2033

Automated Storage and Retrieval System Market Size and Share:

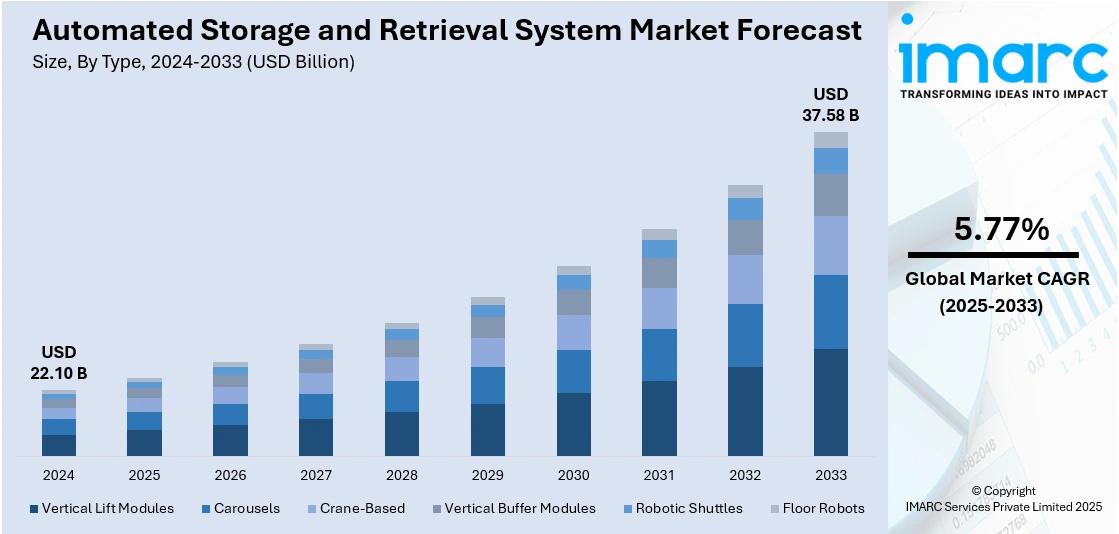

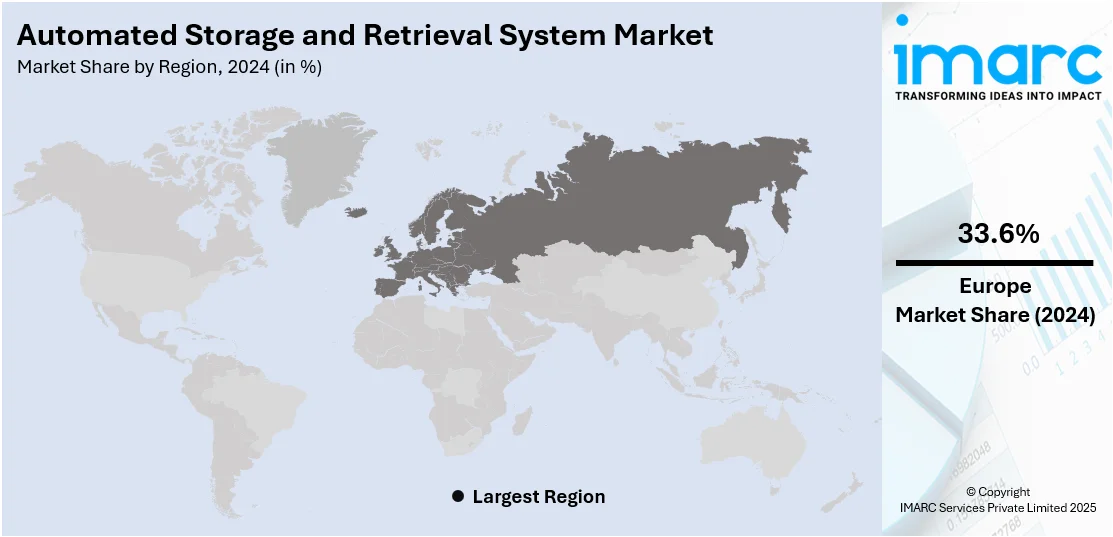

The global automated storage and retrieval system market size was valued at USD 22.10 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 37.58 Billion by 2033, exhibiting a CAGR of 5.77% during 2025-2033. Europe currently dominates the market, holding a significant market share of 33.6% in 2024. This leadership is driven by strong demand across automotive, retail, and food sectors, along with widespread adoption of Industry 4.0 technologies, boosting overall automated storage and retrieval system market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 22.10 Billion |

|

Market Forecast in 2033

|

USD 37.58 Billion |

| Market Growth Rate (2025-2033) | 5.77% |

The global market is being driven by increasing emphasis on warehouse automation to reduce operational costs and improve inventory accuracy. For instance, Falcon Autotech offers NEO, an advanced 3D automated storage and retrieval system (ASRS) that boosts picking efficiency up to 700-800 pieces per person per hour. NEO targets industries like fashion, grocery, pharmaceuticals, and e-commerce. By maximizing vertical storage and automating operations, Falcon addresses rising real estate and labor costs. With over 1,800 installations in 35+ countries, Falcon is transforming warehousing through software-driven solutions that reduce expenses and improve order tracking and fulfillment. Rising e-commerce penetration has intensified the need for faster order fulfillment and optimized space utilization. Additionally, advancements in robotics, AI, and IoT are enhancing system capabilities, enabling real-time data tracking and predictive maintenance. Environmental considerations are also encouraging the shift toward energy-efficient, high-density storage solutions. Moreover, labor shortages in logistics sectors globally are prompting greater reliance on automation. Government initiatives promoting smart manufacturing and digital transformation across industrial facilities are further propelling the adoption of ASRS technologies across a broad range of applications.

To get more information on this market, Request Sample

In the United States, the automated storage and retrieval system market growth is flourishing due to surging demand for scalable and flexible supply chain infrastructure, particularly in the retail and pharmaceutical sectors. The proliferation of omnichannel distribution models is compelling companies to invest in automated solutions that support rapid inventory turnover and accurate order processing. Moreover, heightened consumer expectations for same-day delivery are driving investments in high-speed, automated warehousing systems. The aging logistics workforce and rising labor costs are also encouraging automation to maintain productivity. Furthermore, the U.S. government’s support for reshoring manufacturing and investments in smart infrastructure are accelerating ASRS deployment to enhance domestic industrial efficiency and competitiveness, thereby creating a positive automated storage and retrieval system market outlook.

Automated Storage and Retrieval System Market Trends:

Rising Demand for Fulfilment Efficiency and E-Commerce Acceleration

The global surge in e-commerce is reshaping fulfilment priorities. With 2.77 billion online shoppers and online purchases projected to account for 21% of global retail in 2025, rising to 22.6% by 2027, businesses are prioritizing fast, precise, and automated fulfilment solutions. ASRS technologies are emerging as indispensable tools for handling rising order volumes, improving picking accuracy, and ensuring quick turnaround times. Small and mid-size enterprises (SMEs) are increasingly adopting ASRS to reduce reliance on labor, mitigate errors, and meet delivery expectations. The appeal of ASRS lies in its ability to streamline inventory management and optimize warehouse space—critical components for online retail success. As global e-commerce scales further, the automated storage and retrieval system market forecast indicates continued strong growth.

Industrial Automation Surge and Technological Innovation

Industrial automation is witnessing unprecedented growth, with over 4.28 million robots currently operational in factories globally as of 2024. This shift is fueling ASRS adoption, as companies seek to elevate productivity, reduce operational errors, and ensure safer, more flexible manufacturing environments. Innovations in ASRS are now being driven by cutting-edge sensor integration, enabling intelligent storage, real-time tracking, and seamless machine-to-machine communication. These systems not only support automated material handling but also complement broader Industry 4.0 goals. Enhanced sensor technologies help reduce downtime, increase throughput, and enable predictive maintenance. As businesses transition to smarter warehouses, ASRS with embedded AI and IoT capabilities are positioning themselves as essential infrastructure for digitally enabled and fully automated supply chains.

Government Investment and Infrastructure Modernization

Governments around the world are increasingly investing in digital infrastructure to boost national competitiveness and industrial efficiency. For instance, as per industry reports, by 2024, global spending on digital transformation (DX) is expected to hit USD 2.5 Trillion, with projections indicating it will rise to USD 3.9 Trillion by 2027. These initiatives are significantly supporting ASRS market growth, as such systems align with smart city logistics, digital warehousing, and automated transport strategies. Public sector funding in infrastructure is creating opportunities for manufacturers to implement ASRS in defense, postal services, healthcare, and transportation hubs. The growing demand for improved storage solutions, especially in urban environments where space is constrained, is being met by the scalability and high-density capabilities of ASRS. Furthermore, as sustainability and space optimization become national priorities, ASRS adoption is expected to rise, supported by favorable regulatory environments and long-term digitization strategies across developed and emerging economies.

Automated Storage and Retrieval System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automated storage and retrieval system market, along with forecasts at the global, regional, and country levels from 2025-2033.The market has been categorized based on type, load, application, and end user.

Analysis by Type:

- Vertical Lift Modules

- Carousels

- Horizontal Carousels

- Vertical Carousels

- Crane-Based

- Vertical Buffer Modules

- Robotic Shuttles

- Floor Robots

Vertical Lift Modules (VLMs) play a critical role in the Automated Storage and Retrieval System (ASRS) market due to their space-saving design and enhanced picking efficiency. These systems are increasingly deployed across warehouses and manufacturing units to optimize vertical space, a key driver in urban and high-rent environments. Their integration with warehouse management systems allows real-time inventory tracking and minimizes errors in high-throughput operations. Industries such as automotive, healthcare, and aerospace are embracing VLMs for their ability to reduce retrieval times and labor costs. The growing need for compact, secure, and automated storage solutions is expected to significantly drive the demand for VLMs in the coming years.

Horizontal and vertical carousels collectively represent a vital segment within the ASRS market, addressing diverse storage needs across industries. Horizontal carousels are favored in facilities with low ceiling heights, offering fast and reliable access to stored items in high-velocity picking environments. They are extensively used in pharmaceuticals, electronics, and retail for order consolidation and distribution. Meanwhile, vertical carousels are ideal for storing items in vertical columns, maximizing storage in limited floor areas. Their ergonomic design reduces physical strain on workers and enhances picking accuracy. The growing emphasis on labor efficiency, space optimization, and quick return on investment fuels the increasing adoption of both carousel types.

Crane-based ASRS solutions are prominent in large-scale industrial and logistics operations, offering high-density storage and handling heavy or oversized goods with precision. These systems are ideal for deep-lane storage and are widely implemented in cold storage, food & beverage, and automotive sectors. Their robust automation capabilities minimize human intervention and are particularly useful in environments with hazardous or temperature-sensitive conditions. The ability of crane-based ASRS to operate 24/7, reduce energy usage, and interface with other automated equipment makes them crucial for high-volume operations. The trend toward full-scale warehouse automation and the rising cost of labor continue to drive the adoption of crane-based systems globally.

Analysis by Load:

- Unit-Load ASRS

- Fixed-Aisle ASRS

- Movable-Aisle ASRS

- Mini-Load ASRS

- Micro-Load ASRS

Unit load ASRS leads the market with around 43.5% of market share in 2024. The Unit Load ASRS segment dominates the market due to its high efficiency in handling large, heavy, and palletized goods, making it indispensable for industries such as automotive, food & beverage, and manufacturing. These systems are designed for high-throughput environments, offering robust storage capacity, reduced labor costs, and improved inventory accuracy. Their ability to automate the storage and retrieval of unitized loads significantly enhances warehouse productivity and space utilization. Additionally, growing demand for large-scale automation, increased adoption in cold storage facilities, and integration with warehouse management systems further contribute to the segment’s dominance, aligning with global trends toward operational efficiency and reduced human error.

Analysis by Application:

- Storage

- Order Picking

- Kitting

- Buffering

- Others

Storage leads the market with around 31.7% of market share in 2024, primarily due to the growing need for efficient space utilization and inventory management across industries. Automated Storage and Retrieval Systems (ASRS) offer high-density storage capabilities, enabling businesses to store more items in less space while improving accessibility and reducing operational costs. With rising e-commerce volumes and increasing SKUs, companies are investing heavily in advanced storage systems to meet fast fulfillment expectations. Furthermore, the demand for temperature-controlled and hazardous material storage in sectors like pharmaceuticals, chemicals, and food processing also supports segment growth. Integration with Warehouse Management Systems (WMS) and the adoption of IoT and AI technologies further enhance storage efficiency, reinforcing its prominent position in the ASRS market.

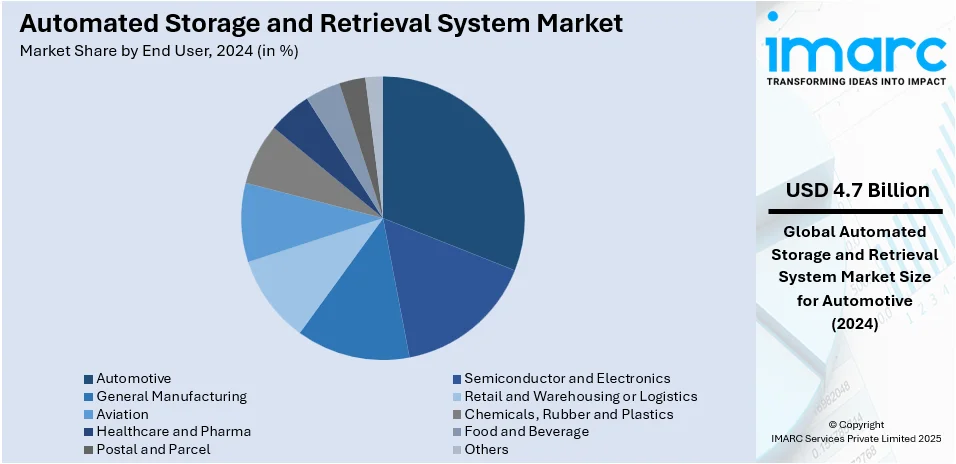

Analysis by End User:

- Automotive

- Semiconductor and Electronics

- General Manufacturing

- Retail and Warehousing or Logistics

- Aviation

- Chemicals, Rubber and Plastics

- Healthcare and Pharma

- Food and Beverage

- Postal and Parcel

- Others

Automotive leads the market with around 21.1% of market share in 2024, driven by the industry's increasing adoption of automation to enhance production efficiency and inventory accuracy. Automotive manufacturers and suppliers rely heavily on Automated Storage and Retrieval Systems (ASRS) to manage complex component inventories, streamline just-in-time (JIT) delivery models, and reduce assembly line downtimes. The demand for customization, coupled with shorter product life cycles, has necessitated more responsive and flexible storage solutions. ASRS helps optimize warehouse space and ensures rapid retrieval of high-value, heavy, or fragile automotive parts. Furthermore, rising investments in electric vehicle (EV) production, along with ongoing digital transformation in manufacturing facilities, are contributing to the growing prominence of ASRS within the global automotive supply chain landscape.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of 33.6%, owing to the region’s strong industrial base and early adoption of advanced warehouse automation technologies. European countries such as Germany, France, and the Netherlands are at the forefront of implementing Industry 4.0 practices, driving demand for ASRS across manufacturing and logistics sectors. Additionally, the presence of prominent automotive and pharmaceutical industries, which require high levels of precision and efficiency in material handling, further boosts adoption. Strict regulations on workplace safety and energy efficiency have also prompted companies to invest in ASRS. Moreover, rising e-commerce activities and supply chain optimization initiatives continue to reinforce Europe’s dominant position in the global ASRS market. For instance, in August 2024, Sensor-Technik Wiedemann (STW) enhanced its automated storage and retrieval systems by integrating Kardex Connect into its existing Kardex Shuttles at its Kaufbeuren facility. The upgrade boosts efficiency through space-saving vertical storage and minimized employee walking distances. Kardex Connect enables remote diagnostics and proactive support, resolving issues quickly and reducing downtime. This integration has improved product availability, workflow, and responsiveness. Kardex, a global intralogistics leader, offers advanced automated systems and lifecycle services, supporting over 30 countries with solutions like vertical modules and AutoStoreTM. STW’s use of Kardex technology showcases intelligent automation’s role in optimizing warehouse operations.

Key Regional Takeaways:

United States Automated Storage and Retrieval System Market Analysis

In 2024, the United States held a market share of around 88.7% in North America. United States is witnessing an increasing shift toward automated storage and retrieval system adoption due to expanding industrial automation aimed at improving productivity and quality across manufacturing sectors. For instance, manufacturing companies in the United States have invested heavily in more automation such as total installations of industrial robots rose by 12% and reached 44,303 units in 2023. Organizations are deploying these systems to enhance safety standards, reduce manual errors, and introduce operational flexibility in fast-paced environments. Automation-driven investments are streamlining inventory handling, ensuring real-time tracking, and minimizing human intervention in material flow. Automated storage and retrieval system integration aligns with the broader trend of smart factories and digital manufacturing, emphasizing precise control, reduced downtime, and cost efficiency. Industrial automation is becoming a key enabler of competitiveness, prompting businesses to upgrade legacy systems with advanced solutions. Automated storage and retrieval system deployment supports lean manufacturing and just-in-time strategies while optimizing space utilization in dynamic industrial operations.

Asia Pacific Automated Storage and Retrieval System Market Analysis

Asia-Pacific is seeing increased adoption of automated storage and retrieval system solutions driven by the expansion of small and mid-size enterprises (SMEs) seeking scalable and efficient storage capabilities. According to India Brand Equity Foundation, with 63.4 Million units spread across India, the MSME sector contributes around 6.11% of the manufacturing GDP and 24.63% of the GDP from service activities. SMEs are turning to automation to reduce labour dependence, manage rising inventory volumes, and improve throughput accuracy. The need to streamline warehousing, support just-in-time production, and minimize space usage is pushing these businesses to embrace advanced systems. Automated storage and retrieval system implementation is offering improved operational agility and reduced cycle times for SMEs managing high-mix, low-volume manufacturing. Growing SME participation in regional supply chains and manufacturing ecosystems is boosting demand for automation technologies.

Europe Automated Storage and Retrieval System Market Analysis

Europe’s growing industrial manufacturing and production sector propels automated storage and retrieval system installations to enhance process efficiency and reliability. According to Eurostat, industrial production up by 1.8% in the euro area and by 1.3% in the EU. As industries scale output, they seek to manage inventory with greater accuracy and minimize downtime through automation. Automated storage and retrieval system solutions address the need for optimized storage density, faster retrieval times, and seamless integration with production lines. Increased focus on sustainable operations and reduced manual labour dependency fosters wider adoption. Precision, traceability, and energy efficiency are key factors driving uptake across diverse manufacturing segments. Digital transformation strategies and the implementation of advanced control systems further encourage automated storage and retrieval system deployment. These systems enable manufacturers to maintain consistent quality, maximize productivity, and improve workflow continuity.

Latin America Automated Storage and Retrieval System Market Analysis

Latin America witnesses increased automated storage and retrieval system usage supported by the growing automotive and semiconductor and electronics sector. For instance, Stellantis has unveiled a historic investment plan for the South American market, committing USD 30 Billion between 2025 and 2030. This marks the most significant financial commitment ever made in the Brazilian and broader South American automotive sector. Automation addresses the critical demand for high-speed, accurate, and space-efficient material handling. Automotive and semiconductor and electronics industries rely on these systems to maintain component traceability and streamline assembly line logistics.

Middle East and Africa Automated Storage and Retrieval System Market Analysis

Middle East and Africa show advancing adoption of automated storage and retrieval system due to the expansion of general manufacturing, retail, and warehousing or logistics sector. For instance, the logistics sector constitutes approximately 14% of the UAE's gross domestic product as of 2024. These industries require reliable storage solutions to manage diverse product ranges and optimize delivery times. Automated storage and retrieval system enhances inventory control and operational flexibility while reducing labor dependency.

Competitive Landscape:

The automated storage and retrieval system market features strong competition, with leading companies emphasizing innovation, strategic collaborations, and regional expansion to strengthen their position and broaden their global footprint. Companies are investing heavily in research and development to introduce advanced, efficient, and customizable ASRS solutions tailored to various industry needs. For instance, in May 2025, Dematic, a global supply chain automation leader, launched the FD Shuttle system, designed specifically for the APAC region. This floor rail-free, lightweight automated storage and retrieval solution offers rapid deployment, flexibility, and scalability for handling up to 1,000 cases per hour with payloads up to 50 kg and storage heights over 20 meters. Ideal for sectors like e-commerce, pharmaceuticals, and electronics, the FD Shuttle supports multiple storage depths and various carton sizes. Locally developed and manufactured, it addresses regional logistics challenges, reduces project timelines, and lowers costs, enhancing supply chain agility. Emphasis on integrating AI, IoT, and robotics technologies is a common strategy to improve system performance and operational efficiency. Market players are also engaging in mergers and acquisitions to broaden product portfolios and enter new markets. Additionally, increasing demand for automation in warehousing and logistics has intensified competition, driving companies to focus on customer-centric solutions, after-sales service, and competitive pricing to gain a competitive edge in this rapidly evolving industry.

The report provides a comprehensive analysis of the competitive landscape in the automated storage and retrieval system market with detailed profiles of all major companies, including:

- BEUMER Group

- Daifuku Co., Ltd.

- Dematic

- Honeywell International Inc

- Kardex

- KNAPP AG

- Mecalux, S.A.

- Murata Machinery USA

- SSI SCHÄFER

- System Logistics S.p.A

- TGW Logistics

- Toyota Material Handling

Latest News and Developments:

- April 2025: Daifuku Intralogistics India launched a new manufacturing plant in Hyderabad, expanding production space fourfold to meet the rapidly growing automation demand. The plant began producing automated storage and retrieval systems (AS/RS), conveyors, and pallet sorters locally, enhancing efficiency and shortening lead times for Indian customers.

- April 2025: Indicold launched its second fully automated frozen facility featuring a state-of-the-art 10,000-pallet automated storage and retrieval system (ASRS) warehouse, expanding its revolutionary impact on India’s cold chain infrastructure. This followed the successful commissioning of its first fully automated high-bay frozen ASRS warehouse in Dholasan, Gujarat, which had set new standards in temperature-controlled logistics.

- February 2025: OPEX® Corporation announced key upgrades to its Infinity® Automated Storage and Retrieval System, increasing payload capacity by 15% and adding advanced storage slotting. The enhanced system, first launched in 2022, also featured improved iBOT robots and racking structures to handle heavier industrial parts.

- February 2025: Exotec launched the next-generation Skypod automated storage and retrieval system (ASRS), featuring autonomous mobile robots (AMRs) that moved totes within a high-density storage array. The upgraded system improved performance and storage efficiency, while advanced software managed operations. Exchanger stations reduced operator walking by delivering items for order picking and replenishment.

- February 2025: Hai Robotics released the HaiPick Climb system, an automated storage and retrieval system using climbing robots on standard racks that simplified goods-to-person automation. The solution enabled easier retrofitting of existing warehouses, increased throughput, and reduced implementation time and costs compared to traditional ASRS, making warehouse automation more accessible and affordable.

Automated Storage and Retrieval System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered |

|

| Loads Covered |

|

| Applications Covered | Storage, Order Picking, Kitting, Buffering, Others |

| End Users Covered | Automotive, Semiconductor and Electronics, General Manufacturing, Retail and Warehousing or Logistics, Aviation, Chemicals, Rubber and Plastics, Healthcare and Pharma, Food and Beverage, Postal and Parcel, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BEUMER Group, Daifuku Co., Ltd., Dematic, Honeywell International Inc, Kardex, KNAPP AG, Mecalux, S.A., Murata Machinery USA, SSI SCHÄFER, System Logistics S.p.A, TGW Logistics, Toyota Material Handling, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automated storage and retrieval system market from 2019-2033.

- The automated storage and retrieval system market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automated storage and retrieval system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automated storage and retrieval system market was valued at USD 22.10 Billion in 2024.

The automated storage and retrieval system market is projected to exhibit a CAGR of 5.77% during 2025-2033, reaching a value of USD 37.58 Billion by 2033.

The market is driven by increasing demand for efficient warehouse automation, rising e-commerce growth, and the need for faster order fulfillment. Technological advancements in robotics and AI, coupled with growing industrial automation and government investments in digital infrastructure, further propel the adoption of automated storage and retrieval systems globally.

Europe currently dominates the automated storage and retrieval system market with a market share of around 33.6%. The dominance is fueled by advanced industrial automation adoption, strong manufacturing sectors, robust infrastructure, and significant investments in smart warehousing technologies. Additionally, stringent regulatory standards and increasing e-commerce activities further drive market growth in the region.

Some of the major players in the automated storage and retrieval system market include BEUMER Group, Daifuku Co., Ltd., Dematic, Honeywell International Inc, Kardex, KNAPP AG, Mecalux, S.A., Murata Machinery USA, SSI SCHÄFER, System Logistics S.p.A, TGW Logistics, Toyota Material Handling, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)