Automatic Baby Swing Market Size, Share, Trends and Forecast by Product Type, Age Group, Distribution Channel, End User, and Region, 2026-2034

Automatic Baby Swing Market Size and Share:

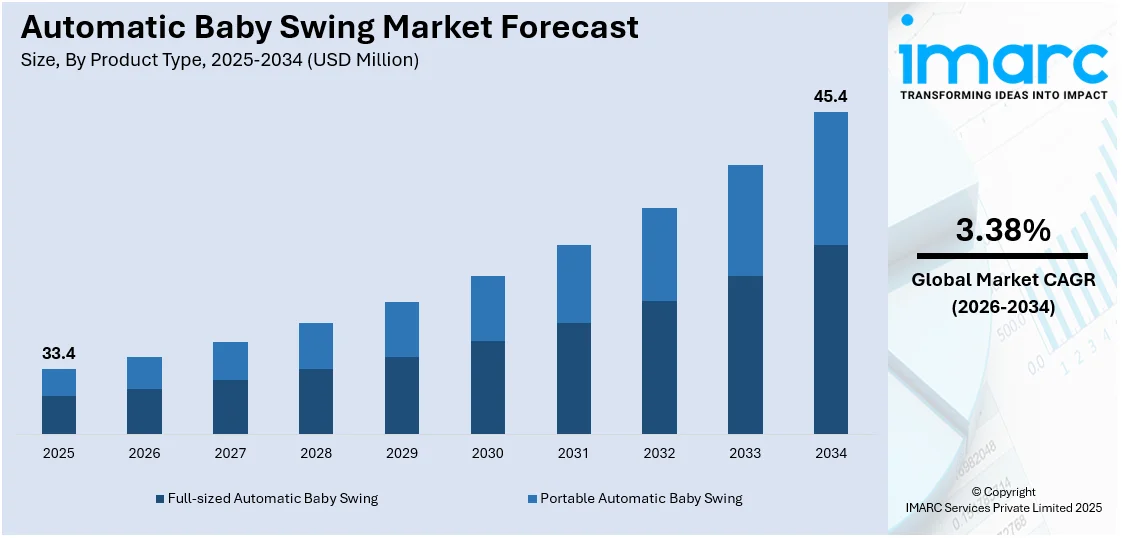

The global automatic baby swing market size was valued at USD 33.4 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 45.4 Million by 2034, exhibiting a CAGR of 3.38% during 2026-2034. North America currently dominates the market, holding a significant market share of 35.0% in 2025. The market is influenced by the growing demand from parents for convenience and versatile baby items. Moreover, product appeal is enhanced by advancements in technology, including Bluetooth integration and intelligent motion sensors. In addition, increasing investments in higher-end models due to greater consciousness about baby health and safety functions, growth of e-commerce facilitating access to different models and brands with greater ease are some of the other factors contributing to the automatic baby swing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 33.4 Million |

| Market Forecast in 2034 | USD 45.4 Million |

| Market Growth Rate (2026-2034) | 3.38% |

The market for automatic baby swings is growing rapidly, fueled by several lifestyle transitions and technology upgrades. Rise of dual-income households and hectic urban lifestyles have created a high demand for items that provide convenience as well as assuage babies with minimal supervision. Automatic baby swings are a convenient option, featuring features like multiple swing speeds, music, vibration modes, and timer settings, which make them extremely popular among contemporary parents. Technological advancements like Bluetooth connectivity and smartphone integration have further boosted product popularity. Moreover, increased awareness about infant comfort and safety is motivating parents to spend money on high-quality, certified baby equipment. The growth in e-commerce sites has also increased accessibility to these products, making it simple for parents to compare prices and features. In addition, the increase in birth rates throughout emerging markets and rise in disposable incomes are driving demand, making the automatic baby swing one of the dynamic baby care segments.

To get more information on this market Request Sample

The United States stands out as a key market disruptor, driven by technological innovation, changing lifestyles, and a strong retail network. The American manufacturers are at the forefront of incorporating sophisticated features like Bluetooth connectivity, personalized rocking patterns, and in-built sound systems. For example, the 4moms mamaRoo has set a benchmark in this segment, simulating movements associated with natural activities like car rides and tree swinging. This focus on innovation caters to tech-savvy parents who desire multifunctional and easy-to-use products. The US marketplace also features a strong shift toward online shopping channels. Companies have increased their online presence and partnered with e-commerce sites to serve a broader base of consumers, further increasing accessibility and convenience for consumers to buy baby swings from the convenience of their homes. In addition, the growth of the US market is fueled by a robust economy, strong disposable incomes, and a culture that appreciates innovation and convenience. These combined elements make the United States a central disruptor in the automatic baby swing market, shaping global trends and setting standards for product innovation and consumer expectations.

Automatic Baby Swing Market Trends:

Changing Consumer Needs and Lifestyle Transitions

The automatic baby swing market's most prominent trend is the change in consumer preference influenced by changing lifestyles. Parents today, particularly in urban and suburban environments, are juggling more hectic schedules and frequently carrying out professional and personal chores concurrently. Such a transformation has created greater need for baby products that are convenient as well as functional. Automatic baby swings accomplish this double duty by calming babies while enabling caregivers to focus on other activities. The focus has shifted from simple swinging action to encompass multi-functional aspects such as in-built music, white noise, vibration modes, and even remote control. According to research published in the Journal of Pediatric Health Care, 65% of working parents reported experiencing burnout. This has led to the growing adoption of automatic baby swings as they provide a hands-free solution for parents to soothe their babies while they attend to other tasks or simply take a break. Moreover, parents are also better educated and discerning, looking for products that provide ergonomic design, comfort, and developmental advantages for their infants. Increased popularity in minimalist parenting and space-saving solutions is also impacting product design, with emphasis on small, foldable units that are suited to modern living spaces without compromise on functionality or safety.

Merging of Smart Technology and Innovation

Technology is having a revolutionizing impact influencing the automatic baby swing market growth. A survey conducted by American “Parents” magazine found that 83% of parents believe baby bouncers and swings greatly ease the demands of parenting. The ability to operate the swing with a remote control or smartphone app further adds to its convenience. Customers are hence, opting for high-technology baby gear that easily synchronizes with smart home systems and mobile devices. Producers are reacting with the introduction of baby swings with Bluetooth, app-controlled, and motion-sensing features that respond to the behavior of the baby. These advancements are convenient and enable more tailored care practices. For instance, certain versions can learn and replicate the most effective soothing motions for a given infant. This degree of customization is increasingly being used as a market differentiator. Moreover, several of the more intelligent swings today carry sensors such as temperature checks and voice commands, demonstrating the increasing presence of consumers seeking items that provide more functionality above simple use. With artificial intelligence and the Internet of Things (IoT) increasingly having an impact on the infant care industry, "smart parenting" gadgets remain on track to be a mainstay in product design.

Focus on Sustainability and Safety Standards

As environmental awareness grows, so does consumer demand for baby items that are safe and sustainable. Manufacturers of automatic baby swings are now placing more emphasis on using environmentally friendly materials, including recycled plastics and organic textiles. This movement is supported by consumer pressure and also by a wider sector drive toward sustainability. In tandem with this, safety is a non-negotiable element in any baby item, and contemporary swings are now put through intensive design and testing regimes to conform to global safety regulations. Items such as five-point harnesses, anti-tip bases, and auto-shutoff timers are now the norm and not the exception. Parents are also demanding more transparency, hoping to know where and how items are produced. Consequently, brands that voluntarily disclose their sustainability policies and safety standards are becoming more competitive. This indicates that there will be a future where functionality, responsibility, and peace of mind become interconnected in the automatic baby swing market outlook.

Automatic Baby Swing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automatic baby swing market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, age group, distribution channel, and end user.

Analysis by Product Type:

- Full-sized Automatic Baby Swing

- Portable Automatic Baby Swing

Full-sized automatic baby swing stands as the largest component in 2025, holding around 55.6% of the market. Standard size automatic baby swings are the dominant product type segmentation influencing the automatic baby swing market forecast owing to their advanced features, reliability, and comfort. Meant for fixed use indoors, these swings come with a greater motion setting, adjustable recline position, and high-tech features such as music, vibration, and intelligent controls. Their sturdy construction gives them added stability, making them the parent's favorite for long-term safe solutions to infant soothing and entertainment. Unique to full-size versions, these swings usually come with plush seating and ergonomic support, ensuring the well-being of the infant during extended periods of use. The larger configurations also enable the incorporation of several sensory aspects, including mobile toys and light shows, into the baby's developmental environment. While heavier and less portable, the value they provide in terms of functionality and reliability renders them the leading option for home applications. Consequently, full-sized units keep demand strong and setting product development trends in the industry.

Analysis by Age Group:

- Infant

- New-born

- Toddler

- Child

New-born leads the market with around 31.4% of market share in 2025. Newborns are the most prominent age group segmentation in automatic baby swing demand, as parents look for efficient means to calm and comfort their newborns in the initial stages of life. Automatic baby swings address the specific requirements of newborns alone, offering soothing rocking motions that reflect the natural motion felt inside the womb. These swings frequently have several recline positions, padded soft seats, and secure harnesses that help support the delicate bodies of newborn babies safely. Most of them also come with soothing features such as lullabies, white noise, and vibration modes that soothe babies during times of fussiness or nap time. As the newborn period is generally the most taxing for caregivers, the ease and hands-free respite provided by automatic swings have made them a favorite and a must-have acquisition. Strong demand from initial-time parents and caregivers guarantees the newborn segment's persistence in driving sales in markets and advancing innovation in design and protection features.

Analysis by Distribution Channel:

- Online

- Offline

Offline leads the market with around 60.8% of market share in 2025. Offline distribution channels continue to be the dominant segment in the automatic baby swing market because of the trust and physical shopping experience they provide to consumers. Physical stores, such as baby specialty stores, department stores, and large-format stores, enable parents to touch and feel products before buying. This experiential experience is especially crucial for baby gear, where safety, comfort, and quality are the most important considerations. Consumers can try out swing features, assess build quality, and speak with expert staff for tailored recommendations, which generates consumer trust. Moreover, physical stores tend to offer instant product availability without delay for shipping, which is an important benefit for parents requiring immediate solutions. A lot of consumers still like seeing, touching, and knowing the product directly, particularly for expensive or long-term use products such as full-sized automatic swings. In-store promotions, bundled packs, and after-sales service also contribute value, propelling offline retail's leadership as the channel of choice in this product category.

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Nursery

- Orphanages and Child Care Centers

- Hospitals

- Others

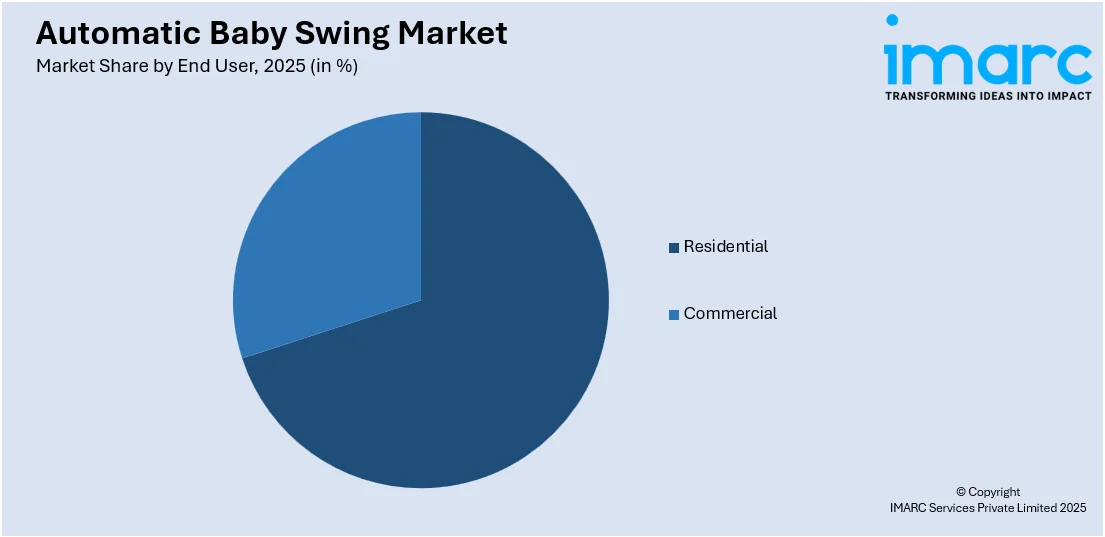

Residential leads the market with around 70.0% of market share in 2025. Residential use is the dominant end user segment in the automatic baby swing market, fueled by increased demand for in-home baby care products among contemporary families. Parents value comfort, safety, and convenience within their homes, where automatic baby swings become a must-have product in nurseries and living rooms. Automatic baby swings offer hands-free assistance, enabling caregivers to handle household chores while keeping infants calm and safe. Domestic customers prefer full-sized models that incorporate various settings like swinging actions, recline levels, music, and vibration for better baby comfort and experience. As more people are engaging in dual-income household setups and teleworking, demands for at-home baby equipment reliability have gained higher significance. Design styles and space-saving designs meant for in-house decoration also contribute to the choice. As parents continue to spend on long-term, multi-functional items for everyday use, the home segment continues to lead while dictating market trends and innovations.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 35.0%. North America stands as the biggest regional segmentation for the automatic baby swing market based on high levels of consumer awareness, strong buying power, and extensive use of sophisticated baby care products. Parents in North America place considerable emphasis on safety, convenience, and technology in choosing infant gear, and automatic baby swings sit well with this demand. Existing brands like Graco, Fisher-Price, and 4moms only add to the regional dominance of consistently providing new, feature-saturated products adapting to changing needs of consumers. Moreover, penetration of both off-line and online channels in North America is deep, making availability and access extremely easy. Such a strong review culture and parental community in the region also influences buyer behavior, and trust in high-end models of swings. In addition, the increasing practice of smart parenting and adoption of technology in daily life has created more demand for app-controlled and Bluetooth-enabled baby swings, further establishing North America's dominance in this market.

Key Regional Takeaways:

United States Automatic Baby Swing Market Analysis

In 2025, the United States accounted for over 84.50% of the automatic baby swing market in North America. The United States automatic baby swing market is primarily driven by the increasing consumer preference for multifunctional baby products combining entertainment, rest, and developmental support. In line with this, the rising number of dual-income households augmenting interest in automated infant care solutions that reduce parental workload, is propelling the market growth. According to the U.S. Bureau of Labor Statistics, in 2024, both spouses were employed in 49.6% of married-couple families. Among married-couple families with children, 66.5% had both parents working. Similarly, heightened awareness about postpartum recovery needs leading to greater adoption of products that help soothe infants without constant manual involvement, is impelling the market. Furthermore, growing popularity of minimalist and space-saving baby gear, encouraging compact and foldable swing options, is influencing design trends in the market. Additionally, improved battery efficiency and USB-powered features are enhancing product usability and appeal in the market. The expanded product availability through major e-commerce platforms is accelerating nationwide access and product sales. Moreover, rising investment in product safety certifications and compliance with federal regulations is increasing consumer trust and fostering market expansion.

Europe Automatic Baby Swing Market Analysis

The European market is influenced by the increasing urbanization and limited living space prompting demand for compact, multifunctional baby gear. In accordance with this, rising birth rates in countries with supportive family policies are contributing to higher product adoption. For instance, Poland’s Family 500+ program reduced extreme child poverty by 94% and improved living standards. It raised the total likelihood of conceiving by 1.5 percentage points, with women between 31 and 40 experiencing the greatest increase in fertility, ranging from 0.7 to 1.8 percentage points. Furthermore, enhanced awareness about infant sensory development, encouraging the use of swings with integrated music, movement patterns, and visual stimuli, is fostering market expansion. An ongoing shift toward gender-neutral and aesthetic baby products aligning with modern parenting preferences and driving style-conscious purchases, is stimulating market appeal. Similarly, the expansion of organized retail, particularly in Central and Eastern Europe, is improving product accessibility. The increased participation of fathers in early childcare influencing design features that prioritize usability and comfort, is impelling the market. Apart from this, favorable government incentives for young families in several EU nations indirectly augmenting spending on early childcare products, are creating lucrative market opportunities.

Asia Pacific Automatic Baby Swing Market Analysis

The Asia Pacific automatic baby swing market is advancing, attributed to rising disposable incomes across emerging economies, enabling greater investment in premium baby care products. In addition to this, increasing maternal employment rates fueling demand for hands-free infant care solutions that offer convenience and support, are bolstering market development. Similarly, the heightened influence of global parenting trends through digital platforms shaping consumer preferences toward tech-enabled baby gear, is enhancing market appeal. The growth in nuclear families and shrinking household sizes encouraging compact and multifunctional designs, is strengthening market demand. According to an industry report, in 2022, nearly 50% of Indian households had 1 to 4 members, up from 37% in 2008, indicating a sharp rise in nuclear families. By 2024, this share is estimated to have exceeded 50%, reflecting a clear demographic shift. Moreover, growing awareness about infant well-being is driving demand for swings with safety certifications, adjustable recline, and multi-sensory features suited to early development, which is impacting the market dynamics.

Latin America Automatic Baby Swing Market Analysis

In Latin America, the market is gaining momentum due to rapid urban migration and rising middle-class income levels. Furthermore, growing consumer interest in imported, tech-integrated infant gear, particularly in countries like Brazil, Mexico, and Chile, is supporting growth in the market. Additionally, increased awareness about early childhood care through digital parenting communities is influencing buying behavior in the market. Besides this, the expansion of regional e-commerce and logistics augmenting access to premium baby swings in semi-urban and emerging urban areas is positively influencing the market.

Middle East and Africa Automatic Baby Swing Market Analysis

The automatic baby swing market in the Middle East and Africa is progressing due to rising birth rates in several African nations contributing to increased demand for infant care products. Statistics South Africa reported that 932,138 births were registered with the Department of Home Affairs in 2023. Similarly, growing disposable incomes, in the Gulf region, and a preference for premium parenting solutions are fueling market expansion. Furthermore, greater health awareness encouraging the adoption of baby gear that supports safe and comfortable infant care, is escalating market demand. Moreover, the heightened influence of international brands and retail partnerships is enhancing product availability and shaping consumer preferences across urban centers.

Competitive Landscape:

Major players in the automatic baby swing industry are leading growth through aggressive innovation, diversification of products, and robust brand-building efforts. Brands such as Graco, Fisher-Price, 4moms, and Ingenuity are heavily investing in R&D to launch intelligent features like Bluetooth connectivity, app integration, motion detectors, and personalized swing patterns that appeal to gadget-oriented parents. These upgrades both enhance performance as well as stand out in competitive markets. Beyond this, they are also shifting to ergonomic product designs and safety-focused, premium materials to satisfy growing parental fears about baby safety and comfort. Partnerships with pediatric professionals as well as the use of worldwide safety standards create further confidence-building for consumers. Major players are also reaching out by deepening their presence across both offline and online shopping channels, with focused marketing campaigns among millennial and Gen Z parents via social media and influencer collaborations. Eco-friendly materials and sustainable manufacturing practices are being used to respond to growing demand for environmentally friendly products. In addition, international expansion strategies—like establishing a presence in emerging markets and tailoring products to local tastes—are being enacted to seize new growth prospects. Together, all these initiatives on the part of top brands are defining the movement of the marketplace and solidifying their positions as industry leaders.

The report provides a comprehensive analysis of the competitive landscape in the automatic baby swing market with detailed profiles of all major companies, including:

- 4moms

- Mamas & Papas

- Mattel Inc.

- Newell Brands Inc.

- Nuna International BV

- Artsana S.p.A.

- Kids II Inc.

- Mothercare (India) Limited

Latest News and Developments:

- March 2025: Stokke launched the Yoga, a dual-motion baby bouncer and swing combining motor-free bouncing and swinging. Developed with physiotherapists, it supported development through vestibular stimulation and featured ergonomic design, breathable fabrics, and FSC-certified wood.

- December 2024: 4moms launched the Birch Collection for its MamaRoo Baby Swing. The swing mimicked real parental movements with multi-motion technology, offering comfort and familiarity to babies.

- July 2024: Momcozy launched its 3D-Motion Electric Baby Swing featuring patented 3D Swing Technology, six unique motions, four speed settings, and a 180-degree rotating seat.

- July 2024: UPPAbaby acquired 4moms, a manufacturer of infant swings, rockers, and sleep products. This acquisition aimed to enhance UPPAbaby's portfolio with 4moms' designs, technology, and presence in the premium baby gear market.

- May 2024: Graco unveiled the SmartSense Soothing Bassinet and Swing featuring patented cry-detection technology. These products offered over 1,000 soothing combinations, including motion, music, and vibration, and were designed with organic fabrics and Bluetooth capability.

Automatic Baby Swing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Full-sized Automatic Baby Swing, Portable Automatic Baby Swing |

| Age Groups Covered | Infant, New-born, Toddler, Child |

| Distribution Channels Covered | Online, Offline |

| End Users Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 4moms, Artsana S.p.A., Kids II Inc., Mamas & Papas, Mattel Inc., Mothercare (India) Limited, Newell Brands Inc., Nuna International BV, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automatic baby swing market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automatic baby swing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automatic baby swing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automatic baby swing market was valued at USD 33.4 Million in 2025.

The automatic baby swing market is projected to exhibit a CAGR of 3.38% during 2026-2034, reaching a value of USD 45.4 Million by 2034.

The automatic baby swing market is driven by rising demand for convenient parenting solutions, increasing dual-income households, and advancements in smart technology. Parents seek safe, multifunctional products that soothe infants while saving time. E-commerce growth and heightened awareness about infant comfort further fuel market expansion across global regions.

North America currently dominates the automatic baby swing market, driven by rising dual-income households, growing demand for smart parenting solutions, and strong retail infrastructure. Technological innovations, such as app control and Bluetooth features, appeal to modern parents. High awareness about infant safety and comfort further supports market growth in the region.

Some of the major players in the automatic baby swing market include 4moms, Artsana S.p.A., Kids II Inc., Mamas & Papas, Mattel Inc., Mothercare (India) Limited, Newell Brands Inc., Nuna International BV, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)