Automotive Axle & Propeller Shaft Market Report by Type, Vehicle Type, Sales Channel, and Region, 2025-2033

Automotive Axle & Propeller Shaft Market Size and Share:

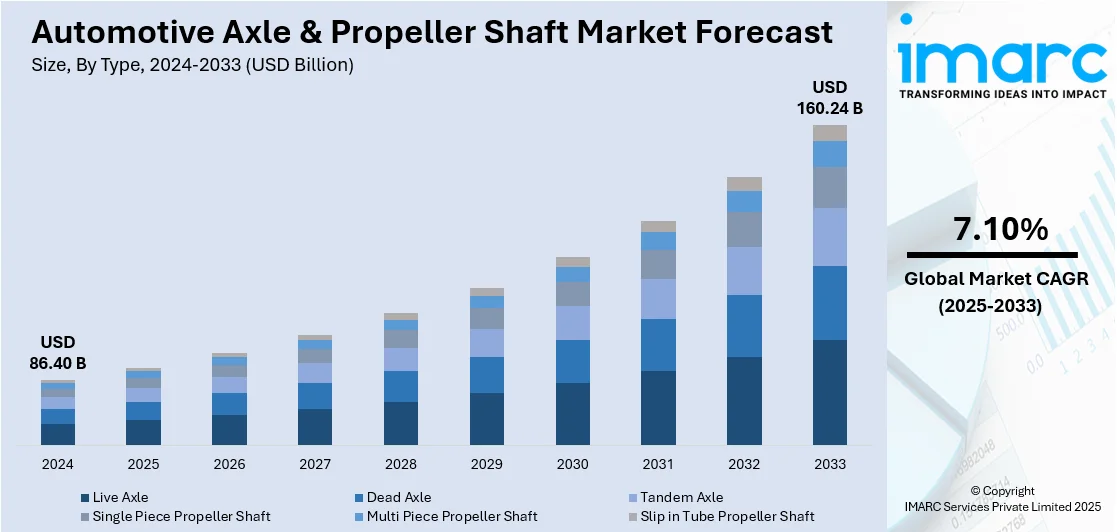

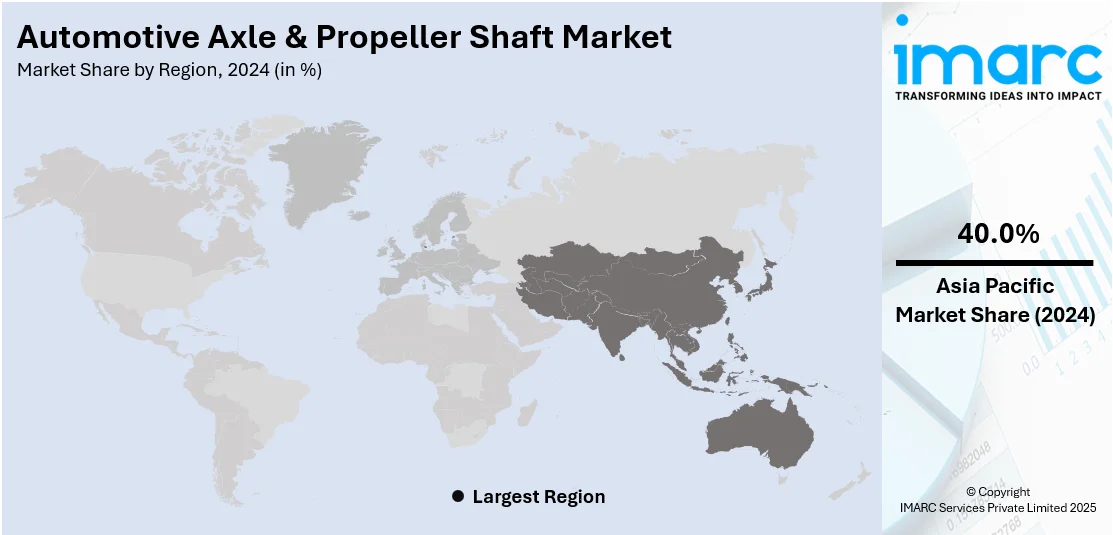

The global automotive axle & propeller shaft market size was valued at USD 86.40 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 160.24 Billion by 2033, exhibiting a CAGR of 7.10% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of around 40.0% in 2024. The market is driven by rising vehicle demand in emerging economies, fueled by urbanization, higher disposable incomes, and expanding mobility needs. Advancements in lightweight materials and EV-specific axle systems further stimulate growth, while increasing adoption of AWD and 4WD vehicles amplifies demand for robust drivetrain components, thus augmenting the automotive axle & propeller shaft market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 86.40 Billion |

|

Market Forecast in 2033

|

USD 160.24 Billion |

| Market Growth Rate (2025-2033) | 7.10% |

The market is primarily driven by the growing demand for vehicles, particularly in emerging economies. India's passenger vehicle sales in 2025 reached an all-time high of 4.32 million units, up 2.5% year-over-year and 11.3% compared to fiscal year 2023, indicating high demand for drivetrain components such as axles and propeller shafts. Maruti Suzuki led the market with 1.76 million units and a 40% market share, followed by Hyundai with 598,000 units (a 2.6% decrease year-over-year) and Tata Motors with 553,000 units. Mahindra trailed behind by just 2,104 units. Notably, Mahindra and Toyota registered the most significant year-on-year growth and market share expansion, reflecting increasing demand from original equipment manufacturers (OEMs) for high-strength axle systems in India's growing automotive sector. Increasing urbanization, improving disposable incomes, and expanding transportation needs are fueling automobile sales, thereby increasing the demand. Additionally, advancements in automotive technologies, such as lightweight materials and electric vehicle (EV) drivetrains, are reshaping the market. Governments worldwide are implementing stringent fuel efficiency and emission norms, pushing manufacturers to innovate in drivetrain components. The increasing inclination towards all-wheel-drive (AWD) and four-wheel-drive (4WD) vehicles in both the passenger and commercial sectors further accelerates the automotive axle & propeller shaft market growth.

To get more information on this market, Request Sample

The United States stands out as a key regional market, primarily driven by strong demand for SUVs, light trucks, and pickup trucks, which dominate vehicle sales in the country. Consumers favor larger, more durable vehicles for both personal and commercial use, increasing the need for robust drivetrain components. Additionally, the growth of the logistics and construction industries is increasing demand for heavy-duty trucks, further propelling axle and propeller shaft sales. In 2023, U.S. heavy-duty trucks carried 11.18 Billion tons of freight, which generated USD 987 Billion in revenue and traveled a distance of 331.27 billion miles, demonstrating a rising demand for robust axle and propeller shaft systems. With over 14.33 million registered trucks and in excess of 577,000 operating motor carriers (95.5% with 10 trucks or less), employing 3.55 million drivers and a total workforce of 8.5 million workers, this sector further emphasizes its importance by accounting for 66.5% of the surface trade value between Canada and the United States, as well as 84.5% of the surface trade value between the United States and Mexico, highlighting the key position trucks hold in cross-border logistics infrastructure. Stringent fuel efficiency regulations are pushing automakers to adopt lightweight materials and advanced designs, enhancing component performance. The aftermarket segment also contributes significantly, as vehicle owners replace worn-out parts to maintain performance and safety standards.

Automotive Axle & Propeller Shaft Market Trends:

Escalating Global Automobile Sales and Electric Vehicle (EV) Expansion

The rapid urbanization and industrialization, especially in emerging economies, are fueling a massive rise in automobile sales, driving significant growth in the market. A key driver is the increasing demand for personal and commercial vehicles, underpinned by infrastructure expansion and rising consumer purchasing power. As per the most recent version of the International Energy Agency's (IEA) Global EV Outlook, electric vehicle sales are on track to surpass 20 million units globally by 2025, which would account for over 25% of all cars sold worldwide. This shift toward EVs intensifies the need for efficient drivetrain components, including high-performance axles and propeller shafts. Therefore, this is further creating a positive automotive axle & propeller shaft market growth. As vehicle production scales up globally, the demand for reliable, durable, and high-torque transmission systems becomes critical, pushing manufacturers to innovate and expand production capacity to meet market needs.

Technological Integration: AI and Machine Learning in Manufacturing

Technological advancements are redefining the automotive components industry, especially with the incorporation of artificial intelligence (AI) and machine learning (ML) into manufacturing processes. These technologies are improving efficiency, consistency, and precision in the production of axles and propeller shafts. By 2025, 50% of automotive manufacturers are projected to adopt AI-driven quality control systems, significantly enhancing production accuracy and minimizing defects. These systems help in real-time detection of flaws, predictive maintenance, and process optimization, leading to better product reliability and faster production cycles. Moreover, AI is aiding in supply chain management and component testing, ensuring that products meet rigorous safety and performance standards. As automation becomes more mainstream, companies that leverage intelligent systems will gain a competitive edge in terms of both cost-effectiveness and product quality.

Rise of Carbon Fiber and Lightweight Components

Material innovation is playing a pivotal role in shaping the future of automotive axles and propeller shafts. A significant trend is the increasing adoption of carbon fiber shafts, especially in high-end vehicles, attributed to their exceptional structural characteristics, durability, toughness, and an impressive strength-to-weight ratio. The use of these materials contributes to a reduction in the overall weight of the vehicle, which in turn enhances fuel efficiency and performance. Additionally, the widespread shift toward lightweight axles and propeller shafts is helping automakers meet stringent emissions regulations and increase energy efficiency, thus creating a positive automotive axle & propeller shaft market outlook. The automotive industry's focus on enhancing torque transmission and reducing vehicle weight aligns with the broader goals of sustainability and fuel economy. According to the U.S. Department of Energy, reducing vehicle weight by 10% can improve fuel economy by 6–8%. In premium cars, carbon fiber driveshafts are up to 60% lighter than traditional steel shafts, enhancing overall drivetrain performance. As automakers continue to innovate, the use of advanced composites and lightweight alloys is expected to become standard, especially in high-performance and electric vehicles, increasing market demand for advanced axle and shaft solutions.

Automotive Axle & Propeller Shaft Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive axle & propeller shaft market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, vehicle type, and sales channel.

Analysis by Type:

- Live Axle

- Dead Axle

- Tandem Axle

- Single Piece Propeller Shaft

- Multi Piece Propeller Shaft

- Slip in Tube Propeller Shaft

Live axle stands as the largest component in 2024, accounting for the largest share due to their widespread use in heavy-duty commercial vehicles, off-road SUVs, and pickup trucks. Their robust construction, superior load-bearing capacity, and durability make them indispensable for applications requiring high torque and rugged performance, particularly in construction, mining, and logistics sectors. Unlike independent suspension systems, live axles provide enhanced stability and towing capability, which is critical for trucks and utility vehicles. Emerging markets, with their growing infrastructure and freight transportation needs, further drive demand. Additionally, the aftermarket segment sustains growth as fleet operators prioritize cost-effective, long-lasting axle solutions. While independent suspensions gain traction in passenger vehicles, live axles remain irreplaceable in heavy-duty and off-road segments due to their mechanical simplicity and reliability. Manufacturers are innovating with advanced materials and weight-reduction techniques to improve efficiency without compromising strength, ensuring live axles retain their market leadership. According to the automotive axle & propeller shaft market forecast, their entrenched position in key automotive segments solidifies their dominance in the foreseeable future.

Analysis by Vehicle Type:

- Passenger Car

- Light Commercial Vehicle

- Heavy Commercial Vehicle

Passenger car leads the market with around 61.3% of market share in 2024, driven by sustained consumer demand, expanding urbanization, and increasing disposable incomes, particularly in emerging economies. The proliferation of SUVs and crossover vehicles often equipped with all-wheel-drive (AWD) systems has further amplified the need for advanced drivetrain components, including axles and propeller shafts. Stringent fuel efficiency regulations have also spurred innovation, with manufacturers adopting lightweight materials and optimized designs to reduce emissions without compromising performance. Additionally, the rise of electric vehicles (EVs) has introduced specialized axle configurations, such as integrated e-axles, creating new growth avenues. While commercial vehicles rely on heavier-duty systems, the sheer volume of passenger car production cements their dominance in the market. Ongoing investments in autonomous and connected vehicle technologies are expected to further reinforce this segment’s leadership, as passenger cars remain at the forefront of automotive innovation and consumer preference.

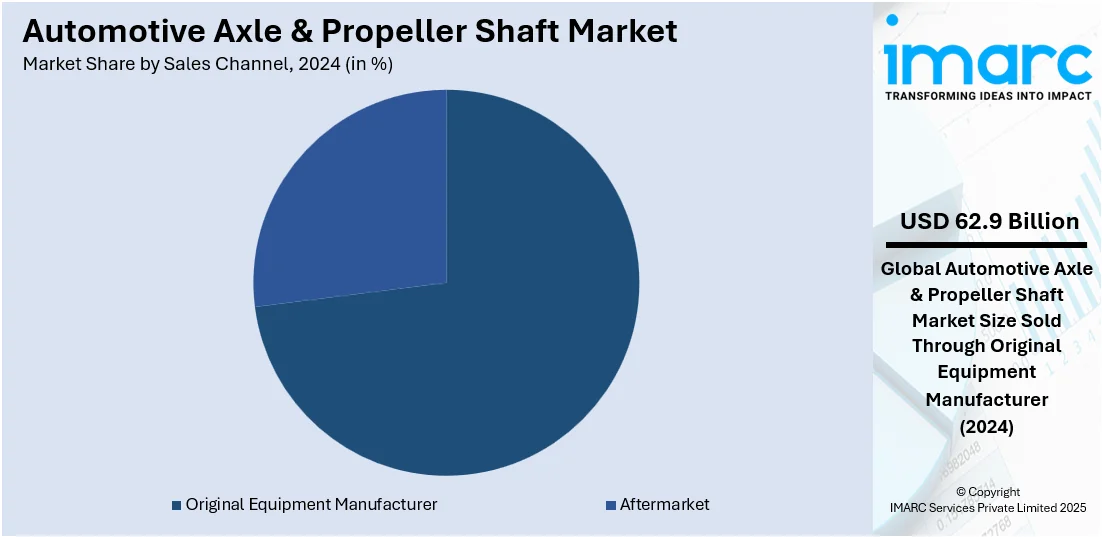

Analysis by Sales Channel:

- Original Equipment Manufacturer

- Aftermarket

Original equipment manufacturer leads the market with around 72.8% of market share in 2024, driven by their direct integration with vehicle production cycles and stringent quality requirements. As automakers prioritize seamless drivetrain performance, OEM-supplied components ensure compatibility, reliability, and compliance with changing emission and safety standards. The shift toward electric and hybrid vehicles has further solidified OEM dominance, as integrated e-axle systems require precise engineering and close collaboration with vehicle platforms. While the aftermarket serves replacement needs, OEMs benefit from higher margins, long-term supply agreements, and advancements in lightweight materials and modular designs. The rise of global platform strategies among automakers—where standardized axles and shafts are used across multiple models—also reinforces OEM demand. With increasing investments in autonomous and connected vehicle technologies, OEMs are poised to maintain their leadership, as these innovations demand tightly controlled, high-performance drivetrain solutions from the outset.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of around 40.0%, accounting for the largest regional share due to its thriving automotive production hubs in China, India, Japan, and South Korea. The region's leadership stems from booming vehicle demand, fueled by rapid urbanization, expanding middle-class populations, and government initiatives promoting domestic manufacturing, such as India's "Make in India" and China's NEV (New Energy Vehicle) policies. As the world's largest commercial vehicle market, Asia-Pacific drives substantial demand for heavy-duty axles, while its passenger vehicle segment the global leader in EV adoption accelerates innovation in electric drivetrain components. Cost-competitive manufacturing ecosystems and strong supplier networks further reinforce the region's position, enabling both local consumption and exports. With automakers increasingly localizing supply chains to mitigate geopolitical risks, Asia-Pacific's strategic advantage in component production is expected to grow, solidifying its status as the axle and propeller shaft market's core growth engine.

Key Regional Takeaways:

United States Automotive Axle & Propeller Shaft Market Analysis

In 2024, the US accounted for around 88.50% of the total North America automotive axle & propeller shaft market. The United States is witnessing a rise in the adoption of automotive axles and propeller shafts, propelled by heightened investment in the automobile industry. For example, Japanese automakers play a crucial role in the U.S. economy, having invested more than USD 61.6 Billion in their 24 manufacturing plants in the U.S. over the past forty years. This investment is facilitating technological advancements and improving manufacturing capabilities, thereby encouraging a greater integration of axle and propeller shaft systems. Automotive manufacturers are focusing on high-performance drivetrain components to meet the increasing consumer demand for advanced vehicle features. As the automobile sector changes with new mobility trends and electrification strategies, the need for efficient and durable axle and propeller shaft systems is accelerating. Increased production of passenger and commercial vehicles is amplifying demand, while supportive policies and private capital infusion in automobile infrastructure are also contributing.

Asia-Pacific Automotive Axle & Propeller Shaft Market Analysis

The Asia-Pacific region is experiencing an increasing adoption of automotive axle and propeller shaft systems due to the continuous growth in the automotive industry. As reported by the India Brand Equity Foundation, in the fiscal year 2024, the Indian automobile sector grew by 19%, reaching a total of USD 122.53 Billion (Rs. 10.22 lakh crore), largely propelled by advancements in the utility and sports utility vehicle (SUV) segments. With rapid industrialization and urbanization, automotive production is scaling up, enhancing the need for advanced drivetrain components. The expansion in the automotive sector is leading to a growing focus on improved vehicle stability and torque delivery, encouraging the integration of refined axle and propeller shaft technologies. Increasing domestic and export-oriented automotive assembly operations are propelling component demand, while localization of part manufacturing further supports scalability. Consumer preferences for enhanced driving performance are aligning with industry innovations, spurring additional axle and propeller shaft adoption.

Europe Automotive Axle & Propeller Shaft Market Analysis

Europe is seeing accelerated automotive axle and propeller shaft adoption, primarily due to growing vehicle ownership across the region. As reported by the European Automobile Manufacturers Association, new car registrations in the EU experienced a 5.1% increase in December 2024. Spain topped the list with a significant rise of 28.8%, while France saw a more modest growth of 1.5%. Rising individual mobility needs and lifestyle changes are increasing new vehicle registrations, creating a robust demand for reliable drivetrain components. The trend of vehicle electrification and hybridization is also contributing, as it requires specialized axle and shaft configurations. With vehicle ownership becoming more prevalent in suburban and rural areas, the automotive industry is scaling the production of components that support diverse terrain handling and load management. Advanced engineering and precision requirements in European vehicles are leading manufacturers to prioritize durable and high-performance axle and propeller shaft systems.

Latin America Automotive Axle & Propeller Shaft Market Analysis

Latin America is showing increased automotive axle & propeller shaft adoption supported by the growth in light commercial vehicle and heavy commercial vehicle demand. For instance, In 2024, Brazil experienced a 14% increase in the sales of new vehicles, which encompasses buses and trucks, reaching a peak not seen in the last decade, as reported by the Associacao Nacional dos Fabricantes de Veiculos Automotores (Anfavea). This growth is influencing vehicle manufacturers to incorporate robust and efficient axle & propeller shaft systems to enhance load-carrying and drivetrain performance.

Middle East and Africa Automotive Axle & Propeller Shaft Market Analysis

The regions of the Middle East and Africa are experiencing a rise in the adoption of automotive axle and propeller shaft components, driven by a growing demand for fuel-efficient vehicles. For example, electric vehicles (EVs) constituted 13% of total car sales in 2023, as reported by the latest figures from the Ministry of Energy and Infrastructure, a significant increase from 3.2% in 2022 and just 0.7% in 2021. Consumers are becoming more conscious of fuel savings and vehicle capability in off-road and variable driving conditions. These preferences are compelling manufacturers to integrate lightweight yet durable axle and propeller shaft systems that support performance without compromising efficiency.

Competitive Landscape:

The competitive landscape in the market is characterized by intense R&D investments and strategic collaborations as players vie for technological leadership. Leading manufacturers are focusing on lightweight, high-strength materials such as advanced composites and forged alloys to improve fuel efficiency without compromising durability. Several firms are expanding their electric drivetrain portfolios, developing integrated e-axle systems tailored for next-generation EVs. Vertical integration strategies are gaining traction, with competitors securing raw material supplies and optimizing production processes to reduce costs. Regional expansion remains a priority, particularly in emerging Asian markets, through joint ventures and localized manufacturing. Aftermarket services are being enhanced with predictive maintenance solutions and digital platforms to strengthen customer retention. The race to meet stringent emission norms while accommodating diverse vehicle architectures continues to drive innovation across the sector.

The report provides a comprehensive analysis of the competitive landscape in the automotive axle & propeller shaft market with detailed profiles of all major companies, including:

- American Axle & Manufacturing Inc.

- Automotive Axles Limited

- Comer Industries Spa

- Cummins Inc.

- Dana Limited

- Hyundai WIA Corporation

- IFA Holding GmbH

- Mark Williams Enterprises Inc.

- Neapco

- RSB Group

- Talbros Axles

Latest News and Developments:

- April 2025: Scania unveiled a new 6×2*4 chassis variant for three-axle electric buses, expanding its e-bus lineup beyond purely urban use. Designed for suburban and intercity routes, the chassis supports higher passenger capacity and enhanced adaptability for demanding operations.

- April 2025: Nexteer Automotive unveiled three advanced Driveline technologies tailored for EVs and premium driving, focusing on durability, NVH optimization, and lightweight design. The innovations include the Face Spline Axle for noise reduction and integration ease, the 8-Ball Joint achieving over 10% mass reduction, and the Premium DO Joint enhancing acceleration.

- January 2025: Eicher marked its debut in the SCV segment with the Pro X series, unveiled at the Bharat Mobility Global Expo 2025. Built on an advanced modular platform with an e-axle configuration that eliminates the propeller shaft, the Pro X offers enhanced energy efficiency and driver comfort.

- January 2025: ZF unveiled its EasyTurn axle concept in India, featuring an 80-degree steering angle to enhance maneuverability in tight urban spaces. It supports MacPherson axle systems and electric vehicles, offering up to 30% turning radius reduction and benefiting both passenger and cargo vehicles.

Automotive Axle & Propeller Shaft Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Live Axle, Dead Axle, Tandem Axle, Single Piece Propeller Shaft, Multi Piece Propeller Shaft, Slip in Tube Propeller Shaft |

| Vehicle Types Covered | Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle |

| Sales Channels Covered | Original Equipment Manufacturer, Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Axle & Manufacturing Inc., Automotive Axles Limited, Comer Industries Spa, Cummins Inc., Dana Limited, Hyundai WIA Corporation, IFA Holding GmbH, Mark Williams Enterprises Inc., Neapco, RSB Group, Talbros Axles, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive axle & propeller shaft market from 2019-2033.

- The automotive axle & propeller shaft market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive axle & propeller shaft industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive axle & propeller shaft market was valued at USD 86.40 Billion in 2024.

IMARC estimates the automotive axle & propeller shaft market to exhibit a CAGR of 7.10% during 2025-2033, reaching a value of USD 160.24 Billion by 2033.

Rising vehicle demand in emerging economies, technological advancements in lightweight materials and EV drivetrains, growing preference for AWD/4WD systems, and stringent fuel efficiency and emission regulations are key drivers of market growth.

Asia-Pacific currently dominates the automotive axle & propeller shaft market, accounting for a share exceeding 40.0%. This dominance is fueled by robust vehicle production in China, India, Japan, and South Korea, rapid urbanization, growing middle-class populations, and supportive government policies.

Some of the major players in the automotive axle & propeller shaft market include American Axle & Manufacturing Inc., Automotive Axles Limited, Comer Industries Spa, Cummins Inc., Dana Limited, Hyundai WIA Corporation, IFA Holding GmbH, Mark Williams Enterprises Inc., Neapco, RSB Group and Talbros Axles, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)